Source: Cointelegraph Original: "{title}"

- Data Comparison: GT's Surge Stands Out Among Mainstream Platform Tokens

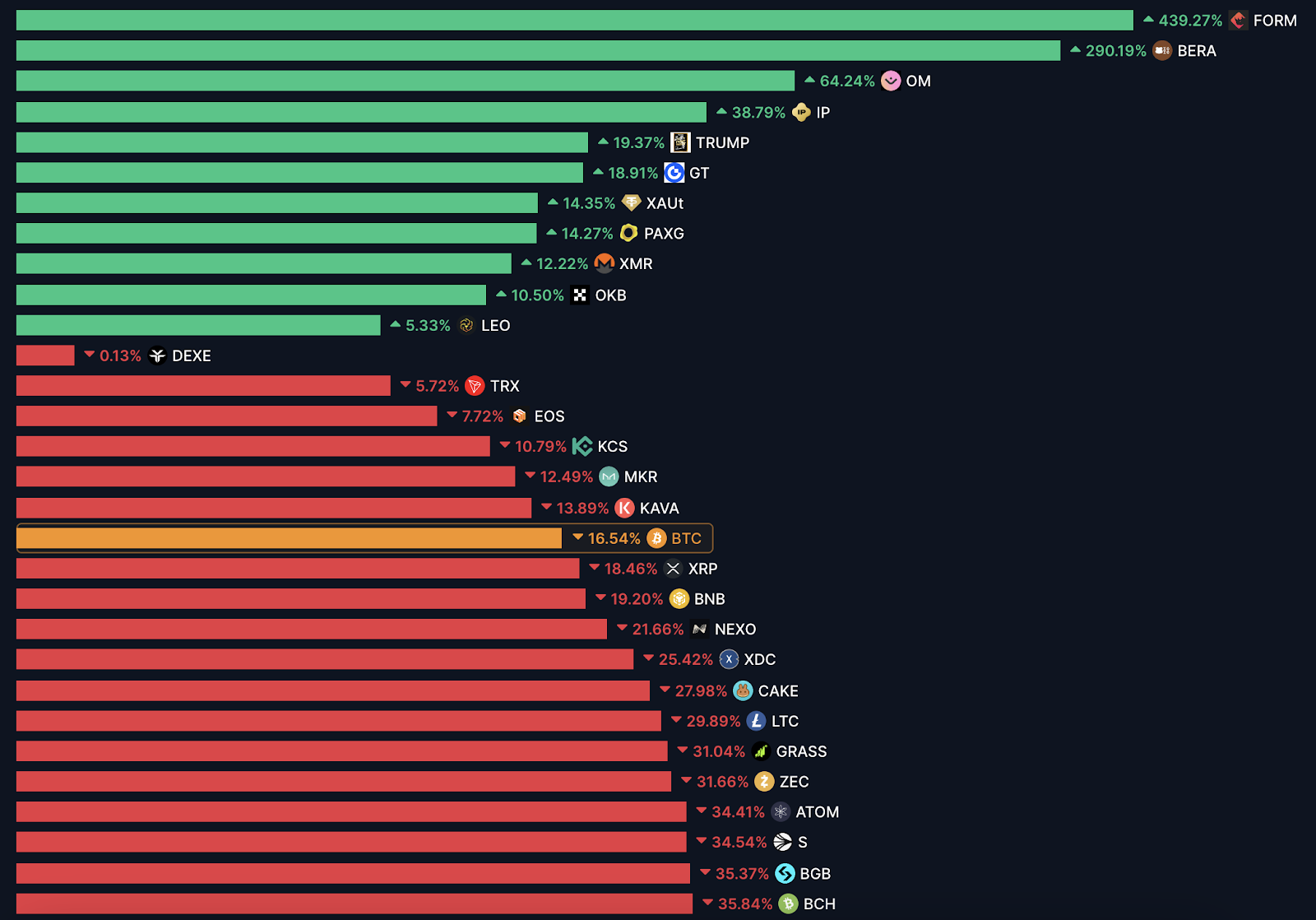

The most intuitive way to measure asset performance is through price trends. According to publicly available data, the performance of several major platform tokens has shown significant differences over the past 90 days:

This set of data clearly outlines the recent landscape of the platform token market: under the same market cycle and macro environment, GT not only achieved positive growth but also significantly outperformed the moderately rising OKB, contrasting sharply with the heavily corrected BNB and BGB. With a surge of over 20%, GT undoubtedly takes the lead among mainstream platform tokens, and its relative strength is particularly prominent in the current market environment.

- Analyzing GT's Competitive Advantages: Why Does It Stand Out in a Downturn Market?

GT's impressive surge during a general market correction must be supported by factors that underpin its competitive advantages. Although the value logic of platform tokens is complex and diverse, it is usually closely related to the following points, in which GT may exhibit its unique advantages:

It is important to emphasize that the above analysis is based on general market rules and the extrapolation of GT's publicly available information; the specific reasons may result from a combination of multiple factors. However, GT's outstanding performance indeed points to certain differentiated competitive advantages it possesses in the current market environment.

- Investment Perspective: Why Should GT Be Given More Attention?

For long-term investors, choosing the right target is crucial. The core logic of regular investment is to buy in batches at different market stages to smooth costs and share long-term growth. When selecting targets for regular investment, the long-term potential of the asset, its risk resistance capability, and its performance during market downturns are all important considerations.

From recent performance, GT has demonstrated several characteristics that are worth noting for regular investors:

Of course, any investment decision should be based on comprehensive research and risk assessment. Regular investment in GT also faces multiple risks, including market volatility, changes in regulatory policies, and the platform's own operations. However, it is undeniable that, based on the market data and performance over the past 90 days, GT has indeed shown stronger resilience and attractiveness compared to some mainstream platform tokens, making it a candidate worth including in a regular investment observation list.

In conclusion:

In the recent cryptocurrency market adjustment, GateToken (GT) has stood out with a surge of over 20% over 90 days, significantly outperforming OKB, BNB, and BGB among mainstream platform tokens. This differentiated market performance may stem from multiple factors, including market confidence in the Gate.io platform, GT's robust economic model and supply-demand relationship, relatively reasonable valuation, and strong community consensus. For investors employing a regular investment strategy, GT's demonstrated resilience in a bear market and relative strength make it a potential target worthy of close attention and in-depth research. In a market full of uncertainties, GT's impressive data provides a clear case of value and resilience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。