We have previously discussed a possibility that #BTC could become a financial tool for high-frequency arbitrage on Wall Street. As long as there is wide volatility, it can bring huge profits. This possibility is likely to be reflected in the latest financial products launched by CME on June 30, marking the beginning of a new era for #RWA, with 24-hour trading and USD stablecoin legislation creating a new gaming market.

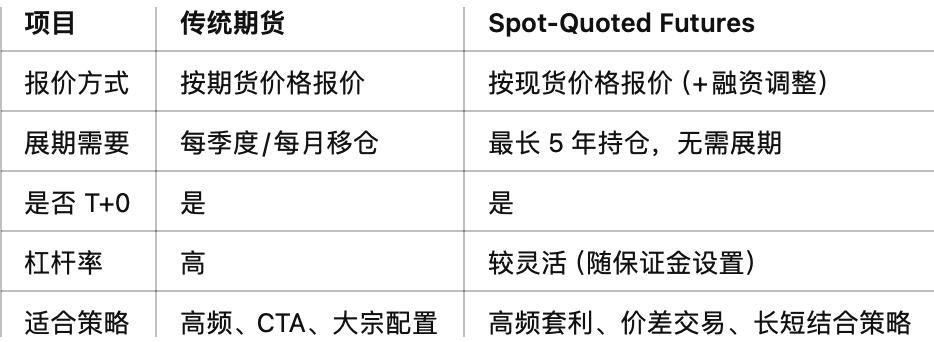

The Spot-Quoted Futures (SQF) that CME will launch on June 30, 2025, is an innovative futures product. The contracts will initially cover two major cryptocurrencies: #BTC and #ETH, as well as four major U.S. stock indices: the S&P 500, the Nasdaq 100, the Russell 2000, and the Dow Jones Industrial Average.

Core Features:

1️⃣ Trade at spot prices. SQF allows investors to trade futures at the spot market price, meaning the trading price directly reflects the current spot price.

2️⃣ Daily "financing adjustment" mechanism. A "financing adjustment" similar to perpetual contracts is introduced for futures contracts to hedge funding costs. This adjustment is published once daily and is the same for all traders on that day. Compared to the current traditional exchanges that adjust rates every 8 hours, this will be a revolution.

3️⃣ Designed for retail investors, with no limit on contract amounts. The contracts are designed to be small (e.g., $1 per point for the S&P 500), making them more suitable for retail investors and quantitative programs to finely control positions.

4️⃣ Maximum holding period of 5 years. This eliminates the frequent monthly and quarterly delivery issues of traditional futures, benefiting long-term strategies.

⏰ Trading hours: Nearly 24-hour trading, from Sunday to Friday, Central Time (CT) daily from 17:00 to the next day 16:00 (with a 1-hour maintenance in between).

Delivery method, for example:

Assuming an investor buys 1 SQF contract of #BTC at a spot price of 79000 at 18:00 on April 8. The financing adjustment for that day is -20.00.

If the investor sells the contract at a spot price of 80000 at 23:00, and the financing adjustment remains -20, then:

• The liquidation closing price: 80000 + (-20) = 79980

• Profit: 79980 - 79000 = 980 points. Since the contract multiplier is $1 per point, the profit is $980.

Some of my thoughts:

This model is frightening because it is like playing a large U.S. stock game where all the data and programs are preset. #AI can automatically match the current game scenario and environment to control market fluctuations and guide the gaming token economic model. When the gaming currency inflates, a few event-driven factors, like Trump’s tariffs, can deflate the bubble; when the gaming currency deflates, a few positive factors can stimulate a wave. Since there is no need for monthly and quarterly deliveries, and pricing power no longer requires physical delivery but comes directly from order flow, matching algorithms, and market-making liquidity, it means that algorithms will control the financial market in the future. This is essentially a tailor-made harvesting machine for Wall Street.

🎯 Specifically designed for high-frequency quant:

• No rollover costs;

• Low slippage;

• Huge space for high-frequency arbitrage;

• Transparent and automated matching mechanism;

• Can arbitrage across multiple asset markets (multi-market price differences).

🎯 Prices are not determined by people: Prices are determined by the order book and matching algorithms, with "fundamental news" becoming a trigger factor for the trading system rather than a pricing basis. The path through which fundamentals affect prices is "inducing changes in order flow," essentially understood and reacted to by algorithmic traders, rather than collective judgments by market investors.

🎯 "Retail investors become a herd":

• Retail investors typically make decisions based on news, charts, and public sentiment, and these variables can be pre-identified and countered by high-frequency trading systems.

• Retail investors lack the speed and resources for T+0 level reactions.

• High-frequency systems directly model the behavior patterns of retail investors and use them as reverse signals.

• The market is no longer a contest of "smart people against dumb people," but a zero-sum game of systems vs. non-systems.

🎯 If Spot-Quoted Futures become the mainstream trading model, and non-USD markets (like Hong Kong stocks, European stocks) do not have a similar structure or liquidity, they will become targets for arbitrage; it will be difficult to attract deep quantitative trading; ultimately, liquidity and valuation power will gradually shift to the USD market.

Although CME's latest financial innovation, Spot-Quoted Futures, has not yet been approved, once it is approved and launched in the market, it will undoubtedly be a deep-water bomb, marking the beginning of the comprehensive #AI algorithmization of financial markets, where retail investors will have no chance of winning!

https://x.com/rocky_bitcoin/status/1904899799847231549?s=46

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。