Trump’s declaration of broad tariffs targeting global trading partners has rattled financial markets, triggering a steep Wall Street downturn and intensifying recession fears. This wave of uncertainty has prompted widespread conjecture that central banks—chiefly the Federal Reserve—may resort to monetary easing to cushion the blow.

The next Federal Open Market Committee (FOMC) meeting is scheduled for May 7. According to CME’s Fedwatch tool, there is a 71.8% probability that the central bank will maintain current rates.

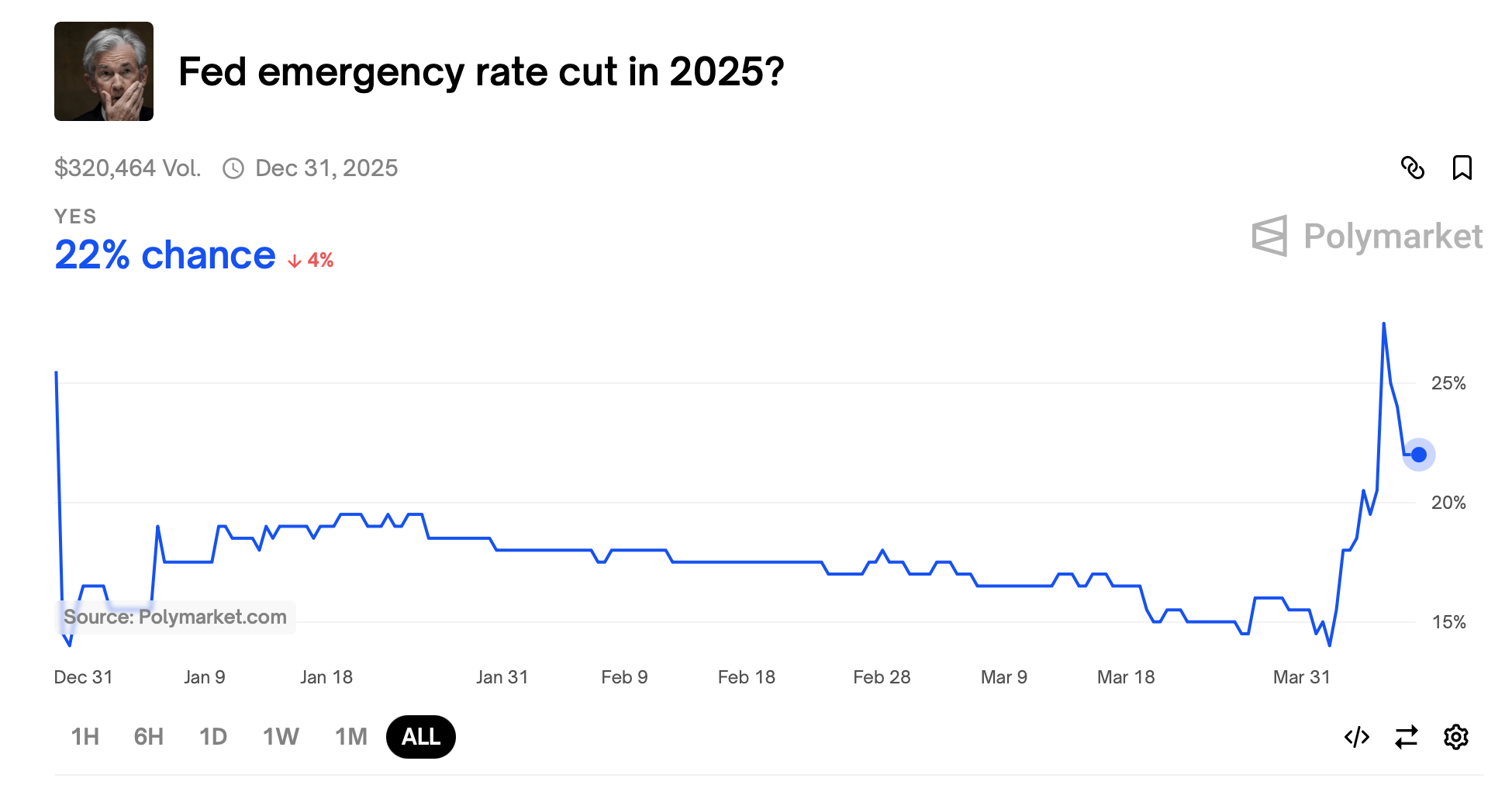

On Polymarket, a predictions platform, the likelihood of no change stands at 75%, while Kalshi’s prediction market similarly indicates a 75% chance that rates will remain steady. Polymarket is also hosting a wager on the possibility of an emergency federal funds rate cut, currently reflecting a 22% probability.

Polymarket emergency rate cut bet.

Emergency rate cuts were last implemented in the volatile days of March 2020, at the onset of the pandemic. The current volume on Polymarket’s emergency rate cut bet sits at $320,464.

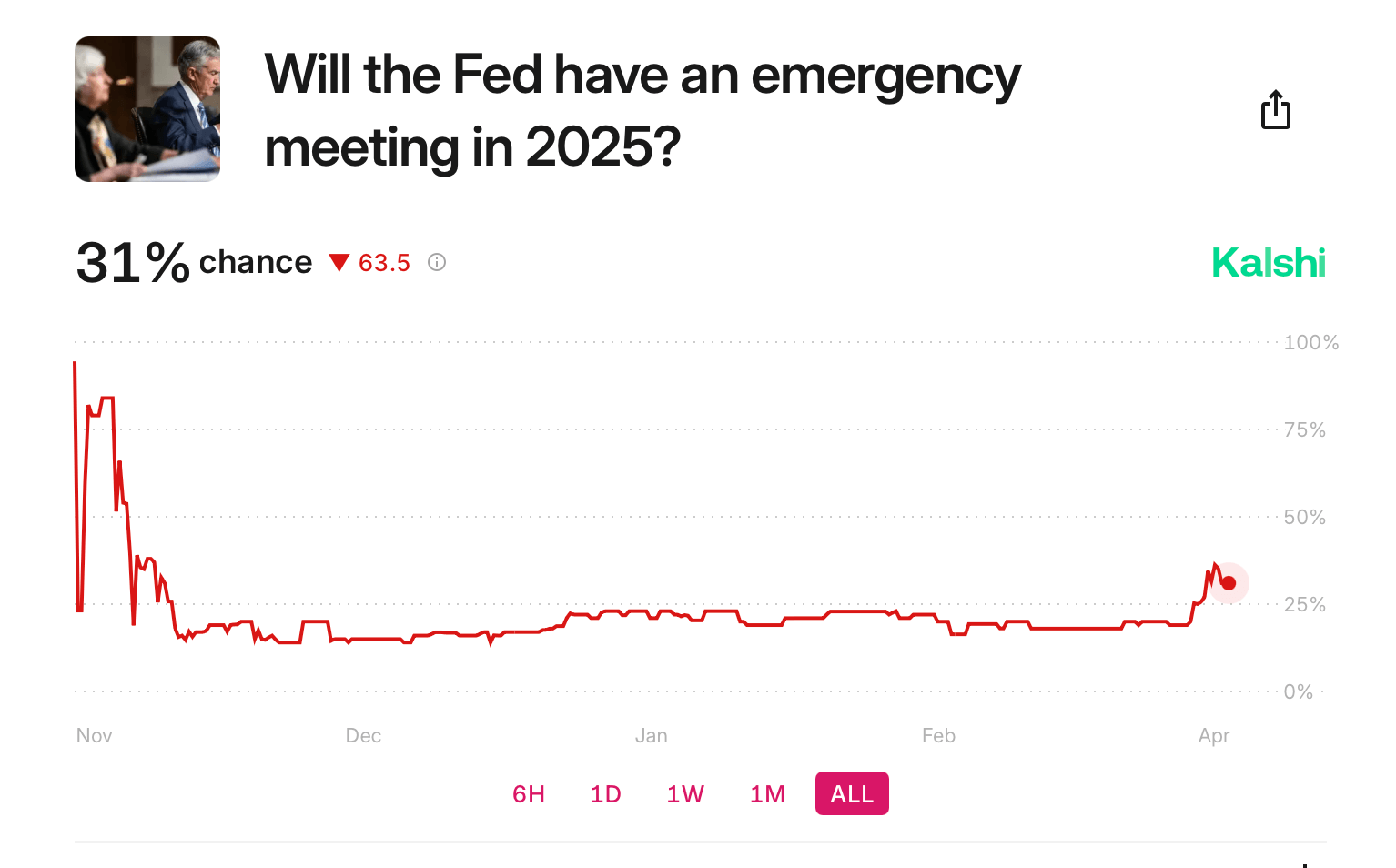

Kalshi emergency rate cut bet.

Kalshi is offering a similar wager, though its figure is higher, with a 31% chance priced in. Before the pandemic, the previous instance of emergency cuts by the Federal Reserve occurred during the 2008 financial crisis.

Trump continues to urge the central bank to lower interest rates, contending that present economic conditions present the “perfect time” to do so.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。