Since Trump announced on April 3 the imposition of "reciprocal tariffs" on major trading partners including China, Japan, and Vietnam, global stock markets have begun to experience varying degrees of plummeting—epic crashes in the U.S. stock market, with Nasdaq futures dropping 4.7% in a single day after the policy announcement, S&P 500 futures down 5%, and Dow Jones futures plunging 1822 points at one point. As of April 9, the S&P 500 index had cumulatively dropped 18.9% from its February peak, with a market value evaporating by $5.8 trillion, marking the worst four-day consecutive decline since 1950. Technology stocks became the "disaster zone" of this stock market crash, with Apple’s stock price plummeting 23% in four days, and the combined market value of seven major tech giants including Microsoft and Nvidia evaporating by $1.65 trillion. This shock directly stemmed from the risk of supply chain disruptions—75% of Apple's components rely on production in Asia, and the pressure from tariff costs is immense. According to Bloomberg, the total market value of global stocks shrank by $1 trillion, with the Vietnamese stock market dropping over 6% in a single day, the Nikkei 225 index plummeting nearly 3%, and the three major European stock indices each falling over 1%.

In a situation where there are no perfect eggs under a collapsed nest, global investors are in deep distress, and Trump himself cannot escape the disaster of this global crash.

Personal Wealth "Backfires" by $500 Million

According to a report by Forbes on April 8, when Trump announced the large-scale tariff plan on April 2, his net worth was estimated at $4.7 billion. However, in less than a week, his assets fell to $4.2 billion, evaporating $500 million in a week. The largest portion of his personal wealth loss came from his Trump Media and Technology Group, whose stock price has dropped about 5% since April 3. Trump holds 114.75 million shares, which alone has resulted in a total asset loss of about $170 million.

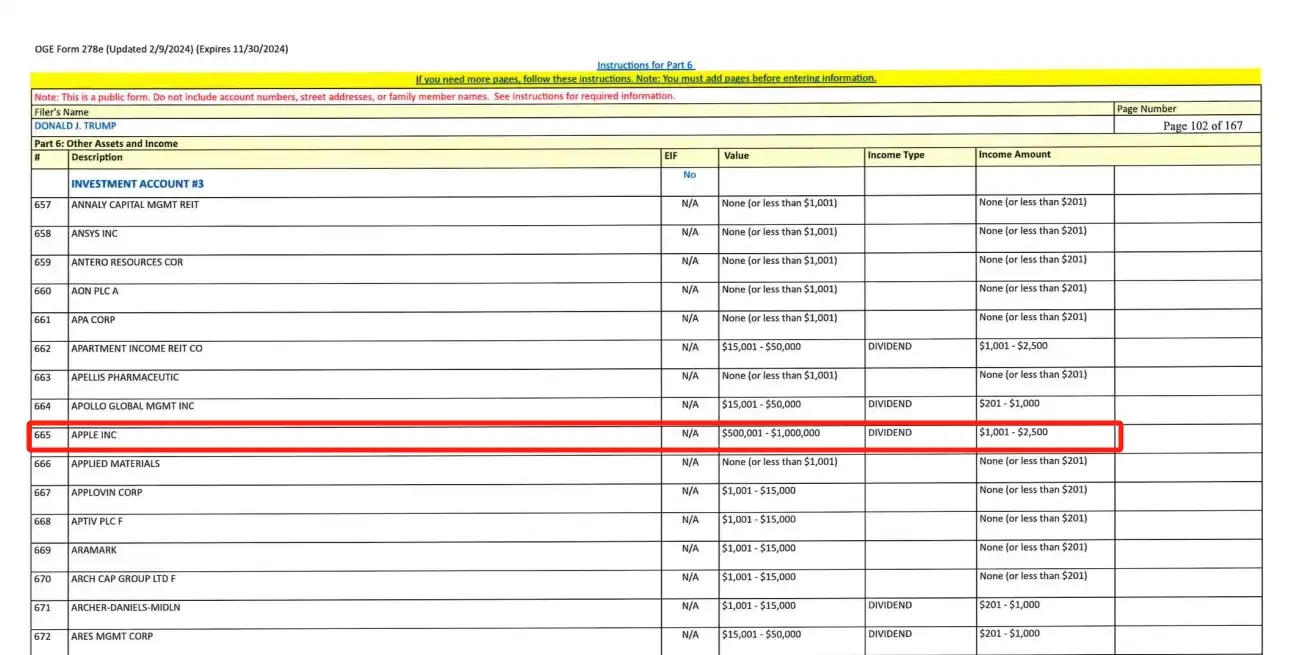

In addition, Trump holds a significant amount of stock in major tech companies. According to the Federal Election Commission (FEC) regulations, presidential candidates must submit personal financial disclosure reports by May 15 each year, covering their assets, liabilities, and sources of income, including stock investments. As a presidential candidate, Trump is required to comply with this regulation. His latest disclosed 2024 report shows that Trump holds stocks in Apple, Microsoft, Nvidia, Amazon, Alphabet (Google), Meta Platforms, Berkshire Hathaway, PepsiCo, and JPMorgan Chase, with values ranging from $100,000 to $1 million, among which the holdings in Apple, Microsoft, and Nvidia each exceed $500,000. The total value of the aforementioned stocks is between $2.25 million and $4.75 million. If Trump has not significantly changed his stock positions within eight months after the disclosure, the crash will have a considerable impact on his paper wealth.

Image source: Trump's personal financial disclosure report

Additionally, the value of the real estate asset portfolio held by the U.S. president also shrank from $660 million to $570 million during this period, a decrease of about $90 million. His golf-related assets also suffered losses, as many golf balls, clubs, and apparel sold in specialty stores rely on imports.

Furthermore, Trump's family crypto project WLFI also incurred huge losses from trading ETH. On April 9, according to Lookonchain monitoring, a wallet suspected to be related to WLFI sold 5,471 ETH at an average price of $1,465, yielding $8.01 million. This address had previously spent about $210 million to buy 67,498 ETH at an average price of $3,259, resulting in a current paper loss of about $125 million.

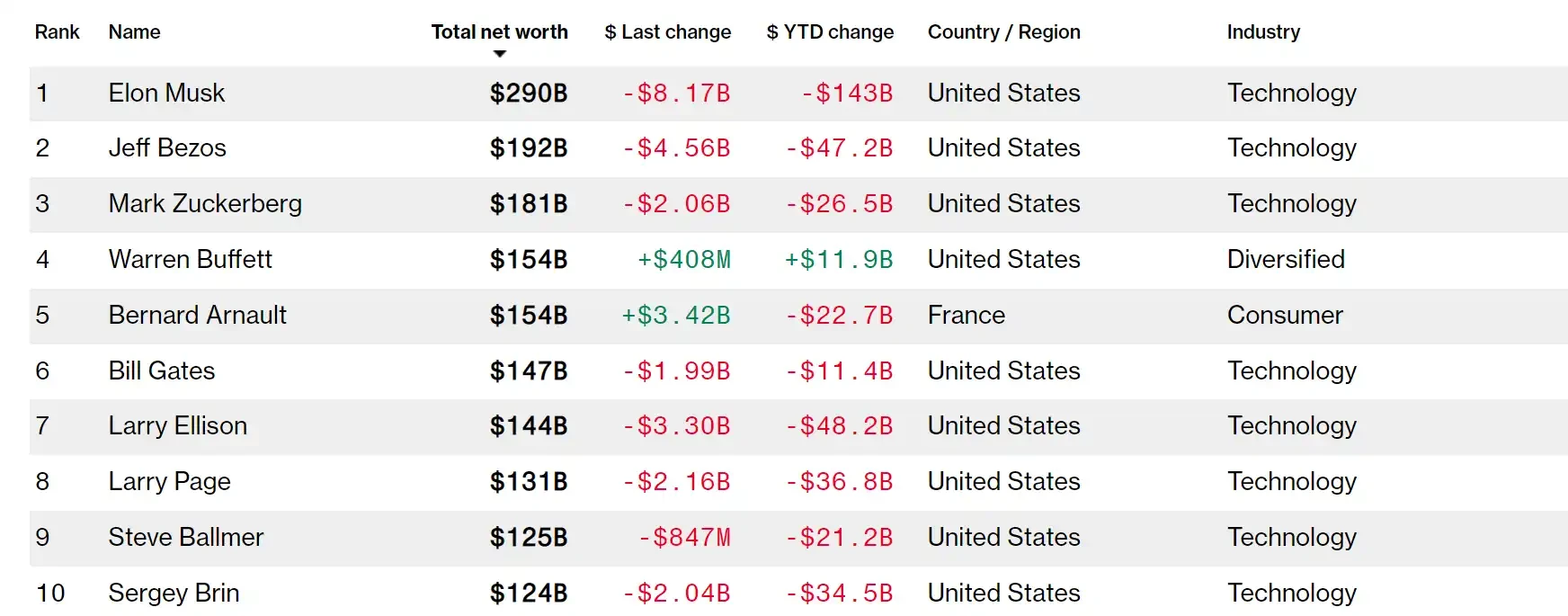

World's Richest Lose Billions

The Guardian reported that since Trump announced the tariff increase on April 3, by the close of trading on April 4, the world's 500 richest individuals lost a total of $536 billion in the first two days of stock market trading, marking the largest two-day wealth loss ever recorded by the Bloomberg Billionaires Index. Among them, several billionaires who supported Trump or attended his inauguration in January saw their wealth shrink to varying degrees, with Elon Musk and Mark Zuckerberg being the most affected. The following image shows the real-time ranking of billionaires by Bloomberg (as of April 9).

Image showing Bloomberg billionaire rankings as of April 9

The world's richest person, Tesla CEO Musk, has seen his wealth significantly shrink after becoming a prominent and controversial figure in the Trump administration. Following the stock price crash, Musk's net worth evaporated by $31 billion by last Friday's close. From the beginning of this year until now, Musk's wealth has shrunk by about $143 billion, but he still firmly holds the title of the world's richest person, with a net worth of $290 billion.

Facebook founder and owner of Instagram and WhatsApp, Zuckerberg, suffered the second-largest loss, amounting to over $27 billion. This third-richest person in the world has an estimated net worth of $181 billion, severely impacted by the plummeting market value of Meta. The tariff war has particularly hit tech companies hard, with the company's stock price dropping nearly 14% in two days. Many of the world's largest companies rely on Asian markets for manufacturing, computer chips, and IT services, and Asia is one of the countries where Trump imposed the most severe tariffs. Just weeks before Trump took office, Zuckerberg made a notable "Trump pivot" for Meta, and so far this year, his personal wealth has evaporated by over $26.5 billion.

Amazon founder and owner of The Washington Post, Jeff Bezos, suffered the third-largest loss in two days, amounting to $23.5 billion. As a leading importer of goods, Amazon's market value has shrunk by hundreds of billions of dollars this year. Chinese sellers account for over 50% of Amazon's third-party market share, and its cloud services also primarily rely on technology produced by Asian manufacturers. In February of this year, Bezos's $10 billion climate and biodiversity fund stopped funding one of the world's most important climate certification organizations, which some believe was a "capitulation" to Trump and his anti-climate action stance. Bezos is the second-richest person in the world, with an estimated net worth of $192 billion, and his wealth has evaporated by $47.2 billion this year.

Despite the two-day crash, not all billionaires saw their net worth shrink. Warren Buffett, the shrewd chairman and largest shareholder of investment company Berkshire Hathaway, has seen his wealth increase to $154 billion this year. During the two-day stock market crash, he did lose $2.57 billion, but so far this year, his net worth has increased by $11.9 billion.

Trump's tariff policy is a high-risk experiment that deeply binds personal political demands with financial markets. The massive evaporation of wealth for Trump and other world billionaires in just a few days not only exposes the conflict of interest between policymakers and capital markets but also reveals the self-contradiction of "protectionism" in the era of globalization—when politicians try to build walls with tariffs, it is often their own wealth empires that collapse first. For investors, this storm once again validates an iron law: in a highly interconnected global market, no one can truly stand alone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。