Original Author: LSTMaximalist

Translation | Odaily Planet Daily Ethan (@ethanzhang_web3)

Editor's Note: In 2025, tariff policies sweep the globe, bringing a "tale of two markets" to the crypto space—short-term liquidity tightening and soaring mining costs, but in the long run, potentially transforming Bitcoin from a "risk asset" into a "store of value king." LSTMaximalist's latest article “Tariffs, Trade Wars, and Bitcoin: How the New Macro Order Shapes Crypto” delves into how tariffs reshape market dynamics, revealing Bitcoin's rising potential in the wave of de-dollarization.

The following content is translated by Odaily Planet Daily, with some adjustments made for reader comprehension.

Summary

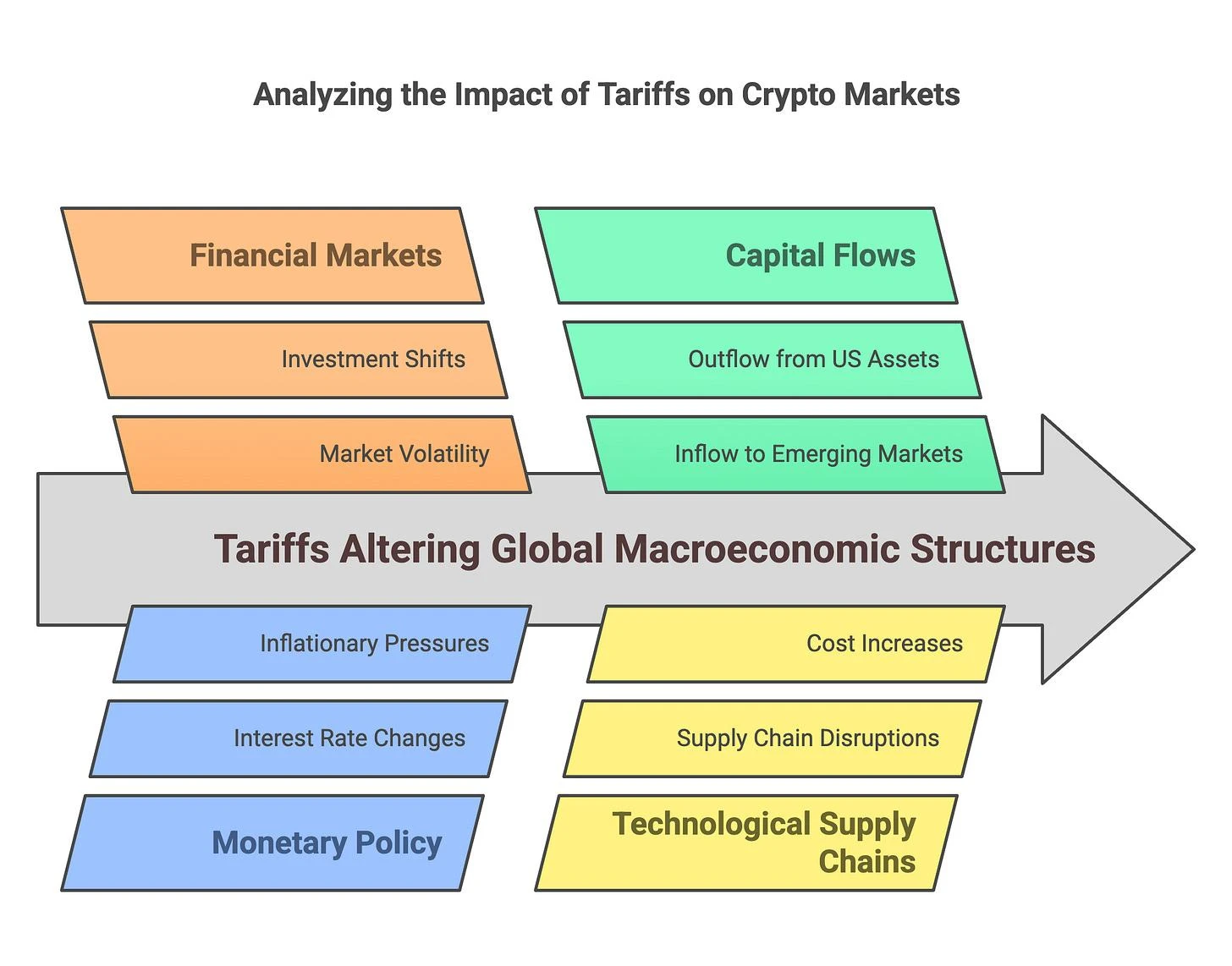

In 2025, the Trump administration's renewed tariffs are changing the global economic landscape, with particularly noticeable effects on the digital asset market. Tariffs are intended to protect local industries, but their secondary and tertiary effects ripple through financial markets, monetary policy, global capital flows, and technology supply chains, all of which are closely related to the crypto economy. This report will analyze how tariffs impact the crypto market, focusing on liquidity, mining economics, capital flows, currency fragmentation, and Bitcoin's new role in the global financial order.

I. Background: "American Ponzi" and Global Capital Flows

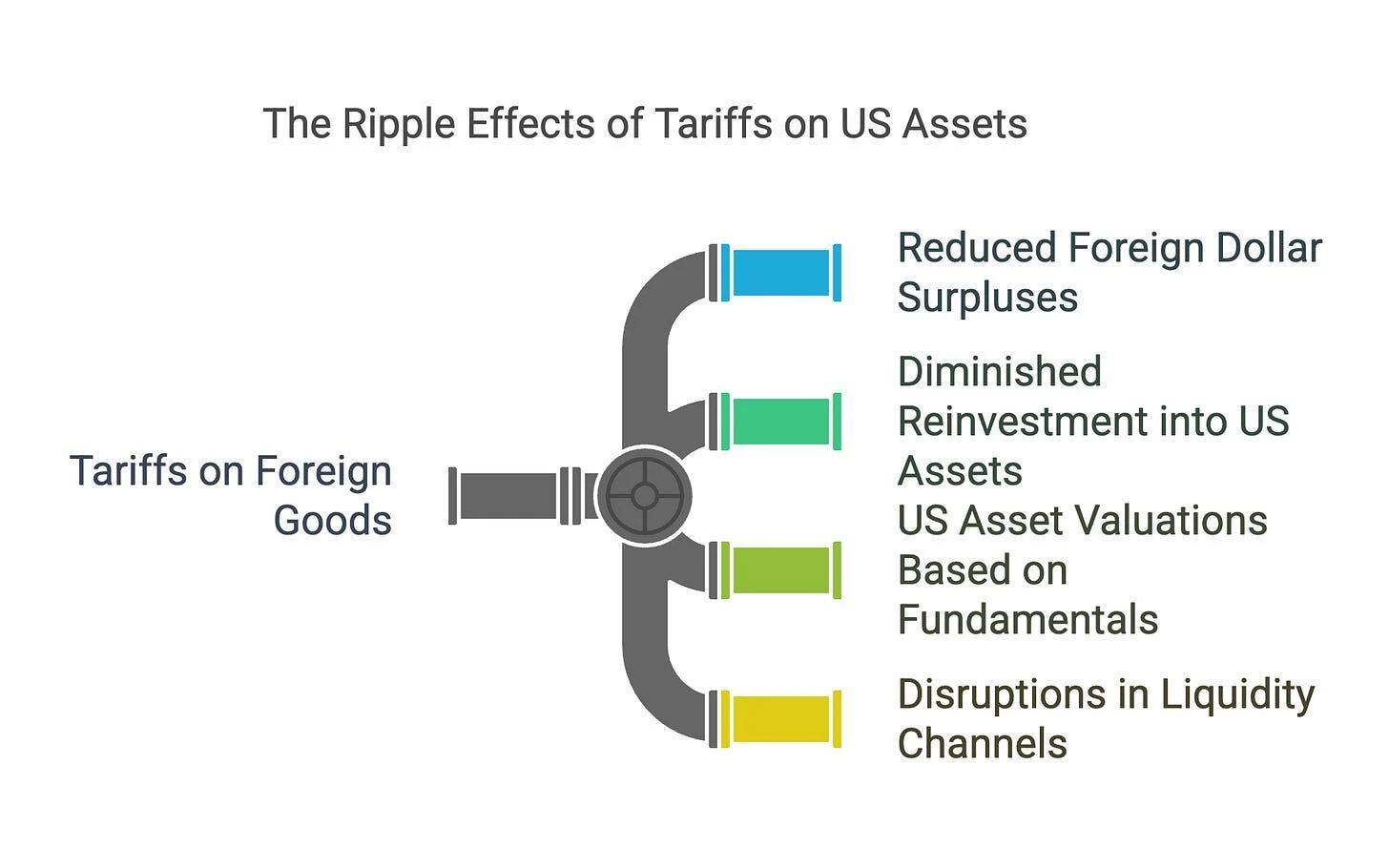

After World War II, the United States created a self-reinforcing economic cycle: foreign countries exported goods to the U.S., and the dollar surpluses earned were reinvested in U.S. assets (government bonds, stocks, real estate), which depressed yields and inflated asset prices. This cycle supported credit expansion, consumption growth, and asset inflation, making the dollar the world's top reserve currency.

However, excessive fiscal spending during the COVID-19 pandemic, aggressive monetary easing, and rising national debt levels have disrupted the stability of this system. The Trump administration's reintroduction of tariffs attempts to "force restart" this system, but it may undermine the core mechanism that sustains this "Ponzi game."

Impact of Tariffs on the Crypto Market

Mechanism of Operation:

Tariffs reduce the dollar surpluses of foreign exporters.

With reduced surpluses, the funds invested in U.S. assets decrease.

U.S. asset prices, which previously relied on foreign funds, must now prove themselves through fundamentals (earnings, growth).

Disruptions in liquidity channels affect all asset classes, including the crypto market.

Chain Reaction of Tariffs on U.S. Assets

II. Short-term Impact: Liquidity Shock and Shift in Sentiment

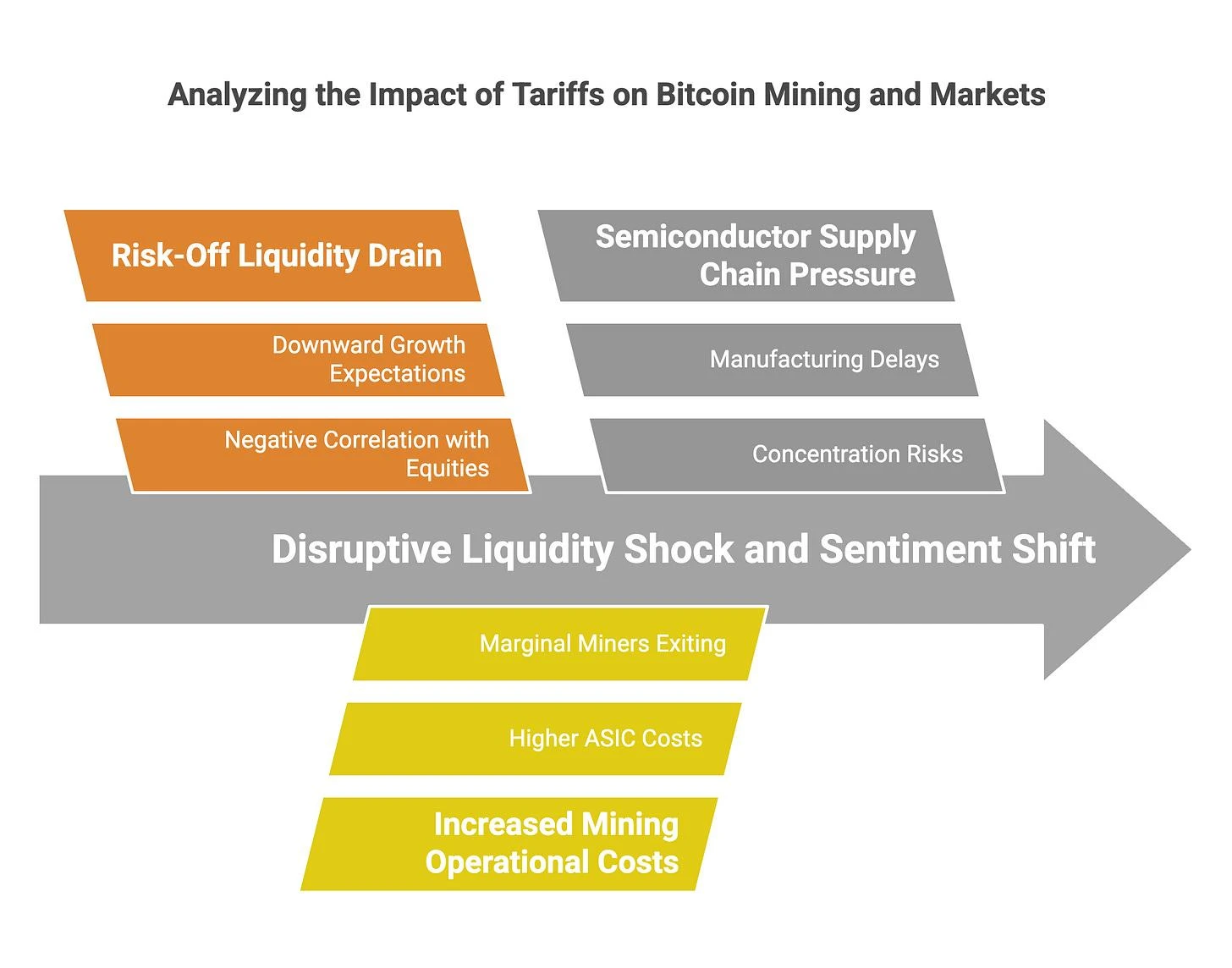

Liquidity Loss Under Risk Aversion: Tariffs trigger global risk aversion, leading to downward adjustments in growth expectations. Bitcoin (BTC), as a high-volatility asset, initially shows a negative correlation with the stock market during this liquidity shock. After the announcement of Trump's tariff policy in April 2025, Bitcoin fell about 8% in a single day, briefly touching $81,000.

Rising Mining Costs: Tariffs on Chinese mining hardware (ASICs, GPUs, semiconductors) increase capital expenditures for mining equipment.

Model Prediction: If ASIC costs rise by 10%, and energy costs and network difficulty remain unchanged, mining profit margins could shrink by 6-8%.

Elasticity Impact: Higher costs may drive out marginal miners, slowing the growth of hash power and tightening the mining economy.

Pressure on Semiconductor Supply Chains: Tariffs on key chip components disrupt the production of next-generation mining hardware, potentially delaying hash power expansion and exacerbating the concentration risk in mining centers.

Impact of Tariffs on BTC Mining and the Market

III. Mid-term Impact: Restructuring of the Monetary System and Cryptocurrency Adoption

Federal Reserve Policy as a Catalyst for Bitcoin: If tariffs dampen GDP growth but do not reignite inflation (due to reduced consumption rather than supply shocks), the Federal Reserve may shift towards easing policies (i.e., dovish).

Mechanism of Operation: Lower interest rates expand liquidity, and real yields decline, which historically has been favorable for Bitcoin prices (negative real rates boost non-yielding assets).

Observation: As of the end of March, net inflows into spot BTC ETFs have reached approximately $600 million year-to-date, indicating stable demand despite tariff fluctuations.

Weaponization of Trade Infrastructure: Trade sanctions and tariffs accelerate the trend of de-dollarization.

Empirical Data:

China and Russia settle energy transactions using Bitcoin and other digital assets.

Bolivia explores using cryptocurrencies for energy imports.

France's EDF considers monetizing exports through Bitcoin mining.

These initiatives validate Bitcoin's value as a neutral settlement layer, free from sovereign interference.

- Global Capital Redistribution: Foreign countries reduce purchases of U.S. government bonds, putting long-term assets (stocks, bonds) under pressure. In this context, non-sovereign assets like Bitcoin may attract liquidity seeking alternative reserves.

Economic Forces and the Role of BTC

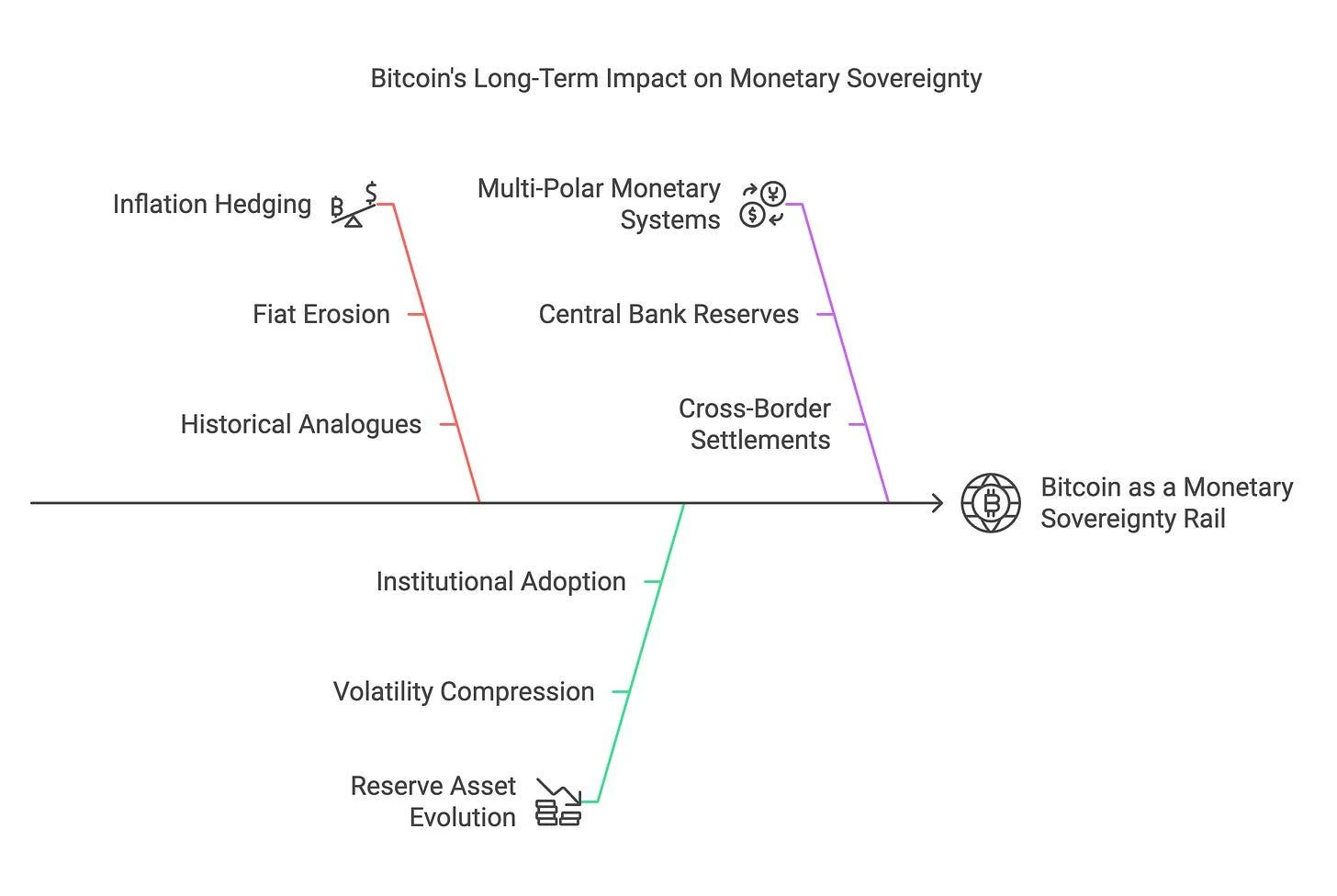

IV. Long-term Impact: Bitcoin as a Channel for Monetary Sovereignty

Inflation Hedge and Fiat Currency Depreciation: If trade disputes long-term weaken the purchasing power of fiat currencies, Bitcoin's utility as an inflation hedge may strengthen.

Historical Analogy:

The usage of Bitcoin surged in Argentina and Turkey during currency collapses.

The performance of gold after the collapse of the Bretton Woods system.

Evolution from Risk Asset to Reserve Asset: Bitcoin's Performance Depends on the Path

If instability in sovereign currencies becomes the norm, Bitcoin's volatility relative to fiat currencies may decrease, attracting institutional allocations.

Key Indicators:

Convergence of volatility compared to the stock market.

Increased correlation with inflation-protected securities (TIPS).

Pilot allocations by treasuries and sovereign wealth funds.

Multipolar Currency System and Bitcoin as a Settlement Layer: The disintegration of the U.S.-led trade framework gives rise to alternative cross-border settlement layers, with Bitcoin uniquely positioned due to its decentralization and censorship resistance.

Potential Trends:

Central banks holding Bitcoin as a tool for reserve diversification.

Energy-exporting countries preferring to settle in Bitcoin to avoid dollar risk exposure.

Long-term Impact of BTC on Monetary Sovereignty

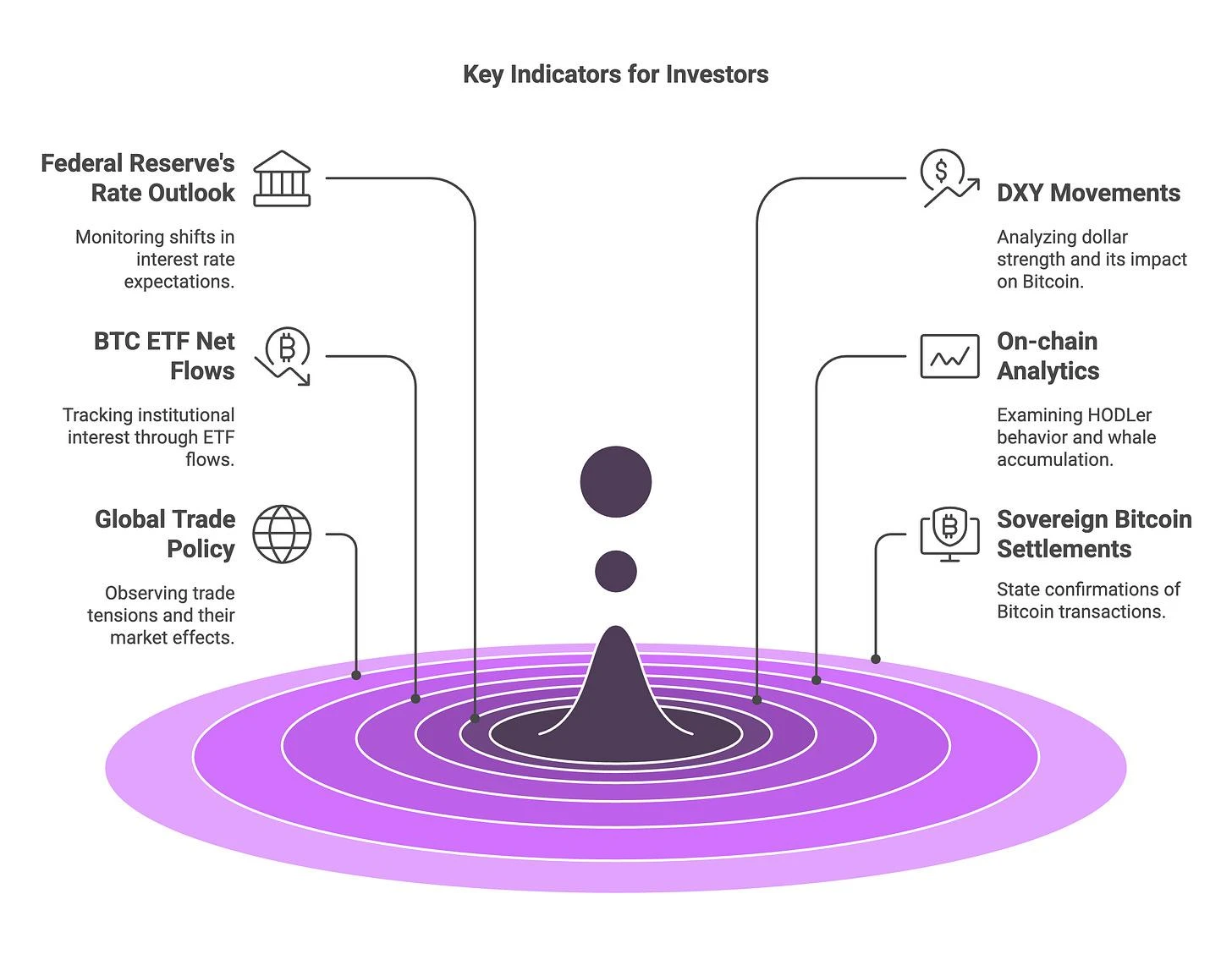

V. Key Indicators for Investors to Watch

Federal Reserve interest rate outlook: Changes in the federal funds futures curve.

Dollar Index (DXY) trends: Continued weakness is favorable for Bitcoin.

Net inflows into BTC ETFs: Reflecting institutional interest.

On-chain data: Holder behavior, whale accumulation, exchange reserves.

Global trade policy escalation: Watch for retaliatory measures from the EU and China.

Sovereign Bitcoin settlements: Monitor confirmed Bitcoin transaction events by national entities.

Key Investment Indicators

VI. Conclusion: A New Paradigm for Currency?

Tariffs are ostensibly aimed at trade balance and industrial protection, but their chain reactions touch every corner of the global capital market. For the crypto market, tariffs are not just short-term risk events; they may catalyze a major restructuring of the global financial landscape.

As economic nationalism, trade fragmentation, and de-dollarization trends accelerate, Bitcoin's concept as a "neutral currency" is becoming less distant. In a financially fragmented multipolar world, Bitcoin, as a sovereign-neutral reserve asset and energy settlement layer, may not only survive but thrive.

Investors, miners, and protocol developers should adjust their strategies to adapt to this era where liquidity flows, monetary credibility, and sovereign trust are being redefined.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。