How to Maintain Stable and Safe Returns During Economic Downturn Expectations, Based on a Yield Combination of Gold, U.S. Treasuries, and Bitcoin "ETFs".

Today, I had a great discussion with two ladies from @matrixdock, @Eva_Matrixdock and Xu Ge'er, about the market structure of gold-backed stablecoins. Of course, the gold stablecoin from matrixdock is pegged to one ounce of gold, not one dollar's worth of gold. This exchange gave me a new executable fixed income plan, and I believe this plan can not only maintain decent dollar-denominated returns during economic recessions but also provide high annualized returns when switching to $BTC, thus hedging against BTC price declines.

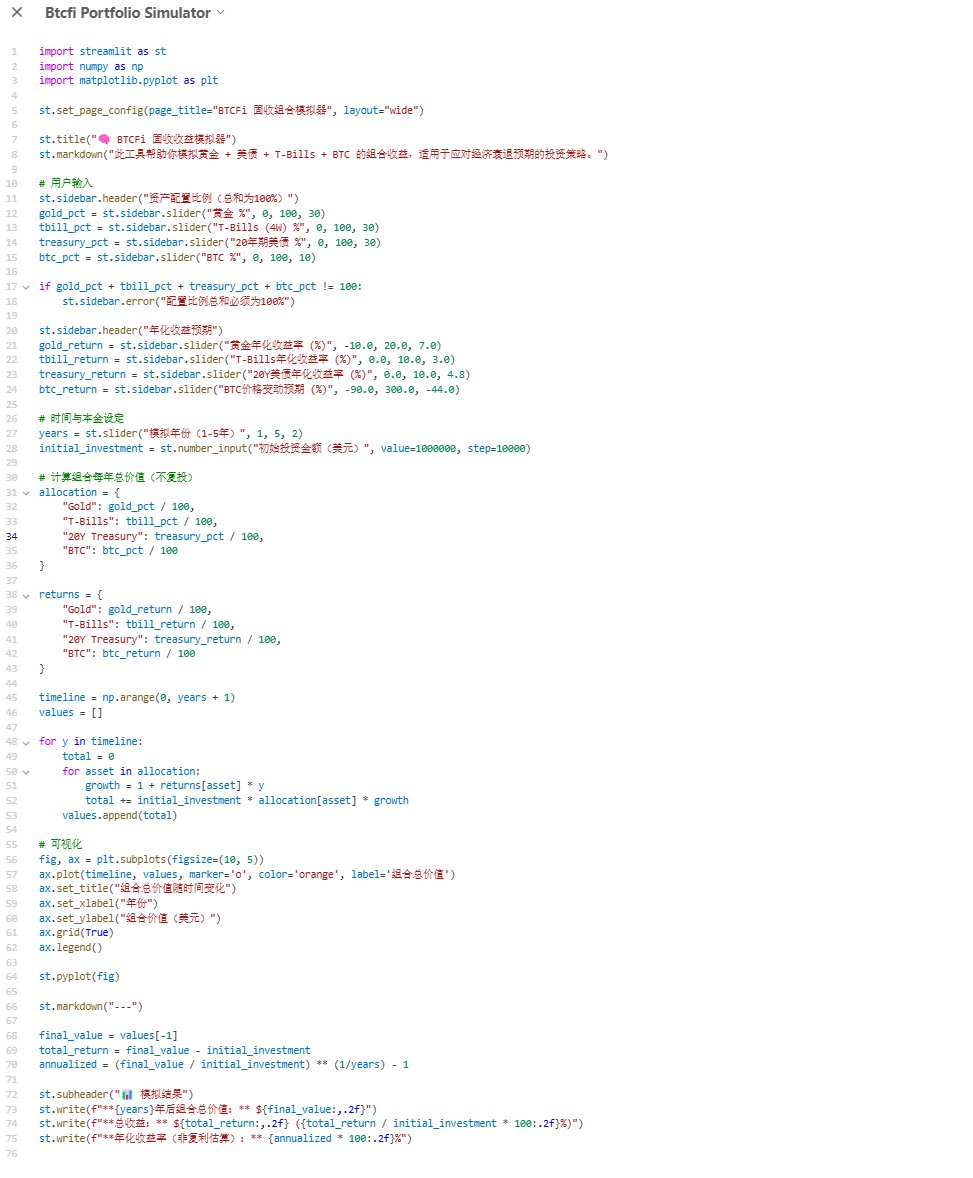

This new idea I summarized should be an extension of my previous BTCFi. In #BTCFi, I encountered some bottlenecks on the yield side, but today's discussion opened my mind, leading to this very promising fixed income idea. Currently, there should be no commercial application for it, so I will start by trying it personally and see if there are opportunities to launch a product.

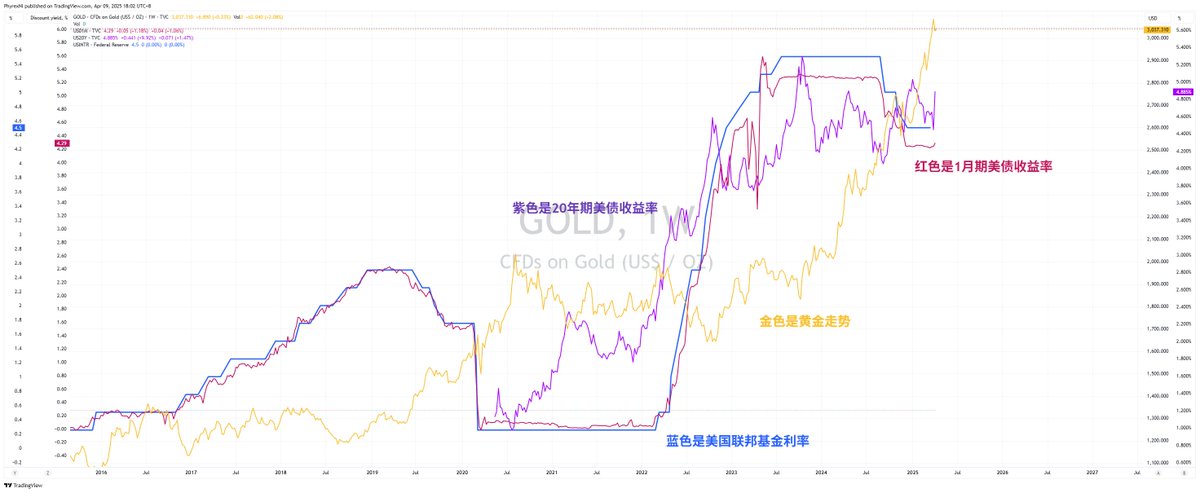

First of all, based on the current global economic development trends, gold's status as a safe-haven asset is unquestionable. When the economy is expected to decline, gold prices will rise, and more investors will choose to buy gold to hedge against asset depreciation risks. However, it is important to note that while gold has high value retention, it also experiences volatility cycles. Compared to the S&P 500, after gold's rapid growth in 2014, whenever the S&P 500 saw a significant drop, gold's gains were relatively lower.

However, when monetary policy is unfavorable to liquidity, during periods of monetary tightening, and when the Federal Reserve implements high interest rates, gold remains a high-quality safe-haven asset. Therefore, we can conclude that the higher the expected downturn in risk markets, the greater the magnitude and probability of gold's rise. Conversely, when more funds enter risk markets for speculation (DXY declines), gold's returns will narrow, or even turn negative (decline).

This explains why, since the beginning of the Federal Reserve's monetary tightening, through Trump's high tariffs, and the expectation of a recession in the U.S. economy, gold prices have been rising. This represents investors' bearish outlook on risk markets, with more funds seeking to invest in gold for safety.

But as mentioned earlier, gold also follows economic cycles. During monetary tightening and economic downturn cycles, it is gold's "golden" time. However, once monetary easing returns or the economy begins to recover (DXY declines), investors will be dissatisfied with the returns from gold and Treasuries, which is quite evident.

Monetary easing = Interest rate decline = Treasury yield decline = Reduced investment

Monetary easing = Dollar depreciation = Increased risk appetite = Increased investment

Thus, it is clear that gold investment can be divided into two types: one is a super long-term safe-haven asset, which, although it has low yields, offers relatively high stability. The other is a short-term (around 12 months) investment strategy to hedge against monetary policy and economic recession.

However, investing solely in gold may be very slow. Even though it has risk resistance, the yield fluctuations can be large, and the time for stable returns may be short. Therefore, simply investing in gold is not the best risk-hedging solution. Hence, I added U.S. Treasuries as the first complementary asset to gold.

For U.S. Treasuries, I chose two types: T-Bills (four weeks) and 20-year long-term Treasuries.

From the chart, we can see that Treasury yields are highly consistent with U.S. monetary policy. When the federal funds rate rises, both short-term and long-term Treasury yields will rise, and when the federal funds rate falls, both short-term and long-term Treasury yields will decline. However, if long-term Treasuries are purchased during high-interest periods, the yield remains unchanged. This means that if the current yield on 20-year Treasuries is 4.8%, then if I buy now, I will receive a 4.8% yield every year until maturity in 20 years.

Moreover, if monetary policy shifts from tightening to easing, the liquidity of 20-year Treasuries in the secondary market will be very good, as the yields on newly issued bonds will decrease. Therefore, if liquidity is needed, one can sell high-yield 20-year Treasuries in the secondary market, which will have a premium, allowing for early redemption of funds and obtaining premium returns.

Thus, pairing 20-year Treasuries with gold allows for long-term holding of gold as a safe-haven asset while compensating for the decline in gold returns due to monetary policy adjustments. However, due to the current uncertainty in monetary policy, the duration of high interest rates may not be long. Once monetary easing occurs due to economic recession, the period of gold's rise will be limited, likely lasting only six to twelve months, while the premium and liquidity of 20-year Treasuries will gradually increase.

Therefore, I also added T-Bills (four weeks) to the combination, and T-Bills are purchased on a rolling basis, ensuring that after the first month, there will be daily maturities of Treasuries starting from the second month, allowing for reinvestment, reducing dollar risk and enhancing asset liquidity.

This combination is not without risks; the biggest risk is the bankruptcy of U.S. stocks, which would prevent the redemption of long-term Treasuries. Without considering the likelihood of this happening, my asset allocation is:

30% Gold + 30% T-Bills + 30% 20-Year Treasuries

The largest risk exposure of this combination is the 30% in 20-year Treasuries. If the U.S. were to go bankrupt, the risk associated with 20-year Treasuries would be higher, while T-Bills could help mitigate losses. However, if such a situation arises, gold would inevitably appreciate, thus offsetting the impact of U.S. bankruptcy and reducing risk exposure. This combination could even be slightly modified to become:

50% Gold + 20% T-Bills + 20% 20-Year Treasuries

The second plan would be more favorable for those worried about the permanent bankruptcy of the U.S. I know some may be curious about the last 10%; let's not rush. First, let's calculate the returns.

If the U.S. enters an economic downturn in the coming year, potentially triggering a recession, gold is likely to trend upward with annualized returns of 5% to 10%. International analysts believe that if the U.S. enters a recession, the likelihood of gold prices rising above $3,300 is very high, corresponding to a 10% increase. Taking the middle value of 7% for calculation.

Next, the long-term Treasuries, based on the current yield, will yield 4.8% annually, while T-Bills (four weeks) currently yield 4.3%. On average, it should maintain a minimum of 3% annually. If we consider a 30-30-30 combination, then investing $1 million would yield:

30% Gold = $300,000 = $21,000 annual return

30% Long-Term Treasuries = $300,000 = $14,400 annual return

30% T-Bills (four weeks) = $300,000 = $9,000 annual return

So, the total annual return on a principal of $900,000 would be $44,400, yielding a rate of 4.93%.

The greatest advantage of this combination is that it can withstand all risks except for U.S. bankruptcy within a year. Although many may think that an annualized return of less than 5% is too low, this is an investment portfolio with almost no risk. If the Federal Reserve chooses monetary easing within a year, even if the U.S. were to go bankrupt, it would not happen within that year, allowing for the complete withdrawal of all principal and avoiding the potential of an economic recession.

This combination's "ETF" risk resistance and liquidity are superior to any individual product (gold, long-term Treasuries, and T-Bills) investment. The effectiveness of the funds can be guaranteed, allowing investors to achieve the most stable returns and cash out quickly (expected to be less than 6 months). In the long run, if the tariff issues and economic recession persist longer, it will undoubtedly benefit the returns of gold and short-term Treasuries.

Therefore, fundamentally, this combination is one of the best responses to economic and tariff risks.

The final 10% is likely known to everyone; this is for Bitcoin.

The idea here is that, first, we confirm that BTC is currently not sufficient to become a complete safe-haven asset. However, if the S&P 500 is expected to drop 50% during a recession, will BTC also drop 50% or more? Logically, this possibility is not very high, as a large amount of BTC is locked in enterprises and ETFs, currently exceeding 2 million coins, almost double the current market liquidity. As long as this portion of BTC is not sold into the market, its impact on the $BTC price will not be very significant. But what if some BTC is sold off?

Still considering a $1 million allocation, the Bitcoin allocation is $100,000. As mentioned earlier, our yield is $44,400 per year, which means we can use this portion of the yield to hedge against a 44.4% decline in BTC, effectively reducing the cost of BTC from $80,000 to $55,000. If it continues to decline, it indicates that market liquidity is worsening, and monetary policy is tightening. In this case, the returns from the 90% investment portfolio will be higher.

Even if the first year cannot cover all downward trends, the second year with a continued annualized return of around 4.5% can almost turn Bitcoin into a zero-cost position. Even if Bitcoin goes to zero, this loss can be compensated within two years, and I don't believe Bitcoin will go to zero within two years.

Therefore, in this investment plan, I would choose to continuously use the returns to purchase $BTC. Each year, the $44,400 yield would be used to buy BTC, resulting in an annualized return of 44.4% in gold terms, while the coin-based return would be at least around 20%. The lower the BTC price within a year, the higher the coin-based return, potentially exceeding 100%. Moreover, this return is 100% safe and stable.

The most important aspect of this combination is the expectation of U.S. monetary policy. The U.S. cannot remain in a high-interest state forever; it will inevitably shift from monetary tightening to easing. The faster the economic recession occurs, the greater the impact, and the shorter the duration of monetary tightening. This presents a good opportunity for liquidity. When transitioning to monetary easing, investors' risk appetite will gradually increase, and approximately six months into the recession will be the best time to buy the dip (pick up the corpses).

Furthermore, the more severe the economic recession, the greater the probability of the Federal Reserve using QE, which will be better for the rebound in risk markets. The expected returns and liquidity release of this plan will be more convenient, allowing for the sale of gold and long-term Treasuries at the bottom of the risk market (peak of recession) to start investing in risk assets. The more gold declines, the more it will be sold. As gold falls, the secondary market yield of long-term Treasuries will rise, and the more monetary policy shifts towards easing, the more likely a bull market will arrive. Converting returns into Bitcoin during monetary easing will likely yield good results.

The current expectation is for fixed income in 2027 and 2028, with 2028 likely ushering in the largest bull market in the last decade.

PS: I will start executing this plan myself and report and track it regularly. The income model code was generated by ChatGPT, and those interested can give it a try.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。