It's a bit late today, so I'll just skim through the homework. I think everyone knows what happened today. Trump, who claimed he wouldn't pause tariffs, went back on his word just a day later. Besides the increase of tariffs on China to 125%, the equivalent tariffs on other countries have been paused for 90 days. During this period, only 10% of the basic tariffs will take effect, which has already provided the market with a good boost. Some institutions have even lowered the probability of a recession in the U.S.

Of course, a 10% basic tariff is still four times higher than the average 2.5% tariff expected in the U.S. for 2024. Not to mention, the 25% tariff on imported cars and parts is still in effect, which could have a significant impact on U.S. inflation. After all, the main components of inflation in the U.S. right now are rent, used cars, and the service industry. The rise in prices of imported cars and parts could likely push up the prices of used cars, thereby increasing inflation.

Currently, due to inventory reasons, the CPI and PCE data for May may not fully represent the implementation of tariffs; it should gradually show in June. The market will also be concerned about how Trump will define equivalent tariffs after the 90 days. Of course, the Federal Reserve will be very concerned as well.

Although many friends think Trump is unreliable after this commotion, the risk market indeed responds to this kind of situation. The Nasdaq and S&P have directly recovered the declines from the past three days, and the VIX has dropped from 57 to 33. At least the market has welcomed a 90-day buffer. Moreover, if the GDP for the first quarter is not good, there is still the second quarter to gamble on. However, it should be noted that we are still in a rebound phase and do not yet meet the conditions for a reversal.

At least from the March meeting minutes released by the Federal Reserve today, it seems that the Fed is not prepared to cut interest rates early unless there is a significant rise in unemployment or expectations of an economic downturn. Therefore, the data for May and June will be more important.

The difficulty in April lies in the fact that it is not a single-direction market; it is more driven by "events."

Looking back at Bitcoin's data, the buying sentiment today is still quite good. We mentioned during the last incident that users have money but are hesitant to jump in. However, with the temporary relief of tariffs and the possibility of a recession being delayed, some investors are willing to take a gamble. From the data, today's turnover rate has slightly increased, and user sentiment is relatively normal, with short-term investors still being the main providers of turnover.

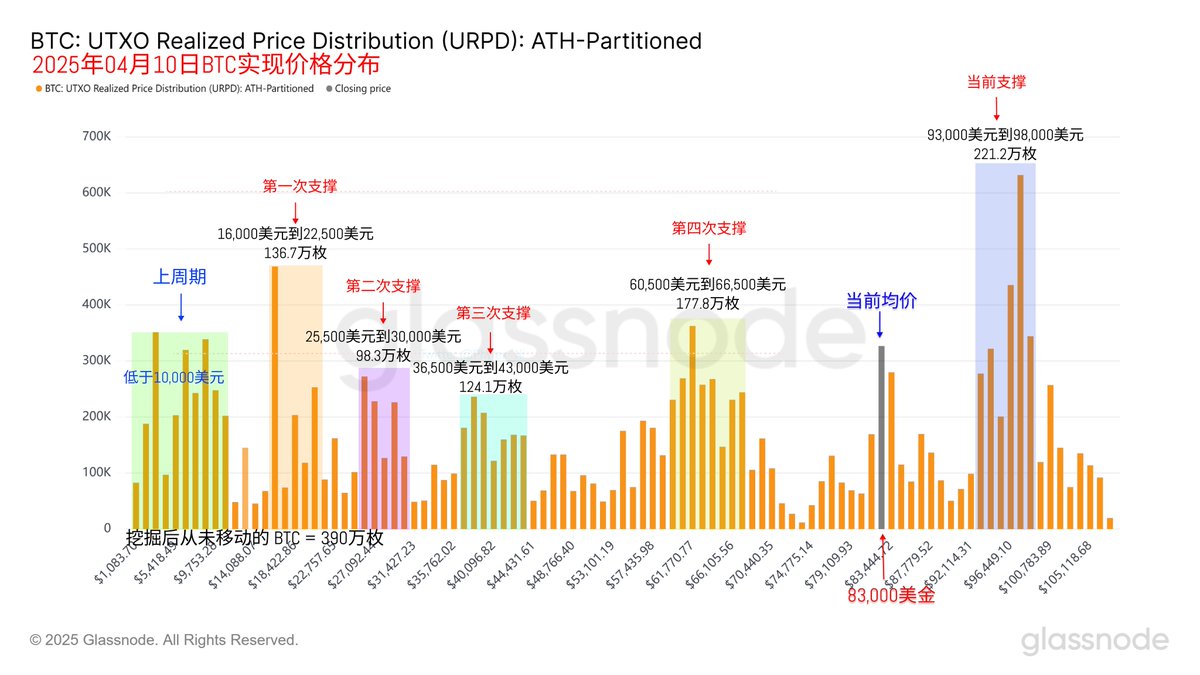

Earlier investors are still in a wait-and-see attitude, but from today's URPD data, we can see that chips around $83,000 are continuing to concentrate, almost forming a new bottom. This group of investors is also starting to shift towards long-term holding.

In contrast, investors in the $93,000 to $98,000 range have only transferred a few thousand $BTC, which is only about one-twentieth of the total turnover, indicating that this group of investors remains very stable. Even when the price dropped to $74,000, there was no panic, so the pressure on prices is not significant.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。