Clarifying the 5 Major Mysteries of Circle's IPO.

Written by: Wenser (@wenser 2010)

At the end of March, according to Fortune, stablecoin issuer Circle has hired an investment bank to initiate IPO preparations, planning to submit a public listing application to the SEC in late April; on April 1, Circle officially submitted its S-1 prospectus to the U.S. SEC, planning to list on the NYSE under the stock code CRCL. As the market believes this move may mean that "the first crypto IPO after Trump's rise to power" is no longer in suspense, just a few days later, with the official launch of Trump's tariff trade war, market news indicated that Circle would delay its IPO process. Thus, the suspense continues regarding which company will ultimately claim the crypto IPO after Trump's administration aimed to establish a crypto-friendly government.

Odaily Planet Daily will analyze the current state of the stablecoin market, trends in U.S. crypto regulation, and compare Circle's valuation system with other potential IPO crypto projects in this article.

Mystery 1: Can Circle Claim the Title of "First Stablecoin Concept Stock"?

To conclude, Circle is very likely to claim the title of "first stablecoin concept stock."

Reasons are as follows:

- Major competitors are not inclined to take the "IPO development route." Previously, after Circle submitted its IPO application prospectus, Tether CEO Paolo Ardoino stated that Tether does not need to go public. (Odaily Planet Daily note: It is worth mentioning that Paolo's tweet included a photo of him with the Wall Street bull, implying a strong message of "I don't need to talk to Wall Street investment banks about going public; rather, Wall Street investment banks need me.")

Tether CEO's bold statement

Circle firmly holds the second position among stablecoin issuers. According to information from Coingecko, USDC currently has a market capitalization of $60.14 billion, second only to USDT, which has a market capitalization of $144 billion, ranking sixth in the cryptocurrency industry by market cap.

Circle has a comprehensive compliance system, making it the "most compliant stablecoin issuer." It is known that Circle is registered as a Money Services Business (MSB) in the U.S. and complies with relevant regulations such as the Bank Secrecy Act (BSA); it holds money transmission licenses in 49 U.S. states, Puerto Rico, and Washington D.C.; in 2023, Circle obtained a Major Payment Institution license from the Monetary Authority of Singapore (MAS), allowing it to operate in Singapore; in 2024, Circle received an Electronic Money Institution (EMI) license from the French Prudential Supervision and Resolution Authority (ACPR), enabling it to issue USDC and EURC in Europe under the EU's Markets in Crypto-Assets Regulation (MiCA). It can be said that USDC is one of the few stablecoins that operate compliantly in the U.S., Europe, and even Asia.

Therefore, based on the current progress of the IPO application submission and USDC's market position, as well as the attitudes of other competitors, Circle should be poised to claim the title of "first stablecoin concept stock."

The next question is: Can Circle's main business become the market value support after the IPO? The answer still needs to be found in Circle's IPO prospectus.

Mystery 2: Is Circle's USDC stablecoin a guaranteed profitable business?

Again, to conclude, at present, Circle's operational situation does not appear particularly optimistic.

Previously, we conducted a detailed analysis of the specific situation and business model of Tether, the dominant player in the stablecoin sector, in the article "The 'First Stablecoin' USDT Hits New Market Highs, Revealing the Billion-Dollar Business Empire Behind Tether"; in the article "7 Major Crypto Money-Making Machines: With Annual Profits of $14 Billion, It is the Ultimate 'Tax Officer' of the Crypto World," we also analyzed Tether's nearly $14 billion annual profit with fewer than 200 employees, highlighting Tether's "high profit, small team" model that places it at the top.

However, Circle's IPO prospectus shows that its operating conditions are significantly different from Tether:

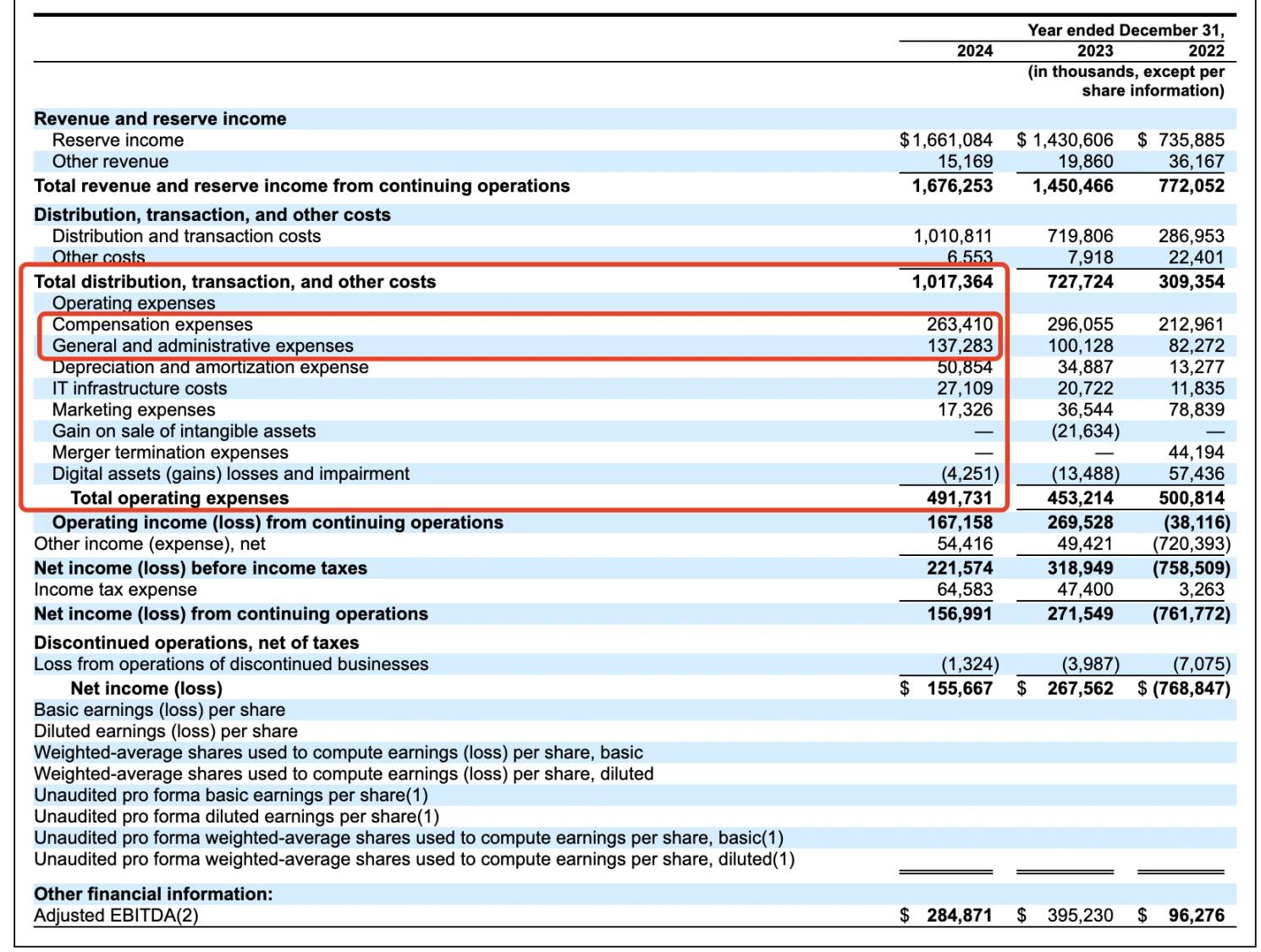

In terms of specific revenue: In 2024, Circle reported revenues of $1.68 billion, up from $1.45 billion the previous year, a year-on-year increase of 16.5%; however, its net profit fell from $268 million to $156 million, a year-on-year decrease of 42%. Part of the reason is the $908 million distribution cost paid to partners (including Coinbase and Binance).

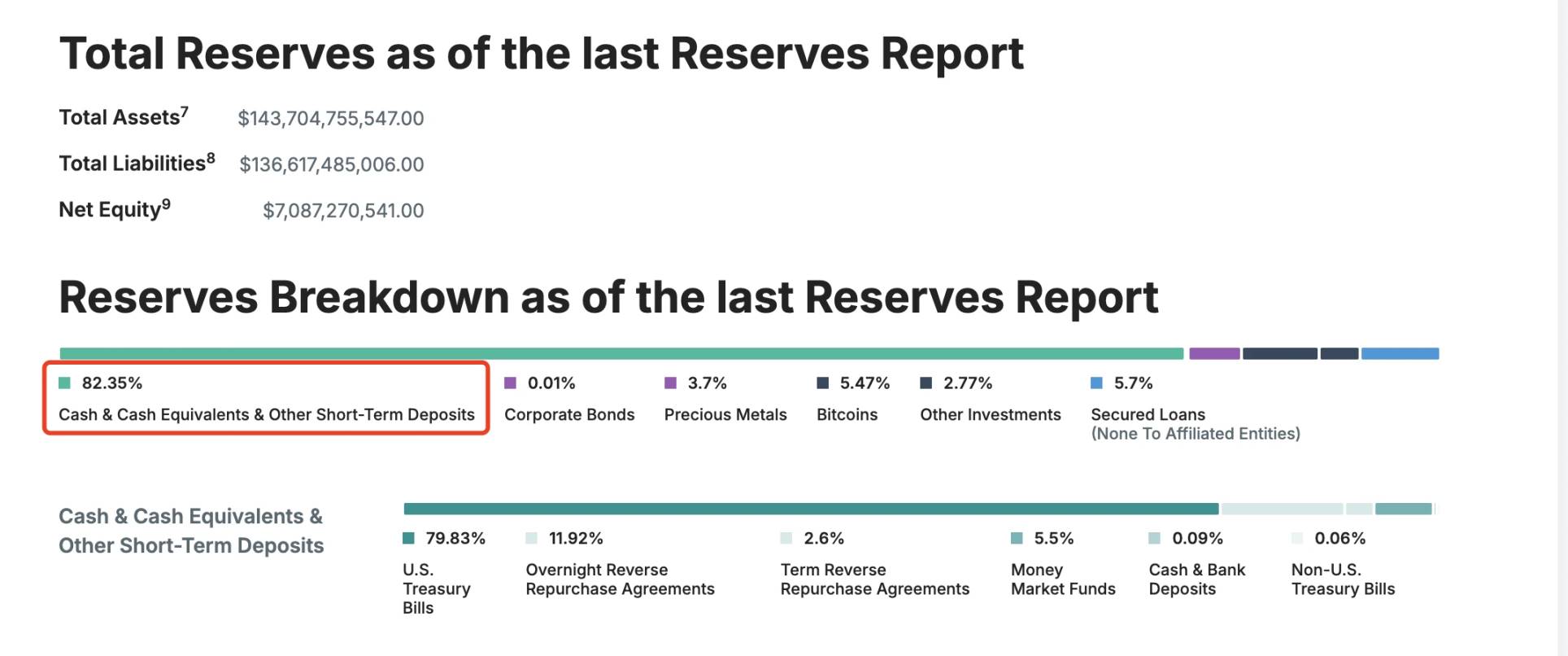

In terms of reserve funds: Approximately 85% of USDC's reserves are invested in U.S. Treasury bonds (managed by BlackRock's Circle Reserve Fund), and about 20% is held in cash deposits within the U.S. banking system; in comparison, USDT's reserves are more diversified, including 5.47% in BTC.

Details of USDT's reserve funds

In terms of management costs: According to the prospectus, Circle spends over $260 million annually on employee salaries and nearly $140 million on administrative expenses; depreciation and amortization expenses amount to $50.85 million, IT infrastructure costs reach $27.1 million, and marketing expenses are around $17.32 million. It must be said that Circle's expenditure categories are far more complex than Tether's.

Circle's operating data over the past three years

Additionally, it is worth noting that Circle's revenue sources are far less than Tether's, with 99% of its revenue coming from reserve interest, approximately $1.661 billion; its transaction fees and other income amount to only $15.169 million.

In other words, at this stage, Circle is engaged in a "deposit interest business," rather than a model like Tether that can "earn from both ends"—earning reserve interest income while also charging service fees for fund redemptions. It is important to note that the cross-border payment market is as large as $150 trillion, and currently, this market is primarily occupied by the more decentralized and less regulated USDT.

In contrast, Circle is still constrained by "partners" like Coinbase and Binance.

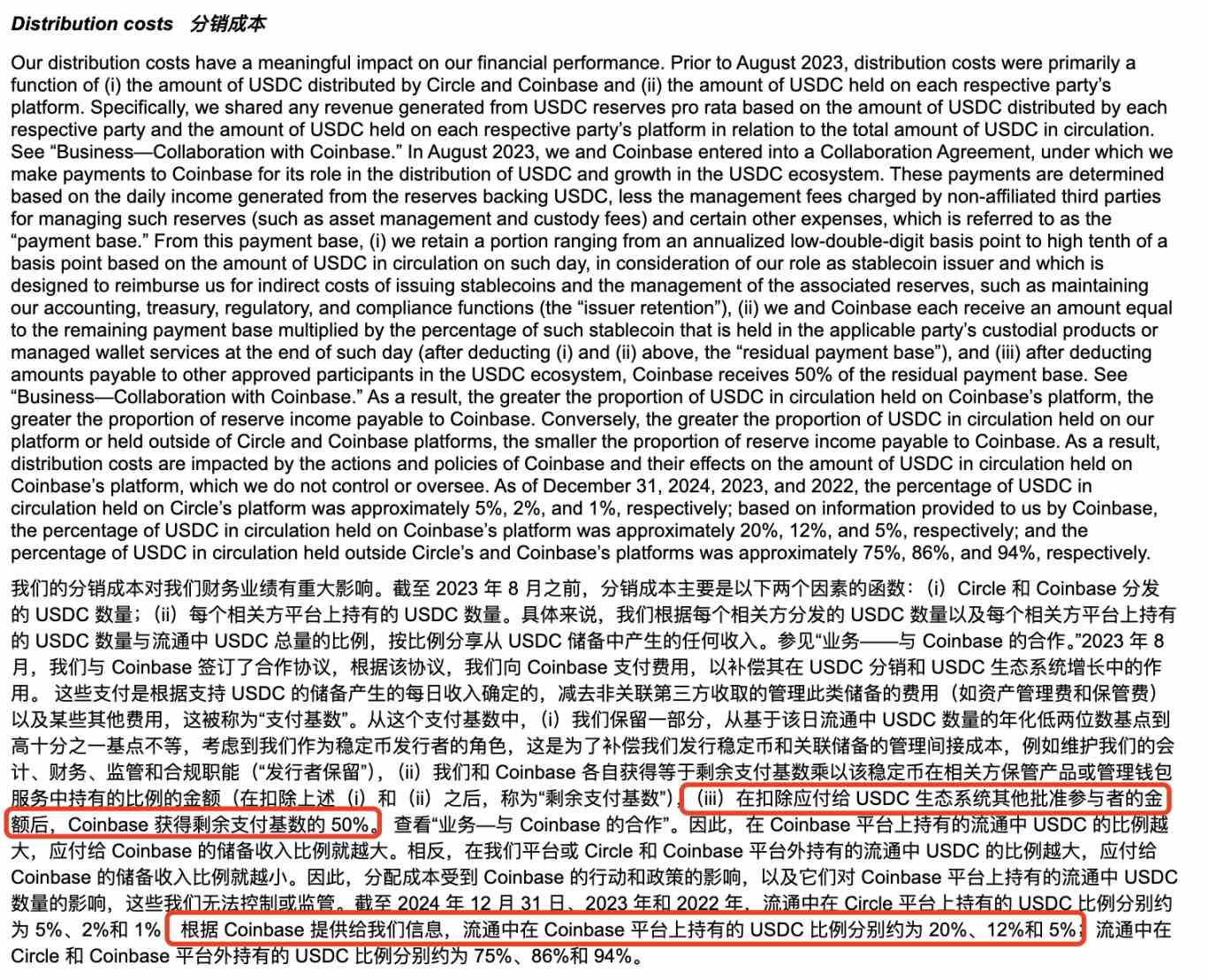

Mystery 3: Will the Ambiguous Relationship with Coinbase Continue?

The full name of the company behind Circle is Circle Internet Financial, Inc., originally founded by Jeremy Allaire and Sean Neville in 2013; the governance of USDC is managed by the Centre Consortium, which was jointly established by Circle and Coinbase. However, with changes in the regulatory environment, in August 2023, Circle spent $210 million to acquire Coinbase's corresponding shares in the Centre Consortium, taking full control of USDC's issuance and governance, but the 50%:50% profit-sharing agreement between the two parties remains in effect.

Distribution cost information in Circle's prospectus

In 2024, of the $908 million distribution cost Circle paid to Coinbase, according to Coinbase's previously released 10-K annual report, $224 million was rewarded to users in the form of staking rewards (holding USDC can earn 4.5% returns, with some users previously reporting APYs as high as around 12%), while approximately $686 million belongs to Coinbase itself.

Real earnings and corresponding interface received by @0x_Todd

Currently, this move may be understood as Circle and Coinbase's "open conspiracy" to expand USDC's circulating market value and market share—however, such high stablecoin interest rates also raise doubts about whether Coinbase and Circle are laying the groundwork for the IPO, doing so out of necessity, and putting on a "high-interest deposit" show for retail investors.

Moreover, the beneficiaries of Circle's high distribution benefits are not limited to Coinbase; Binance is also included.

The prospectus indicates that in November 2024, Binance became the first approved participant under Circle's stablecoin ecosystem protocol. According to the cooperation agreement, Binance is required to promote USDC on its platform and hold a certain amount of USDC in its financial reserves; Circle paid Binance a one-time upfront fee of $60.25 million and agreed to pay monthly incentive fees based on the USDC balance held by Binance. The incentive fees are only paid if Binance holds at least 1.5 billion USDC, and Binance commits to holding 3 billion USDC (with exceptions in specific circumstances). The cooperation is divided into market promotion and financial reserves, both for a two-year term. If Binance prematurely terminates the market promotion agreement, it must still fulfill a one-year reduced fee payment and promotion obligation. Both parties can terminate the agreement early under specific circumstances.

It is evident that in terms of attracting allies to expand the market base, Circle understands the importance of high-profile strategies.

In addition, in the past year, Circle has been very active in the Solana and Base ecosystems. According to incomplete statistics from Odaily Planet Daily, since 2025, over 3.25 billion USDC has been issued in the Solana ecosystem alone, totaling 13 times, with a single issuance amounting to as much as 250 million.

Incomplete statistics

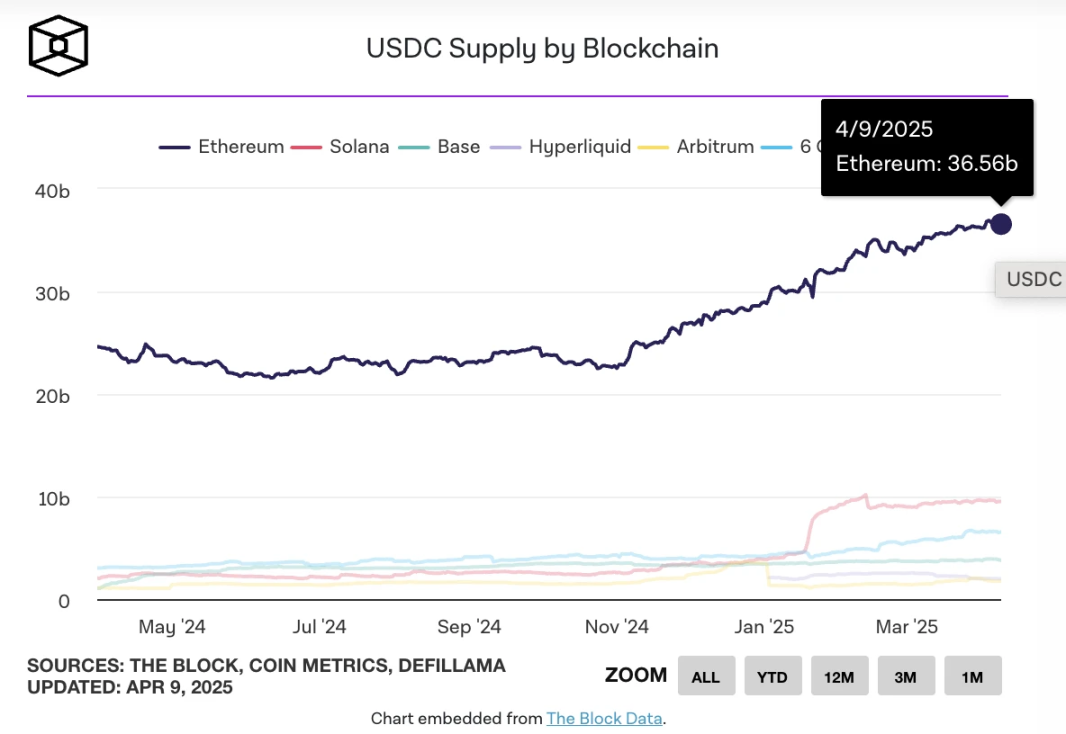

On March 26, as the on-chain issuance of USDC surpassed $60 billion, TheBlock reported the following distribution:

Approximately 36 billion issued on Ethereum;

About 10 billion on Solana;

Approximately 3.7 billion on Base;

About 2.2 billion on Hyperliquid;

Approximately 1.8 billion on Arbitrum;

About 1 billion on Berachain.

TheBlock statistics on USDC issuance across chains

As of now, the circulation of USDC remains around $60 billion. According to DefiLlama data, the total market capitalization of stablecoins is approximately $233.535 billion, with a 7-day decline of about 0.58%; USDC's market share is about 26%.

From this, we can tentatively conclude that Circle's subsequent development still relies on the support of Coinbase, and it may continue to "supply" around 50% of its distribution revenue to Coinbase.

Mystery 4: Will Circle be Affected by U.S. Stablecoin Regulatory Legislation?

In the prospectus, Circle mentioned potential risks related to regulatory legislation, such as U.S. regulatory agencies or legislation requiring stablecoin issuers with issuance amounts exceeding $10 billion to be banks or have bank affiliations.

Risk disclosure section of the prospectus

According to existing information, the latest progress on U.S. stablecoin regulatory legislation is as follows:

In February 2025, U.S. Senator Bill Hagerty and others proposed the "U.S. Stablecoin National Innovation Guidance and Establishment Act" (GENIUS Act), aimed at establishing a federal regulatory framework for payment stablecoins. The bill stipulates that stablecoin issuers with a market capitalization exceeding $10 billion will be regulated by the Federal Reserve (FED), while smaller issuers may choose to operate under state-level regulation; all issuers must back their stablecoin issuance with high-quality liquid assets (such as U.S. dollars and Treasury bonds) on a 1:1 basis, and the issuance of algorithmic stablecoins is prohibited.

At the same time, U.S. Representative Maxine Waters proposed the "Stablecoin Transparency and Accountability to Promote Better Ledger Economy Act" (STABLE Act), which requires all stablecoin issuers to obtain federal licenses and be supervised by the Federal Reserve; the bill emphasizes consumer protection, requiring issuers to hold reserve assets equal to their issuance volume and comply with anti-money laundering (AML) and KYC regulations.

As a model of stablecoin compliance, Circle is right to make necessary risk disclosures in this regard. Although there have been reports that "Tether is working with U.S. lawmakers to influence the regulation of fiat currencies," Circle, under the care of allies like Coinbase and BlackRock, should be able to handle regulatory pressures without significant issues.

Therefore, the risks in this area are relatively controllable.

Mystery 5: What is Circle's Valuation?

Although Circle's S-1 document does not specify a concrete IPO fundraising price, based on secondary market trading, its valuation is currently around $4-5 billion. The equity structure is divided into Class A (1 vote/share), Class B (5 votes/share, capped at 30%), and Class C (no voting rights), with the founders retaining control. The IPO will also provide liquidity for early investors and employees.

Compared to the previous high valuation of $9 billion during the last round of financing, this figure has been halved due to the stablecoin market share and recent market downturns, but there is still some profit potential.

In comparison, Coinbase's current stock price is reported at $151.47, with a market capitalization of approximately $38.455 billion; this is about 8-9 times that of Circle.

Additionally, due to the tariff trade war initiated by the Trump administration, expectations of interest rate cuts by the Federal Reserve may impact Circle's revenue, which should also be taken into account.

Whether Circle's diversified business can support the corresponding valuation remains to be seen over time.

Personally, I believe that compared to the more flexible use cases of USDT, USDC can only achieve greater development space by integrating with U.S. banking-related businesses. Previously, U.S. banks Custodia Bank and Vantage Bank jointly issued the first U.S. bank-supported stablecoin, Avit, based on a permissionless blockchain on the Ethereum network, which may signal the intensifying competition in the next round of stablecoins.

If Circle wants to ensure its position as the "second stablecoin," it may need to learn from Tether's revenue-generating experiences in BTC reserves, redemption fees, and other areas.

Finally, a "surprise" from Circle's IPO prospectus—Circle officially mentioned that it is a "remote work-oriented company," which poses higher operational and cybersecurity risks. Considering the $1.5 billion asset theft incident at Bybit in February and various security incidents caused by hackers represented by the North Korean hacker group Lazarus Group, this risk warning may not be unfounded, but rather a risk factor that many crypto projects need to consider in advance.

Circle's official disclosure of remote work risks

In conclusion, I personally predict that Circle will conduct its crypto IPO earlier than other crypto companies like Kraken and Chainalysis. After all, for stablecoin companies with high operating costs and a singular narrative, reaching out to "outside retail investors" through an IPO is more urgent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。