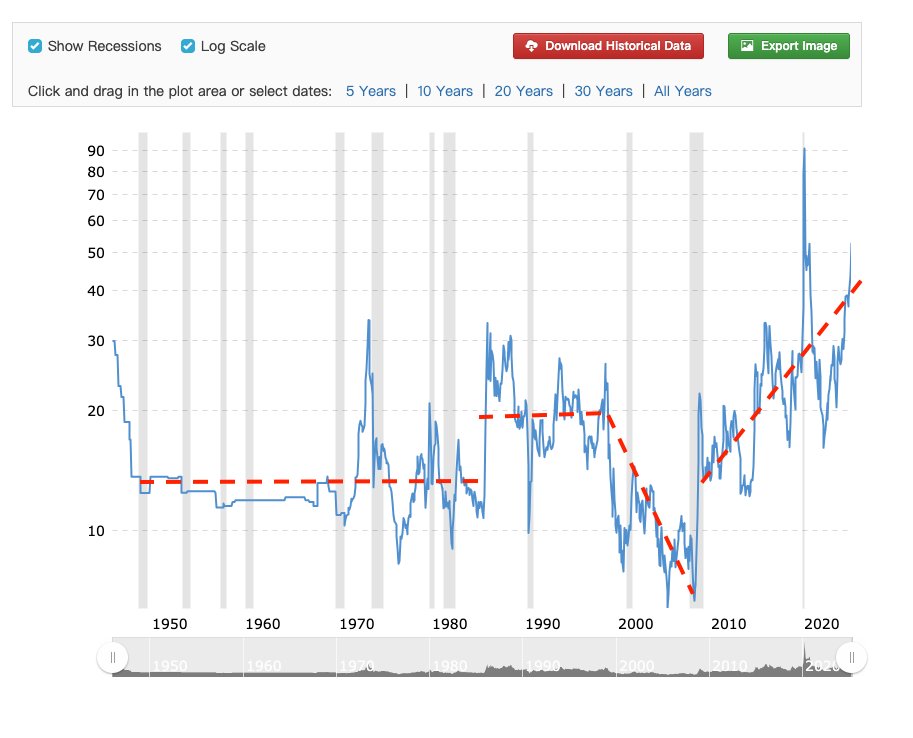

The gold-oil ratio is quite interesting. Before 1985, it was relatively stable. In 1986, oil prices plummeted, and the gold-oil ratio began to rise. Around 1998, oil prices started to soar, while gold remained relatively unchanged, causing the gold-oil ratio to decline.

Then, starting in 2008, we entered a phase of continuous increase in the gold-oil ratio. As everyone knows, QE began in 2008.

Both gold and oil are related to the US dollar, but their effects differ. Gold tends to decline in value against the dollar, while oil often benefits from a strong US economy, and during recessions (like in 1985), prices usually fall.

Currently, it seems that these trends are still ongoing: the dollar is being viewed negatively, and there is an economic recession. Therefore, I estimate that the gold-oil ratio will maintain its upward trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。