Source: Cointelegraph Original: "{title}"

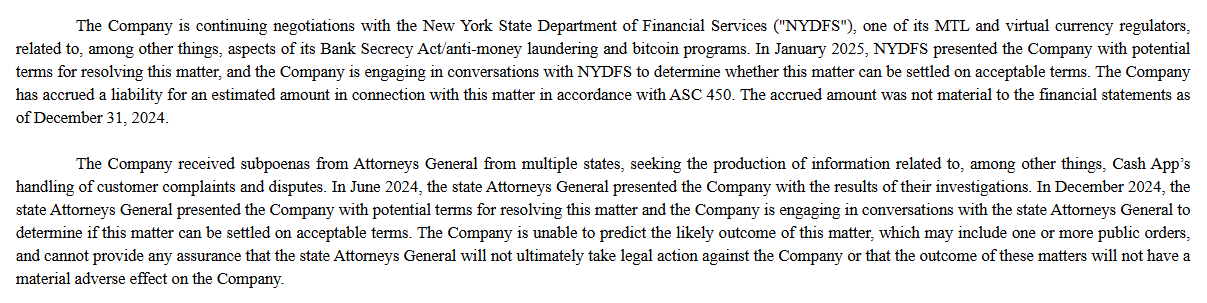

Bloomberg reported on April 10 that digital payment company Block Inc. has reached a $40 million settlement with New York regulators regarding compliance misconduct related to its Cash App platform.

Bloomberg stated that after reviewing the consent order from government agencies, Block was fined by the New York Department of Financial Services (NYDFS) for its anti-money laundering (AML) and cryptocurrency compliance operations concerning Cash App.

The NYDFS found that Block allegedly violated consumer protection laws and failed to conduct proper due diligence on its customers. It was reported that the company was too slow in reporting suspicious transactions to regulators and did not adequately screen so-called "high-risk" Bitcoin (BTC) transactions.

Block confirmed that it has worked with the NYDFS to "address issues primarily related to Cash App's past compliance program." However, according to Bloomberg, Block did not admit to any wrongdoing.

Block was founded in 2009 by internet entrepreneur and Bitcoin advocate Jack Dorsey, and has been negotiating a settlement with the NYDFS since last year, based on documents submitted to the U.S. Securities and Exchange Commission (SEC).

Excerpt from Block Inc.'s 10K form submitted to the U.S. Securities and Exchange Commission Source: U.S. Securities and Exchange Commission

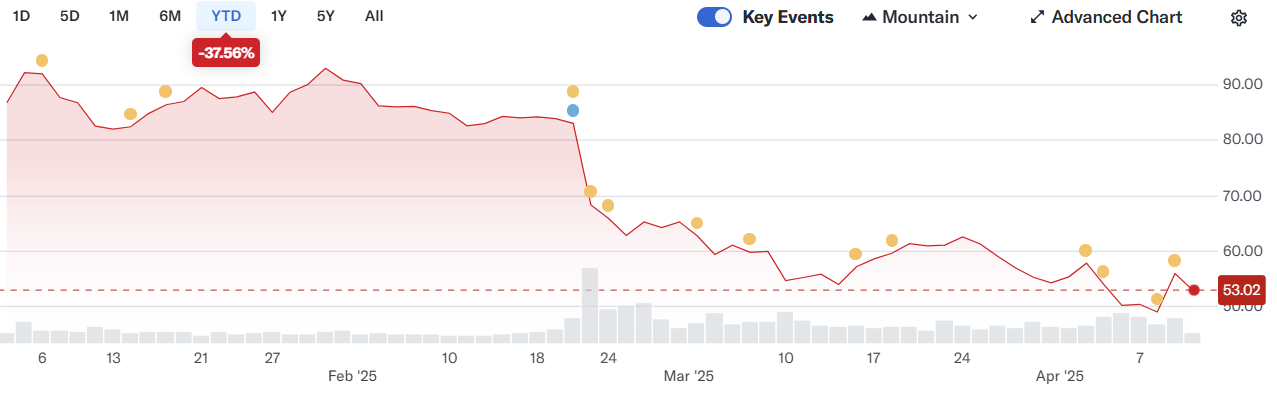

The NYDFS settlement is not the first fine Block has agreed to pay this year. As reported by Cointelegraph, the company paid $80 million in fines to regulators in multiple states for allegedly violating its AML program.

Block Remains in Growth Mode

Despite regulatory troubles, Block's core business continues to perform strongly through the end of 2024. The company's overall revenue grew approximately 4.5% year-over-year to $6.03 billion, with earnings per share rising 51% to $0.71.

Another positive note is that Block's total payment volume from merchants, which is the total amount processed through its system, increased by 10% to $61.95 billion.

Cash App continues to be a major driver of growth, with the segment recording a gross profit of $1.38 billion in the fourth quarter.

By early 2024, the mobile payment service had over 57 million monthly active transacting users.

Despite reporting strong growth, Block Inc. (XYZ) shares have fallen over 37% this year, part of a broader market sell-off Source: Yahoo Finance

Since 2018, Cash App users have been able to purchase Bitcoin through the platform. In 2023, Cash App integrated cryptocurrency accounting software TaxBit, making it easier for users to track and report their cryptocurrency-related taxes.

Related Articles: Thailand Targets Foreign Cryptocurrency P2P Services in New Anti-Crime Law

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。