The information, opinions, and judgments regarding the market, projects, cryptocurrencies, etc., mentioned in this report are for reference only and do not constitute any investment advice.

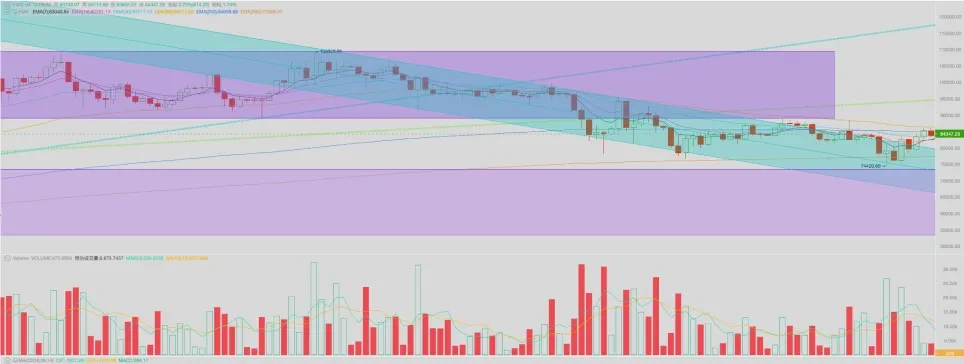

This week, BTC opened at $78,370.15 and closed at $84,733.07, rising 6.84% over the week, with a volatility of 14.89% and a significant increase in trading volume. Since late January, BTC's price has effectively broken through the upper boundary of the descending channel for the first time, approaching the 200-day moving average.

Trump's "Tariff War" remains the largest macro-financial variable globally this week. Its dramatic developments have left the world astonished, with China's countermeasures making a strong statement.

In the "standoff game," the first to blink is likely to lose. The tariff war declared against the world has triggered both overt and covert reactions from global powers, including but not limited to political, business, and capital sectors.

This ultimately led to capital fleeing the U.S. market, resulting in a rare triple whammy for U.S. "stocks, bonds, and currency."

Faced with a massive financial crisis, the Trump administration chose to make concessions, either partially delaying the implementation of reciprocal tariffs or reducing the intensity of the supplementary exemption list, while also releasing goodwill towards its main competitor, China. Thus, the "Tariff War" gradually entered its second phase, with multiple parties set to engage in negotiations and compromises.

The risk equity market, which had plummeted due to the impact of the first phase, welcomed a significant rebound. Perhaps the most terrifying phase triggered by the "Tariff War" has passed, but the ensuing chaos will continue to dominate various markets. The reciprocal tariff crisis will neither pass easily nor be exempt from triggering new crises. Whether the subsequent "reciprocal tariffs" will escalate into conflict, whether the Federal Reserve will "timely" cut interest rates, and whether the U.S. economy will fall into recession have become key points of observation.

Policy, Macro Finance, and Economic Data

As most countries are unable to counter the "reciprocal tariffs," the countermeasures from China and the European Union have become the main forces resisting U.S. hegemony, with China being the backbone of this resistance.

After several rounds of confrontation, the U.S. raised tariffs on China to 145%, while China retaliated with tariffs on the U.S. reaching 125%. This has effectively severed the possibility of normal trade exchanges, leading China to announce that it would no longer respond to any potential future tariff increases from the U.S.

On April 10, the U.S. suspended reciprocal tariffs on most countries (excluding China), retaining a 10% "baseline tariff" and initiating negotiations. As a result, U.S. stocks surged, with the Nasdaq achieving its second-largest single-day increase in history.

China's seemingly passive actions have, in fact, exerted tremendous pressure on the U.S. On the 12th, the U.S. exempted some Chinese goods from the 145% "reciprocal tariffs," including smartphones, tablets, laptops, semiconductors, integrated circuits, flash memory, display modules, and more.

What truly pushed the Trump administration into the "second phase" was not just China's countermeasures but also the strong "opposition" from both the political and business sectors in the U.S., as well as the stock, bond, and currency markets.

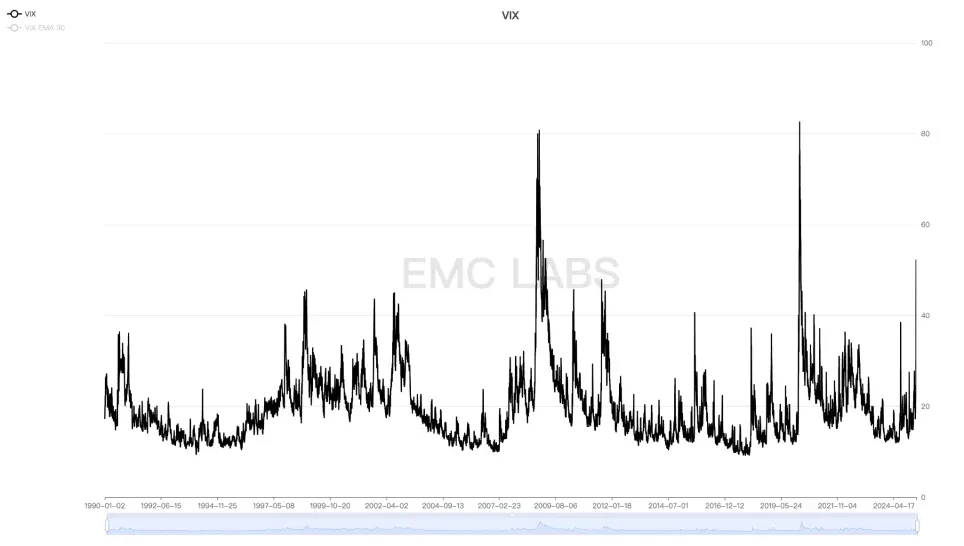

On Monday, April 7, the three major U.S. stock indices all fell sharply, reaching or nearing technical bear market territory. The next day, the VIX fear index hit a high of 52.33, marking the third-highest peak since the 2008 subprime crisis and the 2020 COVID-19 crisis.

S&P 500 VIX Index

During the same period, short-term Treasury yields fell to 3.8310% on Thursday, while long-term Treasury yields saw a significant rebound on Friday, closing at a high of 4.4950%.

U.S. 10-Year Treasury Yield

Following the massive sell-off in U.S. stocks, U.S. Treasury funds also joined the selling action, compounded by capital fleeing the U.S. to Europe and other regions, leading to a significant drop in the DXY dollar index.

Dollar Index

The "triple whammy" of stocks, bonds, and currency forced the Trump administration to signal a de-escalation of the tariff war and announce an exemption list. At the same time, the Federal Reserve also released "dovish" signals. Boston Fed President Collins stated in an interview with the Financial Times on Friday that the Federal Reserve is "absolutely prepared" to use various tools to stabilize financial markets when necessary.

The easing of the tariff war and the Federal Reserve's verbal support temporarily calmed the U.S. financial markets. On Friday, the three major U.S. indices all ended the turbulent week with gains.

EMC Labs assesses that the U.S. reciprocal tariff war has entered its second phase, with market fears easing and gradually beginning to find a bottom. However, due to the "irrationality" of the Trump administration and the significant risks of U.S. economic recession and inflation (the University of Michigan consumer confidence index released this week continued to decline to 50.8), achieving a V-shaped recovery is a low-probability event.

Selling Pressure and Sell-Off

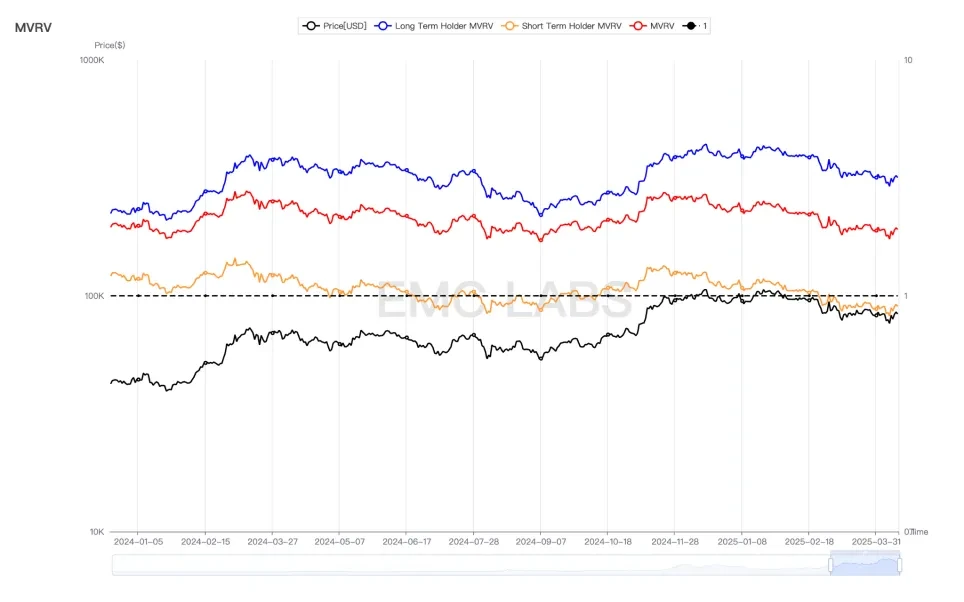

This week, the selling pressure on the long and short chains has weakened, slightly halting three consecutive weeks of panic selling. The total on-chain selling volume for the week was 188,816.61 coins, with shorts accounting for 178,263.27 coins and longs for 10,553.34 coins. On the 7th and 9th, the short group experienced significant losses amid global market panic.

Currently, the long group is still playing a stabilizing role, increasing their holdings by nearly 60,000 coins this week, indicating that market liquidity remains quite scarce. By the end of the weekend, the short group was still at a 10% floating loss level, indicating that the market continues to bear significant pressure.

On-Chain Market Floating Profit and Loss

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0.125, indicating that the market is in an upward continuation phase.

EMC Labs

EMC Labs was established in April 2023 by cryptocurrency asset investors and data scientists. It focuses on blockchain industry research and investments in the crypto secondary market, with industry foresight, insights, and data mining as its core competencies. It aims to participate in the thriving blockchain industry through research and investment, promoting the benefits of blockchain and cryptocurrency assets for humanity.

For more information, please visit: https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。