After a week of fluctuating tariff tensions, the market finally had a chance to catch its breath over the weekend. However, it remains uncertain how long this respite will last, as tariff issues are event-driven emergencies that lead to capital flight and a temporary collapse of sentiment, resulting in significant volatility.

Once the market confirms the fundamental changes brought about by tariffs and the release of risk-averse sentiment, the entire financial market can find a new balance. This is why global stock markets, especially U.S. stocks, ended last week on a positive note, as evidenced by the changes in the S&P 500 volatility index.

As we can see, the VIX index reached a recent high last week. In the past few years, the only events that could "compare" to this were the extreme event of the Bank of Japan's interest rate hike last year and the financial turmoil caused by the pandemic in 2020. This is why the market experienced such significant fluctuations over the past week; after all, such historical occurrences are rare.

When this massive volatility subsides, the factors influencing the crypto market will revert to the familiar discussions of "inflation" and "interest rate cuts," as only interest rate cuts can lead to a "flood" of liquidity, bringing growth hopes for risk assets led by BTC.

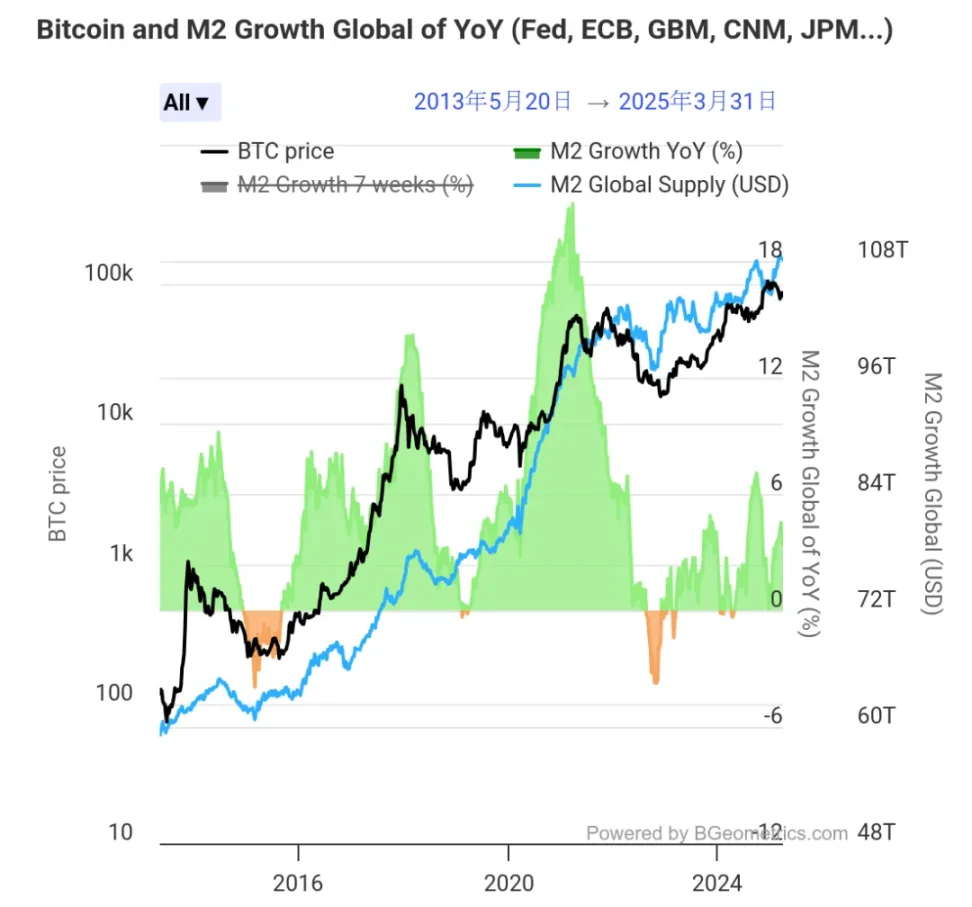

By comparing the global broad money supply (M2) over the past 10 years with BTC's trends, we can analyze this correlation. The following chart visually demonstrates that BTC's significant increase over the past decade is built on the explosive growth of global M2, and this correlation far exceeds that of other financial data.

This is why BTC tends to fluctuate whenever the U.S. releases data related to inflation or interest rate cuts, as it ultimately affects whether new capital will enter the crypto space.

However, it seems that most people in the crypto market are currently focused solely on the Federal Reserve's interest rate cut path, overlooking another important data point worth attention—the PBOC's asset scale, which reflects the current liquidity situation of our country's currency.

While everyone is focused on the financial markets on the West Coast, they are neglecting our own financial liquidity, which is equally related to BTC's price movements. After all, we are a major power, one of the top two.

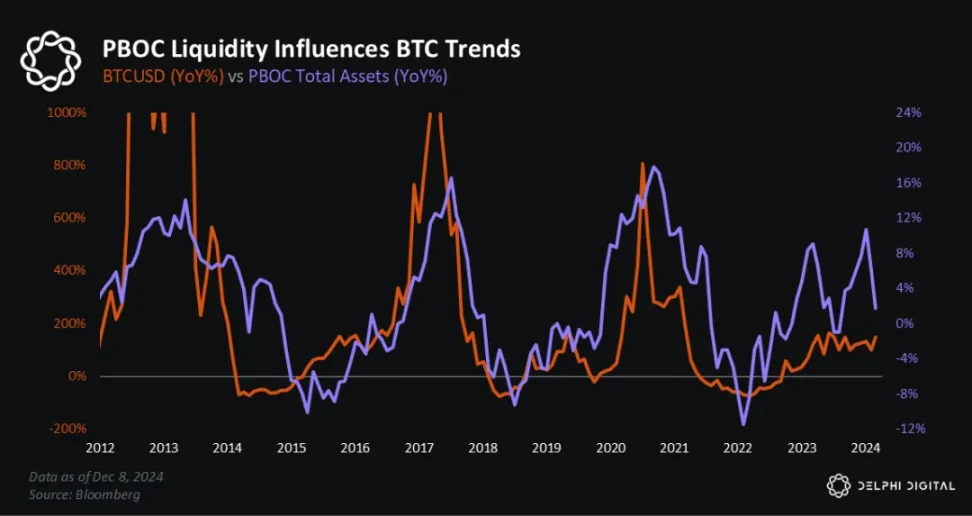

The following chart shows the changes in BTC's price increases over the past three cycles compared to the growth of the PBOC's asset scale. This correlation has been evident during each significant BTC surge and corresponds to the four-year cycle.

The PBOC's liquidity has played a role in the crypto bull market of 2020-2021, the bear market of 2022, the recovery from the cyclical low in early 2023, the surge in the fourth quarter of 2023 (before the approval of the BTC ETF), and the pullback from the second to third quarters of 2024.

Similarly, in the months leading up to the 2024 U.S. election, the PBOC's liquidity turned positive again, coinciding with a wave of "election bulls."

However, in the chart below, we can see that the PBOC's scale began to decline after September 2024 and reached a low at the end of 2024, currently rising to a high point over the past year. From the data correlation perspective, changes in PBOC liquidity typically precede significant fluctuations in BTC and the crypto market.

Interestingly, during the BTC bull market in 2017, the Federal Reserve was not the one "injecting liquidity"; instead, it raised interest rates three times throughout the year and engaged in quantitative tightening. Nevertheless, risk assets led by BTC still performed very optimistically in 2017 because the PBOC's scale reached a new high that year.

Even in terms of the S&P 500's performance, there is a certain correlation with the PBOC's liquidity. Historical data shows that the correlation coefficient between the PBOC's total asset scale and the S&P 500's annual performance is approximately 0.32 (based on data from 2015-2024).

Of course, in a sense, this is also because the PBOC's quarterly monetary policy reports overlap with the Federal Reserve's meetings, which amplifies the correlation in the short term.

In summary, we can see that in addition to closely monitoring the U.S. liquidity situation, we also need to pay attention to changes in domestic financial data. A week ago, news was released stating: "There is ample room for adjustment in monetary policy tools such as reserve requirement ratio cuts and interest rate cuts, which can be implemented at any time." What we need to do is track these changes.

It is worth noting that as of January 2025, China's total deposits amount to $42.3 trillion, while the U.S. total deposits are approximately $17.93 trillion. It must be said that from the perspective of deposit scale, we have more financial possibilities. If liquidity improves, it may lead to some changes.

Of course, another point to discuss is whether this liquidity can flow into the crypto market, as there are still certain restrictions. However, Hong Kong has already provided an answer; from the perspective of policy looseness and convenience, it is different from a few years ago.

Finally, to conclude this week's commentary, I would like to borrow a quote from Lei Jun: "When the wind rises, even pigs can fly." It is better to ride the wave than to row against the current. What we need to do, besides waiting, is to dare to rise when the wind blows and soar against the wind.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。