U.S. Customs and Border Protection quietly published a notice late Friday night exempting imported electronics from President Donald Trump’s aggressive tariffs, sparking a Monday morning rally in global markets and briefly sending bitcoin above $85K.

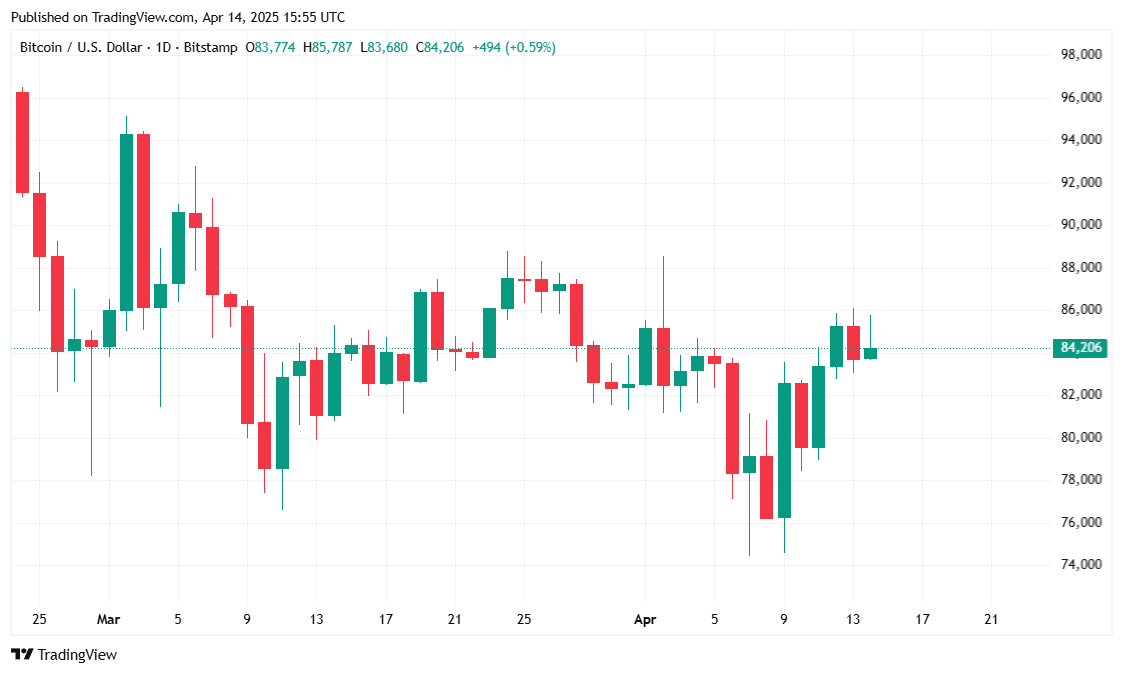

The cryptocurrency has continued its modest recovery over the past 24 hours, trading within a narrow range between $83,027.00 and $85,785.00. At the time of reporting, the cryptocurrency is valued at $84,176.64, reflecting a slight 0.45% gain over the past day and a healthy 7.06% increase over the past week.

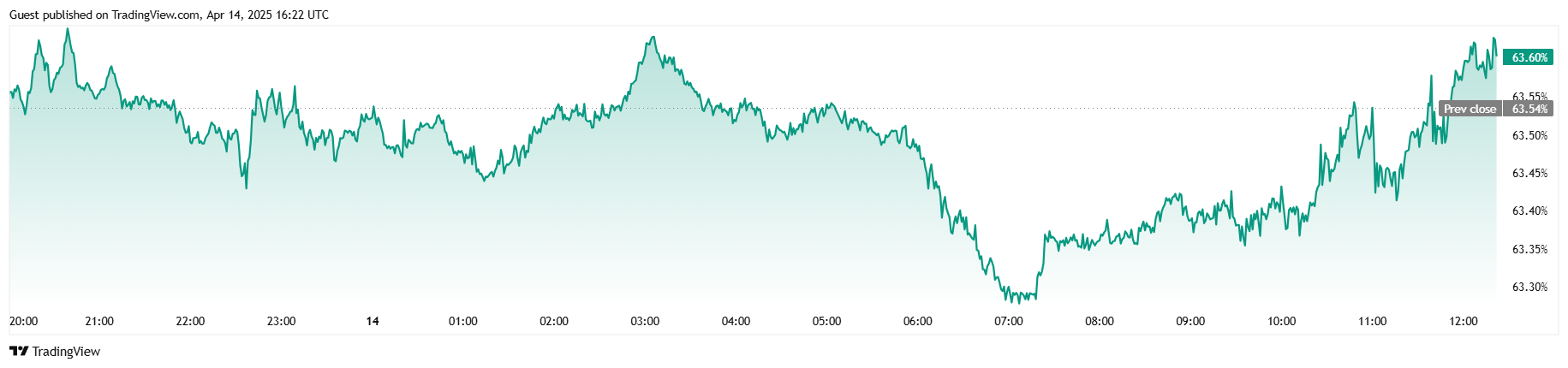

Trading activity remains robust, as evidenced by a 24-hour trading volume of $35.28 billion, up 34.77% over the past day, but mostly due to a post-weekend rebound. Despite a small decline in total BTC futures open interest (down 1.39% to $56.03 billion), bitcoin’s market capitalization has risen modestly by 0.38% to $1.66 trillion, and BTC dominance holds steady at 63.60%, up by 0.13%.

Notably, liquidation data from Coinglass shows that total liquidations amounted to $11.03 million, with a striking imbalance: Long liquidations were $10.39 million versus just $637,960 in short liquidations, clearly indicating that bullish positions bore the brunt of BTC’s volatility.

Imported computer chips, smartphones, and computer storage devices will not be taxed, at least for now. That’s according to the recently issued tariff exclusion list published by the U.S. Customs and Border Protection on Friday night.

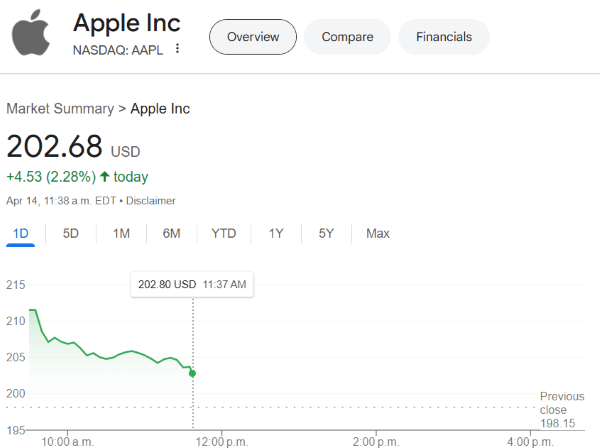

Tech giants that rely on imported Chinese components such as Apple breathed a sigh of relief and their stock prices reflected the development, as markets rallied on the news early Monday morning.

Apple stock was up 2.37% at the time of reporting, trading at $202.64. The S&P 500 climbed 0.88%, the Dow inched up 0.74%, and the Nasdaq saw a 0.40% uptick. Not big moves, but trending upward nevertheless.

BTC may be able to build support at the $80K level despite the continuing changes in U.S. trade policy, as sellers have begun to show signs of exhaustion.

“Bitcoin investors have locked in losses of up to $240M over 6-hour windows during the recent drawdown, among the largest of the cycle,” crypto analytics platform Glassnode explained in an X post on Friday. “Yet with each leg lower, realized losses are shrinking, suggesting early signs of seller exhaustion.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。