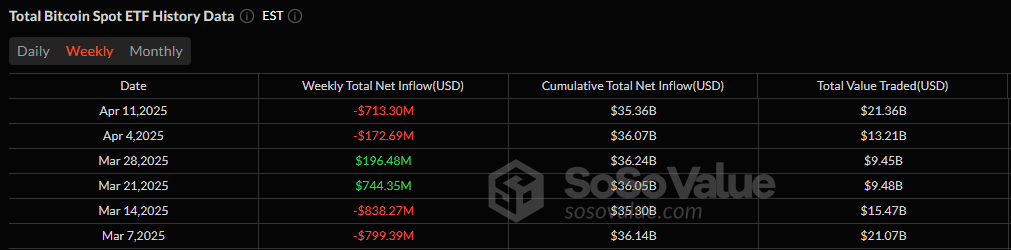

Bitcoin ETFs Bleed $713 Million in One of 2025’s Worst Weeks

Investors weren’t holding back this past week, as bitcoin ETFs saw a brutal $713.30 million net weekly outflow. This marked their second straight week in the red and the third-largest weekly outflow of 2025.

The worst came on Tuesday, April 8, when $326.27 million exited the space in a single day. Notably, no daily net inflows were recorded throughout the entire week.

Leading the pack was Blackrock’s IBIT, shedding a massive $342.61 million. Grayscale’s GBTC followed with $160.93 million in redemptions, while Fidelity’s FBTC lost $74.63 million.

Source: Sosovalue

Other weekly outflows included Bitwise’s BITB ($38.13 million), Invesco’s BTCO ($27.30 million), Ark 21shares’ ARKB ($26.01 million), Franklin’s EZBC ($18.10 million), Wisdomtree’s BTCW ($11.90 million), Vaneck’s HODL ($10.75 million), and Valkyrie’s BRRR ($5.32 million). The only glimmer of green came from Grayscale’s Mini Bitcoin Fund, which posted a modest $2.39 million inflow.

Bitcoin ETFs ended the week with $93.36 billion in total net assets, a far cry from previous highs of over $100 billion.

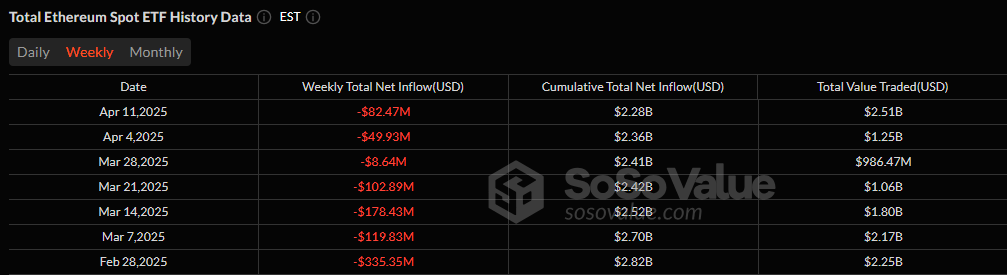

Ether ETFs fared no better, locking in their 7th consecutive week of net outflows at $82.47 million. Fidelity’s FETH led the bleed with $45.04 million, followed by Grayscale’s ETHE ($28.32 million), Bitwise’s BITB ($5.65 million), and VanEck’s ETHV ($4.44 million).

Source: Sosovalue

Blackrock’s ETHA stood alone with a slight inflow of $977k, as ether ETFs ended the week with $5.24 billion in total net assets.

As macroeconomic uncertainty and risk-off sentiment persist, the crypto ETF market remains volatile. With no signs of a reversal yet, all eyes are now on this week’s flows for a potential turnaround or further fallout.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。