Source: Cointelegraph Original: "{title}"

Bitcoin (BTC) and the U.S. stock market both experienced significant declines following U.S. President Donald Trump's announcement of a reciprocal tariff list against multiple countries.

On April 3, the S&P 500 index fell by 4.2% at market open, marking the largest single-day drop since June 2020. The Dow Jones Industrial Average dropped by 3.41%, falling from 42,225.32 points to 40,785.41 points, while the Nasdaq Composite Index decreased by 5.23%. Overall, the U.S. stock market saw a market capitalization evaporation of $1.6 trillion at the open.

The value of Bitcoin decreased by 8%, but a positive sign is that bulls seem to be able to hold the support level at $80,000. These sharp declines are primarily driven by uncertainty over the new tariffs and heightened investor concerns about an impending economic recession.

Source: X

According to CoinGecko, the entire cryptocurrency market fell by 6.8% in the past 24 hours, and a relief rebound seems unlikely in the short term.

Cryptocurrency liquidations soared to $573 million

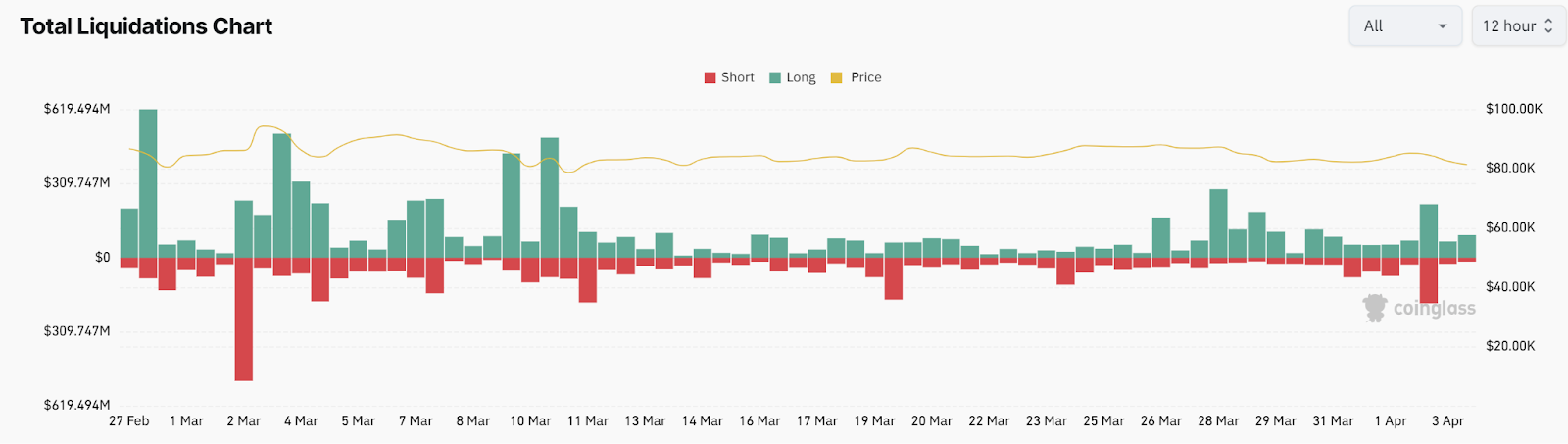

According to CoinGlass, over 200,000 traders were liquidated in the past 24 hours, totaling more than $573.4 million. The largest liquidation occurred on the Binance exchange, where an ETH/USDT position worth $11.97 million was forcibly closed.

Total cryptocurrency liquidation chart Source: CoinGlass

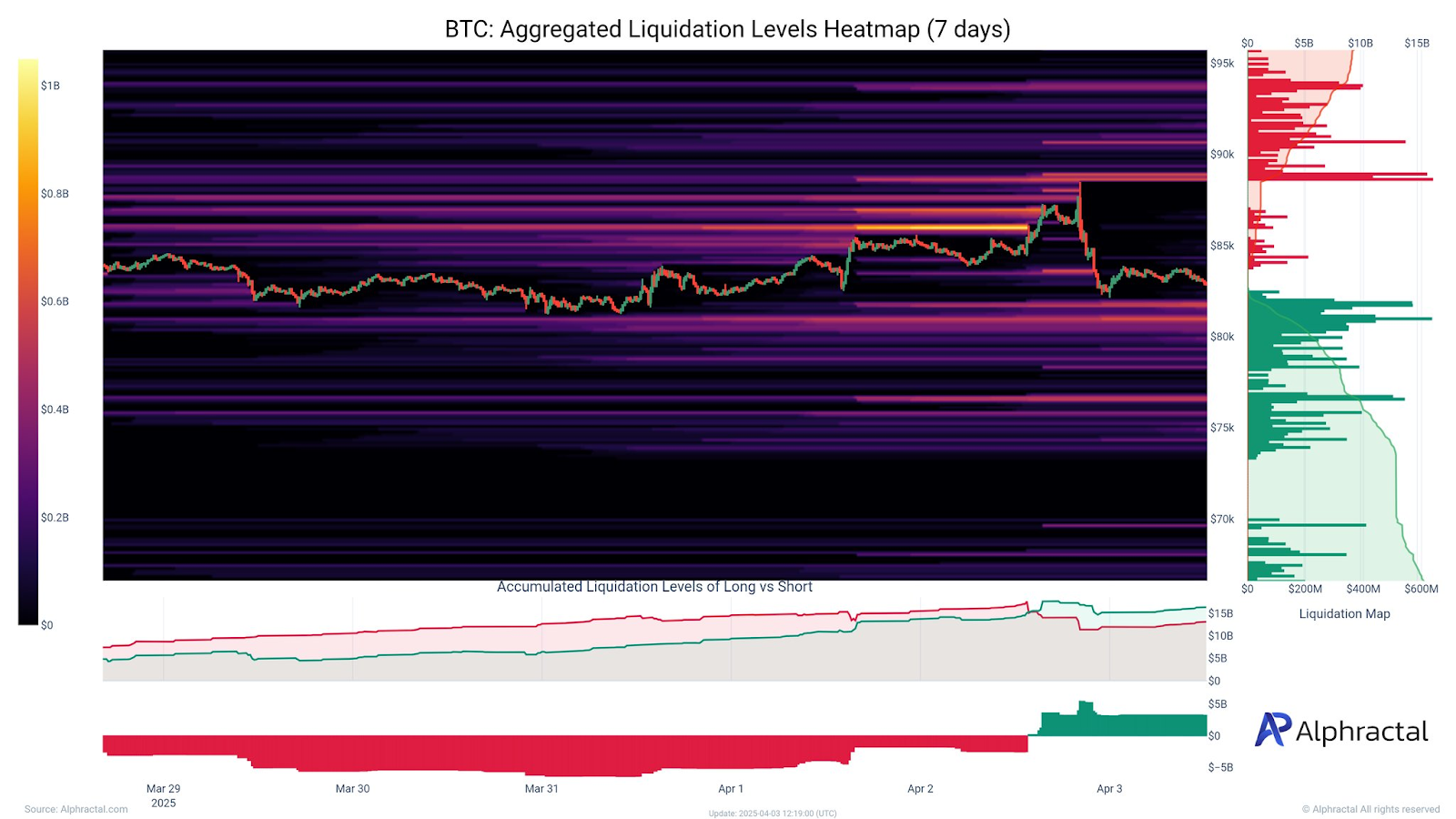

Meanwhile, the open interest in Bitcoin fell below $50 billion, reducing market leverage. Joao Wedson, CEO of Alphractal, mentioned that the liquidation heatmap shows significant leverage around $80,000, and if Bitcoin breaks this level with high trading volume, it could drop to $64,000 to $65,000.

Bitcoin liquidation map Source: X

This article does not contain investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research before making decisions.

Related articles: The dollar falls to a three-year low and PPI inflation drops significantly, Bitcoin still maintains at $82,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。