Key Indicators: (March 31 4 PM -> April 14 4 PM Hong Kong Time)

- BTC against USD increased by 3% (82,000 USD -> 84,450 USD), ETH against USD decreased by 11.1% (1,800 USD -> 1,620 USD)

Despite chaotic performance in other markets over the past two weeks, Bitcoin's price has remained relatively strong. Last week, the price touched the initial resistance level of 74,000 USD, formed after the U.S. elections last year, twice, and then broke through the mid-term downward range since January. It is now stuck in a strong support area between 81,800 and 82,300 USD, with strong resistance above at 88,000 to 90,000 USD.

Overall, technical indicators suggest that Bitcoin's price may consolidate in the range of 82,000 to 88,000 USD in the coming weeks, and the current market positions appear cleaner. If the double bottom at 74,000 USD holds, it would signal the end of the downward correction since the election and pave the way for the price to rise to 115,000 to 120,000 USD in the next month.

Market Themes

The global market experienced extreme volatility over the past two weeks. Trump's reciprocal tariff policy exceeded the most hawkish expectations, especially as pressure on China escalated into retaliatory measures, leading to tariffs exceeding 100% on both sides, making trade between the two countries virtually impossible. The VIX fear index surged from 20 at the beginning of April to nearly 60, as the market struggled to digest the impact of the tariff events. Trump spent a week trying to bring countries to the negotiating table but ultimately failed to shift positions. Due to the fragility of the U.S. bond market, Trump announced a 90-day tariff suspension for countries other than China, easing market sentiment. The VIX index closed below 40 last week.

The impact of this event was not limited to the stock market; in fact, the market was quite resistant to U.S. assets following the announcement of the tariff policy, causing the DXY dollar index to drop nearly 5% in April alone. Long-term U.S. Treasury bonds, once seen as a "safe-haven asset," also faced selling, resembling a "new emerging asset crisis." It is estimated that unhedged dollar assets held globally exceed 10 trillion USD. Therefore, although the pace of dollar value adjustment has slowed, this trend is inevitable as the market readjusts asset hedges from the Trump era.

As for cryptocurrencies, they have recently been largely influenced by asset volatility. Bitcoin has repeatedly tested the 74,000 to 75,000 USD range, while Ethereum experienced significant liquidations and briefly dropped to 1,400 USD. However, with the 90-day tariff suspension and the decline in the VIX index, the stock market improved, and Bitcoin began to regain its footing, showing a differentiated trend from traditional markets. Ultimately, we still need a more sustained and stable macro backdrop to support Bitcoin's rise to 88,000 to 90,000 USD; on the downside, we need new lows in U.S. stocks or new highs in the VIX index for the price to break below 74,000 USD. Overall, the price is currently stabilizing in a range before Easter.

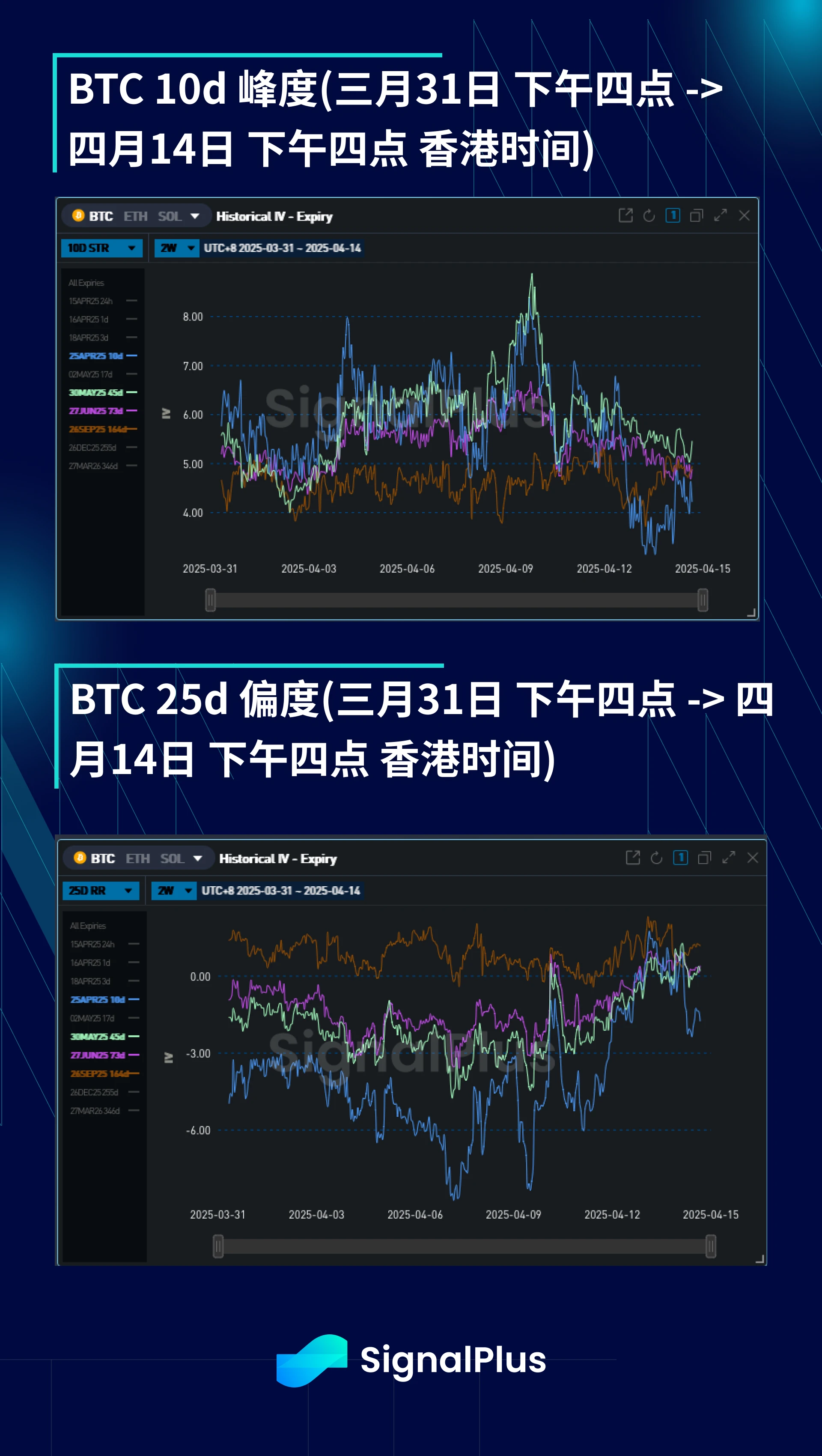

BTC ATM Implied Volatility

Over the past two weeks, Bitcoin's implied volatility has fluctuated dramatically alongside the stock market. There doesn't seem to be much demand for buying volatility on the downside, except for some strategic short-term protection needs. Therefore, as actual volatility surged, only the implied volatility of short-term contracts rose, leading to an inverted term structure across the board.

With the VIX index stabilizing towards the end of this week and U.S. bonds finding a balance, it is unlikely that the cryptocurrency market will see significantly higher volatility in the next 90 days. Therefore, we expect to see a lot of selling on both sides as the price stabilizes within the range. If further chaos occurs in the stock or interest rate markets, the risk of central bank intervention (including potential quantitative easing) will rise, and these tail risks may again push up cryptocurrency volatility.

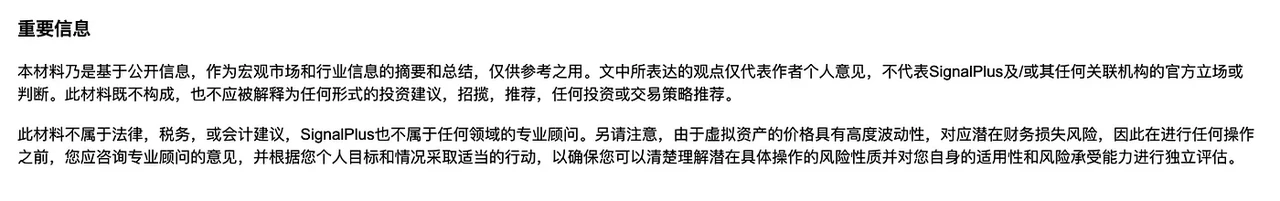

BTC Skew/Kurtosis

With each rise in the VIX or decline in U.S. stocks, the skew has aggressively tilted towards the downside of the price. Therefore, the current Bitcoin price maintains a relatively high correlation with the S&P index, and the price of Bitcoin is similarly correlated with volatility and the S&P index. Beyond the April expiration, the downward slope of the skew is not as pronounced, indicating that there is not a significant structural demand for downside hedging in the market, but we have indeed seen some buyers of June 60,000 to 70,000 USD put options in the market.

The kurtosis ended this week relatively unchanged, despite the significant fluctuations in implied volatility and the high correlation between price and skew (skew drops sharply when the price falls, and recovers when the price rebounds). Overall, the recent price has been fluctuating locally while remaining relatively stable in the mid-term range of 74,000 to 90,000 USD, so the market is not very interested in buying the wings. Structurally, we still believe that the prices on the wings are too low, based on the relatively volatile volatility and the dynamic performance of spot against skew.

Wishing you good luck next week!

You can use the SignalPlus trading sentiment indicator feature for free t.signalplus.com/news, which integrates market information through AI, making market sentiment clear at a glance. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat, please remove the spaces between the English and numbers: SignalPlus 123), Telegram group, and Discord community to interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。