Original Title: "Behind the 2000% Surge of RFC Token: The Capital Game of Whales and the Narrative of Musk"

Original Author: Alvis, Mars Finance

I. Phenomenal Surge: From Marginal Meme to Hundredfold Myth

On the night of April 13, 2025, monitoring alerts on the Solana chain suddenly went off— a meme token named RFC (Retard Finder Coin) surged 200% in just 15 minutes, with a market cap exceeding $100 million, and the price peaking at $0.199. The climax of this frenzy was ignited by a massive buy order worth $1.2 million. While the market speculated whether this was a collective frenzy of retail investors, on-chain data revealed a more complex capital game: a sophisticated network woven by at least three associated address groups, five market makers, and $180 million in speculative funds was pushing this "community carnival" toward an unpredictable abyss.

1.1 Capital Riot: Completing a Hundredfold Leap in Two Weeks

Since Elon Musk first liked the "Retard Finder" social media account on March 29, RFC entered a frenzied upward trajectory. From $0.003 on April 1 to a historical high of $0.2 on April 13, its price curve exhibited a typical "stair-step control" characteristic: every time it broke through an integer threshold, there was a massive buy order supporting it, with pullbacks consistently controlled within 15%. This unusual stability is rare among meme coins, which are typically known for high volatility.

1.2 Whale Revealed: The Secret of $120 Million Liquidity

In the early hours of April 14, on-chain detective @CaNoe disclosed key evidence: a whale address starting with 0x3d… purchased $1.2 million worth of RFC through four transactions, pushing the market cap over $100 million.

But this was just the tip of the iceberg—this address completed fund splitting through 14 associated wallets within three days, with the actual buying scale exceeding $8 million, accounting for 23% of the total trading volume.

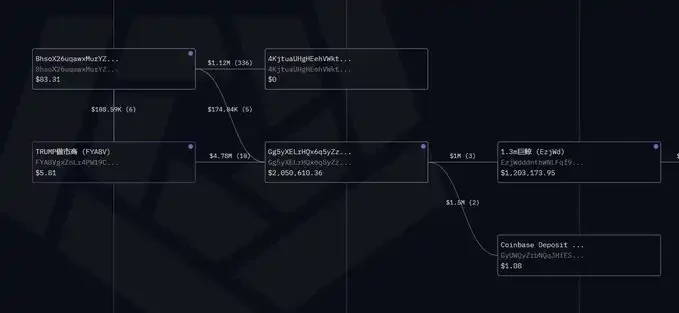

Even more shocking was the flow of funds:

Upstream liquidity pool: $100 million USDC came from a certain TRUMP market maker address, routed through Gg5yX…

Relay network: The address group 8hsoX… completed 10 cross-chain conversions involving ETH, SOL, and BASE public chains.

Terminal operation: Ultimately completed RFC purchases through five newly created addresses on the SOL chain.

This three-tiered flow of funds exposed the operator's sophisticated skills in evading regulation. As crypto analyst Yu Jin stated: "This is not a spontaneous speculation, but a premeditated capital layout over months."

II. Dissecting the Whale: The Capital Map of Cross-Ecosystem Operators

2.1 TRUMP Market Maker's Reinforcement

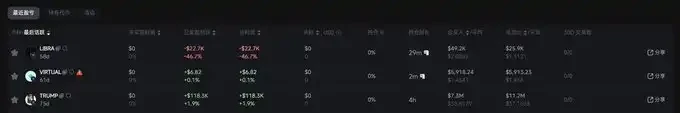

By tracing the historical behavior of the 0x3d address, we found a deep binding with the TRUMP concept coin for the 2024 election.

This address has interacted with only three coins: $TRUMP, $VIRTUAL, and $LIBRA. Notably, on $TRUMP, there were nearly 50 frequent interactions, with total buys of $7.3 million and total sells of $11.2 million, indicating that this address is likely a market maker.

It also engaged in activities on $LIBRA and $VIRTUAL, both recognized as super strong manipulated coins, not to mention $LIBRA's entanglement in the manipulation scandal behind the entire foundation (though not many people mention it now).

This typical market maker behavior pattern was perfectly replicated in the RFC campaign. Notably, this address group suddenly cleared all TRUMP holdings on March 15, coinciding with the start of RFC's upward surge.

2.2 Underlying Network of Connections

Digging deeper into the flow of funds, we mapped out a larger network of connections:

(Data Source: GMGN On-Chain Analysis Platform)

These projects collectively outline the operator's strategic preferences: selecting tokens with strong narratives, low circulation, and celebrity endorsements, creating an illusion of liquidity through high-frequency trading. RFC happens to meet all these conditions—Musk's interactions, support from the Solana ecosystem, and fixed supply characteristics make it an ideal target for manipulation.

III. The Musk Effect: The Fatal Temptation of Decentralized Narratives

3.1 From Twitter Interaction to Code Mystique

The explosion of RFC was no coincidence. On March 7, when Musk replied on Twitter to the "Retard Finder" account about "cryptocurrency needing more rebellious spirit," sharp capital had already sensed the opportunity. On-chain data shows:

March 8-10: Six new addresses rushed to buy $800,000 worth of RFC.

March 15: The project's official website updated its codebase, revealing the "XCorp" key (a company under Musk).

April 1: Eric Trump retweeted RFC-related posts, igniting fervor in the right-wing community.

This three-stage marketing of "celebrity interaction - code hint - community dissemination" precisely hit the narrative hunger of the crypto market. Even though Musk has never publicly acknowledged a relationship with RFC, enough "coincidences" have driven speculators into collective madness.

3.2 The Damocles Sword of Concentrated Chips

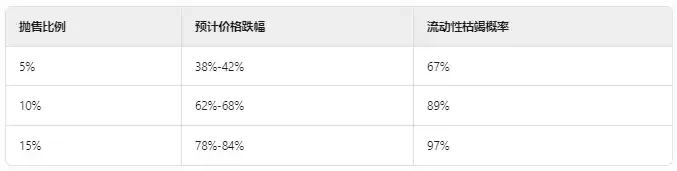

M7 Research's on-chain report reveals a more dangerous reality: the top 500 addresses control 36.46% of the RFC supply, with a single address group in the green cluster accounting for 29.61%.

This concentration even exceeds that of SHIB in 2021 (when the top 10 addresses accounted for 27%), granting whales absolute market control.

We simulated price impacts under different sell-off scenarios:

(Data model based on historical meme coin liquidity data)

This means that of the current $120 million daily trading volume, at least $40 million belongs to "false liquidity"—once whales start selling, price collapses could be measured in hours.

IV. Ecological Resonance: Solana's Wealth Creation Machine and Risk Hotbed

4.1 The Mysterious Push from the Foundation

The deep involvement of the Solana ecosystem injected additional momentum into RFC's surge. On-chain data shows:

March 25: The SOL Foundation address transferred 5,000 SOL to the RFC development team.

April 5: An RFC/SOL liquidity pool appeared on Serum DEX, with an initial injection valued at $2 million.

April 12: An address associated with Solana Ventures participated in RFC community governance proposal 7.

This interplay of support, both overt and covert, allowed RFC to transcend the ordinary meme coin category, becoming a "model project" showcasing the capabilities of the Solana ecosystem. But the question remains—when the project party and ecosystem builders' interests are deeply intertwined, has the so-called "decentralization" become merely a marketing tactic?

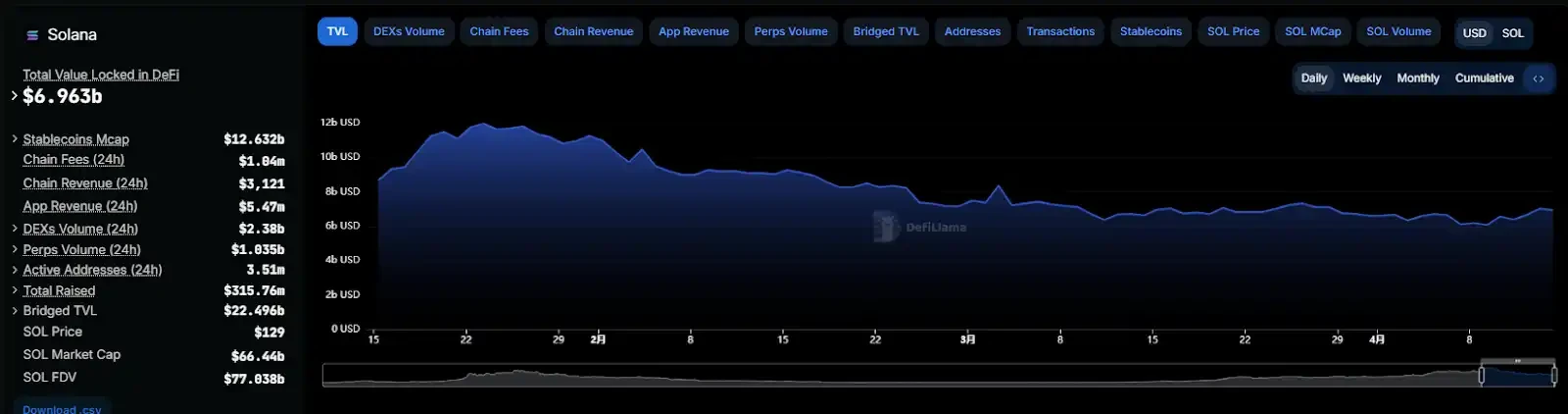

4.2 Liquidity Siphoning Effect

Since April, the TVL on the SOL chain has grown by 16%, but 63% of that comes from meme coin-related protocols. The price of the SOL token has risen from a low of $95 to the current $130, an increase of over 35%. The rise of RFC coincided with a critical recovery period for the Solana ecosystem.

Future Projection: Directional Choices in the Capital Game

Based on historical data modeling, we predict that RFC may face two potential paths:

Optimistic scenario: Market makers continue to maintain the price in the $0.08-$0.12 range, hedging profits through the derivatives market, extending the lifecycle to 6-8 weeks.

Pessimistic scenario: A new hotspot emerges in the Solana ecosystem, leading to a liquidity shift, with whales starting to distribute above $0.15, triggering a pullback of over 60%.

The current market may lean more towards the second possibility— the flash crash of OM coin on April 14 (a single-day drop of 90%) has triggered a chain panic, rapidly shrinking investors' risk appetite.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。