Bitcoin ETFs Edge Back Into Positive Territory While Ether ETFs Log Another $6 Million Exit

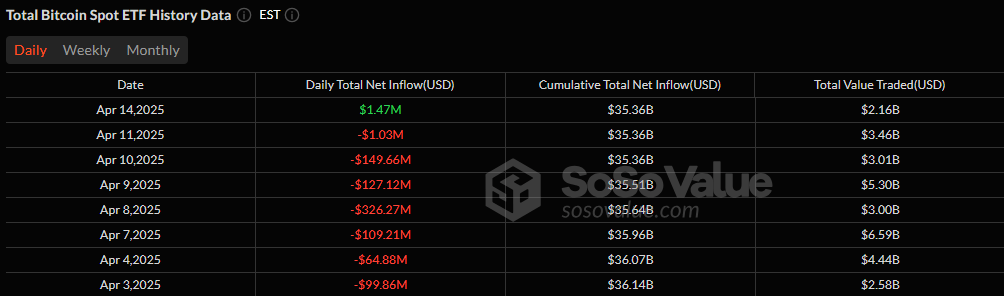

After 7 consecutive days of redemptions, bitcoin ETFs posted a much-needed, if modest, reversal. Monday, April 14 saw a net inflow of $1.47 million, bringing a temporary sigh of relief after a bruising week of capital flight.

The day’s activity was concentrated in just two funds. Blackrock’s IBIT led the charge with a $36.72 million inflow, while Fidelity’s FBTC saw $35.25 million pulled from its fund. The remaining 10 spot bitcoin ETFs remained quiet, with no recorded flows. Still, total trading volume came in at a healthy $2.16 billion, and net assets ticked up to $94.69 billion.

Source: Sosovalue

While bitcoin ETFs found their footing, ether ETFs weren’t as fortunate. The segment recorded another $5.98 million in outflows, driven primarily by Fidelity’s FETH, which lost $7.78 million. The bleeding was slightly cushioned by a $1.80 million inflow into 21shares’ CETH, but it wasn’t enough to push the overall number into positive territory.

Total value traded for ether ETFs stood at $285.64 million, with total net assets settling at $5.47 billion by the end of the session.

As both markets start the new week, all eyes will be on whether bitcoin’s return to inflows can gain traction and if ether can finally break its persistent outflow cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。