Bitcoin ( BTC) surged past $86K on Tuesday morning even as 46 economists polled by global consulting firm Wolters Kluwer projected a 47% probability of a U.S. recession by the end of the year, according to reporting by USA Today.

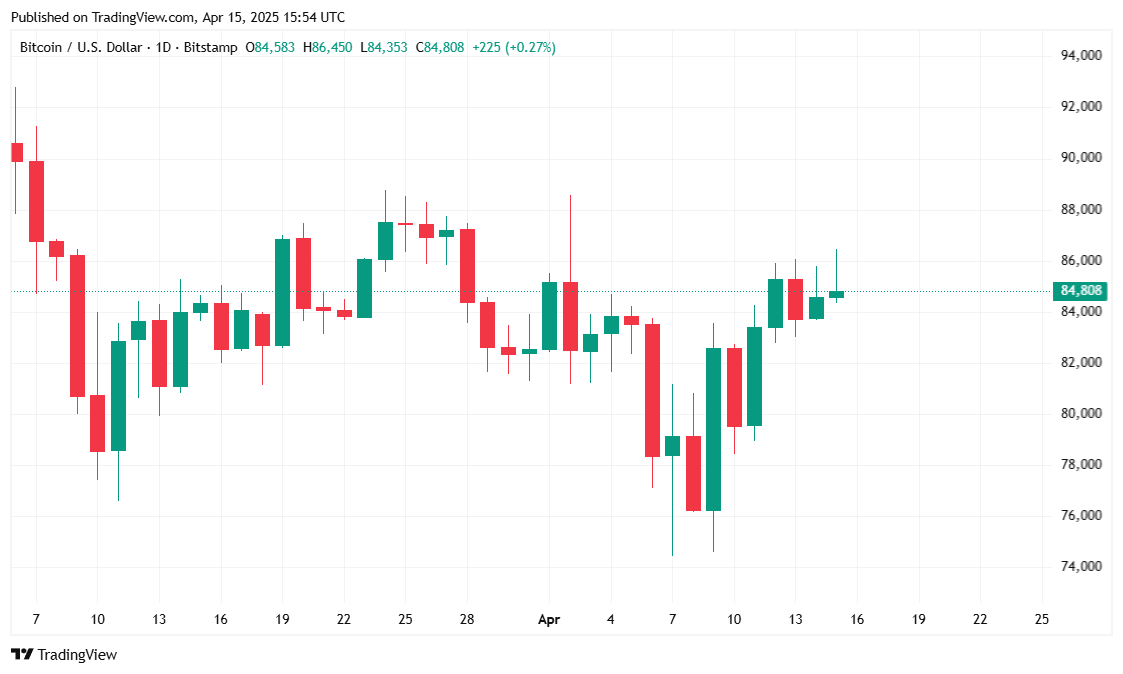

However, the digital asset is now trading at $84,771.63 at the time of reporting, marking a 0.68% gain in the past 24 hours and a 9.04% increase over the past week. BTC traded within a tight range of $83,743.33 to $86,429.35 in the last day, reflecting a modest but positive market trajectory. Trading volume fell by 15.87% to $29.73 billion over the same period.

( BTC price / Trading View)

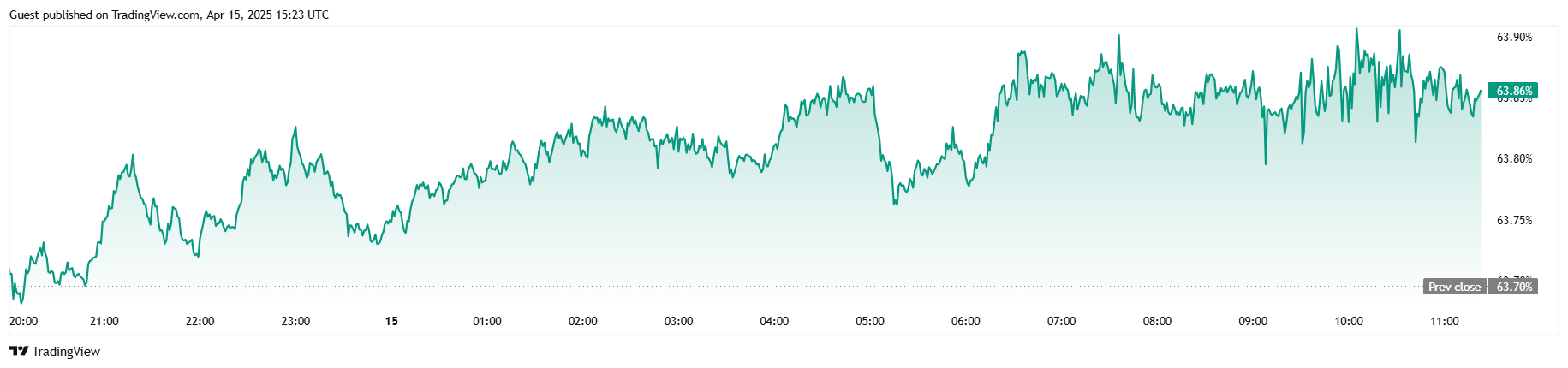

Bitcoin’s market capitalization is currently sitting at $1.69 trillion, mirroring its 24-hour price gain. BTC dominance also rose slightly to 63.85%, a 0.26% increase, indicating that bitcoin has been outperforming altcoins in recent sessions.

( BTC dominance / Trading View)

Data from Coinglass shows a relatively calm derivatives market, with total liquidations at just $659,180. Short sellers took a larger hit, accounting for $482,570 of those losses, while long liquidations remained minimal at $176,610. Futures open interest dipped 3.22% to $54.91 billion, suggesting some cautious positioning by traders despite bitcoin’s strong weekly performance.

Economists surveyed by Wolters Kluwer in February put the chances of a recession at 25%. That projection has almost doubled to 47%, as per USA Today. Experts now say the U.S. economy “will nearly stall or slip into recession over Trump’s tariffs,” despite the recently announced 90-day pause.

Hedge fund billionaire Ray Dalio, founder of Bridgewater Associates, has an even more dire prediction: “something worse” than a mere recession could be on the horizon if President Donald Trump and his administration mismanage the current tariff situation.

The U.S. Dollar Index continues to flounder at 3-year lows, whereas bitcoin has been gradually inching upward as Trump’s tariff policies continue to erode confidence in U.S. assets. The outcome of the president’s trade strategy may end up firmly establishing the cryptocurrency as a legitimate safe haven instead of a risk asset.

“Right now, we are at a decision-making point and very close to a recession,” Dalio said during a Sunday NBC interview. “And I’m worried about something worse than a recession if this isn’t handled well.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。