1. Market Observation

Keywords: OM, ETH, BTC

The market on the Solana chain is gradually warming up, with the trading volume of Meme coins returning to early February levels. Institutional investors are also increasing their positions in SOL, with the U.S. listed company Janover announcing the purchase of approximately $10.5 million worth of 80,567 SOL, bringing their total holdings to 163,000 SOL, valued at about $21.2 million. Meanwhile, partners at Multicoin Capital seem to be quietly increasing their holdings, with signs indicating they have transferred $7 million USDC to Coinbase, possibly preparing for SOL's future market.

In contrast, Bitcoin's recent performance has left many industry OGs feeling confused and disappointed. Arca's Chief Investment Officer Jeff Dorman admitted that he left Wall Street to enter the crypto space to escape a market environment dominated by macro factors, but now Bitcoin has become a post-market trading tool for large funds, moving almost in sync with the Nasdaq, losing its independence. The high correlation between Bitcoin and the S&P 500 and Nasdaq 100 has been particularly evident during recent stock market volatility. Crypto analyst Eugene also acknowledged that as the crypto market becomes increasingly influenced by macro factors, his trading strategy has had to shift to a more cautious approach, maintaining low trading volumes and setting strict stop-losses until the market direction becomes clear again. However, McKenna from Arete Capital pointed out that markets often bottom out amid the worst news, and the panic when Bitcoin fell to $74,000 has already set in; unless U.S.-China relations worsen further, future news may only cause market fluctuations rather than trend changes. Despite the short-term volatility, institutional interest in Bitcoin continues to grow steadily. Data from Bitwise shows that in the first quarter of 2025, publicly listed companies purchased 95,000 Bitcoins, a 16% increase from the previous quarter, with the number of companies holding Bitcoin reaching 79, accounting for 3.28% of Bitcoin's total supply. In addition to Janover, companies like CleanSpark, Value Creation, Metaplanet, and Semler Scientific have also announced Bitcoin investment plans.

Although institutions are continuously increasing their BTC holdings, the central bank's attitude towards BTC remains unclear. The latest survey results from the Bank for International Settlements are less optimistic, showing that the proportion of central banks considering investing in digital assets in the next 5-10 years has dropped sharply from 15.9% last year to 2.1% this year. Among the 91 central banks managing $7 trillion in reserves, none currently hold digital assets. However, 11.6% of central banks believe that cryptocurrencies are becoming a more credible investment option, and 50 central banks (59.5%) oppose establishing a Bitcoin strategic reserve. Additionally, Google announced that it will implement MiCA crypto advertising rules in the EU starting April 23, indicating that large tech companies are adapting to the new regulatory environment.

In terms of the macroeconomic environment, although recent tariff policies from the Trump administration have caused market turbulence, ARK Invest founder Cathie Wood remains optimistic, believing this could be a form of "shock therapy," ultimately aimed at reducing trade barriers and stimulating economic growth. Wood predicts that GDP may experience negative growth in the first half of 2025, which could provide the government and the Federal Reserve with more room to stimulate the economy.

2. Key Data (as of April 16, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, GMGN, Tomars)

Bitcoin: $83,525.29 (Year-to-date -10.94%), Daily spot trading volume $2.617 billion

Ethereum: $1,579.83 (Year-to-date -53.06%), Daily spot trading volume $1.198 billion

Fear and Greed Index: 29 (Fear)

Average GAS: BTC 1.05 sat/vB, ETH 0.35 Gwei

Market Share: BTC 62.9%, ETH 7.3%

Upbit 24-hour trading volume ranking: AERGO, ARDR, XRP, SNT

24-hour BTC long-short ratio: 1.0088

Sector performance: AI sector down 5.23%, Meme sector down 4.95%

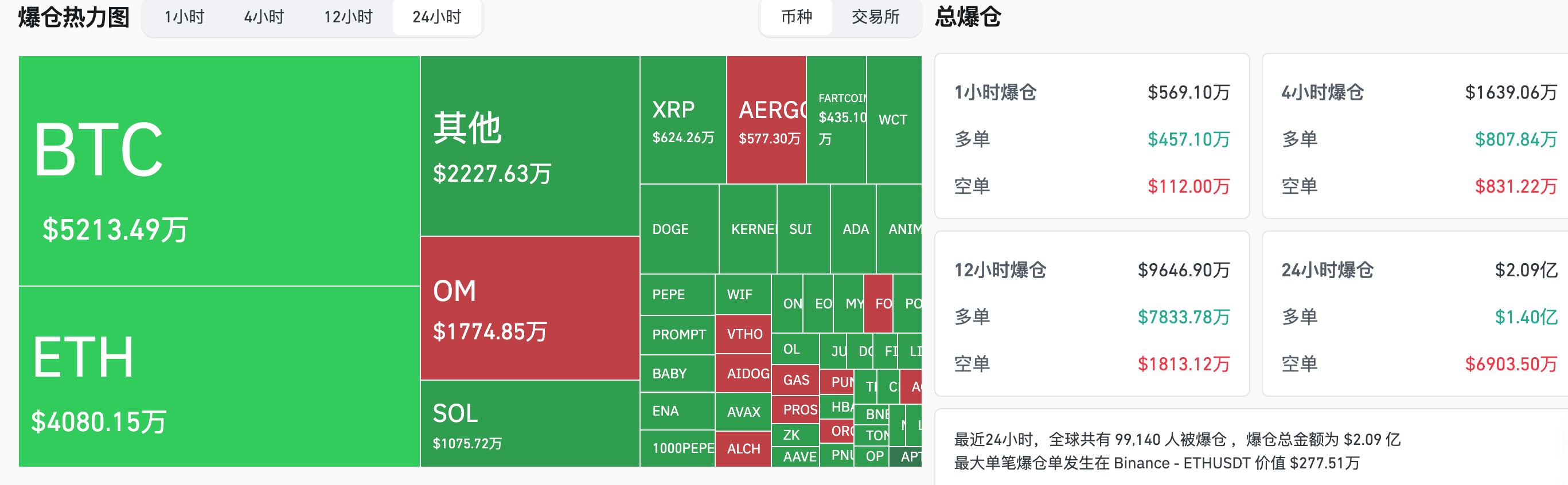

24-hour liquidation data: A total of 99,140 people were liquidated globally, with a total liquidation amount of $209 million, including $52.13 million in BTC, $40.80 million in ETH, and $17.74 million in OM.

BTC medium to long-term trend channel: Upper line ($83,721.28), Lower line ($82,063.44)

ETH medium to long-term trend channel: Upper line ($1,665.45), Lower line ($1,632.47)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of April 15 EST)

Bitcoin ETF: $76.4151 million

Ethereum ETF: -$14.1821 million

4. Today's Outlook

Coinbase International will launch COMP-PERP, UXLINK-PERP, and ATH-PERP on April 17

EigenLayer will launch the confiscation mechanism on the mainnet on April 17

Arbitrum (ARB) will unlock approximately 92.65 million tokens at 9 PM on April 16, accounting for 2.01% of the current circulation, valued at about $28.5 million;

deBridge (DBR) will unlock approximately 1.14 billion tokens at 8 AM on April 17, accounting for 63.24% of the current circulation, valued at about $26.5 million;

Omni Network (OMNI) will unlock approximately 8.21 million tokens at 8 AM on April 17, accounting for 42.89% of the current circulation, valued at about $1,630;

ApeCoin (APE) will unlock approximately 15.6 million tokens at 8:30 PM on April 17, accounting for 1.95% of the current circulation, valued at about $680;

U.S. initial jobless claims for the week ending April 12 (in thousands) (April 17, 20:30)

- Actual: To be announced / Previous value: 22.3 / Expected: 22.6

Today's top 500 market cap gainers: ARDR up 125.22%, FUEL up 35.88%, SNT up 35.06%, GFI up 31.67%, OM up 29.40%.

5. Hot News

Japanese listed company Value Creation plans to invest another 100 million yen in Bitcoin

Metaplanet announces the issuance of $10 million in bonds to increase Bitcoin holdings

Towns will launch the TOWNS token in Q2, with an initial airdrop ratio of 10%

Semler Scientific applies to issue $500 million in securities to purchase more Bitcoin

U.S. listed company Janover announces an increase of approximately $10.5 million in SOL holdings

Multicoin Capital partners lend $7 million USDC to Coinbase, possibly to increase SOL holdings

A certain address deposited 710,000 AVAX into Coinbase, expected to incur a loss of $12.19 million

Terra: Deadline for submitting loss claims to the Terraform liquidation trust fund is May 17

Google will implement MiCA crypto advertising rules in the EU starting April 23

CoinShares: Last week saw a net outflow of $795 million from digital asset investment products

Canada approves a spot Solana ETF, set to launch this week and support staking

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。