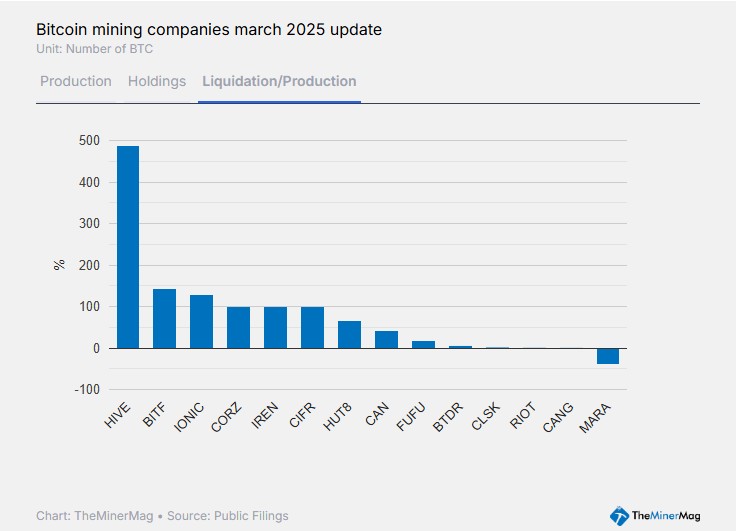

Public bitcoin mining companies resumed heavy selling in March, parting with over 40% of their monthly BTC output, the highest liquidation rate since October 2024.

According to theminermag.com, the shift follows several months of accumulation and reflects growing financial strain amid persistently low hash price levels and rising uncertainty from global trade tensions.

This renewed selloff contrasts with the post-election rally in late 2024, when miners, buoyed by bitcoin’s upward momentum, opted to hold their BTC reserves. But with the market down roughly 20% from its highs and block fees falling to just 1.1%, firms appear to be cashing out to maintain liquidity.

Source: Minermag

Notably, miners like Cleanspark have announced they’ll now sell portions of monthly production to cover operational costs, while dipping into reserves to support expansion plans. Others, including HIVE, Bitfarms, and Ionic Digital, reportedly sold more than 100% of their March production, indicating they’re drawing from reserves or borrowing against future output.

At the same time, capital-intensive moves like ASIC upgrades and data center expansion are continuing across the sector, suggesting that miners are betting on long-term growth despite short-term pressures.

While some firms have stopped monthly disclosures, the available data highlights a clear industry trend: miners are tightening their belts and leveraging every available BTC to stay competitive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。