Original Author: Pzai, Foresight News

On April 17, Federal Reserve Chairman Jerome Powell reiterated in a speech at the Chicago Economic Club that the Fed will remain cautious about interest rate cuts and will consider such actions only when the situation becomes clearer. He warned that the Fed faces a dilemma with conflicting dual goals of inflation and economic growth. Powell also denied the existence of a Fed Put to support the market, emphasizing that the market is orderly and operating as expected.

Influenced by Powell's views, cryptocurrencies experienced slight fluctuations. Bitcoin's latest quote reached $83,921, with a daily high of $85,511, marking a 24-hour increase of 0.19%. The weekly high was $86,512, while the low was $83,150, resulting in a weekly increase of 0.27%.

In terms of mainstream assets, ETH, BNB, and SOL showed muted responses, with Solana rising 2.6% in a single day, approaching the $130 mark; ETH fell slightly by 0.7%, retreating to around $1,580; BNB also dipped by 0.7% to $581. Regarding ETFs, Bitcoin spot ETFs saw a net outflow of $200 million in a single day, with a total net asset value of $93.61 billion. Ethereum spot ETFs had a net outflow of $7.74 million, with a total net asset value of $5.3 billion.

In terms of derivatives data, according to Coinglass, over 134,000 people were liquidated in the last 24 hours, with a total liquidation amount of $275 million, including $161 million in long positions.

Affected by related factors, the three major U.S. stock indices accelerated their decline, hitting new daily lows towards the end of the trading session. The Dow Jones fell by over 970 points, a decline of more than 2%; the S&P index dropped over 3%; and the Nasdaq fell by more than 4%.

Among them, the "Big Seven" tech stocks showed a general decline. Nvidia hit a daily low during the midday session, with a drop of about 10.5%, ultimately closing down nearly 6.9%. Tesla closed down nearly 5%, Apple fell by nearly 3.9%, Microsoft and Meta both saw declines close to 3.7%, Amazon dropped over 2.9%, and Alphabet fell by 2%.

After the Trump administration delayed the implementation of tariffs, market expectations for a Fed interest rate cut in the second half of 2025 briefly warmed. However, Fed analysts pointed out that even if the tariff pause continues and inflationary pressures ease, rate cuts would still need to overcome extremely high thresholds. What happened before and after Powell's speech?

"Rate cuts won't solve immediate problems"

In his speech, Powell further elaborated on the complex economic landscape: growth in the first quarter of 2025 is expected to slow from last year's robust pace. Despite strong auto sales, overall consumer spending momentum is insufficient, and businesses are expected to face pressure on GDP growth due to concentrated imports ahead of potential tariffs. Additionally, stagnation in labor growth and government layoffs are impacting the job market. He stated, "If the U.S. becomes a jurisdiction with higher structural risks in the future, it will reduce our attractiveness as a jurisdiction."

Market analysis generally suggests that if the tariff pause effectively alleviates import inflation pressures, the Fed may delay the rate cut process in the medium to long term. Conversely, if global trade frictions continue to escalate, risk assets will face pressure in the short term, and the Fed's monetary policy will encounter more challenging trade-offs—seeking a balance between curbing inflation and avoiding excessive economic contraction. Powell also admitted, "The impulses we feel are higher unemployment rates and higher inflation rates, and our tools can only address one of these issues at a time, making it a difficult situation for central banks."

Bloomberg economist Chris G. Collins believes, "These remarks indicate that the Fed will prioritize the inflation aspect of its dual mandate as they await more information on how government policies will impact the economy."

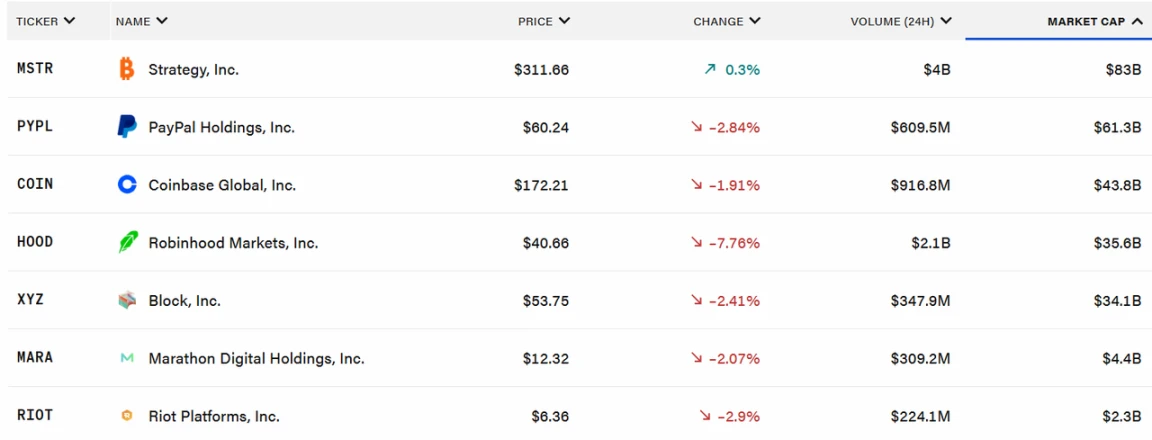

In the crypto stock sector, major crypto-related U.S. stocks all closed down, with an average decline of around 2%, while MSTR saw a slight increase of 0.3%. Powell's clear signal of "waiting on rate cuts," along with warnings about the conflict between inflation and economic goals, undoubtedly intensified market uncertainty regarding policy direction.

Image Source: The Block

The current market faces multiple contradictions: the high valuation of tech stocks versus the pressure of earnings realization, the tug-of-war between gold's safe-haven demand and the dollar's resilience, and the uncertainty of tariff policies versus the divergence in Fed monetary policy. Gareth Ryan, Managing Director of IUR Capital, stated, "Sentiment towards U.S. risk assets shows signs of long-term scars. If there is no significant progress in trade negotiations with major U.S. trading partners within the next 90 days, the stock market may face a difficult summer."

In the crypto market, Coinbase's latest report indicated that extreme negative sentiment has emerged due to the implementation of global tariffs and the potential for further escalation. Meanwhile, although regulatory slowdowns have led to an increase in venture capital funding for cryptocurrencies in the first quarter of 2025 compared to the previous quarter, it remains 50%-60% lower than the peak levels of the 2021-2022 cycle, significantly limiting new capital entering the cryptocurrency ecosystem, especially in the altcoin sector, which may lead to a long-term decline in market liquidity expectations. In the medium to long term, attention should be paid to the Fed's interpretation of economic data, the progress of global supply chain recovery, and the third crypto policy roundtable meeting scheduled for April 25.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。