Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@AssassinMalvo)_

Since BTC peaked in early February and fell below the $100,000 mark again, market sentiment and trends have significantly declined. Especially after Libra caused a collapse in Solana Meme, the few active sectors in the market have also fallen silent. SOL dropped from a high of $295 to a low of $95, a decline of 67.8%.

In this context, old VC tokens and Meme tokens have begun to tumble, with tokens like ACT and OM experiencing dramatic halving events in a short time. Meanwhile, the valuation bubble of tokens has been burst; for example, newly launched VC tokens like SHELL have a circulating market cap of only $30 million, with few projects having an opening market cap exceeding $100 million.

Therefore, tokens that were previously overvalued and have a low unlocking ratio are likely to be quality shorting targets. This article will compile data on tokens listed on Binance contracts to provide readers with this information as a potential operational reference.

Basic Information

Statistical Objects: Tokens currently tradable on the Binance contract market, listed after January 1, 2023

Data Sources: Token market cap from CoinGecko, token listing time from Binance contract API, token unlocking ratio from token.unclocks and CoinGecko

Further Explanation: The unlocking ratio from token.unclocks is derived from the website's statistics and calculations based on project white papers and actual announcements, which is considered a relatively accurate unlocking ratio but has a smaller coverage. Therefore, CoinGecko's circulating market cap/FDV is also used as a backup unlocking ratio.

Results Display

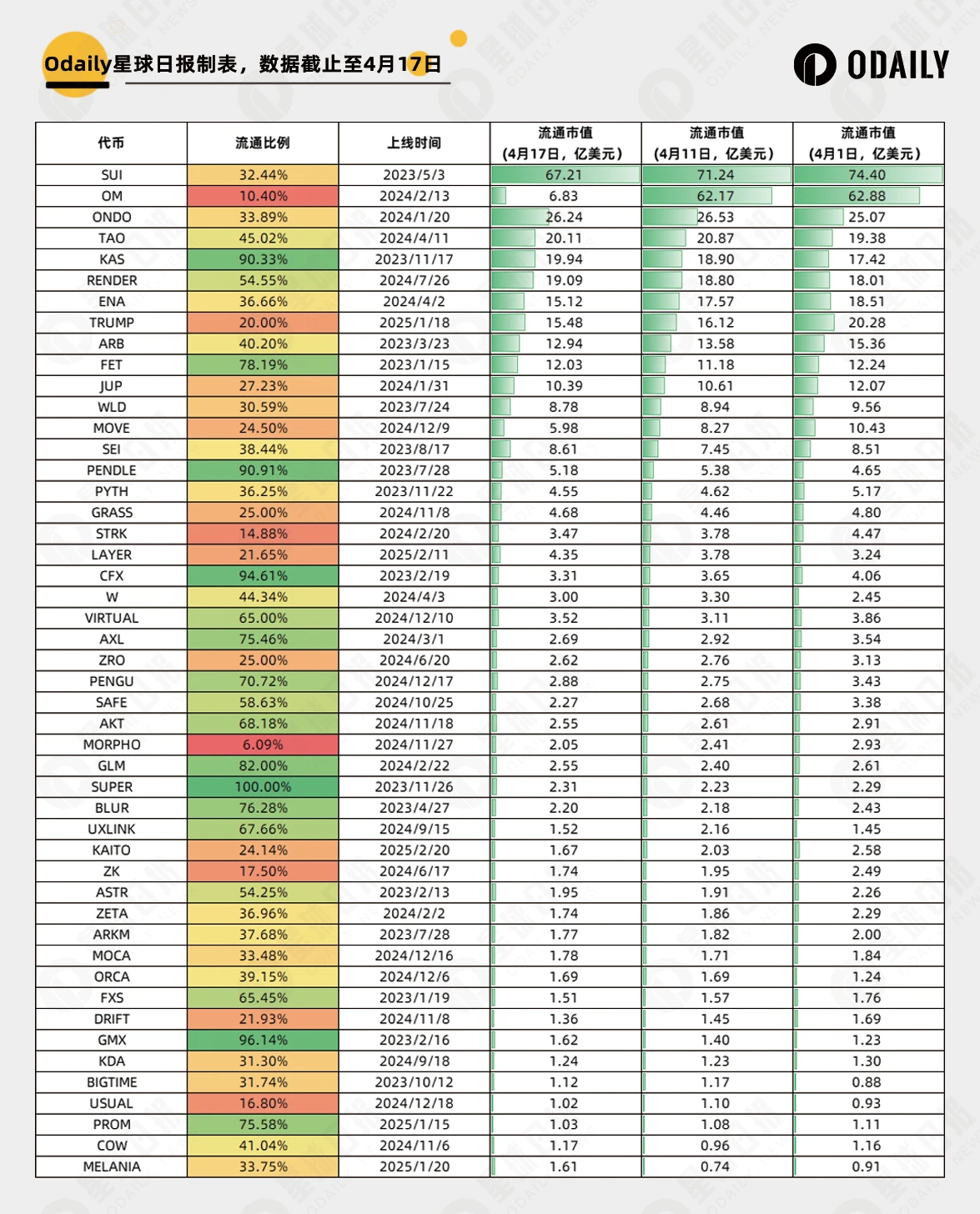

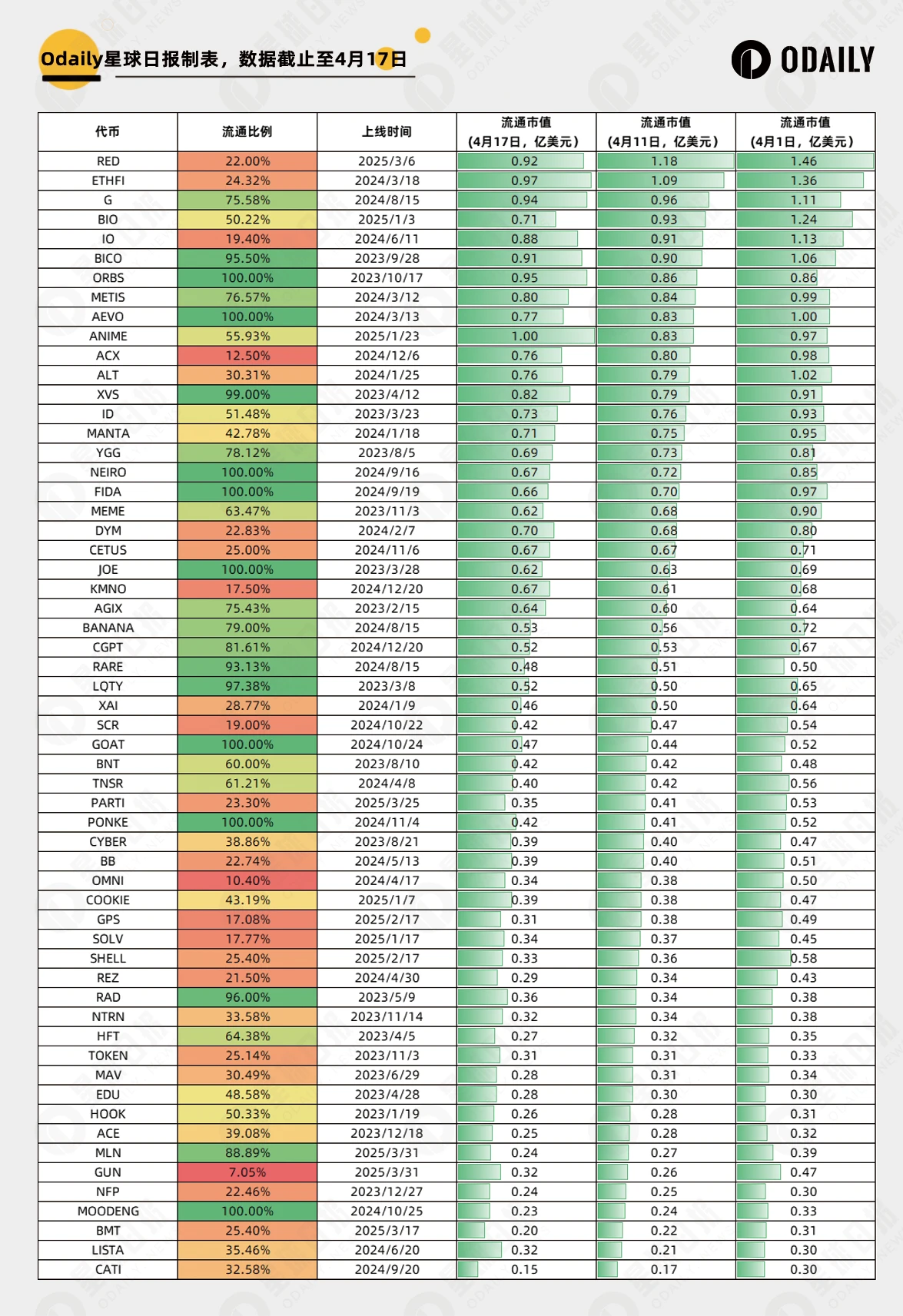

Since 2023, Binance contracts have listed a total of 216 tokens, with token.unclocks providing unlocking data for 106 tokens. The tokens with a circulating market cap greater than $100 million and less than $100 million are divided into the following two images:

Market Cap Greater than $100 Million

Market Cap Less than $100 Million

Theoretically, the higher the market cap and the lower the circulating ratio (red), the more worthwhile it is to short, for example, during the first statistics, OM had an unlocking ratio of only 10% but a market cap as high as $6.2 billion, theoretically offering extremely high shorting odds.

Currently, tokens with a market cap greater than $100 million and an unlocking ratio of less than 25% include OM, TRUMP, MOVE, STRK, LAYER, MORPHO, KAITO, ZK, DRIFT, and USUAL. There are even more tokens with a market cap of less than $100 million and a ratio of less than 2%, which readers can refer to in the table; this will not be elaborated further here.

It is also important to note that a low unlocking ratio does not automatically mean it can be shorted; it also needs to be combined with the token's unlocking situation. For example, although ONDO has a low unlocking ratio, it only unlocks once a year (as shown below), so there will not be selling pressure from unlocked tokens in the short term. A low unlocking ratio cannot be a reason for shorting.

Besides Looking at Ratios, How Else Can We Choose?

Initially, the author believed there are three types of tokens that are best not to short, including:

Historical meme coins (SUI, OM, etc.)

DeFi tokens with continuous, stable income (PENDLE, etc.)

Korean forces (UXLINK, IP)

However, based on the actual situation in the past two weeks, these "historical meme coins" have entered a netting phase, so some previously strong but recently underperforming tokens can also be included in the shorting category.

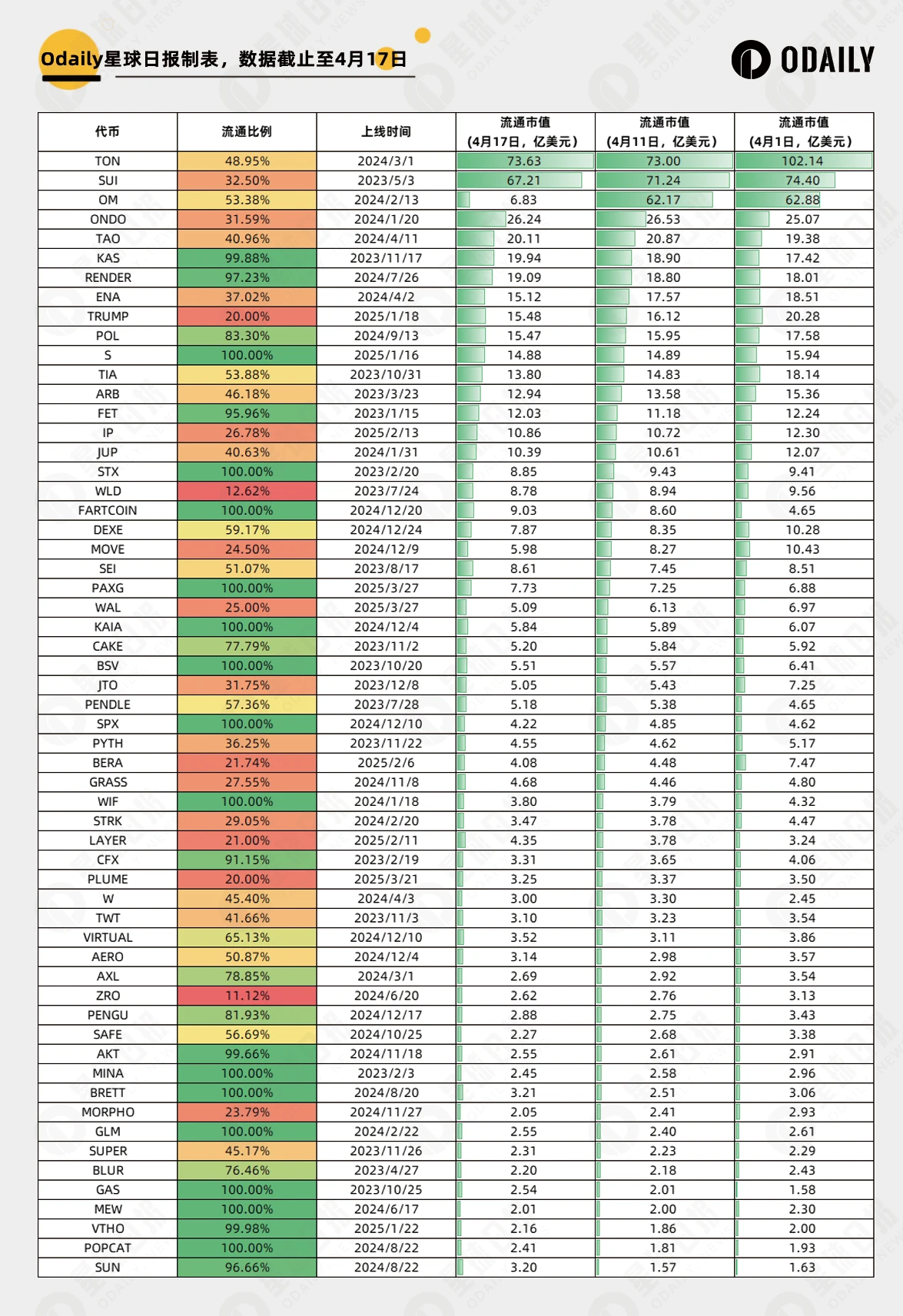

CoinGecko Unlocking Ratio Reference

Using CoinGecko's circulating market cap/FDV as the unlocking ratio, and filtering for tokens with a market cap greater than $200 million, the situation is as follows.

Most tokens have not seen substantial changes in their unlocking ratios, but several low-circulation tokens for which token.unlocks did not provide data have been added, including IP, WAL, BERA, and PLUME.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。