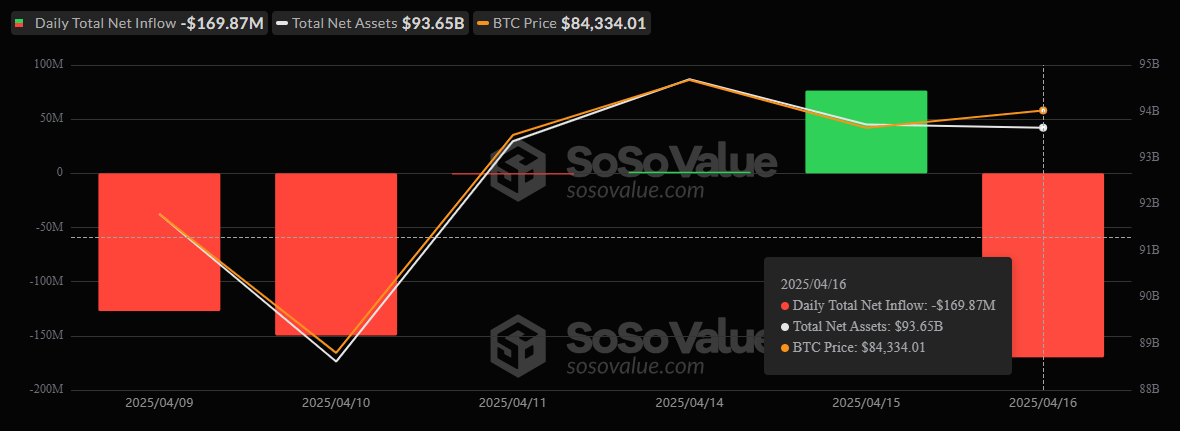

Bitcoin ETFs Retreat After Brief Rebound as Ether ETFs Extend Outflow Streak

The tide turned sharply as bitcoin ETFs looked poised to regain momentum. A staggering $169.87 million flowed out of the sector, ending a brief two-day recovery streak and reminding investors that market sentiment remains fragile.

Source: Sosovalue

Blackrock’s IBIT led the modest inflow group with $30.58 million. It was followed by Bitwise’s BITB ($12.81 million), Invesco’s BTCO ($6.74 million), Grayscale’s Bitcoin Mini Trust ($3.36 million), Vaneck’s HODL ($2.38 million), and Valkyrie’s BRRR ($1.31 million). Total trading volume stood at $1.83 billion, while total net assets dipped slightly to $93.65 billion.

Meanwhile, ether ETFs remained stuck in reverse. Another $12 million in outflows marked the seventh consecutive red day for the segment. Grayscale’s ETHE led the downturn with $8.20 million in exits, followed by Blackrock’s ETHA ($4.27 million) and Franklin’s EZET ($1.78 million). A small $2.24 million inflow into Grayscale’s Ether Mini Trust offered little comfort.

With $392.98 million traded and total ether ETF assets now at $5.25 billion, the pressure continues to mount. Investors are still cautious and waiting for a firmer signal from the broader crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。