Original Title: Networks in Crypto VC

Original Author: @Decentralisedco, Web3 Consulting Firm

Original Compilation: Rhythm Little Deep

Editor's Note: The article explores the network relationships in cryptocurrency venture capital, analyzing how VCs choose co-investments and historical investment patterns. The researchers reveal which funds frequently co-invest, how their investment performance is, and how large funds support their portfolio companies through follow-on financing. The article emphasizes that understanding the VC network and co-investment habits can help founders optimize their fundraising strategies, while also pointing out that capital is concentrating towards a few top funds, and co-investment is increasingly reliant on partner relationships rather than fund brands, potentially evolving towards private equity in the future.

The following is the original content (reorganized for better readability):

We studied how cryptocurrency VCs choose co-investments and the historical patterns in their investment strategies. The tools mentioned in the article can be accessed here.

As an asset class, venture capital follows an extreme power law distribution. However, the extent of this phenomenon has not been thoroughly studied, as we are always busy chasing the latest market narratives. As a founder, understanding which VCs frequently co-invest can save time and optimize your fundraising strategy. Each deal is like a fingerprint; once we visualize them as charts, we can reveal the stories behind them.

In other words, we can track the nodes responsible for most of the financing in the cryptocurrency space. We are trying to find the "ports" in the modern trade network, similar to merchants from a thousand years ago.

We believe there are two reasons why this is an interesting experiment:

- We operate a VC network that is somewhat like a "Fight Club." No one is really throwing punches (at least not yet), but we also don’t talk about it much externally. This VC network includes about 80 funds. Across the entire cryptocurrency VC landscape, around 240 funds have invested over $500,000 in seed rounds. This means we have direct contact with about 1/3 of those funds, while nearly 2/3 of the funds will read our content. This coverage exceeds my expectations, but that is the reality.

Nevertheless, tracking who is actually investing where remains challenging. Sending founder updates to each fund can turn into noise. The emergence of this tracking tool is meant to filter out which funds have invested in which areas and who they co-invest with.

- For founders, understanding where capital flows is just the first step. More importantly, it is crucial to understand how these funds perform and who they typically co-invest with. To clarify this, we calculated the historical probability of a fund receiving follow-on financing after an investment, although the data becomes murky in later stages (like Series B) as companies often issue tokens instead of traditional equity financing.

Helping founders identify active investors in cryptocurrency VC is the first step. Next is understanding which sources of capital perform better. Once we have this data, we can explore which funds co-invest to yield the best results. Of course, this is not rocket science. No one can guarantee Series A financing with just a check, just as no one can guarantee marriage after a first date. But understanding the situation you will face, whether in dating or risk financing, is immensely helpful.

Building Success

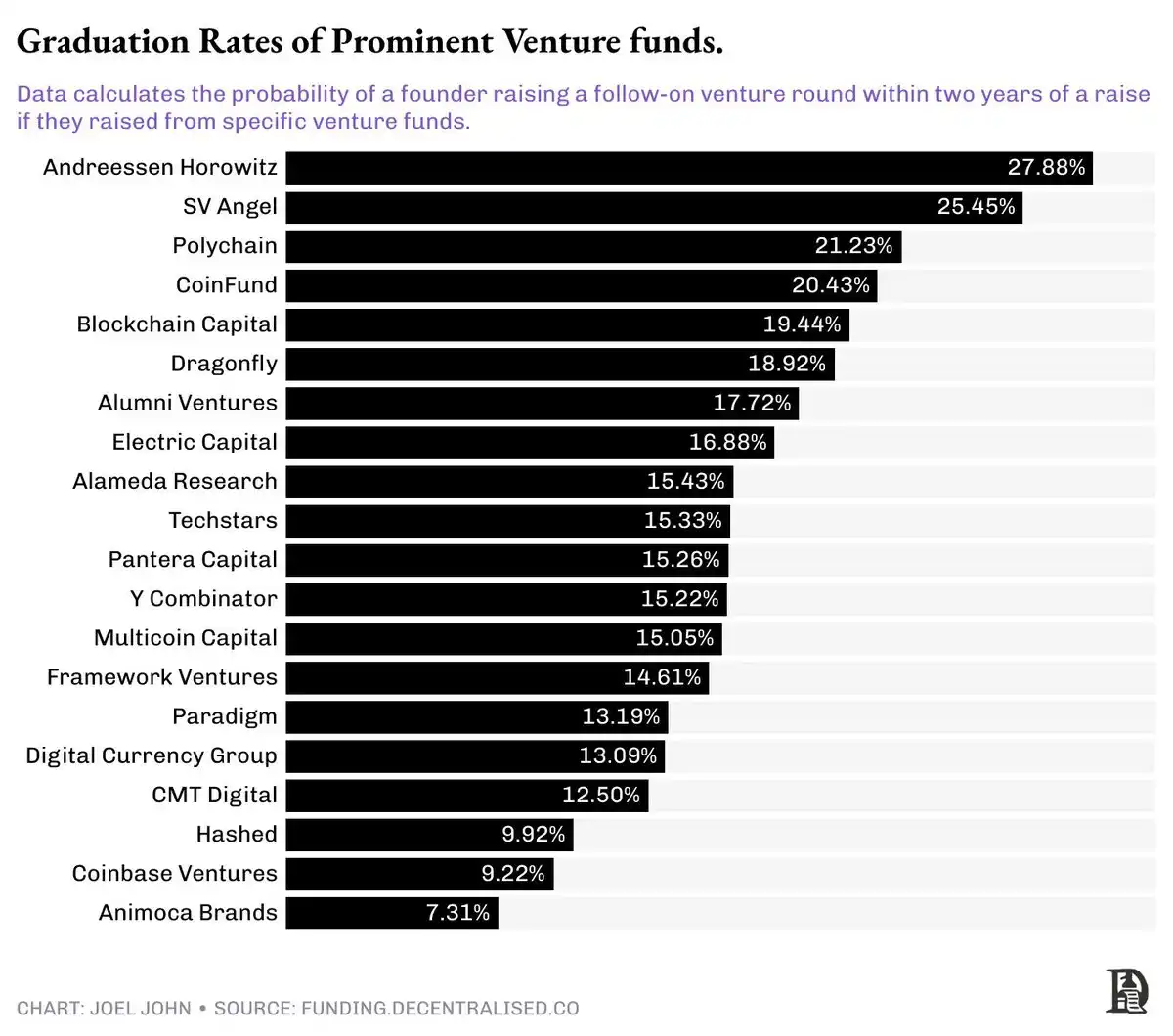

We used some basic logic to identify the funds with the most follow-on financing rounds in their portfolios. If a fund has multiple companies that received financing after the seed round, it likely did something right. The value of a VC's investment increases when the company raises the next round at a higher valuation. Therefore, follow-on financing is a good indicator of performance.

We selected the 20 funds with the most follow-on financing rounds in their portfolios and then calculated the total number of companies they invested in during the seed round. You can effectively calculate the percentage probability of founders receiving follow-on financing from this. If a fund invested in 100 companies during the seed round, and 30 of them received follow-on financing within two years, we calculate the "graduation probability" for follow-on financing as 30%.

The limitation here is that we set a strict two-year time filter. Typically, startups may choose not to raise funds at all or may take longer to raise funds.

Even among the top 20 funds, the power law distribution is extremely pronounced. For example, receiving funding from A16z means you have a 1/3 chance of raising another round within two years. In other words, for every three startups supported by A16z, one will go on to raise Series A financing. Considering the probability on the other end is 1/16, this is a relatively high graduation rate.

Funds ranked close to 20 (in this follow-on financing top 20 fund list) have a 7% probability of their invested companies receiving follow-on financing. These numbers may look similar, but for clarity, a 1/3 probability is like rolling a die and getting a number less than 3, while a 1/14 probability is roughly equivalent to the chance of having twins. This is a completely different outcome, both literally and probabilistically.

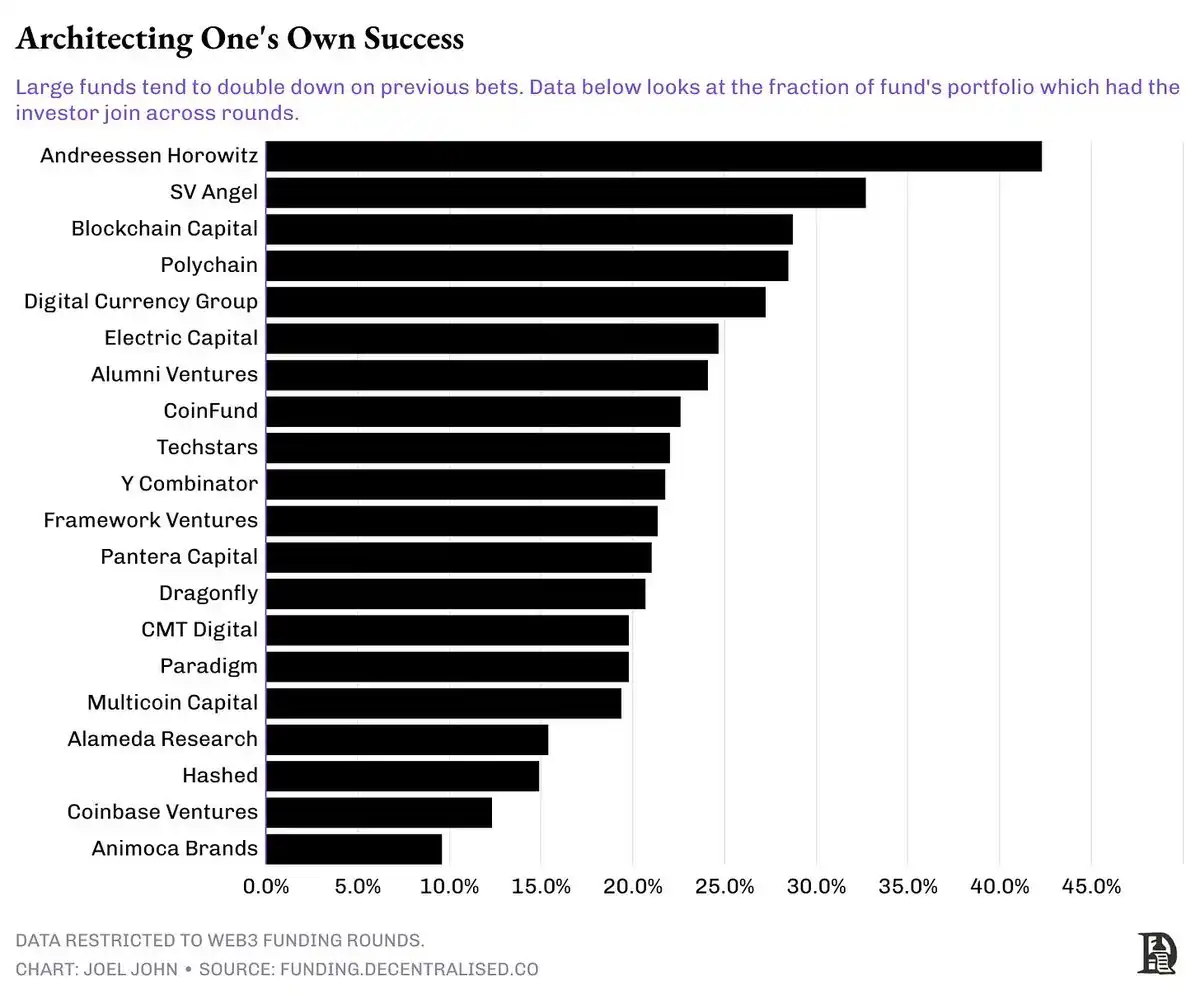

Jokes aside, this shows the degree of concentration within cryptocurrency VC funds. Some VC funds can even orchestrate follow-on financing for their portfolio companies because they also have growth funds. Therefore, they may invest in the same company during both the seed round and Series A. When a VC fund doubles down on the same company, it usually sends a healthy signal to investors in subsequent rounds. In other words, whether a VC firm has a growth-stage fund internally significantly affects the company's success probability in the coming years.

In the long run, cryptocurrency VC may evolve into private equity investments for projects with substantial revenue.

We have a theoretical argument for this shift. But what does the data actually show? To study this, we considered the number of startups in our investor group that received follow-on financing. Then, we calculated the percentage of companies that received follow-on financing rounds in which the same VC fund participated again.

That is, if a company received seed round financing from A16z, what is the probability that A16z will invest again in their Series A?

A pattern quickly emerged. Large funds managing over $1 billion are more likely to make follow-on investments frequently. For example, 44% of the startups in A16z's portfolio received additional financing with A16z participating in the follow-on rounds. Blockchain Capital, DCG, and Polychain followed up with 25% of the companies in their portfolios that received follow-on financing.

In other words, who you raise funds from in the seed or pre-seed round is far more important than you might think, as these investors are often more inclined to support their companies frequently.

Habitual Co-Investment

These patterns are the result of retrospective observation. We do not imply that companies funded by non-top-tier VCs are doomed to fail. The ultimate goal of all economic activity is either growth or profit generation. Startups that can achieve both functions will see their valuations rise over time. But increasing the probability of success certainly helps. If you cannot raise funds from this top 20 fund group, one way to increase your odds is through their networks. In other words, connecting to these capital hubs.

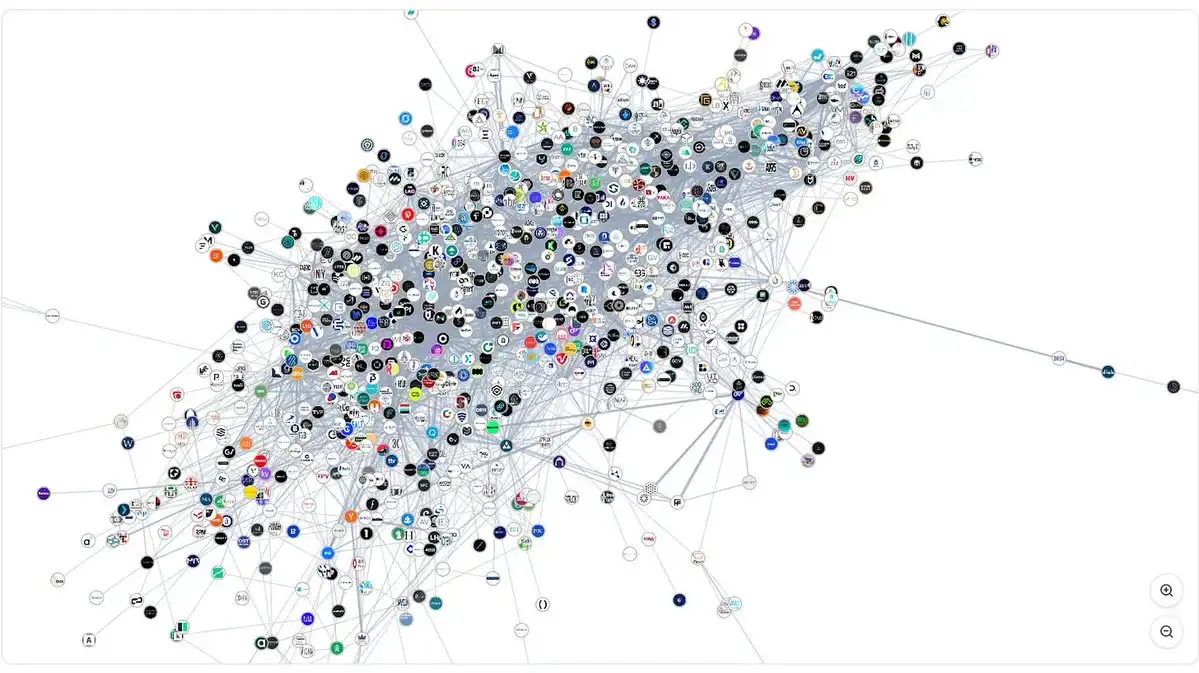

The image below shows the network relationships of all VCs in the cryptocurrency space over the past decade. There are 1,000 investors sharing about 22,000 connections with each other. A connection is formed when one investor co-invests with another. It may look crowded, even like too many choices.

However, this includes funds that have already shut down, never returned capital, or are no longer investing.

I know, it’s messy.

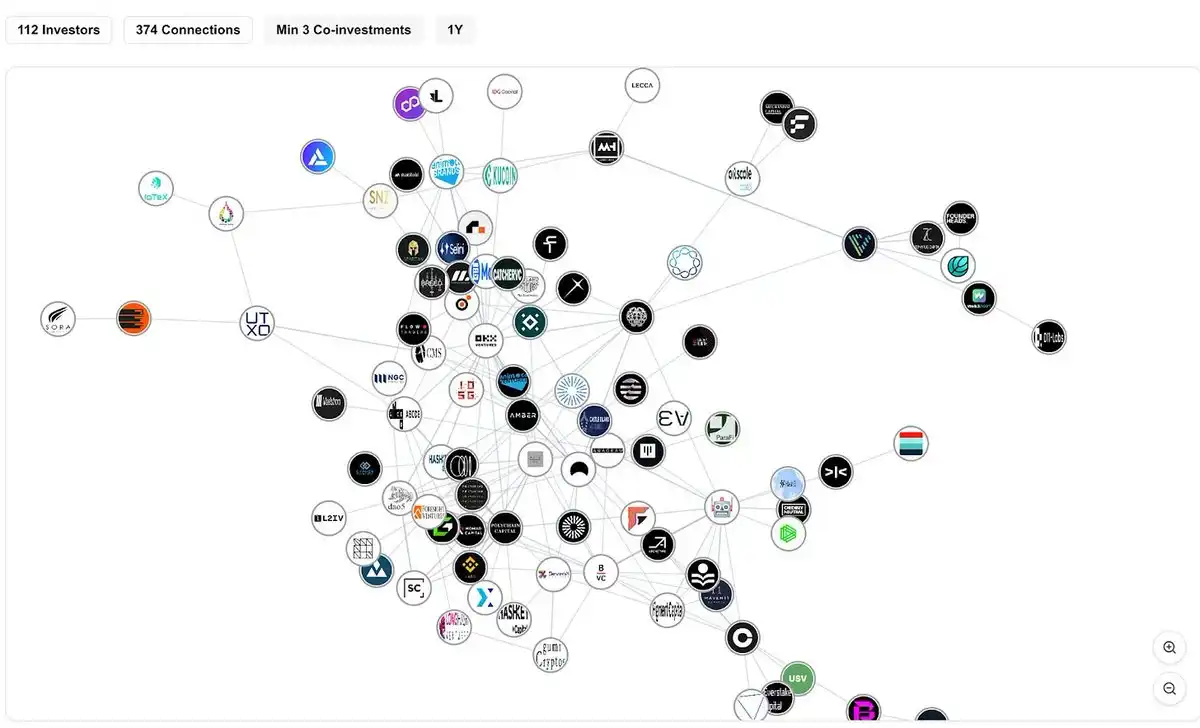

The image below more clearly shows the future direction of our market. If you are a founder looking to raise Series A, there are about 50 funds in the pool that invest over $2 million. The network of investors participating in such rounds consists of about 112 funds. These funds are increasingly inclined to consolidate, showing a stronger preference for co-investing with specific partners.

The Ocean of Investors from Seed to Series A

It appears that funds have developed co-investment habits over time. That is, when a fund invests in a particular entity, it often brings along another peer fund, either due to complementary skills (such as technical expertise or marketing assistance) or based on partner relationships. To study how these relationships operate, we began exploring co-investment patterns between funds over the past year.

For example, in the past year:

- Polychain and Nomad Capital shared 9 co-investments.

- Bankless and Robot Ventures had 9 co-investments.

- Binance and Polychain had 7 co-investments.

- Binance and HackVC also had 7 co-investments.

- OKX and Animoca had 7 co-investments.

Large funds are becoming increasingly selective about their co-investors.

- For instance, in last year's 10 investments by Paradigm, Robot Ventures participated in 3 rounds.

- DragonFly shared 3 rounds with Robot Ventures and Founders Fund in its total of 13 investments.

- Similarly, Founders Fund had 3 co-investments with DragonFly in its total of 9 investments.

In other words, we are transitioning to an era where a few funds make large investments, with fewer co-investors, and these co-investors are often well-established, reputable funds.

Entering the Matrix

Another way to analyze the data is by examining the behavior of the most active investors. The matrix above considers the funds with the most investments since 2020 and how their relationships unfold. You will notice that accelerators (like Y Combinator or Outlier Venture) have few co-investments with exchanges (like Coinbase Ventures).

On the other hand, you will also find that exchanges typically have their own preferences. For example, OKX Ventures has a high level of co-investment with Animoca Brands. Coinbase Ventures has over 30 co-investments with Polychain and 24 with Pantera.

What we are seeing are three structural things:

Despite high investment frequency, accelerators have few co-investments with exchanges or large funds, which may be due to differing stage preferences.

Large exchanges have a strong preference for growth-stage venture funds. Currently, Pantera and Polychain dominate in this regard.

Exchanges tend to collaborate with local players. OKX Ventures and Coinbase show different co-investment preferences, highlighting the global nature of capital allocation in Web3.

So, if venture capital funds are clustering, where will the next marginal capital come from? I noticed an interesting pattern: corporate capital has its own clusters. For example, Goldman Sachs has had 2 co-investment rounds in its history with PayPal Ventures and Kraken. Coinbase Ventures has 37 co-investments with Polychain, 32 with Pantera, and 24 with Electric Capital.

Unlike venture capital, corporate funding pools typically target growth-stage companies with significant product-market fit. Therefore, the behavior of this funding pool during periods of declining early-stage venture financing still needs to be observed.

Evolving Networks

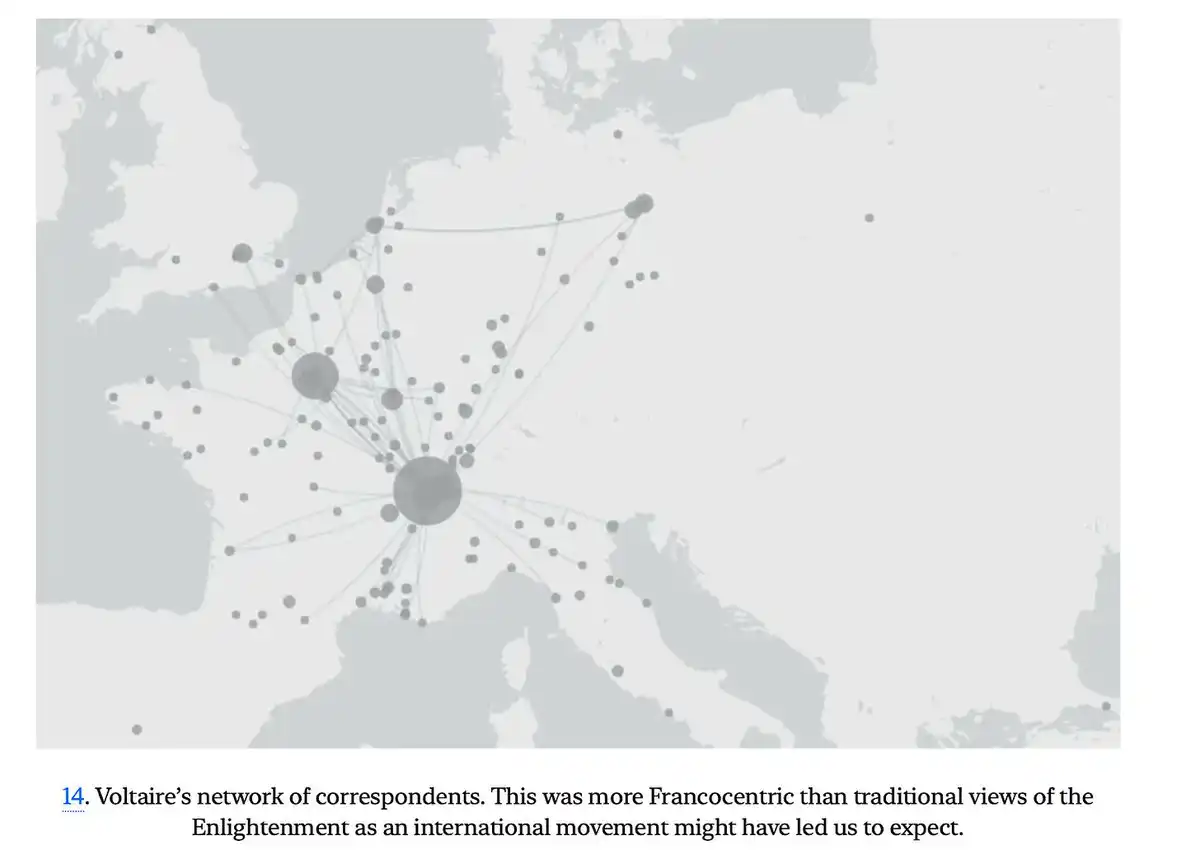

Excerpt from "The Square and the Tower"

After reading Neil Ferguson's "The Square and the Tower" a few years ago, I began to hope to study the relational networks within cryptocurrency. This book reveals how the spread of ideas, products, and even diseases is related to networks. It wasn't until a few weeks ago when we built the financing dashboard that I realized it was possible to visualize the connection networks between sources of cryptocurrency capital.

I believe that such a dataset and the economic interactions between these entities can be used to design (and execute) mergers and acquisitions and token privatization buyouts. We are internally exploring both of these. They can also be used for business development and collaboration initiatives. We are still researching how to allow specific companies access to this dataset.

But let's return to the topic at hand.

Can networks really help funds achieve excess returns?

The answer is somewhat complex.

A fund's ability to choose the right team and provide substantial capital will become increasingly important, surpassing its connections with other funds. However, what truly matters are the personal relationships between general partners (GPs) and other co-investors. VCs do not share deal flow with brands; they share it with people. When a partner switches funds, this connection simply transfers to the new fund.

I have an intuition about this, but the means to validate this argument are limited. Fortunately, there is a paper coming out in 2024 that studies the performance of the top 100 VCs over time. In fact, they examined 38,000 funding rounds involving 11,084 companies and even segmented the market's seasonality. Their core arguments can be summarized as follows:

Past co-investments do not guarantee future collaboration. If previous investments fail, a fund may choose not to collaborate with another fund again.

During periods of frenzy, co-investments often increase as funds seek to deploy capital more aggressively. VCs rely more on social signals during frenzies, reducing due diligence. In bear markets, funds deploy cautiously, often investing alone due to lower valuations.

Funds choose partners based on complementary skills. Therefore, having investors with the same expertise crowded into a round often leads to trouble.

As I mentioned earlier, ultimately, co-investments happen at the partner level, not at the fund level. Throughout my career, I have seen individuals transition between different institutions. The goal is often to work with the same person, regardless of which fund they join. In an era where AI is taking over human jobs, it is reassuring to know that interpersonal relationships remain the foundation of early-stage venture capital.

There is still much work to be done regarding how cryptocurrency VC networks form. For example, I would like to study the preferences of liquid hedge funds in capital allocation, or how late-stage deployments in cryptocurrency evolve with market seasonality, or how mergers and acquisitions and private equity fit into this. The answers are in the data we have today, but it will take time to ask the right questions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。