The Painful Lesson of Missing Out on 1 Million with RFC

That day, while I was driving and waiting at a red light, I saw RFC. A foolish mockery + an account with 650,000 followers + frequent interactions with Musk. At first glance, I knew it was my thing. I felt that impulse inside me, the kind that says no one should stop me, I just have to go for it. So, I opened my VPN, waited for the TG messages to update, opened the Bot, only to find that this account had only 0.1 Sol left. It then occurred to me that I had moved all my funds to play with BSC recently.

Half an hour later, I arrived at my destination and started to juggle my funds. Wallet transfer to the exchange - sell BNB - withdraw Sol, and seeing that the withdrawal would take some time, I decided to handle my main business first. Later, when I picked up my phone again, I had both good news and bad news. The good news was that the Sol had arrived, and the bad news was that RFC had already quadrupled to 8M.

I thought I would wait for a pullback. However, I didn’t expect it to be a tease, speeding off in a Ferrari without looking back. Leaving me silently crying in place, feeling like the dog next to me was mocking me: you RFC.

This might have been the closest I’ve ever been to getting rich. Previously, with Trump, it was my lack of understanding; although I got in at 3 dollars, I didn’t dare to buy much. This time, it was just because I happened to be out for a bit. But one can’t always be in front of a computer; there are times to go out. Maybe to meet friends, spend time with family, travel, or eat. So, when I saw Go Rich, I thought it was fantastic. Even without any advertising fees, I wanted to recommend it to my followers.

Let me introduce Go Rich, which offers a smooth experience of a centralized exchange.

1) You can register directly with your phone, no KYC required.

2) You can directly purchase on-chain tokens with USDT, no need to hold Sol, BNB, or ETH.

3) Users do not have their own on-chain wallet in Go Rich, so there’s no need to remember private keys.

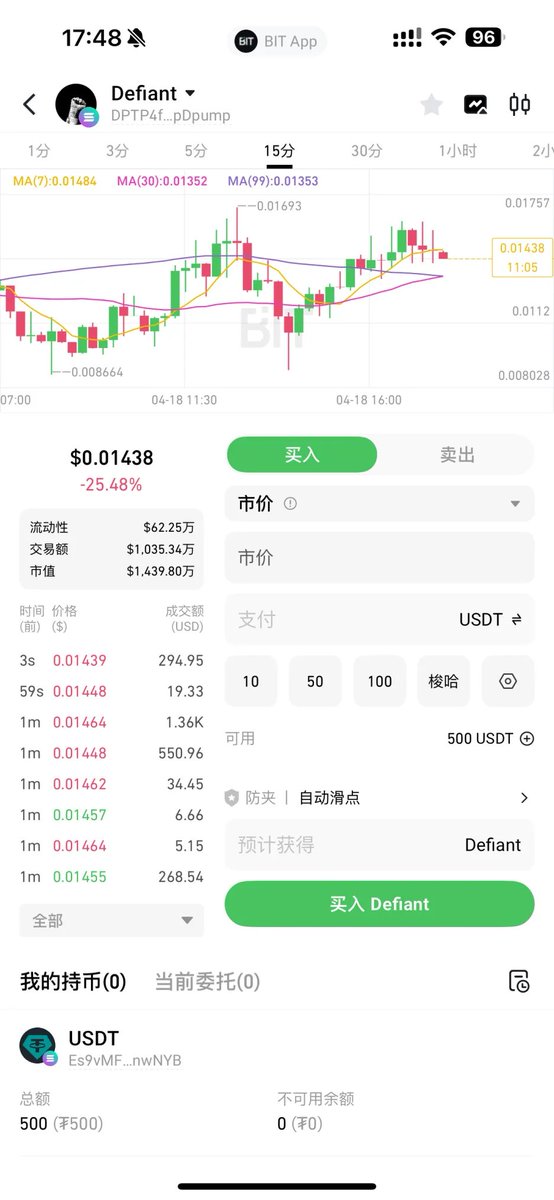

The logic behind this is that when a user buys 10 RFC on Go Rich, it uses the exchange's wallet to purchase 10 RFC on-chain. Looking at the app's interface, you will find that buying is very convenient, with slippage and fees already set by default. This is what I want to keep handy.

From a positioning perspective, Gmgn and Axiom operate on-chain, trading all assets on-chain. Binance offers an exchange experience, trading part of the assets (Alpha selected). Go Rich, on the other hand, provides an exchange experience while purchasing all assets on-chain. There are significant differences in positioning.

Lastly, Go Rich is not a new exchange but a new brand for on-chain trading under the Bit exchange. Bit exchange is an established exchange founded by Wu Jihan, and it belongs to the same group as Matrixport. So there’s no need to worry about "safety" issues. Moreover, you don’t need a lot of funds to invest in tokens; small amounts are sufficient.

So my thought is, you might not need it all the time, but keep a little fund in Go Rich. When you’re out, you can use your phone to buy another RFC anytime. Sigh, when will the next enticing CA come around? It’s frustrating!

I sincerely recommend this great thing; please support me by using my link.

https://bitweb.bitexch.io/zh-CN/signup?code=TL8U75

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。