Last week, major U.S. indexes diverged: the S&P 500 rose 0.52% over five trading days, the Dow Jones Industrial Average fell 0.89%, the Nasdaq composite slipped 0.44%, and the Russell 2000 gained 2.9% in that span. Likewise, crypto markets exhibited mixed trends, with bitcoin ( BTC) posting gains over the past week while ETH, ADA, and XRP slipped.

In that same period, an ounce of gold ended about 3.8% higher against the U.S. dollar. By week’s end, President Trump stated in the Oval Office that the U.S. and China were engaged in talks.

“Yeah, we’re talking to China. I would say they have reached out a number of times,” he told reporters. He even cryptically hinted that Chinese President Xi Jinping had reached out to speak with him. This weekend, Trump also contended that any executive who decries tariffs is effectively confessing a lack of financial wisdom.

“The businessmen who criticize tariffs are bad at business, but really bad at politics,” Trump remarked on Truth Social. “They don’t understand or realize that I am the greatest friend that American capitalism has ever had … The golden rule of negotiating and success: he who has the gold makes the rules,” he added. Ultimately, to many market players, it all boils down to persistent uncertainty in the markets going forward.

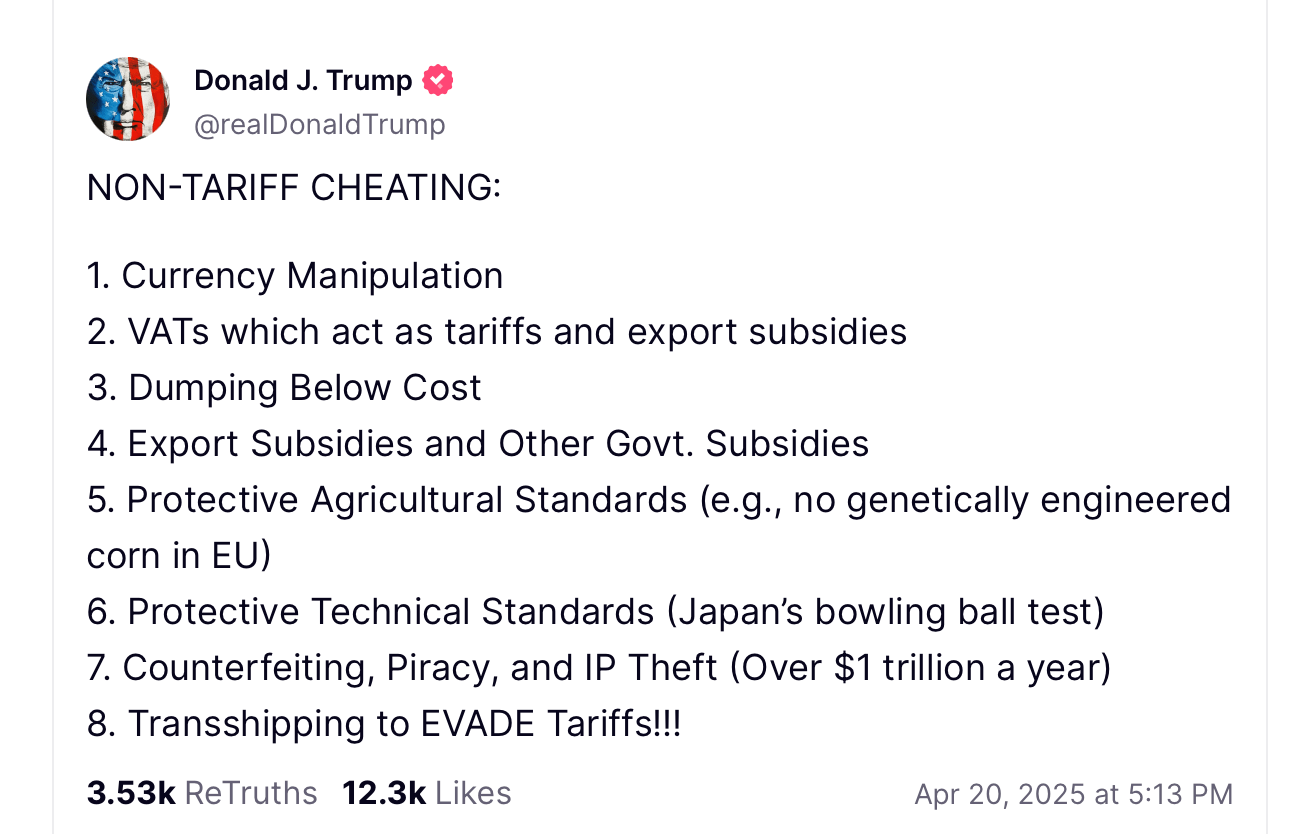

Many detractors bristle at Trump’s tariffs because they believe it will drive up costs for businesses and consumers, threaten jobs, and reduce wages. Some expect it to compress the U.S. economy and household incomes. Trump argues that tariffs serve the nation by safeguarding U.S. jobs, boosting domestic manufacturing, fortifying national security and generating government revenue while encouraging consumers to purchase U.S.-made goods and curbing dependence on foreign imports.

Markets have been unsettled by the ambiguity these trade measures engender, their prospective economic fallout, and shifting investor sentiment toward safe havens. Gold has registered a noticeable rise amid the trade frictions, affirming its standing as a classic safe haven. Yet digital assets posted uneven returns, though bitcoin remained steadier than most during the course of the week.

This may imply that some investors, cautious about the trade war’s effect on traditional markets, turned to bitcoin ( BTC) as a decentralized asset less entwined with tariff-driven economic upheaval. Conversely, some anticipate that bitcoin and crypto markets, in general, will mirror equity trends. Time remains the ultimate arbiter; nevertheless, you can wager confidently that attention will remain riveted on Trump’s forthcoming moves.

On Sunday evening, just ahead of Monday’s market open, CNBC reported a modest retreat in U.S. equity futures: contracts tied to the Dow were off by 0.5%, while futures linked to both the Nasdaq composite and the S&P 500 also dipped 0.5%. Meanwhile, bitcoin moved decisively past the $87,000 threshold during the same window reaching $87,236.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。