1. Market Observation

Keywords: MAGIC, ETH, BTC

This morning, Trump stated on social media that "those who own gold make the rules." Spot gold prices have been rising since the market opened today, breaking above $3,380 per ounce for the first time, with New York futures gold at $3,375.9 per ounce. Many gold jewelry brands have also seen their gold prices rise, approaching 1,040 yuan per gram. Meanwhile, in the crypto asset space, TreasureDAO announced a shift to the AI agent companion sector after ending game operations and Treasure Chain a few days ago, initially integrating with the SMOL series, leading to a more than twofold increase in its ecosystem token MAGIC over the weekend.

Recently, Bitcoin prices have fluctuated between $83,000 and $86,000, with neither bulls nor bears fully controlling the market. Although Bitcoin has maintained support at $83,000, bulls have yet to reclaim key moving averages. If this level cannot be held, it may trigger a new round of selling, potentially pushing prices below $80,000. Greeks.live macro researcher Adam pointed out that the key price level for BTC is in the $66,000-$67,000 range, which several traders believe is a concentration zone for short stop-losses. 21Shares and economist Timothy Peterson both predict that Bitcoin prices could reach around $138,000 by the end of 2025, while "Rich Dad Poor Dad" author Robert Kiyosaki believes Bitcoin will reach $180,000-$200,000 by 2025. Meanwhile, Swiss bank Sygnum noted that with improvements in digital asset regulation and increased user participation, altcoins are expected to rebound in the second quarter of 2025. Macro economist Lyn Alden, however, has taken a more cautious stance, lowering her Bitcoin price forecast, expecting it to be above $85,000 in 2025, and believes that "massive liquidity unlocking" could be the catalyst Bitcoin needs.

Charles Schwab's new CEO Rick Wurster revealed that the company plans to launch direct spot cryptocurrency trading services within the next 12 months. He stated that as the regulatory environment continues to improve, cryptocurrency trading services will become an "inevitable choice" for every major brokerage firm. Statistics show that there are currently nine altcoins and four meme tokens that have submitted applications for spot ETFs, with SOL and XRP being the most popular, having six and ten institutions applying, respectively. Among the altcoins that have submitted spot ETF applications, SOL, XRP, LTC, ADA, and SUI are referred to as "American coins," while AVAX, APT, MOVE, and TRX belong to the WLFI investment portfolio.

On the macro front, the US dollar index has fallen below 99 for the first time since April 2022, down 0.57% on the day. Goldman Sachs' head of hedge fund business Tony Pasquariello analyzed in a recent report that global capital flows are becoming a market focus, providing three main reasons for a significant decline in the dollar: the dollar is overvalued by about 20%; American "exceptionalism" is threatened by tariff policies, which will put immense pressure on US corporate profits and household purchasing power; the current situation resembles Brexit rather than the first trade war, representing a confrontation between the US and the world, making the foreign exchange market a focal point. Goldman Sachs also noted that after the global financial crisis, the unhedged dollar over-allocation in the US reached $2.2 trillion, which will take time to unwind. Currently, mainly Eurozone investors are selling US stocks, while other regions continue to steadily purchase US assets.

2. Key Data (As of April 21, 12:00 HKT)

(Data Source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $87,144.42 (Year-to-date -6.8%), Daily Spot Trading Volume $22.899 billion

Ethereum: $1,633.91 (Year-to-date -50.91%), Daily Spot Trading Volume $9.543 billion

Fear and Greed Index: 39 (Fear)

Average GAS: BTC 1.55 sat/vB, ETH 0.33 Gwei

Market Share: BTC 63.1%, ETH 7.2%

Upbit 24-Hour Trading Volume Ranking: AERGO, LOOM, XRP, WCT, BTC

24-Hour BTC Long/Short Ratio: 1.096

Sector Performance: AI sector up 3.98%, GameFi sector up 1.71%

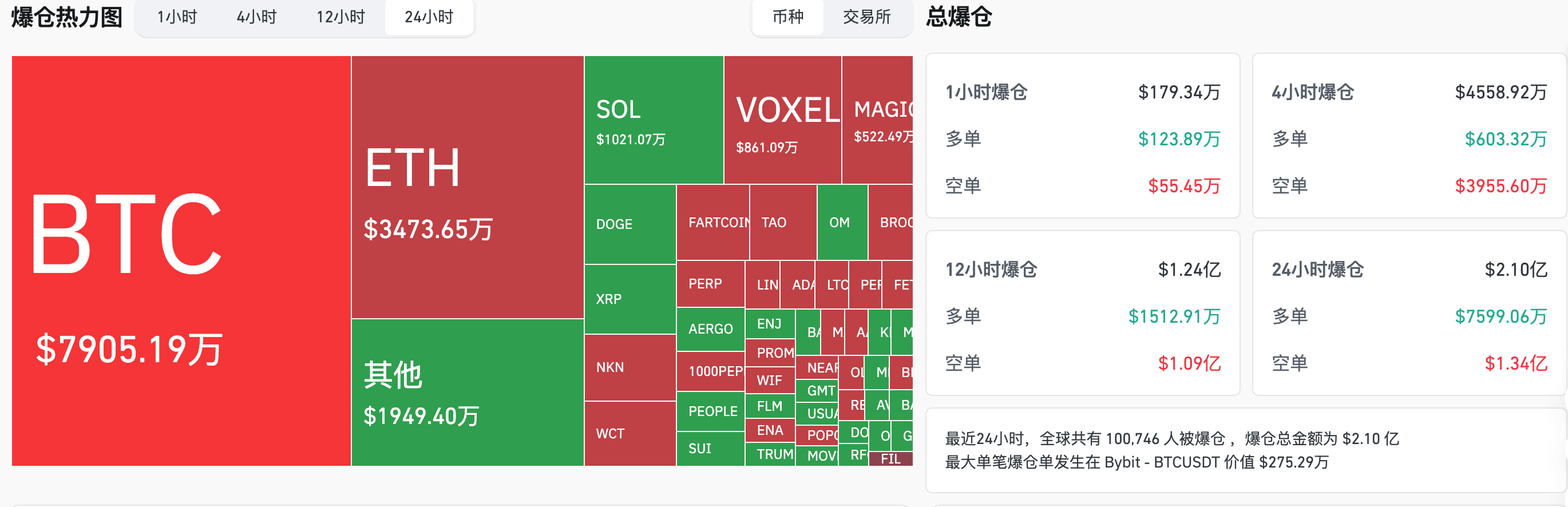

24-Hour Liquidation Data: A total of 69,616 people were liquidated globally, with a total liquidation amount of $210 million, including $79.05 million in BTC, $34.73 million in ETH, and $10.21 million in SOL.

BTC Medium to Long-Term Trend Channel: Upper line ($84,690.59), Lower line ($83,013.55)

ETH Medium to Long-Term Trend Channel: Upper line ($1,634.94), Lower line ($1,602.57)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (April 14 to April 17 EST)

Bitcoin ETF: $15.85 million

Ethereum ETF: -$32.17 million

4. Today's Outlook

Pectra client expected to be released today, adding EIP-7702 delegation status to JSON-RPC

Coinbase has applied to the CFTC to launch XRP futures, expected to go live today

Kraken will launch BNB spot trading pair at 10 PM on April 22

Bittensor (TAO) will unlock 210,000 tokens on April 21, valued at approximately $47.7 million

Scroll (SCR) will unlock 40 million tokens on April 22, valued at approximately $111 million

SPACE ID (ID) will unlock approximately 12.65 million tokens on April 22, representing 2.94% of the current circulation, valued at approximately $2.4 million

Top 500 Market Cap Gainers Today: MAGIC up 40.66%, AURORA up 33.33%, ENJ up 31.11%, GFI up 20.30%, SOS up 19.42%.

5. Hot News

This Week's Macro Outlook: The Fed's "Verbal Storm" Approaches, Is Powell's Chair Unstable?

Metaplanet has purchased an additional 330 BTC, increasing total holdings to 4,855 BTC

Raydium LaunchLab created 3,761 tokens in 5 days, with a graduation rate of only 1.12%

Spot gold hits a new high, currently priced at $3,360 per ounce

Bitcoin price reached $84,600 on Easter 2025, marking the highest in nearly 17 years

Retail dominance index on Binance reaches 89.6%, while the index on Coinbase Prime is only 18.3%

Bitcoin mining difficulty increased by 1.42% to 123.23 T, setting a new historical high

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。