Key Points

The total market capitalization of global cryptocurrencies is $2.86 trillion, up from $2.77 trillion last week, with a weekly increase of 3.15%. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $35.37 billion, with a net inflow of $15.84 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.24 billion, with a net outflow of $32.17 million this week.

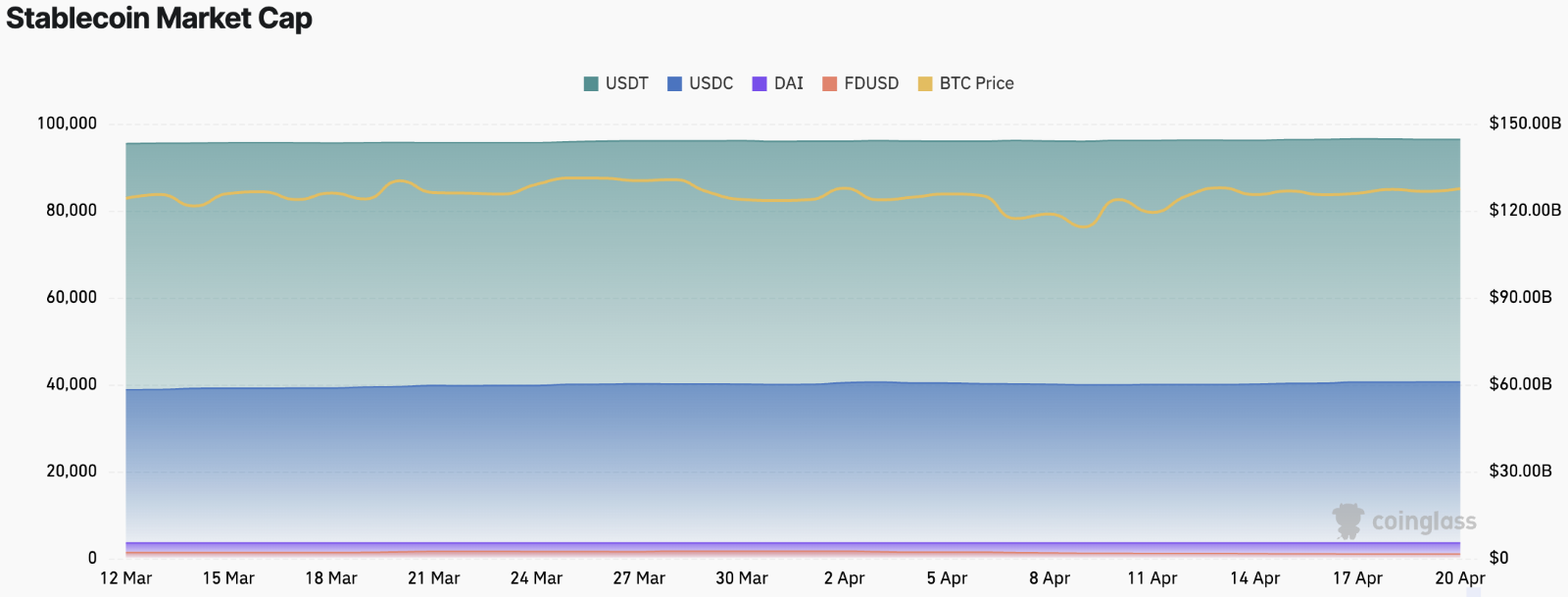

The total market capitalization of stablecoins is $212.5 billion, with USDT's market cap at $142.2 billion, accounting for 66.92% of the total stablecoin market cap; followed by USDC with a market cap of $56.2 billion, accounting for 26.4%; and DAI with a market cap of $5.36 billion, accounting for 2.52% of the total stablecoin market cap.

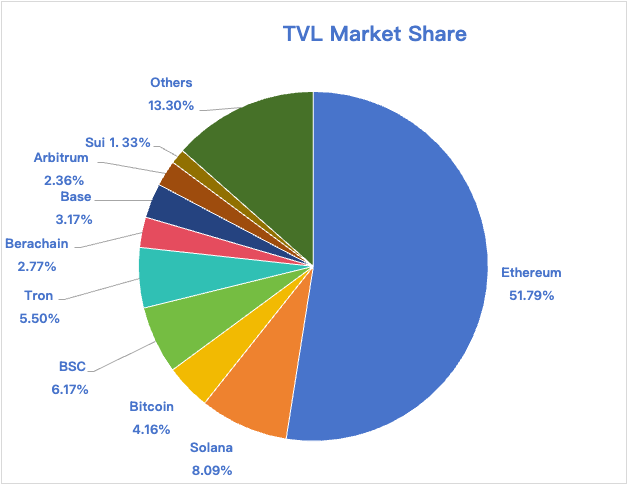

According to DeFiLlama, the total TVL of DeFi this week is $89.406 billion, nearly unchanged from last week. By public chain, the top three chains by TVL are Ethereum, accounting for 51.79%; Solana, accounting for 8.09%; and Binance Smart Chain, accounting for 6.17%.

From on-chain data, Aptos' daily trading volume increased by about 12%, while other chains saw declines, with ETH and Solana down 38.67% and 21.2%, respectively; in terms of transaction fees, Solana saw a significant decrease of 56.57%, while other chains remained relatively stable. Solana's daily active addresses grew by 19.21%, SUI increased by 3%, while Aptos and TON saw significant declines of 49.83% and 16.76%, respectively; overall, TVL slightly rebounded, with Solana up about 6.3%, ETH up 1.1%, and only SUI down 2.64%.

New Project Focus: ORO is a decentralized AI data platform that ensures privacy through cryptographic technology, encouraging users to share data for AI model training and achieving data assetization. EdgeX builds a decentralized edge computing network, integrating global computing resources to support efficient operation of AI models on edge devices, promoting the implementation of AI technology. Rekord is a blockchain data verification platform that supports multi-chain data on-chain and verification, ensuring the reliability and traceability of key data in industries such as agriculture and logistics.

Table of Contents

Key Points

Total Cryptocurrency Market Capitalization / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Cap and Issuance Situation

II. This Week's Hot Money Trends

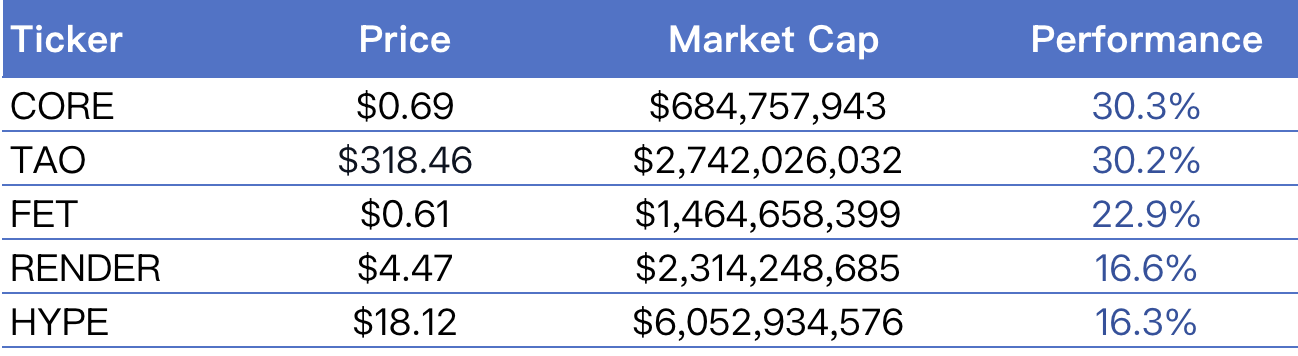

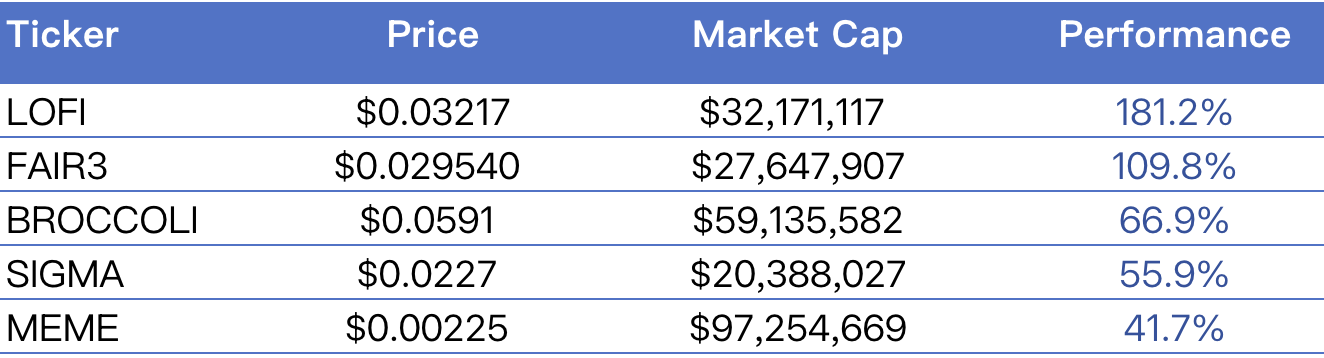

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

I. Market Overview

- Total Cryptocurrency Market Capitalization / Bitcoin Market Cap Proportion

The total market capitalization of global cryptocurrencies is $2.86 trillion, up from $2.77 trillion last week, with a weekly increase of 3.15%.

Data Source: cryptorank

Data as of April 20, 2025

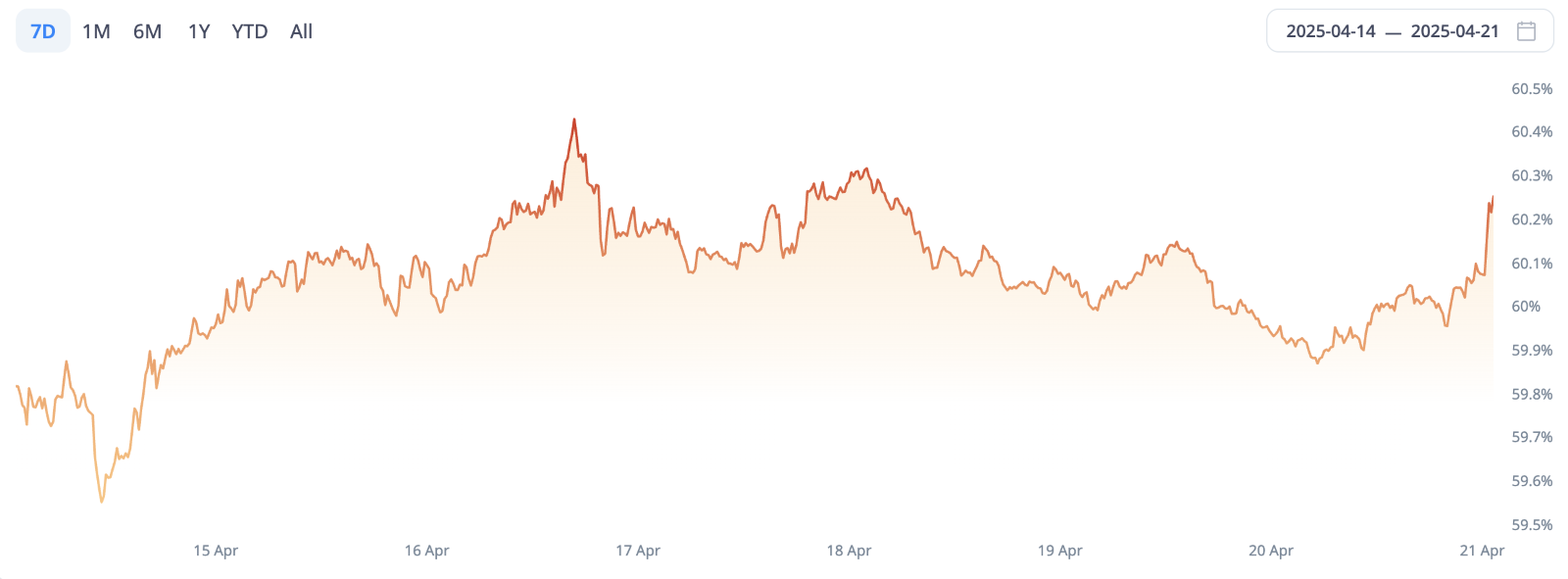

As of the time of writing, Bitcoin's market cap is $1.73 trillion, accounting for 60.5% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $212.5 billion, accounting for 7.43% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of April 20, 2025

- Fear Index

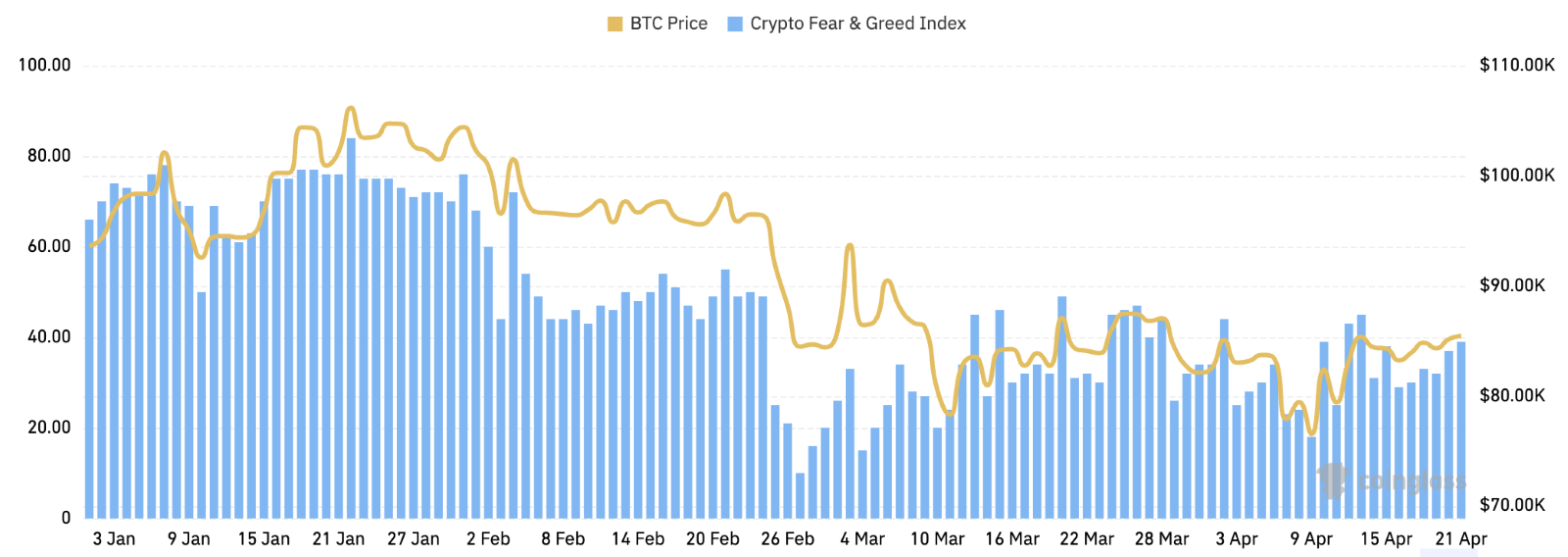

The cryptocurrency fear index is at 39, indicating fear.

Data Source: coinglass

Data as of April 20, 2025

- ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $35.37 billion, with a net inflow of $15.84 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.24 billion, with a net outflow of $32.17 million this week.

Data Source: sosovalue

Data as of April 20, 2025

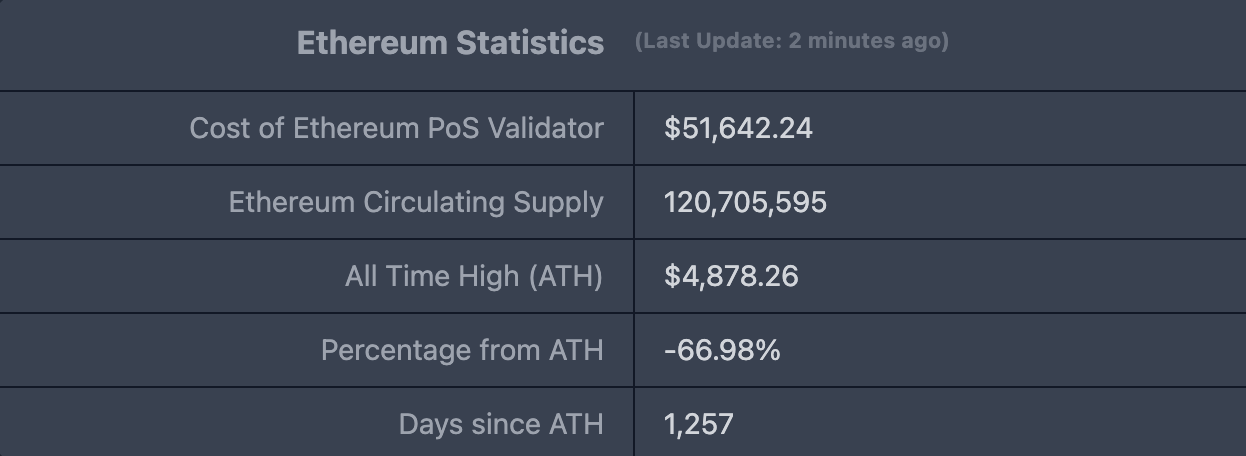

- ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $1,614.77, all-time high $4,878, down approximately 66.89% from the all-time high.

ETHBTC: Currently at 0.018532, all-time high 0.1238.

Data Source: ratiogang

Data as of April 20, 2025

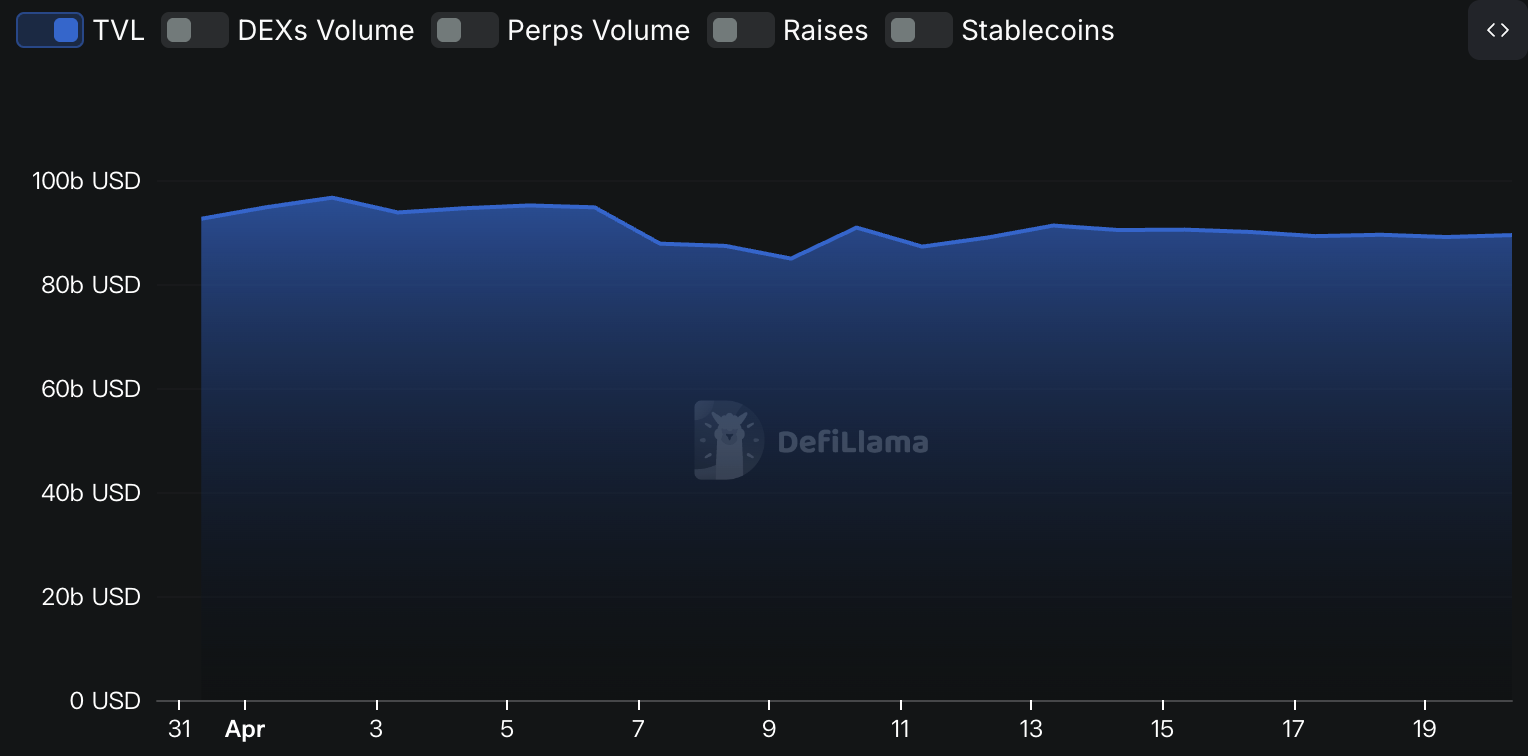

- Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $89.406 billion, nearly unchanged from last week ($89.4 billion).

Data Source: defillama

Data as of April 20, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 51.79%; Solana, accounting for 8.09%; and Binance Smart Chain, accounting for 6.17%.

Data Source: CoinW Research Institute, defillama

Data as of April 20, 2025

- On-Chain Data

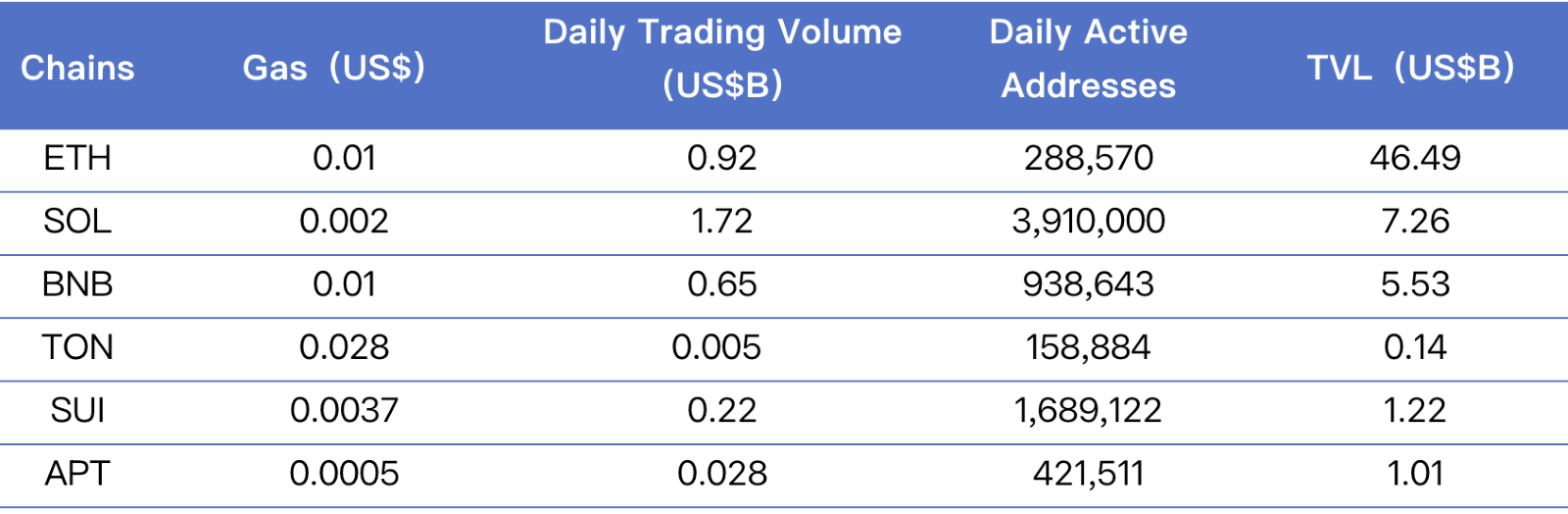

Layer 1 Related Data

Mainly analyzing daily trading volume, daily active addresses, and transaction fees for the current major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of April 20, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, daily trading volume increased by about 12% on Aptos, while other chains saw declines, with ETH down 38.67% and Solana down 21.2%. In terms of transaction fees, Solana saw a significant decrease of 56.57%, while other chains remained relatively stable.

Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. In terms of daily active addresses, Solana saw an increase of about 19.21% compared to last week, and SUI increased by 3%; other chains experienced varying degrees of decline, with Aptos seeing a significant drop of about 49.83%, followed by TON with a decline of 16.76%. In terms of TVL, this week, except for SUI which decreased by 2.64%, other chains saw varying degrees of increase, with Solana up about 6.3% and ETH up about 1.1%.

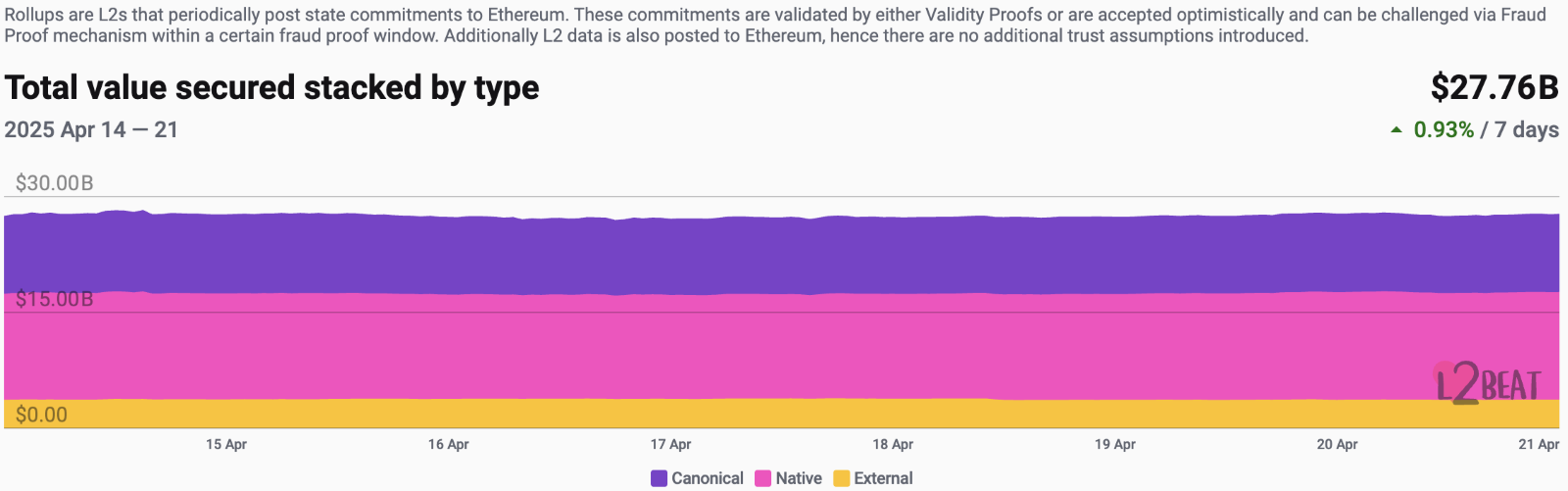

Layer 2 Related Data

According to L2Beat, the total TVL of Ethereum Layer 2 is $27.76 billion, with an overall increase of 0.95% compared to last week ($27.5 billion).

Data Source: L2Beat

Data as of April 20, 2025

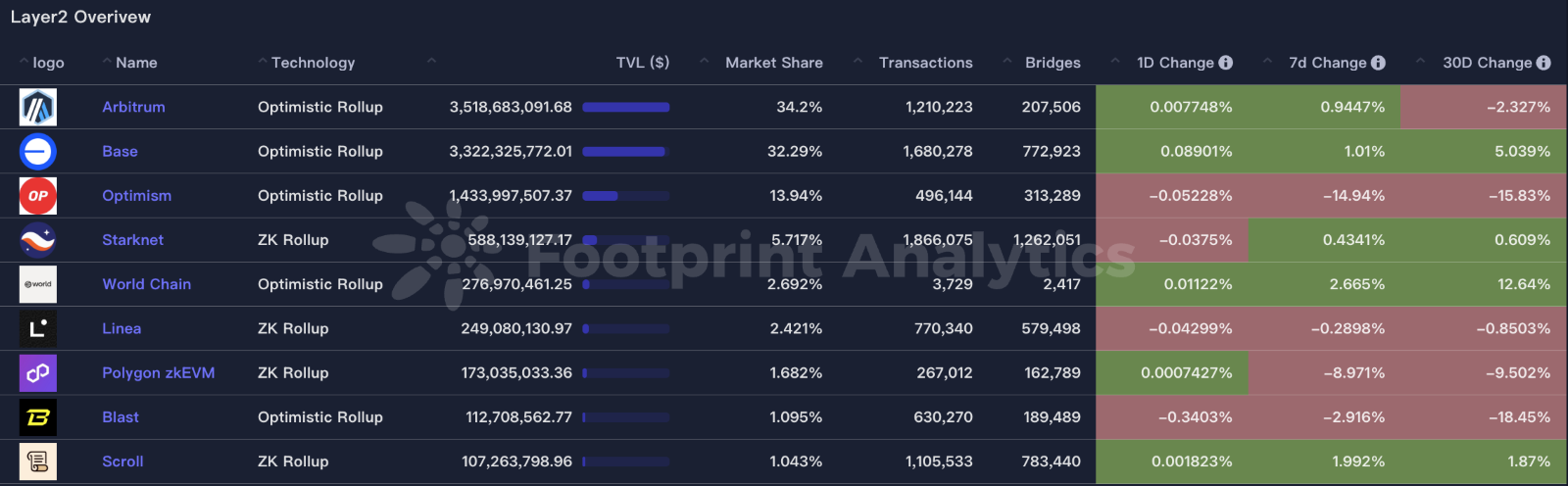

Arbitrum and Base occupy the top positions with market shares of 34.2% and 32.29%, respectively, but overall proportions have increased.

Data Source: footprint

Data as of April 20, 2025

- Stablecoin Market Cap and Issuance Situation

According to Coinglass, the total market capitalization of stablecoins is $212.5 billion, with USDT's market cap at $142.2 billion, accounting for 66.92% of the total stablecoin market cap; followed by USDC with a market cap of $56.2 billion, accounting for 26.4%; and DAI with a market cap of $5.36 billion, accounting for 2.52% of the total stablecoin market cap.

Data Source: CoinW Research Institute, Coinglass

Data as of April 20, 2025

According to Whale Alert, this week the USDC Treasury issued a total of 463 million USDC, while Tether Treasury had no USDT issuance this week. The total issuance of stablecoins this week was 463 million, a decrease of approximately 62.96% compared to last week's total issuance of stablecoins (1.25 billion).

Data Source: Whale Alert

Data as of April 20, 2025

II. This Week's Hot Money Trends

- Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of April 20, 2025

The top five Meme coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of April 20, 2025

- New Project Insights

ORO is a decentralized AI platform dedicated to securely sharing user data through cryptographic technologies (such as zkTLS) while protecting privacy, transforming this data into assets usable for AI training. The platform helps AI models acquire high-quality data while incentivizing users for their data contributions.

EdgeX is a decentralized edge computing network aimed at supporting AI projects and agents. By integrating globally distributed computing, storage, and bandwidth resources, it builds an efficient, secure, and transparent AI infrastructure. The platform supports various AI models to run seamlessly on edge devices, promoting the widespread implementation of AI technology in edge scenarios while significantly reducing computing costs.

Rekord is a blockchain data verification platform headquartered in Zug, focused on providing verifiable data standards for industries such as agriculture, logistics, manufacturing, and law. The platform allows any system, sensor, or software to put data on-chain for subsequent verification, ensuring a single trusted source of data. Currently, Rekord's multi-chain verification technology has been adopted by A.DNA and Pondus for managing critical enterprise data and ensuring traceability and trust in the poultry supply chain.

III. Industry News

- Major Industry Events This Week

On April 17, 2025, at 19:30 (UTC+8), the native token GM of Gomble Games was launched for trading on the Binance Alpha platform. To celebrate the launch, Binance airdropped 403 GM tokens to users who made purchases on the Alpha platform between March 27, 2025, 08:00 and April 16, 2025, 23:59 (UTC+8) through spot or funding accounts, directly credited to their Alpha accounts. Gomble Games is a blockchain casual gaming platform launched by the South Korean game studio 111Percent, focusing on creating entertainment-centric Web3 gaming experiences, with notable titles including "RumbyStars." The project has received investments from well-known institutions such as Binance Labs and Animoca Brands, aiming to drive community engagement and token distribution through gamified tasks and NFT incentive mechanisms.

On April 18, 2025, Lorenzo Protocol, in collaboration with Binance Web3 Wallet and PancakeSwap, held an exclusive TGE event for its governance token BANK, raising $200,000 (in BNB) based on the BNB Chain, issuing 42 million tokens, which is 2% of the total supply, at a unit price of $0.0048, with a maximum subscription of 3 BNB per user. Lorenzo Protocol is a decentralized protocol focused on liquid staking of Bitcoin, enhancing the liquidity and yield potential of BTC assets by splitting staked assets into stBTC (principal) and YAT (yield rights), and plans to provide a stBTC/BTCB liquidity pool on PancakeSwap to enhance usability.

On April 18, 2025, the decentralized data storage protocol Walrus announced an airdrop for holders of the SuiPlay0X1 gaming handheld. Eligible users will receive a soul-bound Walrus Airdrop NFT, which encapsulates WAL tokens that can be claimed upon the mainnet launch. This airdrop accounts for 4% of the total WAL supply (5 billion tokens) and aims to reward early participants in the Walrus and Sui ecosystems. Users can check their airdrop eligibility and claim details by updating their Sui Wallet or visiting the Suivision browser.

On April 18, 2025, the airdrop for deBridge's governance token DBR has been opened for collection, with eligible users able to claim it on the deBridge Foundation's official website. The airdrop collection deadline is May 17, 2025, at 16:00 (UTC+8). Participation conditions include users who completed interactions on the deBridge platform and accumulated points before July 23, 2024, at 21:00 (UTC).

WalletConnect officially launched its WCT token listing and airdrop plan on April 15, 2025, distributing a total of 800,000 WCT rewards to the community, covering two major activities: PoolX staking and CandyBomb. The PoolX staking activity is open from April 15, 19:00 to April 22, 19:00 (UTC+8), where users can lock WCT to share 150,000 WCT rewards, with a maximum lock-up limit of 2,500,000 WCT per user. The CandyBomb activity runs concurrently, allowing users to participate by depositing to share 650,000 WCT. As a core infrastructure of Web3, WalletConnect has been committed to building a decentralized connection network, currently supporting over 35 million user interactions on-chain. The launch of the WCT token and incentive plan marks a key step in its ecological development, aiming to further enhance user engagement and community vitality.

- Major Upcoming Events Next Week

Balance is an AI+Web3 protocol developed by Epal Labs, dedicated to combining intelligent AI agents with blockchain technology to create a decentralized ecosystem for social and gaming scenarios. To celebrate the launch of its token EPT, the project will airdrop 3,500 EPT to users who purchased EPT on the Binance Alpha platform between April 11 and April 17, 2025, at 12:10 (UTC). EPT will be listed for spot trading on Binance Alpha on April 21, 2025, at 12:00 (UTC), and the EPTUSDT perpetual contract will launch at 13:00 (UTC), supporting up to 20x leverage.

The lending protocol Dolomite announced that its native token DOLO will officially launch its token generation event (TGE) on April 24, 2025, with a total supply of 1 billion tokens, and an estimated circulating supply of about 361 million tokens (including locked veDOLO) at TGE. The airdrop snapshot was completed on January 6, 2025, and users can check their airdrop eligibility on the official website. DOLO will be listed for DEX trading on KodiakFi and will also be available on centralized exchanges like Kraken. Additionally, Boyco rewards will not be included in this round of airdrops; users participating in the Boyco liquidity market can unlock 90-day locked assets and receive veDOLO rewards starting May 6. Over the past two years, Dolomite has achieved over $920 million in trading volume and over $1 billion in TVL across chains like Arbitrum, Berachain, and Mantle.

To celebrate the official launch of the AB token, AB DAO will initiate a two-week dual airdrop incentive event from April 16 to April 30, 2025, distributing a total of 235 million AB tokens, covering PoolX staking and CandyBomb trading as participation methods. In the staking segment, users can lock AB or BGB to share 26,247,000 and 108,926,000 AB rewards, respectively; the CandyBomb trading activity encourages users to trade AB or BGB to participate in the distribution of 78,134,000 token rewards. This diversified incentive mechanism aims to further enhance the activity of the AB DAO community and accelerate the ecological launch process.

- Important Investments and Financing from Last Week

Optimum announced the completion of a $11 million seed round financing, led by 1kx, with participation from Robot Ventures, Spartan, Animoca, and others. The funds will be used for product development and ecosystem integration. Optimum is a decentralized high-performance memory infrastructure project based on RLNC technology, launching the node communication layer OptimumP2P and decentralized memory product DeRAM, aiming to provide efficient data transmission and storage solutions for any blockchain, with the testnet set to launch soon. (April 15, 2025)

The stablecoin protocol Resolv Labs announced the completion of a $10 million seed round financing, co-led by Cyber.Fund and Maven11, with participation from Coinbase Ventures, Arrington Capital, and others. Resolv aims to provide competitive returns for its stablecoin USR holders and liquidity providers by tokenizing market-neutral investment portfolios, launching a crypto-native, fiat-independent Delta neutral yield strategy. (April 16, 2025)

Bitcoin mining machine manufacturer Auradine announced the completion of a $153 million Series C financing, led by StepStone Group, with participation from Samsung Catalyst Fund, Qualcomm Ventures, and others. Auradine is developing scalable, sustainable, and secure infrastructure for the future internet based on blockchain, security, zero-knowledge, and AI technologies; this oversubscribed financing will help further expand into the AI infrastructure sector. (April 16, 2025)

a16z announced an additional investment of $55 million to purchase ZRO tokens from the cross-chain messaging protocol LayerZero, with a lock-up period of 3 years. LayerZero is an interoperability protocol supporting lightweight messaging between multiple chains, having previously received multiple investments from a16z. The valuation for this round was not disclosed. (April 17, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。