🧐 The ultimate moat of exchanges is not traffic, not the pace of listings, but security | Observations on the CEX trust system amid the major changes in the industry in Q1 —

📊 A report, seven perspectives, explaining the Matthew effect of exchanges and the underlying logic of security.

CoinGecko's latest release, the "2025 Q1 Crypto Industry Report," is recommended for everyone to read, reflecting many conditions in the market this quarter:

Clearly, this is not a calm quarter:

Liquidity contraction, increased regulation, fluctuating sentiment: unclear Federal Reserve policies, severe macro volatility, cooling Meme frenzy, frequent FUD;

What we see are all "noise," "declines," and "anxiety";

In addition to the main data reflecting the market's cooling conditions, such as total market cap decline, daily trading volume decrease, and Bitcoin's rising dominance;

The most interesting aspect is some data from CEX and the intriguing phenomenon of how people vote with their feet when choosing exchanges;

Data shows:

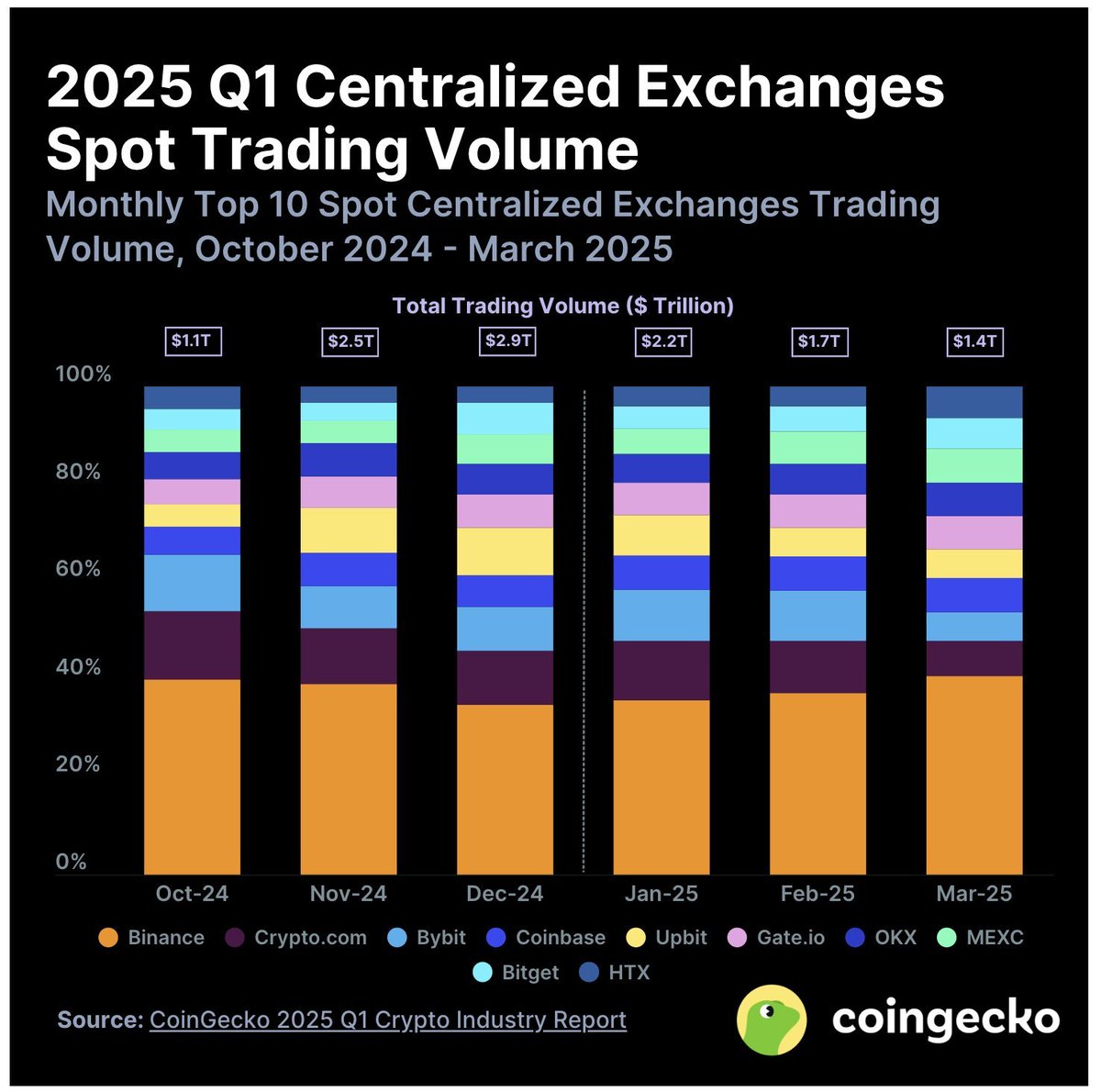

In Q1 2025, the total spot trading volume of the top ten centralized exchanges (CEX) worldwide reached $5.4 trillion, a quarter-on-quarter decrease of -16.3%;

Yet, it is precisely in this environment of severe market and emotional fluctuations that we see a new pattern in the CEX world:

This article primarily studies the choice logic and security logic behind CEX through this report —

1️⃣ Binance remains at the top, with a market share of 40.7% backed by security logic —

As of the end of March 2025, Binance continues to hold the leading position in CEX with a market share of 40.7%.

"The strong get stronger," but this strength is not solely based on traffic and hype; it is built on the most overlooked yet most critical first principle in the industry —

Security.

CoinGecko data shows that, in addition to leading traffic and user accumulation, Binance's standout points include:

1) System online rate under high concurrency (99.99%);

2) Stable custody of user assets and on-chain verifiability;

3) Smooth fund inflow and outflow, covering multiple fiat channels globally;

This industry is evolving rapidly, but one thing remains unchanged:

Safety and stability are the fundamental necessities in the Web3 black forest.

2️⃣ OKX platform: Rapid user growth and compliance challenges —

CoinGecko's latest data shows:

Although OKX's trading volume has slightly declined, it remains one of the strongest players in derivatives, contract trading, and hot asset liquidity;

📈 Source of popularity:

Strong contract depth: OKX has been deeply engaged in the derivatives market for years, attracting a large number of high-frequency traders and professional players;

Active Meme coins and on-chain ecosystems: As one of the few mainstream CEX and Wallets embracing new ecosystems (such as BRC20, ZK rollups, MeMe), OKX is quicker to adapt than anyone else;

APP experience & Web3 wallet layout are well-developed: The mobile + wallet interaction experience has been rated by many users as "surpassing Coinbase."

Challenges are also clear: user structure leans towards short-term hot money, insufficient "autonomy" in the ecosystem, and emerging compliance pressures;

In summary, the vibrant CEX holds promise for the future!

3️⃣ Other platforms: Clear differentiation trends | Who is crossing the cycle? Who is stuck halfway up the mountain?

The performance of other CEXs is also intriguing:

Upbit: As a local leader in South Korea, despite regional limitations, its market share continues to grow, indicating that localized deep cultivation strategies are effective;

Bybit: With "strong topics + aggressive promotion" and "optimized listing strategies," it maintains relatively impressive active data and high activity levels;

Coinbase: A stable representative, but also shows signs of "growth bottlenecks," relying more on brand credibility and compliance user accumulation, with limited new space.

KuCoin / HTX / Gate, etc.: Many have seen declines, with some platforms affected by regulatory pressures and declining brand trust, reflecting the vulnerabilities of the "FUD era."

4️⃣ The overall trading volume of CEX has declined, which actually reflects the differentiation trend of users "voting with their feet":

A core insight from CoinGecko's Q1 report:

In times of trading volume contraction and market downturn, the platforms chosen by users actually reflect a "trust ranking" — rather than a popularity ranking.

The barbaric era has passed; people are no longer paying for high APRs or high popularity but are judging the long-term value of platforms based on sustainability and fund security.

Security is becoming increasingly important in this part of CEX!

The strong get stronger, and the Matthew effect has already formed a pattern in CEX; security should be the first principle of exchanges, while other factors are secondary;

If there is sustained trust, highlighted compliance, and substantial backing, then people will trust you more; if not, it will lead to a vicious cycle;

CEX exchanges are no longer the best entrepreneurial opportunities in the crypto space; if you haven't secured your advantageous position now, the future will likely have nothing to do with you;

5️⃣ Discussion on the security of exchanges | Finding the least risky place between on-chain transparency and real-world complexity.

At this point, we can discuss what kind of CEX is the safest, or relatively the safest;

We can start from "first principles" to break down a core logic line:

1) Safety is not about avoiding incidents, but about "containing incidents when they occur" —

All systems face risks, but the core of a secure system is: when risks occur, can they be detected, isolated, and mitigated?

This includes: abnormal transaction identification at the system level, user asset custody and hot/cold wallet separation, employee permission control and internal control processes, on-chain transfer transparency;

A truly secure CEX is not one that is not attacked, but one that "does not lose user funds when attacked," so it must have sufficient asset reserves and 1:1 fund proof; misappropriating user assets is a bottom line that no exchange can touch;

2) Security is the "verifiability of the trust system" —

Where does the sense of security come from? From "I know where the money is."

A safer exchange must at least achieve: asset reserve proof mechanisms, allowing users to verify whether the exchange truly "coins in and out, accounts match"; on-chain audit trails, where every on-chain transfer can be publicly queried;

Liabilities and liquidity must be disclosed to avoid situations where "user assets are lent to others without anyone knowing";

Security is not a black box; it is "something you can see clearly at any time."

3) Security also includes compliance and resilience —

A truly secure platform cannot bypass compliance in this era; continuing stable operations amid regulatory shocks may be the most valuable CEX in the future, bar none.

Although this seems to contradict the decentralized concept of WEB3, which requires certification and compliance from centralized institutions;

But this is not just about having a license; it is about:

Is there a reliable deposit and withdrawal system;

In the face of sudden policies, is there an emergency switching capability;

Legally, can it connect users' legitimate claims and loss mitigation mechanisms;

Currently, regulation serves these functions;

Whether a platform can "restore services within 72 hours of a sudden event" is a real test of its security.

4) Security must be built at the system and process levels, not just "shouted trust" —

Is there a comprehensive disaster recovery system (disaster recovery plans, cold backups, distributed databases), is there a multi-signature wallet + permission isolation mechanism to prevent "one person's wrongdoing from dragging down the entire platform," and has an internal audit + third-party audit mechanism been established to reduce systemic loss of control;

These are very boring and technical, but they are the foundation of "whether you dare to go all in."

Finally, a judgment standard:

A truly secure CEX is the kind of platform where "you are willing to put your assets in, even if you don't check for a month, and can sleep soundly."

It will not be chaotic due to airdrop trends, Meme hotspots, nor will it go into "emergency maintenance" due to hacker attacks, and it will not collapse due to the departure of a certain executive; most importantly, it has been tested by time and practice, and has the regulatory advantages of CEX.

6️⃣ So back to your question: Who is the safest CEX?

This answer may differ for everyone, but in terms of data and facts, only a few can stand out:

Binance: The strongest resilience globally, highest system stability, best asset liquidity, with increasing transparency year by year;

OKX: Rapid user growth, high popularity, and stable system;

Coinbase: The strongest compliance credibility in the U.S. market + checks and balances from being a publicly listed company;

Upbit: Deeply rooted locally, with very strict risk control, suitable for high-net-worth individuals in the South Korean market;

Kraken: Niche but stable, suitable for long-term users.

7️⃣ Conclusion —

Markets will cycle, projects will explode, narratives will be rewritten, and traffic will migrate,

But among the CEXs that can survive through multiple liquidity winters, there is a common point:

Who can maintain the lowest level of "trust firewall," we will choose;

In every cycle, many exchanges rise based on hype; some rely on new listing rhythms, some on explosive topics, and some on extreme operations to capture the market in a short time.

But now, the entire industry is increasingly approaching a realistic and harsh consensus:

Those who truly cross the cycle are not those who rise quickly or roll fiercely, but those who can maintain their systems, assets, and users when sentiment is at its worst and trust is at its lowest.

Therefore, the real value of this report is not to tell us how much trading volume has declined, but to help us see: under the multiple pressures of black swans, declining liquidity, and regulatory crackdowns, which platforms still stand firm, hold their ground, and win users' "votes with their feet."

Finally, a shout-out to Binance:

After experiencing multiple bull and bear markets, it has been found that whenever the market is bad, it starts to favor FUD and conspiracy theories; for instance, Binance is often heavily FUDed, and many times, "criticizing Binance" has become akin to crypto's version of "political correctness," even turning into an eye-catching SEO tactic.

In times of poor sentiment, some people always need to find an outlet, but is this really right?

We all know that the survival rules of this industry are brutal: when prices rise, no one questions it; when they fall, all problems are magnified.

But countless practices have already proven —

Users ultimately vote with their feet.

You can question its expansion, question its products, question its strategies,

But you cannot deny: at countless points of "on-chain congestion, market crashes, regulatory onslaughts," more people still put their money into Binance;

This world is too good at using emotions to obscure facts and using ridicule to mask fear.

But in the high-risk, high-volatility black forest of crypto, we should not pay attention to what others are saying, but rather to what they are doing!

This is not a stance; it is a fact. 📉📈

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。