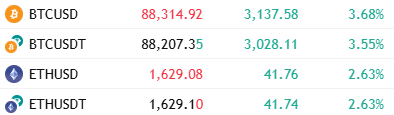

Another thing I care about is that the price difference of $BTC between Coinbase and Binance can reach over $100, while the exchange rate difference between USDC and USDT is only 0.02. This intuitively shows that the difference in $ETH is almost negligible, but the price difference in BTC is significant.

Generally, when BTCUSD is considered higher than BTCUSDT, it indicates a trend of fiat currency arbitrage, ETF buying, or the inflow of US funds, which means that American investors are investing more in BTC, and the same logic applies to CME.

This is often a trend indicating that American investors are bullish on BTC, but as mentioned earlier, the logic for BTC's independent rise is currently not visible, and it's unclear if there are any positive developments that we are unaware of about to happen.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。