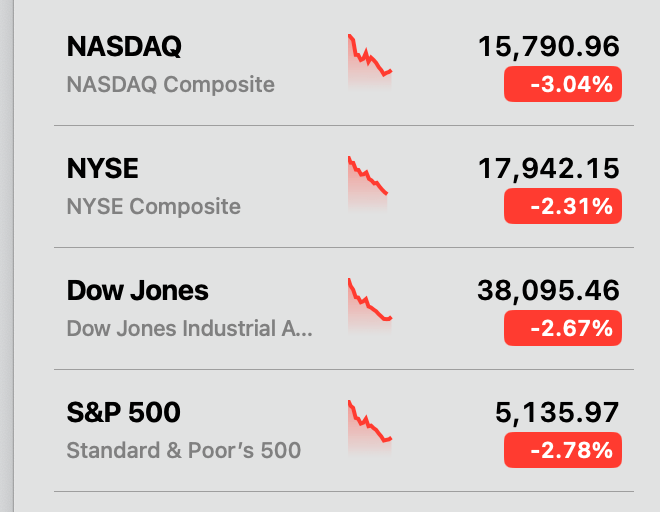

The exodus from U.S. assets intensified, with the Nasdaq Composite off 3%, the NYSE slipping 2.31%, the Dow Jones falling 2.67% and the S&P 500 down 2.78% as of 1 p.m. Eastern. This slump coincides with the ICE U.S. Dollar Index dropping Monday to a three‑year trough of 97.92. By 1 p.m., the gauge had edged back to 98.34. The rare pairing of rising long‑term yields and a softer dollar suggests global capital is questioning the steadiness and credibility of U.S. policy.

The four major U.S. equity indexes on Monday, April 21, 2025, at 1 p.m. Eastern time.

The 10‑year Treasury yield has climbed to 4.40%, up from 4.34% only days ago and comfortably above its long‑run norm of 4.25%. Longer bonds followed suit, with the 20‑year note at 4.82% and the 30‑year benchmark touching 4.88%. Investors are demanding richer coupons to offset perceived threats—ranging from inflation and fiscal stress to political volatility—especially with the greenback lingering near the three‑year low.

Digital‑asset capitalization expanded more than 3% Monday to $2.75 trillion. Bitcoin tapped $88,527 on Bitstamp roughly an hour ago. Ether advanced 2.4%, BNB gained 2.2% and dogecoin appreciated 4% over the same span. Market analysts argue the move may pave the way for a run at $90,000 and higher if demand persists. A subset of traders say BTC is sidestepping the trade‑war turbulence and behaving more like gold’s digital cousin or a barometer of macro risk. BTC has since seen a slight pullback, sliding to $87,200 by 1 p.m. ET.

Gold continued its climb Monday, holding comfortably above $3,400 per ounce. The metal’s swift advance reflects intensifying global uncertainty—prompted by the U.S.-China trade confrontation—and a noticeably weaker dollar. Investors are gravitating toward bullion as a refuge amid cooling worldwide growth, stubborn stagflation fears and escalating geopolitical flashpoints from Eastern Europe to the Middle East.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。