Original Title: How Trump's Bitcoin Policies Are Making The U.S. A Crypto Superpower

Original Author: Leigh Cuen, Forbes

Original Translation: Luffy, Foresight News

U.S. President Donald Trump (right) and Salvadoran President Nayib Bukele are both implementing economic strategies that support Bitcoin, making them stand out in the global crypto market. Image source: Bloomberg

Trump is overhauling cryptocurrency regulation, updating tax policies, and working on establishing a national Bitcoin reserve strategy, putting the U.S. on the path to becoming the first G7 economy to fully embrace cryptocurrency.

Forbes author Sandy Carter wrote, "Trump's second term is reshaping the U.S. cryptocurrency landscape."

Small countries like El Salvador have attracted Bitcoin businesses by establishing strategic Bitcoin reserves and crypto-friendly policies. The International Monetary Fund (IMF) recently restricted El Salvador's future Bitcoin purchases, but it has accumulated about 6,101 Bitcoins as a strategic reserve. Reportedly, one of the world's most profitable crypto companies, Tether, has also moved its headquarters to El Salvador.

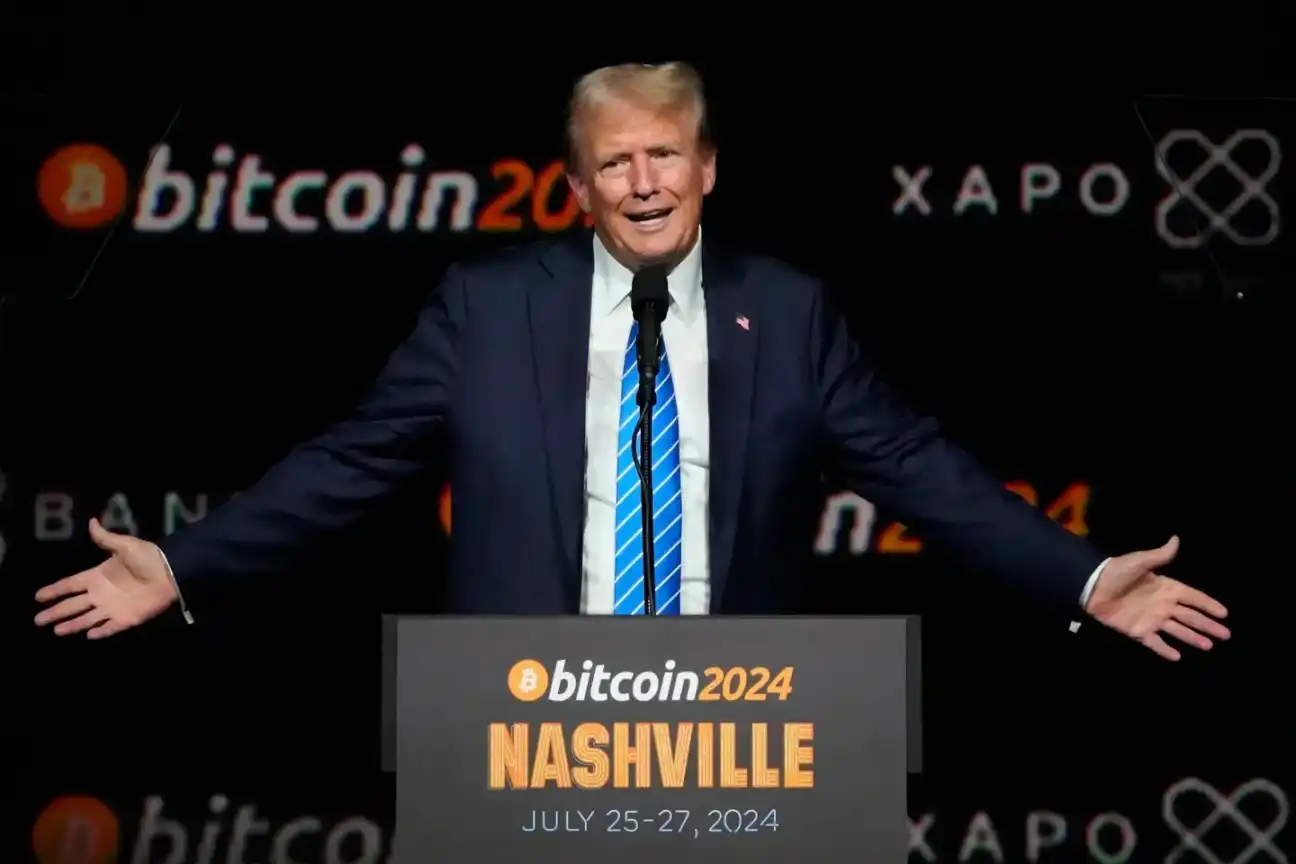

Similar to President Bukele of El Salvador, Trump has attracted crypto voters during his 2024 campaign. Last July, he made a striking promise to an enthusiastic crypto crowd at the Bitcoin conference in Nashville.

Forbes author Susie Violet Ward wrote that Trump stated, "America will become a 'Bitcoin mining powerhouse' and urged supporters to never sell their Bitcoin."

Susie Violet Ward wrote, "The combination of political will and financial innovation marks a decisive moment in the Trump era and signifies broader recognition of Bitcoin in mainstream politics."

Despite Trump's erratic tariff policies causing market turmoil, his crypto-friendly policies have helped Bitcoin prices avoid falling below the previous cycle's high of about $73,000. The relative stability of cryptocurrency prices may partly be attributed to the U.S. government's newly adopted more lenient regulatory stance.

The Republican Party has observed Singapore's success through minimal regulation and is adjusting this crypto strategy to fit the U.S. context.

Trump's Crypto Policies Imitate Singapore and Dubai's Light Regulatory Models

Zennon Kapron, a fintech writer from Singapore and director of the Asia Securities Industry and Financial Markets Association, wrote that Singapore has established a reputation as a crypto hub by avoiding complex regulations, even without establishing a Bitcoin strategic reserve.

Kapron stated, "Crypto companies flock to Singapore not so much because of what the country has done, but because of what it hasn't prohibited."

He added that through minimalist regulation, Singapore became the world's third-largest blockchain investment center in 2023, following the U.S. and the U.K.

Trump has seen the rapid rise of Singapore due to its light regulatory model and has established a similar regulatory framework in his administration. This relatively laissez-faire strategy is closer to the non-intervention policies enjoyed by crypto investors in regions like the Cayman Islands and Hong Kong. Along this line, Trump signed H.J. Res. 25 on April 10, simplifying the previously complex (and sometimes nearly impossible) tax paperwork for decentralized finance (DeFi) brokers.

Forbes tax writer Robert Woods explained, "Taxpayers need to know when they purchased cryptocurrency, how much they paid, and what they received. This may be simple for stocks and real estate, but it can be much more complicated for cryptocurrency. Many crypto investors make multiple purchases over different times and years."

Although crypto users and companies still need to report taxable events, the simplified paperwork makes it easier for Americans to comply with the law. Before this new tax guideline was issued, the Office of the Comptroller of the Currency had sent a letter in March to rescind a guideline that made it difficult for banks and savings institutions to provide crypto services.

Earlier this month, a memo from the U.S. Department of Justice indicated that the government had disbanded a team of prosecutors focused on crypto companies. Forbes writer Andrea Tinianow noted that this shift in the Justice Department could positively impact pending court cases related to crypto privacy tools like Tornado Cash, which will determine "whether developers should be held criminally liable for open-source code used by others to commit financial crimes." According to a memo issued by U.S. Deputy Attorney General Todd Blanche, law enforcement will no longer act as "digital asset regulators" through prosecution but will focus on combating "bad actors."

The memo stated, "The Justice Department will no longer target virtual currency exchanges, mixing services, and offline wallets for the actions or unintentional violations of their end users." In short, the Justice Department will not hold developers of crypto tools or taxpaying businesses providing legitimate crypto services accountable. The Trump administration hopes for less government intervention in the crypto industry.

Forbes tax writer Joshua Smeltzer wrote, "This move aims to reduce regulatory burdens, encourage responsible innovation, and ensure that banking activities are treated consistently, regardless of whether the underlying technology involves blockchain."

This may have been inspired by small countries taking a more lenient approach to crypto regulation. Dubai lawyer and Forbes writer Irina Heaver noted that hundreds of crypto companies have flocked to the UAE, regulated by Dubai DMCC. They now contribute 7% of the UAE's GDP.

Heaver wrote, "Regulatory clarity is the cornerstone of Dubai's success as a crypto hub."

Recently, President Trump's son Eric Trump announced the establishment of a new Bitcoin mining company, American Bitcoin, alongside his brother Donald Trump Jr.

Dominance in Bitcoin Mining

Trump is unabashed about his reasons for clearing obstacles for the crypto industry: to bring high-paying jobs and dominance in crypto mining to the U.S.

According to the Cambridge Bitcoin Electricity Consumption Index, the most powerful crypto mining companies in 2022 were from China or Russia. Since then, dozens of companies have migrated to Texas, but this shift has stalled during the Biden administration.

Now, Trump's second term coincides with the four-year bull market cycle in the crypto market; Bitcoin prices have risen nearly 30% since Trump's election six months ago.

Forbes writer, Bitcoin core developer, and venture capitalist Abubakar Nur Khalil wrote, "Bitcoin prices tend to rise significantly during each halving cycle, whether in the year of the halving or two years later. Unlike previous halvings, investors can now leverage an increasing number of financial tools and methods to capture Bitcoin price movements, from directly purchasing Bitcoin, stocks of Bitcoin mining companies, or shares of publicly traded companies holding Bitcoin on their balance sheets, to Bitcoin ETFs."

Legal experts, including former Penn State Dickinson Law professor and Forbes writer Tonya Evans, also pointed out how the Trump family is profiting personally from crypto projects, an unprecedented move for a sitting president. In addition to various altcoin companies, Eric Trump and Donald Trump Jr. announced their new Bitcoin mining venture, American Bitcoin, earlier this month.

Trump hopes to include assets like BTC, ETH, ADA, and XRP in the strategic cryptocurrency reserve.

Bipartisan Support for Strategic Crypto Reserves

So far, Trump's Bitcoin reserve strategy seems to have bipartisan support. Forbes writer Sam Lyman described California Congressman Ro Khanna as "an important voice on crypto issues within the Democratic core group," while Alabama Democratic Congressman Shomari Figures and Arizona Democratic Congresswoman Yassamin Ansari have also made public statements indicating potential support for the strategy. Ansari pledged to "lead the way in blockchain and crypto innovation."

Additionally, 14 Democrats, including New York Congressman Ritchie Torres, wrote to the chair of the Democratic National Committee last year, urging the party to "take a forward-looking approach to digital assets and blockchain technology." Even Trump expressed in March a desire to include higher-risk assets like ETH, ADA, and XRP in the strategic crypto reserve.

In addition to welcoming Bitcoin mining companies, holding various cryptocurrencies in strategic reserves, and pausing enforcement actions against small industry participants, the Trump administration is also leveraging bipartisan interest in protecting dollar-pegged stablecoins. If globally popular crypto assets continue to be pegged to the dollar, this could indirectly benefit the U.S. economy.

Cleve Mesidor, executive director of the Blockchain Foundation and Forbes writer, stated, "The recent 13-hour marathon revision of the 'Stablecoin Transparency and Accountability to Promote Better Ledger Economy Act' may indicate a need for longer bipartisan cooperation."

It is still too early to assert whether these policies will attract new companies to the U.S., but industry giants like Coinbase CEO Brian Armstrong are now criticizing the previous administration, expressing a preference for Trump’s policies. Many crypto companies, including Coinbase, Kraken, Ripple, Robinhood, and Circle, have also donated to Trump's inauguration committee. Shortly after Ripple's donation, U.S. regulators dropped legal charges against the company related to XRP, and the Trump administration included XRP in the strategic reserve plan.

Trump attended the Bitcoin 2024 conference held in Nashville, Tennessee last year.

The Future of U.S. Crypto Enterprises and Bitcoin Price Trends

The bipartisan efforts to relax regulations and establish strategic reserves for crypto assets seem to be shielding the cryptocurrency market from the turmoil on Wall Street. Bitcoin's current price trend is more stable than that of the U.S. stock market.

The current halving cycle may end in early 2026, and the Trump administration's policies could further impact the Bitcoin market. This includes the normalization of conflicts of interest. The Trump family is now actively involved in the crypto business, as well as reallocating enforcement resources and pardoning Bitcoin "pioneers" like Silk Road founder Ross Ulbricht and BitMEX founders Arthur Hayes, Benjamin Delo, Samuel Reed, and Gregory Dwyer.

Looking ahead, conducting crypto business in the U.S. may face fewer legal risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。