"Everyone" includes retail traders who do not understand the difference between meme coins and content coins; they should not become collateral damage in the "on-chain culture" experiment.

Written by: Token Dispatch, Thejaswini M A

Translated by: Block unicorn

Introduction

A tweet. 69 minutes. $17 million. Then chaos ensued. What happened next on the official Base account left the entire crypto community questioning "content coins," insider trading, and the responsibilities of major platforms.

Three mysterious wallets somehow knew exactly when to buy in, making a profit of $666,000, while thousands of retail traders suffered heavy losses.

Base claims this was just a harmless experiment in "on-chain culture"—but on-chain evidence reveals a more complex truth. Is this a new frontier for creators to monetize, or a pump-and-dump scheme with a new name?

In today's in-depth analysis, we will dissect the most controversial "non-token token" launch event in the crypto space from various angles.

Event Overview

On a very ordinary Wednesday afternoon, Base—Coinbase's Ethereum Layer 2 network—posted a seemingly harmless tweet: "Base is open to everyone."

What happened next is a perfect case study of the evolving etiquette in the cryptocurrency space, where the line between experimentation and irresponsibility remains frustratingly blurred.

Just 60 seconds after the initial tweet, Base added a link in the comments to a Zora post that was identical to the tweet. For those unfamiliar, Zora is an "on-chain social protocol" that automatically turns any content published on its network into tradable tokens. Publish some clever content, and people can buy and sell tokens of your wisdom.

Base's leadership may have thought this was a harmless "on-chain culture" experiment. However, what the crypto community saw was something entirely different: a meme coin worth $17 million appearing out of thin air, bearing the name of one of the most recognized brands in the crypto space.

The story gets interesting—and complicated—here.

As you might expect, the market's reaction when a major Layer 2 network "launches" a token was as follows:

Market cap skyrocketed from $0 to $17 million in just 69 minutes

Then plummeted nearly 90% (falling below $2 million)

Recovered somewhat in the following hours, peaking at $20 million

As of this writing, stabilized around $8 million to $10 million

To onlookers, this looked very much like a classic pump-and-dump. For Base, it was a real-life lesson about the law of "unintended consequences."

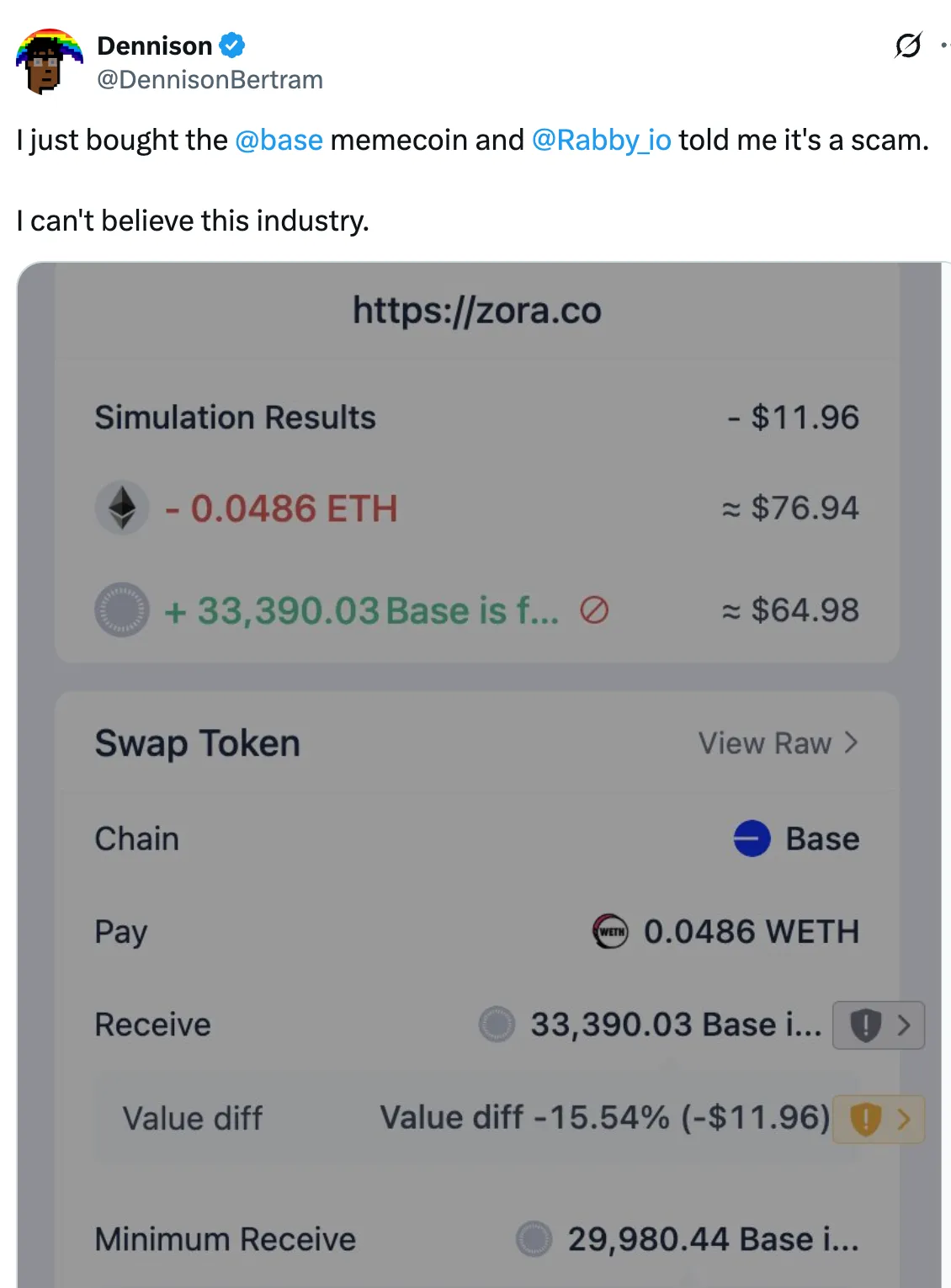

For the thousands of retail traders who bought at the peak, it was an expensive education on the difference between "content coins" and "meme coins"—a distinction that means little to those who just lost money.

Base's founder Jesse Pollack tweeted.

Analysis of the Controversy

What makes this event particularly noteworthy is not just the price volatility, but the subsequent findings of on-chain detectives.

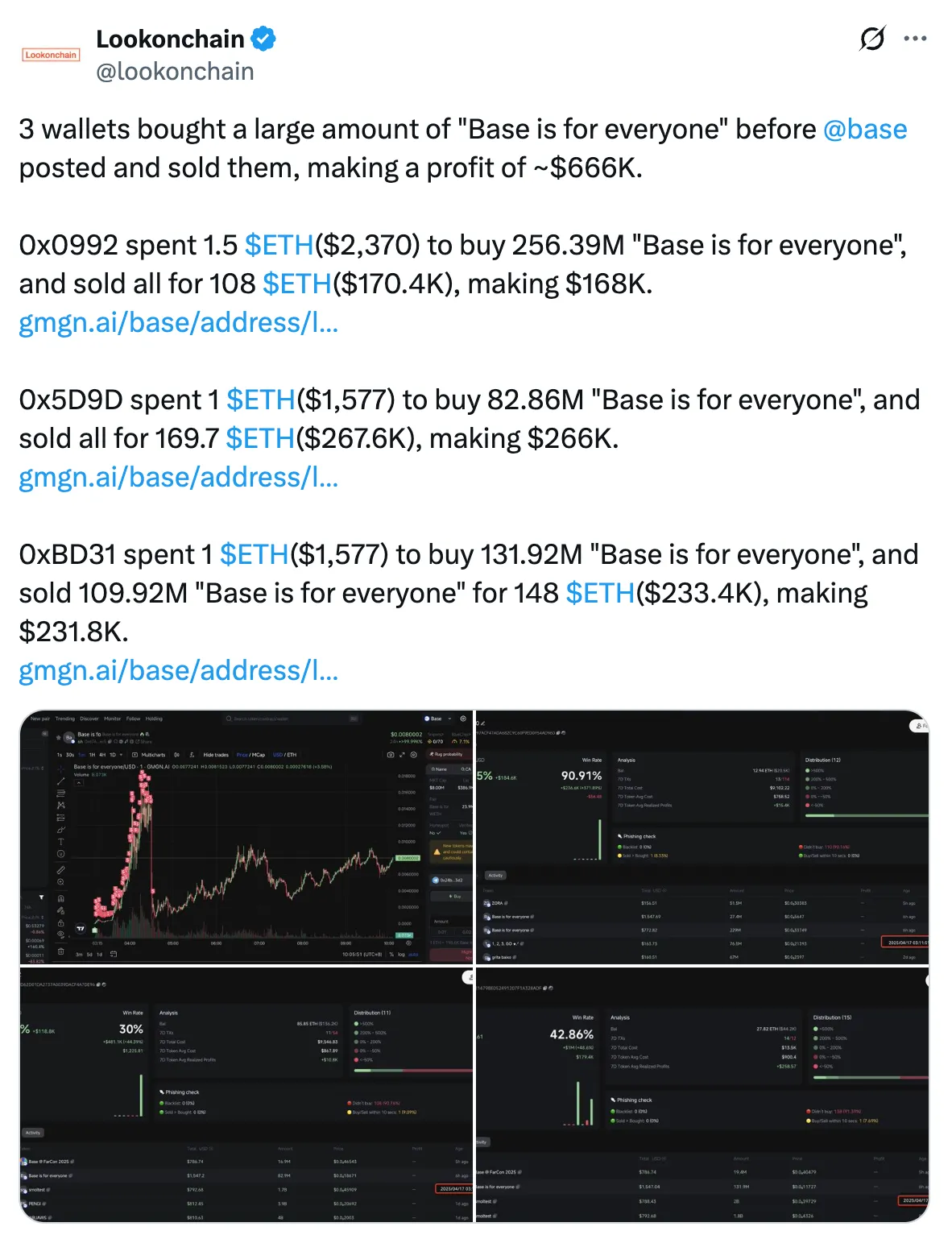

Blockchain analysis platform Lookonchain revealed that three wallets bought large amounts of the token before Base's official announcement and then sold at the peak, netting a total profit of about $666,000. These wallets collectively held 47% of the token's supply.

Meanwhile, as a content creator, Base received 10 million tokens (1% of the total supply) and earned about $81,000 from transaction fees. Although Base promised never to sell these tokens, the optics are not good.

So we see three wallets:

Somehow knew to buy in before the public announcement

Held nearly half of the supply

Sold at the peak, profiting over $666,000

The community is very unhappy with this chaos.

Thus, despite Base claiming they never sold their 1% allocation, they still profited from the trading fees generated by the frenzy they sparked.

The timing of the pre-purchases raises serious questions about whether anyone had prior knowledge of Base's post.

Of course, perhaps the three random wallets just happened to buy large amounts before one of the biggest brands in the crypto space promoted this specific token. Maybe I’ll win the lottery tomorrow too.

If the "Base is open to everyone" event wasn't chaotic enough, Base launched a second token on the same day: "Base @ FarCon 2025."

This token was also created on Zora, aimed at promoting Base's appearance at FarCon (the annual conference for the decentralized social media platform Farcaster).

FarCon also experienced a decline like its "brother."

Playing with Words

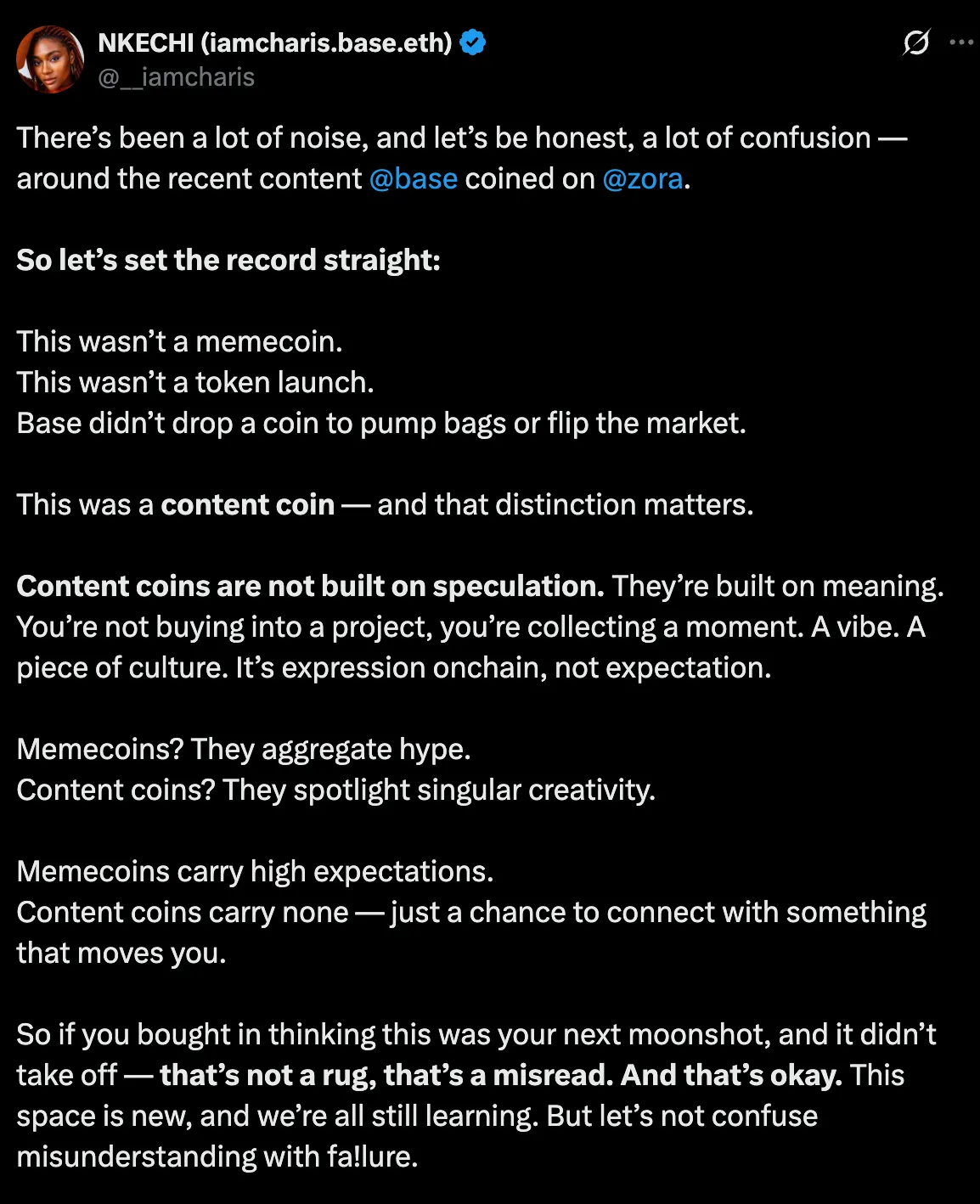

In the face of criticism, Base and its supporters adopted a defense reminiscent of Mark Zuckerberg's insistence that Facebook is not a media company: "This is not a meme coin; this is a content coin."

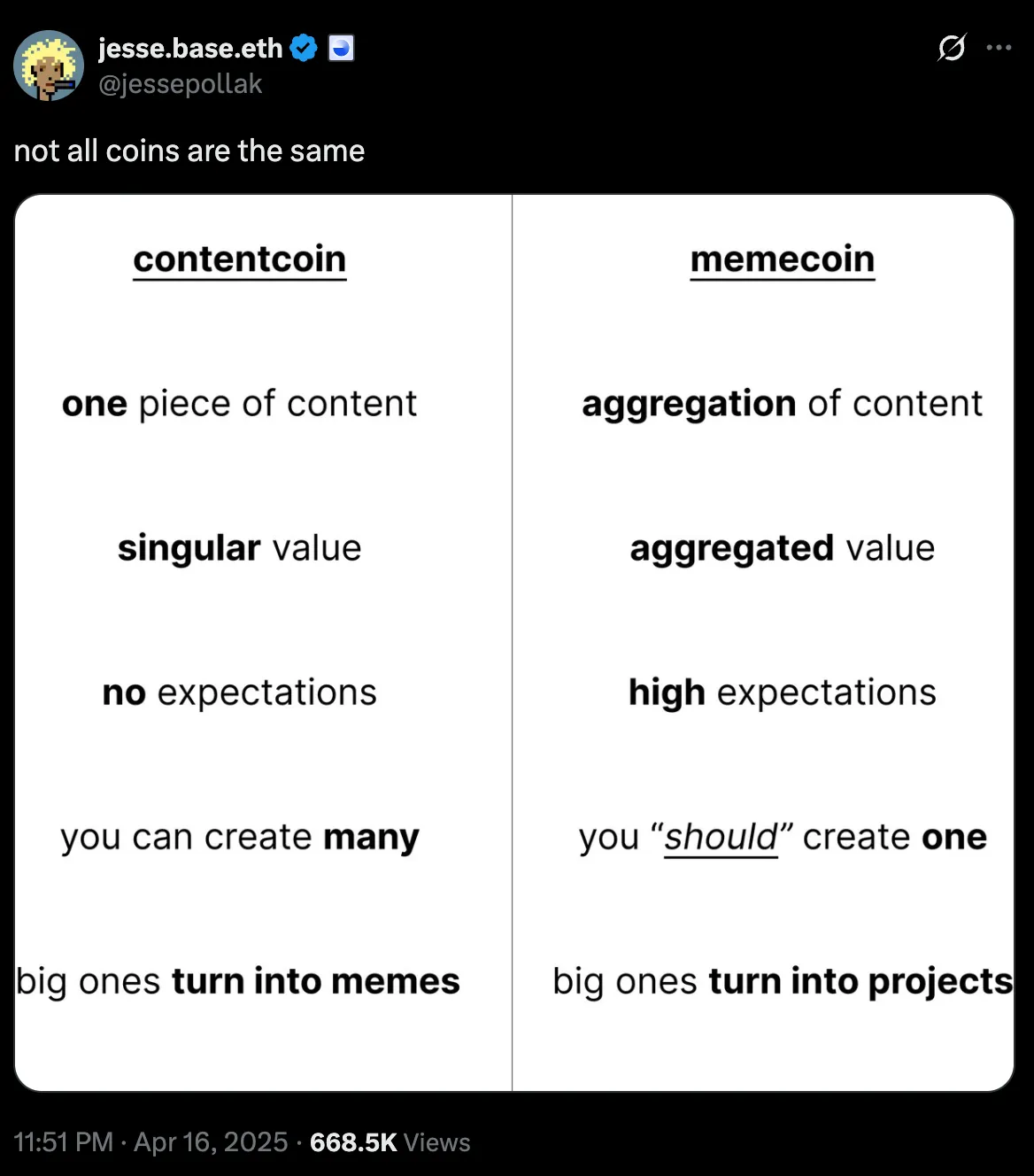

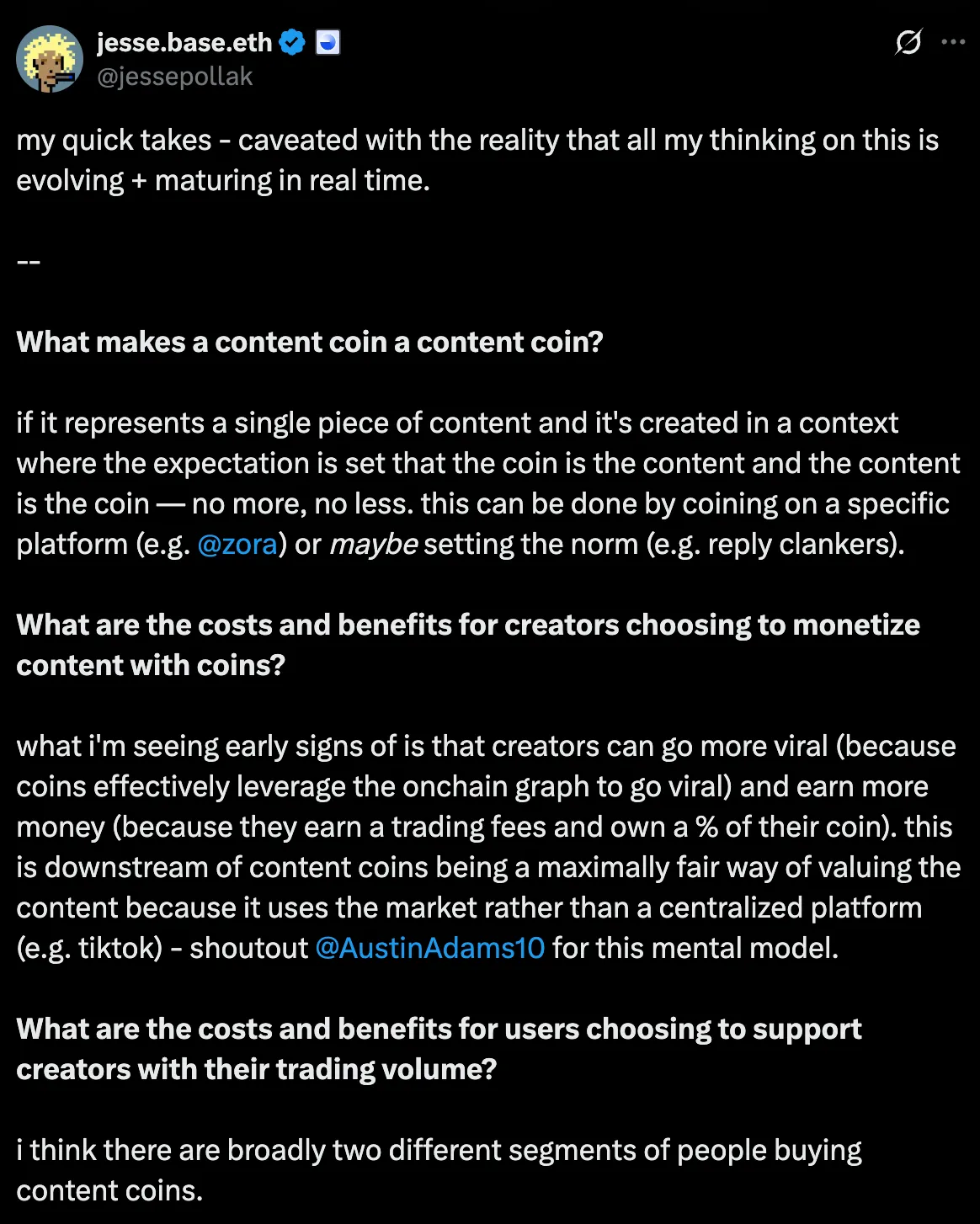

Base's founder Jesse Pollack provided this distinction: content coins represent "single content," with "single value" and "no expectations set," contrasting sharply with meme coins that aggregate content and carry high expectations.

Another Base developer, Charis, was more direct: "This is not a meme coin. This isn't even a token launch. Base did not launch a token to pump and dump or hype the market. This is a content coin—this distinction is important."

In response, most cryptocurrency traders rolled their eyes.

What’s the Difference Between Content Coins and Meme Coins?

Let’s dissect the debate over "content coins" versus "meme coins," as this is the crux of Base's defense.

Jesse Pollack stated that the definition of a content coin is "if it represents single content and is created in the context where the expectation is set as coin equals content, content equals coin—no more, no less."

He believes that content coins can help creators go viral, and that clear monetization is not necessarily a bad thing.

Zora co-founder Jacob Horne pointed out in a February article that content coins can resolve the contradiction between free information and high production costs. In his vision, content coins create an open market that rewards creators, distributors, and consumers while keeping information freely accessible.

In theory, this sounds good. But in practice, the "Base is open to everyone" token event looks very much like a pump-and-dump:

The token launched under the implicit endorsement of a big brand

Prices skyrocketed

Early buyers (mysteriously aware in advance) sold out

Late buyers suffered heavy losses

Afterward, everyone argued over the semantics

A post on Zora retweeted a succinct summary from an anonymous user, Larp von Trier: "Solana newbies completely misunderstood how Zora works, so they got wrecked."

Our Perspective

The "Base is open to everyone" event reveals a critical gap in our thinking about responsibility in the crypto space. Traditional finance has clear lines of accountability—if an investment promoted by a bank fails, there are consequences. In the crypto space, these boundaries are at best blurry.

When Base tweets a link to create a token, and its market cap skyrockets to $17 million only to plummet 90%, who is responsible? Is it Base for posting the link? Is it Zora for automatically tokenizing the post? Is it the traders who didn’t understand what they were buying? Or is it the wallets that front-ran the announcement?

Frustratingly, the answer seems to be "it's complicated."

This ambiguity is both the greatest strength and the most enduring weakness of the crypto space. The field develops rapidly because the barriers to experimentation are extremely low. But the same freedom also creates an environment where chaotic events like "content coins" happen frequently.

Just being associated with Base/Coinbase is enough to draw millions of dollars into a token that has no utility, no roadmap, and no future.

This is not unique to Base—we have seen similar phenomena involving tokens allegedly related to Solana, Bitcoin, and almost every other mainstream crypto project.

This influence comes with responsibility. Base's core mission—to "build a global on-chain economy that fosters innovation, creativity, and freedom"—is commendable. Their technological innovations are impressive. Their growth data (900,000 daily active addresses, $2.4 billion total locked value) demonstrates reasonable development potential.

This makes the recent meme coin misstep particularly perplexing. Base does not need to chase short-term victories or social media hype. They are building something truly meaningful for the long term.

Given that Base has just released an ambitious Q2 roadmap, the defense of "content coins" seems particularly hollow. The plan outlines impressive technological innovations such as Flashblocks (reducing block time to 200 milliseconds), Base Appchains (third-layer chains for specific applications), and enhanced privacy features.

Base's serious technological ambitions stand in stark contrast to this seemingly reckless attempt to tokenize a social post, which is hard to ignore.

The line between innovation and irresponsibility may be blurry, but the ability to successfully navigate this line is what distinguishes truly transformative projects from interesting but ultimately failed experiments.

In the crypto space, as in life, good intentions are not enough to solve problems. "Base is open to everyone" is a nice slogan—but it presupposes that "everyone" includes those retail traders who do not understand the difference between meme coins and content coins; they should not become collateral damage in the "on-chain culture" experiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。