Using compliance as a lever to guide the deep integration of traditional finance and crypto finance will not only be an exponential growth opportunity for Backpack but also an essential path for crypto finance to achieve large-scale explosion.

Written by: Deep Tide TechFlow

Trading is the main theme of crypto, and thus exchanges are the core infrastructure of crypto.

We can see that every cycle produces representative exchanges that lead innovations in capital efficiency:

In 2016, BitMEX introduced perpetual contracts to the crypto market;

In 2020, FTX gained fame with its stablecoin settlement, cross-margining, and tiered liquidation mechanisms.

However, in this cycle, there has yet to be a phenomenon-level exchange product like FTX that has broken out. In the current competition, who will stand out?

Hyperliquid may have a chance; after its airdrop in 2024 ignited the market, Hyperliquid's contract trading volume quickly surpassed one trillion dollars. However, consecutive incidents of price manipulation and community doubts about its liquidation mechanism and decision-making transparency have plunged it into a whirlpool of public opinion.

Another frequently nominated seed player by the community is Backpack: On one hand, due to the connection between Backpack and FTX, the community finds it hard not to compare the two; on the other hand, since its inception, Backpack has been advocating for "compliance." Recently, it officially completed the acquisition of FTX EU and has captured a large number of users with innovative mechanisms such as "automatic lending" and "interest-bearing perpetual contracts."

If we reflect on the development of exchanges from the perspective of FTX's explosive rise and fall, can we more clearly predict the competitive landscape of exchanges in this cycle?

Based on the principle of "taking the essence and discarding the dross" from FTX, will Backpack replicate or even surpass FTX's former glory?

This article aims to penetrate Backpack's product logic, compliance layout, and future plans, seeking more precise answers within.

Made in America: FTX's Capital Efficiency Elevated by Backpack

"Made in America" has always been a prominent label in the crypto industry: it signifies more complete financial infrastructure, higher quality talent, a more open policy environment, and more active capital, nurturing well-known crypto companies such as Coinbase, ConsenSys, and a16z Crypto over the past decade.

The influence of the U.S. in this cycle cannot be underestimated: on one hand, under the new president Trump's crypto-friendly attitude, the U.S. is leading the global crypto market towards a more open, inclusive, and clear regulatory framework, with compliance becoming a key factor in attracting institutional participation; on the other hand, as geopolitical conflicts and trade frictions escalate due to tariffs, on-chain finance, which boasts advantages of being permissionless and reducing friction, will rise rapidly, undoubtedly bringing more incremental funds and users to U.S.-based crypto companies.

From FTX to Backpack: "Made in America" Twins

Whether FTX or Backpack, both bear the indelible mark of "Made in America":

FTX was born in the U.S., and Backpack was also founded in the U.S.;

FTX founder Sam Bankman-Fried graduated from the world-renowned Massachusetts Institute of Technology; Backpack founder Armani Ferrante also has an elite educational background, graduating from the University of California, Berkeley, known as the top public university in the U.S.

With a Western base looking towards the East, both founders share a passion for the Asian market: FTX established its headquarters in Hong Kong, the Pearl of the East; while Backpack set its headquarters in Tokyo, Japan, which is also a vital economic hub in Asia.

Of course, the connection between Backpack and FTX goes far beyond this: several core members of Backpack, including founder Armani Ferrante, were former employees of FTX:

According to Armani's introduction in an interview, he briefly worked at Alameda Research (the cryptocurrency quantitative trading firm founded by SBF) and joined FTX in September 2020, focusing on Solana-related business.

Additionally, Backpack has recruited many employees responsible for legal compliance at FTX, including former FTX General Counsel Can Sun, who currently holds an important legal position at Backpack.

In terms of financing background, Backpack also intersects with FTX:

On one hand, both have received investments from top crypto VC Jump Crypto; on the other hand, in September 2022, Coral, the development company behind Backpack, announced the completion of a $20 million financing round led by FTX Ventures.

Born for Traders: New Challenges in the New Cycle

Excellent products often possess "altruism," meaning that a great trading platform must design its products from the trader's perspective, and for traders, the most concerning issues are effective management of trading risks and enhancement of capital efficiency.

When we focus on the product itself, we find that both Backpack and FTX are designed with the philosophy of "born for traders."

With a background as a trader, SBF understands traders' demands better: FTX's pioneering "three-tiered liquidation model" can prevent a significant portion of user funds from being used to cover liquidation losses; another major innovation, the "unified margin account," allows users to participate in various derivative trades using the same margin pool, with stablecoins as universal collateral, greatly simplifying operations and further enhancing capital turnover efficiency. Additionally, features like leveraged tokens have been adopted by many trading platforms.

For Backpack, as the market size continues to expand, product richness increases, and traders grow, in the new market environment of the new cycle, building a "trading platform designed for traders" faces more extreme tests in aspects such as how to construct a more robust risk engine, how to effectively aggregate multiple chains, and how to maximize capital efficiency.

With a background in engineering, Armani's dual perspective of trading and product allows Backpack to elevate the trading experience.

No Proprietary Market Maker + Three-Stage Liquidation: Backpack's Powerful Risk Engine

Most trading platforms operate their own market makers to capture more profit space, but Backpack, taking heed of the devastating consequences caused by FTX lending customer funds to market maker Alameda Research, chooses not to operate its own market maker, fundamentally eliminating Backpack's motivation to liquidate users, ensuring it will not become a counterparty to users, and further ensuring that when a crisis occurs, Backpack can prioritize saving users.

Additionally, Backpack employs a three-stage liquidation mechanism to further ensure the system's solvency:

Order Book Liquidation: When Backpack detects that a user's margin maintenance ratio reaches 100%, the system will immediately cancel unfilled orders and attempt to sell or hedge in batches at the best possible price on the order book, reducing market impact while protecting users.

Backup Mechanism Liquidation: When liquidity on the order book is insufficient during extreme market conditions, the system will transfer positions to market makers participating in the backup plan to assume the risk.

Automatic Position Reduction Liquidation: If the first two steps cannot complete the liquidation, the system will forcibly hedge or reduce positions to ensure overall risk is zero, preventing platform default.

At the same time, Backpack also reduces market impact through gradual liquidation, price protection, and other measures, protecting users from unreasonable liquidations and further enhancing the friendliness and fairness of the liquidation process.

During the market's violent fluctuations caused by the Trump administration's announcement of tariff increases, Backpack's liquidation mechanism demonstrated strong robustness. According to data from an Alameda Research article: 99.82% of liquidations on the Backpack platform occurred directly on the order book, with only 0.18% happening through the backup mechanism, and 0% through automatic position reduction.

Global Margin + Automatic Lending + Automatic Profit and Loss Settlement: Backpack Builds a Revenue "Perpetual Motion Machine"

In terms of achieving more intuitive asset management and more mechanized capital efficiency, Backpack's innovative design is concentrated in its natively integrated highly automated lending market:

To lower account management thresholds and enhance capital utilization, Backpack adopts a unique single global margin account design: Under one main account, users can create unlimited sub-accounts with one click, applicable to all products on the Backpack trading platform.

Users can manage different capital strategies through different sub-accounts or collaborate across teams, for example, one sub-account dedicated to lending and another for spot trading; transferring funds between different sub-accounts is efficient and convenient with just a few clicks; additionally, trading strategies are completely isolated, further reducing risk.

At the same time, Backpack employs a "full margin + multi-asset collateral" design, where all qualifying assets are automatically accepted as collateral and can be used for all products. This design not only speeds up capital turnover but also allows for more agile responses to rapidly changing market conditions.

For each sub-account, users can set the "automatic lending" feature:

For a long time, even with a single global margin, idle funds would still exist in accounts, generating no income.

Through automatic lending, users' margin accounts and lending pools merge, and all qualifying available assets in the sub-accounts will automatically be deposited into the lending pool to earn income: these available assets can be idle funds or even unrealized floating profits in contracts, and once the borrower repays, the interest will be added to the available balance in real-time.

This is akin to: qualifying chickens can lay eggs to earn income, and while the eggs are still inside the chicken, users can continue to earn income from these eggs, and even the income generated from these eggs can compound.

The assets lent by users will be counted as 100% collateral, meaning that even during position trading, users can still earn lending income or generate additional income through arbitrage trading strategies that hedge risks, leading to higher returns and capital efficiency.

While pursuing extreme capital efficiency, Backpack also achieves highly automated settlement through the "automatic profit and loss settlement" feature to further lock in profits and create an efficient, robust trading market:

Backpack automatically settles profits and losses every 10 seconds while keeping contract positions unchanged, directly paying the losing party's funds to the winning party. At this point, the profits can be transferred to the account as "available balance," providing more "bullets" for the next trade while avoiding the borrowing needs caused by unrealized losses.

For users holding stablecoins, this is an efficient settlement method; for users without stablecoins, Backpack introduces a virtual profit and loss settlement (vPNL) mechanism, synchronizing unrealized profits and losses to the lending market through a virtual liquidity fund, allowing the losing party to pay interest while the winning party earns profits, further reducing lending risks and margin pressure.

With a series of product advantages, Backpack has already accumulated a good reputation among users and impressive on-chain data performance.

Many community members have expressed that after getting used to Backpack, using other trading products always feels like "going from luxury to frugality," because once you are accustomed to Backpack's functional design that always anticipates your trading needs, it becomes hard to accept the closed, cumbersome, and inefficient nature of other trading platforms.

On the first day of the public beta launched on January 27, 2025, Backpack's total trading volume (spot + perpetual contracts) exceeded $200 million within 24 hours. Among them, the perpetual contract business achieved a trading volume of $100 million within the first 20 hours after the public beta opened.

According to data from its official website: Backpack's total trading volume has now surpassed $60 billion, with a cumulative total of 5 billion transactions completed.

Of course, beyond product advantages, another important label for Backpack is "compliance."

From its inception, Backpack has firmly chosen a compliance development path, not only due to the historical lessons brought by the collapse of FTX but also because of the team's profound insights into industry trends.

After years of deep cultivation, Backpack's compliance landscape has not only gradually expanded globally but is also poised to welcome significant growth opportunities in 2025, when on-chain finance is set to explode.

Compliance Pioneer: Bridging On-Chain and Off-Chain, Creating a Core Hub for Asset Management

The market has not forgotten the significant impact of FTX's collapse on the industry, but viewing the issue from a developmental perspective, FTX's downfall has propelled the entire industry from a phase of reckless growth towards a regulated development path that pursues transparency and compliance.

Ensuring Every Transaction Happens in a "Glass House": Backpack's Pursuit of Transparency

Since FTX, public proof of reserves has become standard for exchanges, and Backpack is no exception: Backpack regularly conducts third-party PoR audits and publishes all details, with the publicly available Hacken audit report showing that Backpack's assets cover over 100% of its liabilities.

However, as demonstrated multiple times in its product design, Backpack is a platform that pursues excellence. In addressing the fundamental issue of transparency that affects user trust, Backpack has taken additional multi-faceted measures: on one hand, it has introduced multi-party computation (MPC) technology, allowing users to self-custody their funds; on the other hand, starting from the underlying infrastructure, multiple independent nodes within Backpack Exchange must reach consensus on every deposit, withdrawal, and transaction that occurs on the exchange, making the entire historical record of transactions replayable and auditable, further enhancing transparency.

From the U.S. and EU to Asia: Backpack's Global Compliance Strategy

Beyond transparency, the more important issue is compliance.

The importance of compliance is self-evident: it is not only the cornerstone of trust but also a significant marker of market maturity, and it is an essential path to attract traditional financial institutions, capital, and users to join and promote the deep integration of on-chain and off-chain.

However, the road to compliance is not easy: it involves balancing product design with regulatory requirements and tests the project team's ability to negotiate with regulatory authorities across various countries/regions. For example, in Japan, which has a unique crypto regulatory system, passing the review of the Japan Virtual Currency Exchange Association (JVCEA) may take at least a year.

This is precisely the immense value of Backpack as a "globally compliant cryptocurrency trading platform":

We know that many former FTX employees on the Backpack team come from legal and compliance departments. This mature compliance team, consisting of dozens of members, enables Backpack to better understand how to advance compliance strategies globally compared to other crypto trading platforms.

In fact, from Backpack's continuously expanding compliance landscape over the past few years, we can see the fruitful results achieved by this compliance team.

As a company founded in the U.S., Backpack's compliance journey starts there, with its product design strictly adhering to U.S. KYC, anti-money laundering, and other relevant regulations. Currently, Backpack's compliant crypto trading business covers 12 states in the U.S., and as U.S. crypto-friendly policies continue to advance, Backpack's "U.S. compliance" strategy will rapidly expand to all 50 states.

In 2023, Backpack officially obtained a virtual asset service provider (VASP) license issued by the Dubai Virtual Assets Regulatory Authority (VARA), marking an important breakthrough for Backpack in the Asian market.

Shortly thereafter, Backpack became a member of the Japan Virtual and Crypto Assets Exchange Association (JVCEA). Japan is known for its high compliance thresholds; before the collapse of FTX, only Binance successfully passed Japan's compliance review, and in the nearly two years following FTX's downfall, Backpack became the first crypto trading platform to pass Japan's compliance review.

This year, Backpack's most significant progress in compliance is the successful completion of the acquisition of FTX EU:

With this acquisition, Backpack will take over the compensation for 110,000 European crypto users, which also means that Backpack will directly gain over 110,000 high-quality crypto trading users, laying a more solid user foundation for its future business development.

More importantly, FTX EU holds a MiFID II license under the EU's new regulations, and by acquiring FTX EU, Backpack has become the only trading platform in the EU with qualifications to operate crypto derivatives such as perpetual contracts, capable of serving the entire EU market and covering 20-30% of global crypto trading volume.

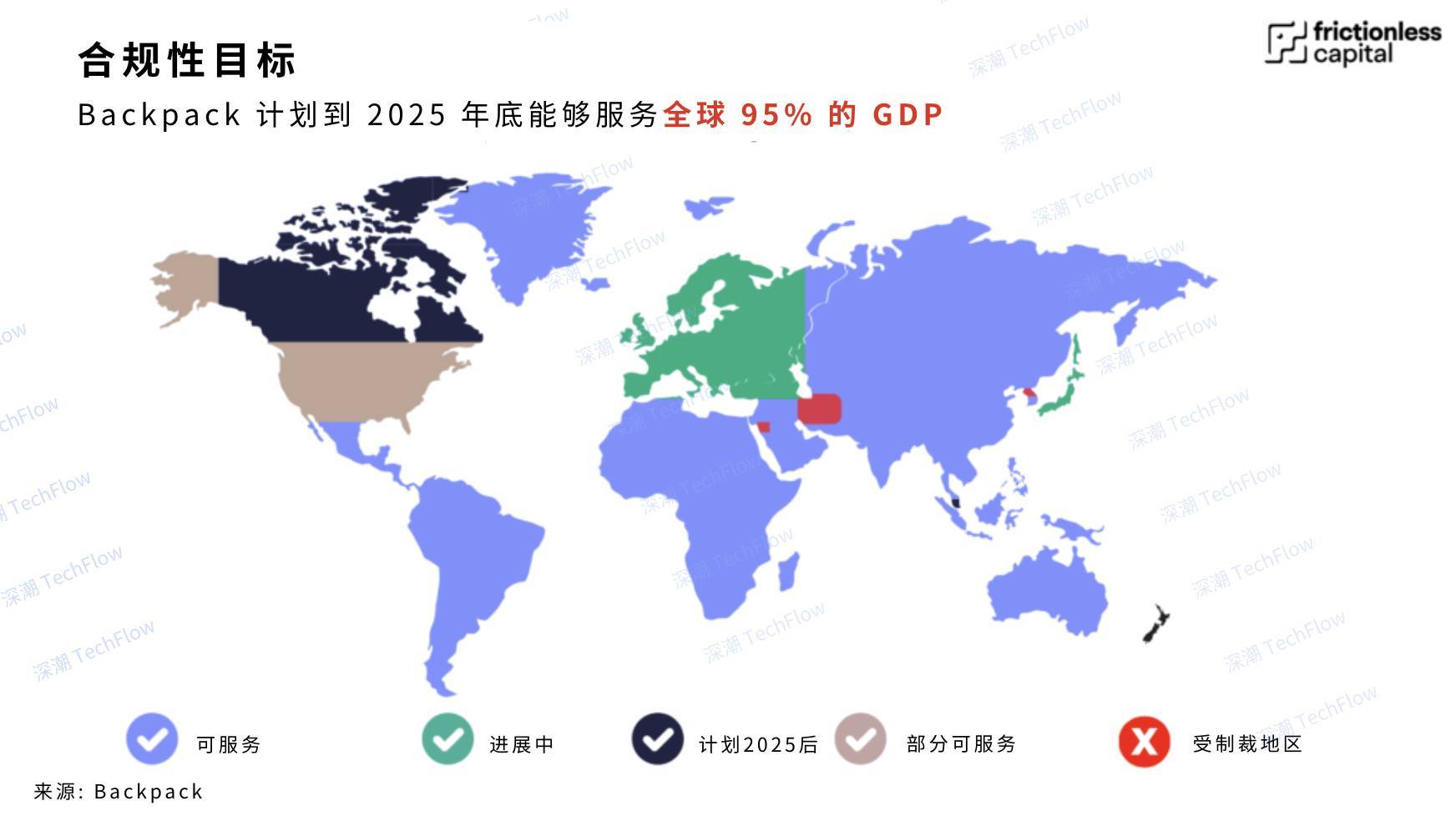

Additionally, Backpack has obtained licenses to conduct crypto asset-related activities in Australia, the UK, and other regions. Currently, according to information on its official website, Backpack is operating in over 150 countries/regions worldwide. Looking towards 2025, Backpack will continue to implement its compliance strategy, initiate more license applications in various countries/regions, and strive to extend its compliance services to users in areas covering 95% of global GDP, reaching nearly 1 billion potential users.

2025: The Year of On-Chain Finance's Rise and Backpack's Explosion

Although the total market capitalization of crypto has surpassed $2.6 trillion, it is still a very small size compared to traditional finance. The total market capitalization of U.S. stocks (Wilshire 5000) in 2024 is projected to be $63 trillion, easily surpassing the total market capitalization of the crypto market by several times. It can be said that using compliance as a lever to guide the deep integration of traditional finance and crypto finance will not only be an exponential growth opportunity for Backpack but also an essential path for crypto finance to achieve large-scale explosion.

After the U.S. fired the first shot in favor of crypto, traditional institutions' participation in crypto has become more proactive. According to a recent survey by Coinbase, 83% of respondents plan to expand their crypto allocations this year, and 59% plan to allocate more than 5% of their asset management scale to crypto assets by 2025.

Through unwavering compliance measures, Backpack alleviates traditional finance's regulatory concerns and provides a compliant, efficient way to participate, attracting more institutions and users.

In fact, the successful acquisition of FTX EU has laid a solid foundation for Backpack's TradFi expansion: The MiFID II license is not only a permission for cryptocurrency trading but also a full financial license covering bond issuance, stock trading, wealth management, and more. With this license, Backpack may become the Web3 version of Goldman Sachs in the EU market.

In the future, starting from the U.S. and Europe to radiate across the entire Western world, and covering the entire Eastern market with points in Dubai, Japan, and Singapore: leveraging its first-mover advantage in compliance and significant innovations in product experience, Backpack is poised to become the biggest beneficiary of the 2025 TradFi development opportunities, ultimately achieving a leap from a crypto exchange to a global asset hub.

Of course, after understanding Backpack's success factors and growth drivers, the more practical question facing users is:

How to efficiently participate in Backpack?

Season 1 is in full swing: Rewarding genuine trading participation, bringing a new paradigm of community incentives

Let us first intuitively feel the immense enthusiasm for participation sparked by Backpack Season 1 through a set of data:

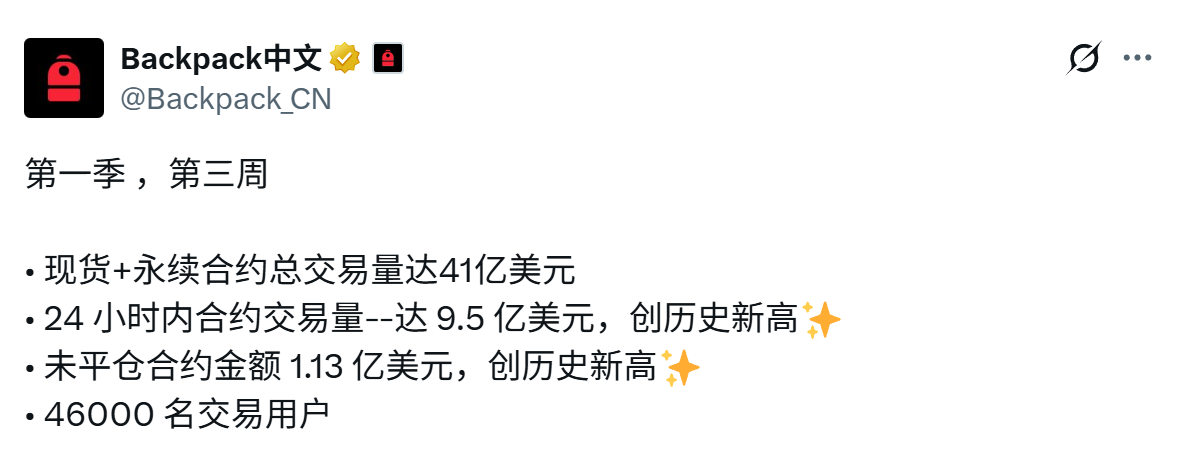

According to data from Backpack's official Twitter, in the third week of the event, multiple trading indicators surged to new highs: 24-hour contract trading volume exceeded $950 million; contract open interest surpassed $113 million; the number of active trading users exceeded 46,000; and the total trading volume of spot and contracts in Season 1 reached $4.1 billion.

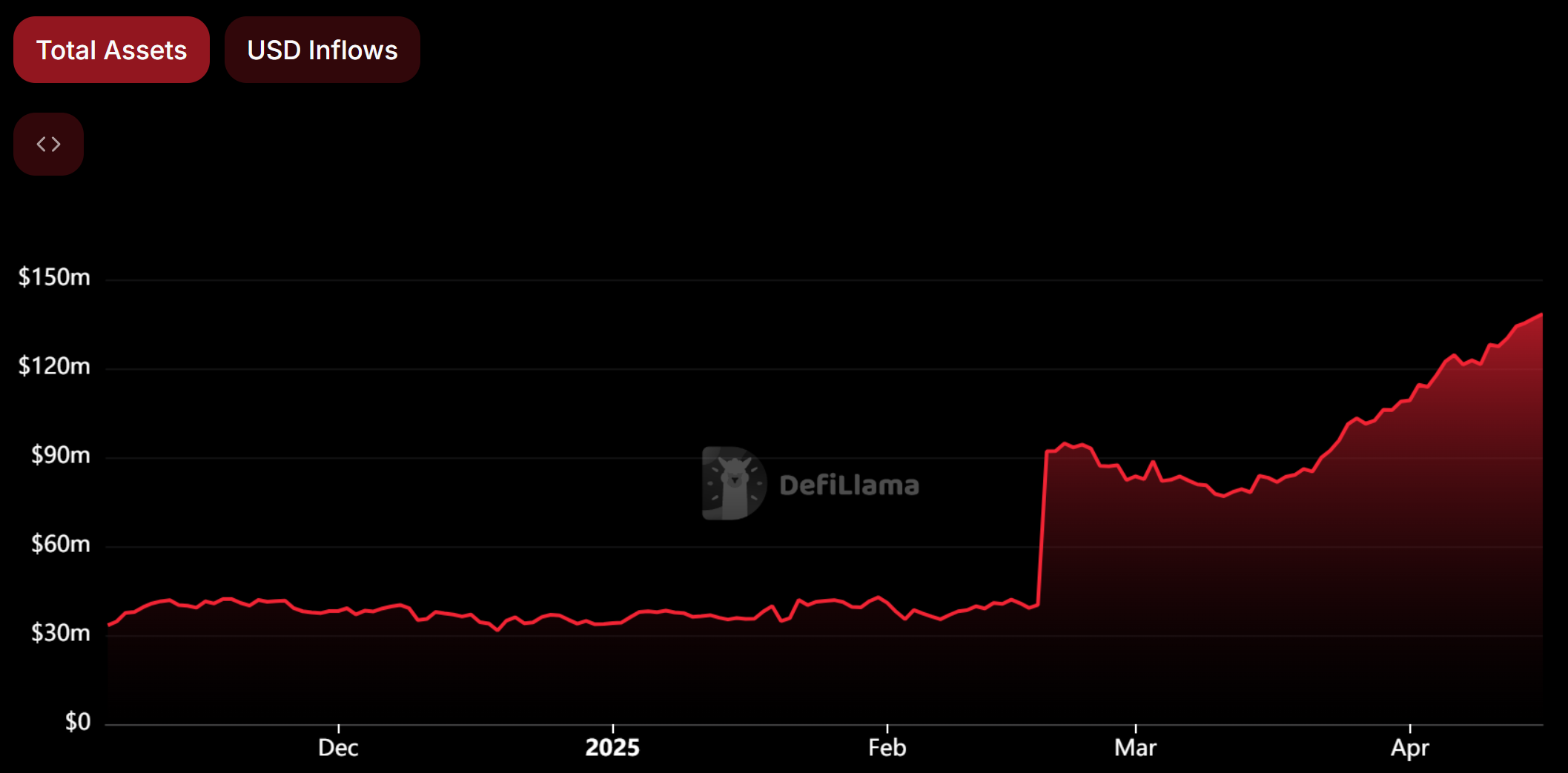

Through DeFi Llama data, we can clearly see that since the launch of the activity, Backpack's asset scale has shown a rapid growth trend.

So, why has Backpack Season 1 been able to trigger such a large scale of participation?

On one hand, participating in Season 1 can earn points rewards, and the points accumulate with airdrop expectations. Users are optimistic about Backpack's future development and naturally hope to win more points to accumulate airdrop chips;

On the other hand, it is inseparable from Backpack's unique design of the activity rules.

Backpack aims to reward genuine trading users through Season 1:

It is reported that Backpack plans to launch quarterly activities in phases, with each quarter consisting of a 10-week cycle, distributing 10 million points each week, totaling 100 million points per quarter, with points distributed every Friday at 10:00 (UTC+8).

During the activity, users can freely explore the product, including providing liquidity, inviting trades, holding positions, lending, etc. Every operational button may generate points.

Each week, Backpack will dynamically adjust the points calculation method to ensure that users are unaware of the points reward scheme, thus avoiding behaviors like point farming and quick in-and-out actions, encouraging users to focus more on the trading itself and ensuring that rewards are distributed to genuine trading participants.

At the same time, Backpack is committed to creating truly fair participation:

In addition to distributing initial points rewards to 475,000 users who participated in trading during the pre-season and public beta, points are not pre-allocated, and they cannot be purchased, transferred, or sold; they belong solely to users of Backpack.

Furthermore, Backpack has introduced a series of stringent measures to ensure the fairness and justice of points distribution. Previously, Backpack announced that it had discovered multiple instances of witch attacks and urged users not to create multiple accounts to participate in the activity, as this could result in points being reallocated.

So, as a user, how can you participate in Season 1 more efficiently?

Perhaps following the rules and returning to simplicity is the most efficient way.

Clearly, unlike most point farming and airdrop chasing, Backpack does not follow a multi-account low guarantee route but encourages genuine trading and real participation. Since this is the case, why not follow Backpack's guidance, seriously experience trading, and feel the product? Based on Backpack's commitment to real users, it is believed that the future will not disappoint those who genuinely participate.

Additionally, Backpack has launched an agent program, allowing qualified referrers to invite friends to earn more points.

Currently, the 10-week Season 1 has entered its fifth week, and both community feedback and Backpack's team response speed have received high praise. There are also numerous detailed tutorial articles available on social media for reference, and interested traders can participate. As an important attempt by Backpack to encourage genuine participation and enhance platform liquidity, with the promotion of the points activity, a rapidly growing crypto financial ecosystem characterized by efficient capital circulation, high compliance, and strong community participation is taking shape.

Conclusion

Although there are often comments in the community that the exchange landscape has been set, and it is not an easy track for disruptors to emerge.

However, trading, as the eternal theme of the crypto market, continues to innovate, and the landscape of exchanges is never definitively established.

As Backpack CEO Armani mentioned in a recent community AMA, the inspiration for Backpack's name comes from the item backpack of characters in "World of Warcraft." In the game, the backpack is the core tool for players to store and manage game items, and Backpack aims to become the primary carrier for users' asset trading activities. With this Backpack, users can traverse the world and embark on their adventure journey.

In the future, Backpack will continue to delve into lowering barriers, optimizing liquidity, and global compliance: soon, Backpack will further promote the deep integration of its wallet products with exchange services, launching a new form of wallet experience through account abstraction, helping users retain self-custody security without needing a mnemonic phrase. Additionally, users can access dApps directly upon logging into Backpack Exchange without needing to install an additional wallet. Furthermore, Backpack will support services such as U.S. stocks, retirement accounts, Apple Pay, and fiat currency deposits, and will further advance applications for major global compliance licenses.

A new round of competition among exchanges has already begun. Can Backpack, a trading platform with deep ties to FTX, leverage features like automatic lending, automatic profit and loss phases, and global margin accounts to provide a new trading experience characterized by efficient capital operation, becoming a representative innovative exchange in this cycle? At the same time, by embracing compliance and enhancing transparency, can it introduce narratives like TradFi and RWA, further building a core hub for on-chain and off-chain asset management, achieving long-term sustainable growth?

As regulatory friendliness and the rise of on-chain finance become keywords for 2025, we look forward to more exciting performances from Backpack.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。