ABCDE announced the cessation of new project investments and the suspension of the second phase of fund-raising, triggering another round of lamentations on Crypto Twitter about the "death of VC." However, during the last cycle, VCs were thriving, relying on narratives to boost valuations, packaging each PPT as the future of the internet.

As a decentralized social leader that raised a total of $180 million during two bull markets, Farcaster is undoubtedly the best representative of the VC narrative. However, Farcaster's answer is gradually becoming clear—no longer betting on "decentralized imagination," but rather on "asset execution." Farcaster is not a failed product, but rather another narrative collapse in the crypto world, where VCs realize they do not have the ability to reconstruct the world; they are merely cashing out in a story of pre-paid valuations.

From Farcaster to Warpcast, and back to Farcaster

Recently, Farcaster protocol co-founder Dan announced that the team is considering renaming the current official client application, Warpcast, back to Farcaster, while also adjusting its web domain to farcaster.xyz, aiming to simplify the brand system and resolve confusion for new users between the protocol and the application.

In 2021, Farcaster launched as a desktop product, and in 2023, it transformed into a mobile and web application, rebranding as Warpcast. Although the initial renaming was thought to facilitate other developers in building their own clients based on the protocol, thereby driving user growth, this concept did not materialize. According to team feedback, the vast majority of users still register accounts and access the protocol through Warpcast.

In May of last year, BlockBeats published an analysis of the Farcaster ecosystem, noting that the front-end application Warpcast held the core functionalities of the Farcaster protocol, such as private messaging and Channels. The entire ecosystem exhibited a clear Matthew effect, where unofficial clients struggled to survive and had to find pain points in Warpcast for functional development. Nevertheless, applications like Supercast and Tako adopted differentiated strategies to develop their own social platforms.

Related reading: "Is there no opportunity on Farcaster?"

Now, the Farcaster team has officially announced the renaming of the front-end Warpcast back to Farcaster, which, to some extent, undoubtedly undermines those front-end application developers who chose the Farcaster protocol.

In fact, this renaming operation is just a small reflection of Farcaster's transformation. Since October of last year, the Farcaster protocol has made adjustments in product updates, strategic layout, personnel changes, and more.

One detail is that in subsequent developer meeting discussions, there is no longer a distinction between "Farcaster topics" and "Warpcast updates," but rather a focus on specific overall issues, such as Growth, Direct Cast, reducing registration costs, Hubs stability, FIP governance, and identity systems.

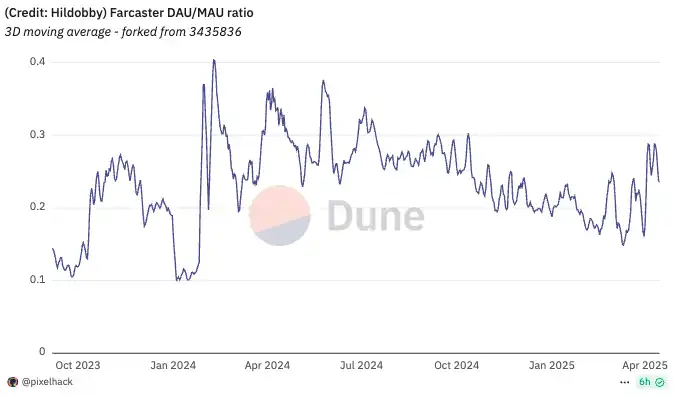

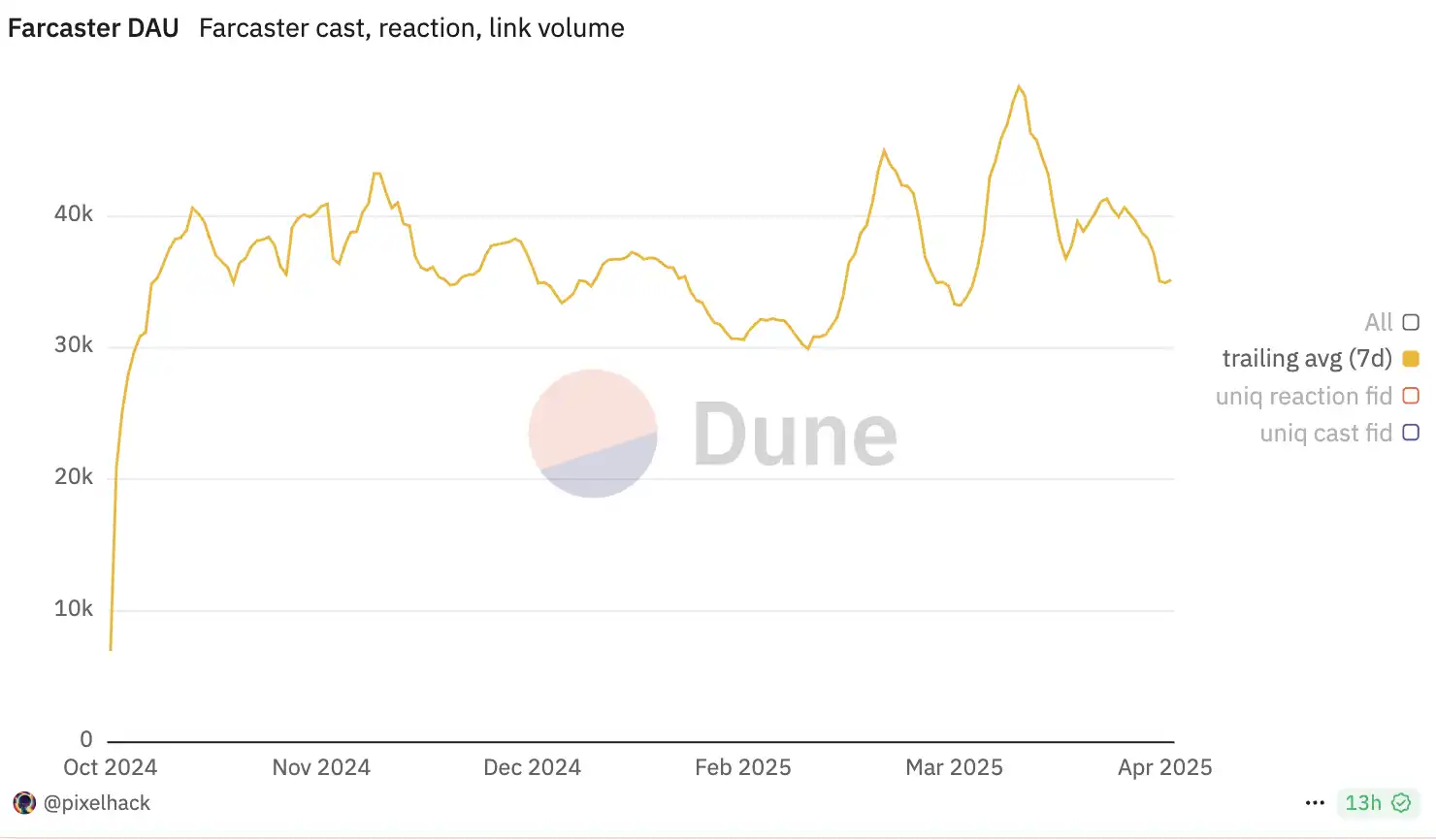

However, from the perspective of user stickiness, Farcaster has yet to escape the typical dilemma of cold-start platforms. According to Dune data, since opening registration in the second half of 2023, its DAU/MAU ratio has long hovered around 0.2, only briefly touching 0.4 at the beginning of 2024 due to the explosive popularity of DEGEN, before quickly falling back.

The DAU/MAU ratio refers to the ratio of daily active users to monthly active users, used to measure how many days users interact with the application each month. The closer the ratio is to 1, the higher the user activity level. When the ratio is below 0.2, the application's virality and interactivity will be weak.

In contrast, early Web2 community products like Reddit or Mastodon maintain a stable DAU/MAU ratio in the range of 0.25 to 0.3. Even smaller, more niche social applications like Discord's small servers often manage to maintain an active ratio above 0.3. Farcaster's data indicates that although it maintains a high level of discussion within the Crypto community, user habits have not truly established, with active users primarily concentrated among a few heavy creators and on-chain natives, failing to form a sustainable content consumption and social loop.

Creating content? Creating assets? Farcaster has no answer

In the initial product logic, Farcaster attempted to build a decentralized social graph through content tools, with the once-promising Channels (similar to topic groups) serving as the core units for community and traffic. However, the incentive effect of assets quickly surpassed the self-organizing ability of content, leading to a shift in product logic.

The abandoned Channels

In February 2024, the social token $DEGEN became popular in the Degen channel on Warpcast, becoming a major driving force for Farcaster's breakout. At that time, Farcaster had only opened network registration for four months, with daily active users exceeding 30,000. As the $DEGEN token gained traction and similar popular channel tokens like Higher emerged, Farcaster's daily active users peaked at 70,000.

The Farcaster team realized that Channels could serve as a medium to gather people, attention, and liquidity. Farcaster founder Dan believes this is an important distinction from centralized social media like Twitter, allowing small communities to emerge within a larger social graph. Although it is just one feature of Warpcast, the plan was to fully decentralize it, enhancing user engagement and creating a more intimate social experience by nurturing these small, concentrated communities.

Thus, the team established the core development positioning for Channels, creating many concepts around it, including various rights for channel owners and channel ownership, which also led to projects and clients centered around channel operations. Dan even urged users not to rush to register channel names, so they could sell them to brands later, referencing a dispute over channel names between the podcast Bankless and users.

However, this approach did not last long. In July 2024, the network expansion bottleneck of the Farcaster protocol emerged. During a developer meeting, the team stated that they would pause the decentralization of Channels and rethink the implementation path.

In response to user inquiries about why they could not speak in certain topic channels, Dan stated that Channels would not bring any additional distribution benefits. There had been some in the past, but the results were poor. He said, "Channels are suitable for operating communities but not for discussing specific topics; we will not recommend them to new users." Historical data shows that Channels have limited impact on user growth, and given limited resources, the Farcaster team will not have plans to add new features for Channels in the short term.

Replacing the product priority are Mini Apps and Wallets, which shift Farcaster from a social protocol focused on content and social graphs to a protocol emphasizing transactions, as the latter can attract more native users in the Crypto space.

Built-in wallets exacerbate monopoly

In a podcast, Farcaster co-founder Dan shared his latest understanding of the concept of "users": users who merely register accounts and engage in light interactions may superficially increase activity, but those who truly bring value to the network are wallet users who hold crypto assets and are willing to engage in on-chain interactions. This refined understanding of users directly influenced the team's product strategy regarding the wallet system.

By the end of November 2024, Farcaster began exploring the integration of a tradable wallet within the application to facilitate on-chain transactions. The goal is to enhance ecosystem stickiness and monetization potential by increasing the frequency of on-chain interactions. In fact, every Warpcast user automatically creates a "Farcaster wallet" upon registration, which binds to the user's identity and is used to log into Warpcast and Frames. However, since it is only stored locally on the phone, its functionality leans more towards authentication and signing rather than fund movement.

In contrast, the newly launched "Warpcast Wallet" is a wallet that can send and receive assets, automatically generated for users upon registration, allowing them to recharge tokens, exchange, transfer, and engage in on-chain interactions through this wallet.

The timing of Farcaster's introduction of a built-in tradable wallet is hard not to associate with the emergence of Clanker.

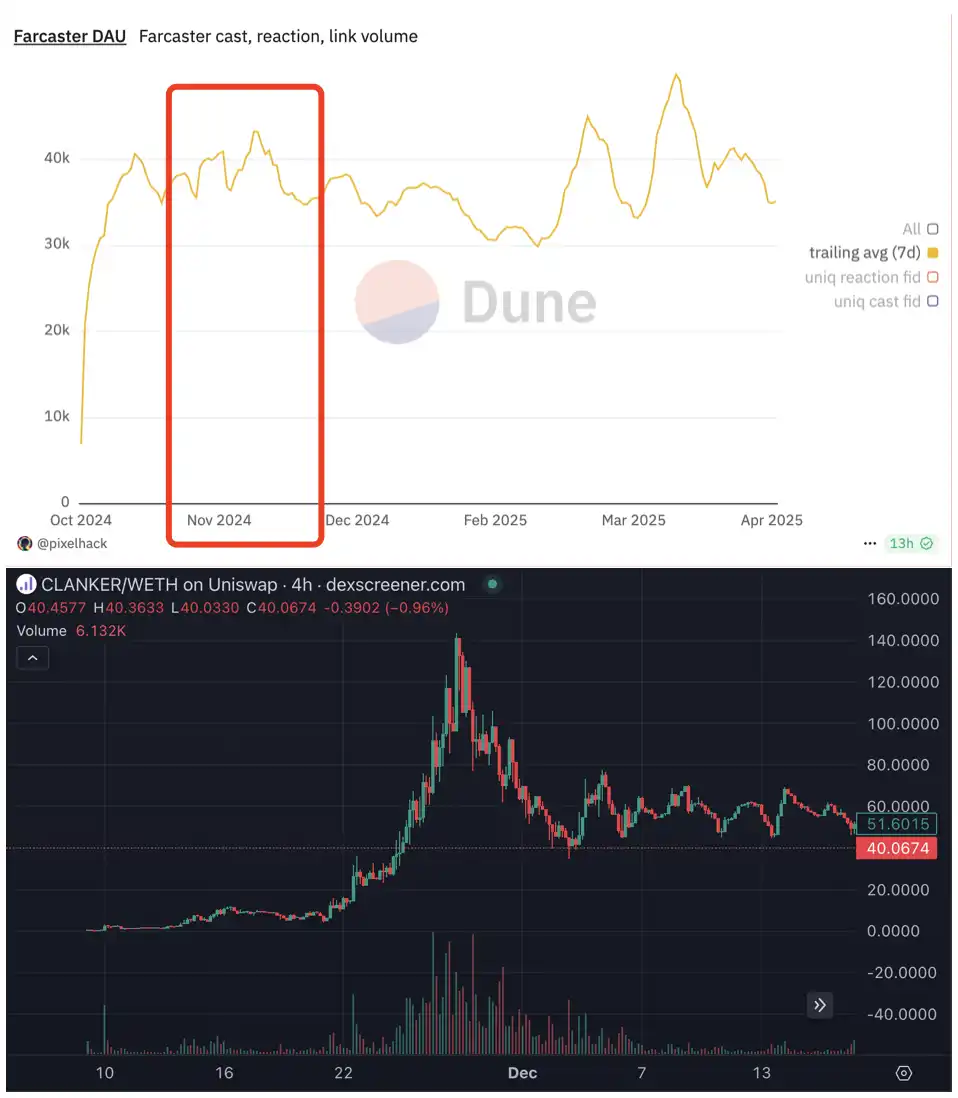

Clanker is a token issuance AI Agent on Warpcast, where users can post and tag Clanker to issue tradable tokens on Uniswap. Its official token $CLANKER surged 20 times last November, making Base and Warpcast competitors in the AI concept track alongside Solana. Also due to the wealth effect of $CLANKER, Farcaster's daily active users reached a new high since last summer.

Unlike the fate of $DEGEN, $CLANKER, which also emerged from Warpcast, received attention and support from the team and core circle from the very beginning. However, in this process, Agents, DEXs, and C-end wallets all benefited from this asset issuance frenzy, while Warpcast did not gain any economic returns.

The success of Clanker made the team realize that if they wanted to facilitate more on-chain interactions within the Farcaster ecosystem, merely relying on open protocols and third-party integrations was insufficient; they must establish a native tradable wallet system, leading to the birth of Warpcast Wallet.

From a product design perspective, the role of Warpcast Wallet is to bridge user social interactions and on-chain behaviors—users do not need to switch or connect to external wallets; they can complete transactions, tip, or claim airdrops with a click on Frame. This "social equals finance" product logic makes Farcaster resemble a "Singapore" in the crypto world—while the user base is not large, wallet activity and average fund volume are high.

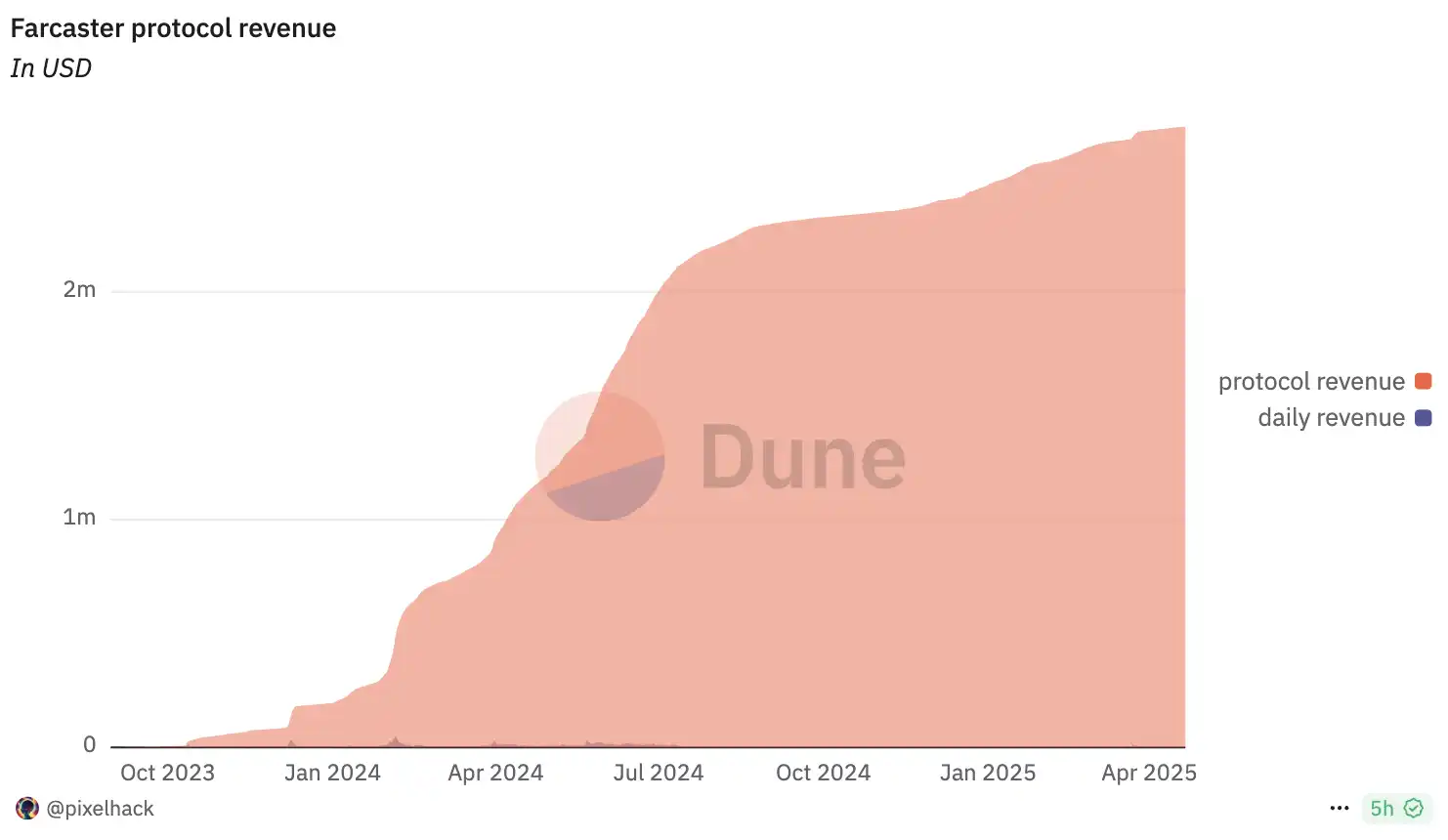

According to official documentation, users are required to pay a 0.85% fee when using the Warpcast Wallet, of which 0.15% goes to the 0x protocol that provides transaction routing, and 0.70% is directly counted as Warpcast's revenue. Dune data shows that since its launch, the revenue curve of the Farcaster protocol has been continuously growing, preliminarily validating the feasibility of the embedded wallet as a commercialization path.

However, it is worth noting that the built-in wallet of Warpcast is not written into the protocol layer. Additionally, with the renaming of the Warpcast client to Farcaster, BlockBeats has learned that some Farcaster developers believe the protocol is becoming increasingly centralized and monopolistic.

The biggest innovation is merely "WeChat Mini Programs"

With the introduction of the built-in wallet, Farcaster has been advancing more smoothly towards becoming an asset-oriented social application. The official has stated that one of the purposes of launching the wallet is to attract developers to build applications based on the Frame framework, thereby promoting the combination of transaction behavior and content distribution.

Frame was first launched in early 2024 as a lightweight application standard running on the Farcaster protocol, allowing developers to embed small programs into social clients. When users click on Frame, developers can identify their wallet addresses and push content or trigger interactive operations. However, as the overall popularity of Farcaster has declined, the usage of Frame has also shown a significant downward trend.

To address this situation, Farcaster launched Frame v2 at the end of 2024. The new version supports building applications with a near-native experience using HTML, CSS, and JavaScript. Developers can also quickly deploy products using the Mini App SDK without going through the app store review process. Frame v2 not only enhances interaction complexity but also deeply integrates with the built-in wallet, further enhancing transaction attributes and making the overall experience closer to WeChat Mini Programs.

In March 2025, Linda Xie, co-founder of Scalar Capital and Bountycaster, joined the Farcaster team to focus on developer relations, emphasizing the development and promotion of Frame. At the same time, Farcaster launched an "Airdrop Program" to encourage developers to build applications using Frame v2 and reach users through asset airdrops. Although this mechanism is not an official token airdrop, it effectively activated user growth. In mid-March, Farcaster's daily active users briefly surpassed 40,000, reaching a peak.

In early April 2025, Farcaster officially renamed Frame to Mini App and placed it alongside Wallet in the bottom navigation bar of the Warpcast client.

Currently, a batch of lightweight applications supporting on-chain interactions has been integrated into Warpcast, and Mini App has officially become an important part of the ecosystem. However, from the user growth data, the ability of Mini App to attract new users has not yet been significantly released, and its long-term impact remains to be observed.

The "Web3" Disappears, Silicon Valley Legends Fail

In fact, the changes in Farcaster are not unique; it has merely exposed the structural dilemmas of the entire Web3 social track—open protocols cannot generate user scale, content distribution cannot drive transactions, and ultimately, it can only return to the one realistic path driven by assets.

Do we really need a "decentralized social platform"?

From $DEGEN to $CLANKER, every breakout of Farcaster is almost linked to assets. What truly drives the surge in daily active users is not the evolution of the protocol or the innovation of the client, but the repeated wealth effects driven by tokens. This recurring pattern reveals a core fact: Farcaster is not "unused," but rather "only used when it can make money." Such platforms do meet certain market demands, but their role is not as social networks but as asset distributors.

This is not coincidental but rather an inevitable result of the long-term misalignment between crypto narratives and real-world usage.

In 2020, BlockBeats published an article titled "The World Hates Today's Social Media", stating that decentralization and protocolization might be the only way for social products to escape the "platform dilemma"—amid increasingly stringent content review and platform monopolies, open protocols carry people's hopes for a "new social order."

At that time, Twitter was considered a typical failure of an unfulfilled protocol: it briefly opened its API to encourage developers to build an ecosystem but ultimately returned to the old path of advertising platforms and data monopolies. Farcaster's initial ambition was to "not become the second Twitter," claiming to center around open protocols to connect developers, users, and assets, achieving a decentralized social network of co-construction and mutual benefit.

However, three years later, Farcaster has replicated not the original protocol ideals of Twitter but rather its later platform logic. Dan, who once called for everyone to "build their own clients based on the protocol," has now personally announced that the client will also be called Farcaster, tightly binding "protocol" and "product."

This shift is rational at the level of product-market fit (PMF) search and can even be seen as a realistic compromise, but it also indicates that the so-called "open ecosystem" has quietly been repurposed as a narrative tool for user growth. The role of developers is not to be genuinely supported but to tell stories. Just like when Twitter closed its API, the developer ecosystem is merely temporary fuel leading to a closed platform loop.

Farcaster has taken three years to prove one thing: social protocols in the crypto context cannot form the ecosystem we expected in 2020. Not because no one is developing clients, but because no one is using them. Not because it is not decentralized enough, but because decentralization is simply not what users care about.

Today, SocialFi, like GameFi, has been labeled a death track to some extent. Recently, a certain KOL confronted the founder of a decentralized social application, saying, "After doing traffic for so long, my followers are still not as high as an ordinary KOL like me. What are you capable of? Your company raised 2M; what have you done? You haven't made as much profit as my SOL wallet." While this brings a wry smile, it also evokes a sense of lament that the era of building infrastructure through narratives has ended, and the valuation system of all VC projects is being reconstructed.

Crypto is not "the next internet"

However, a16z is the biggest evangelist of this narrative, having invested early in social media like Twitter and Facebook. When the investment giant encounters decentralized social products, it naturally cannot ignore their existence. As a Google executive said, "They act like madmen, boldly inserting themselves into every transaction."

a16z stands for Andreessen Horowitz, named after the surnames of its two founders, Marc Andreessen and Ben Horowitz, who established it in 2009. As a renowned software catcher, it has almost hit all the most dazzling companies in the internet sector: Facebook, Twitter, Airbnb, Okta, Github, Stripe, etc. Its investment strategy combines early sensitivity with decisive growth-stage actions, being able to invest in Instagram during the seed round, compete for Github in the A round, and lead a $150 million investment in Roblox in the G round.

Its keen foresight and bold investment style are vividly reflected in its layout in the crypto field. When Coinbase, which it invested in 2013, went public, its market value reached a peak of $85.8 billion, making it one of the largest public companies in tech history. After cashing out $4.4 billion, a16z still holds 7% of the company. Well-known crypto projects like OpenSea, Uniswap, and dYdX are also representative works of a16z.

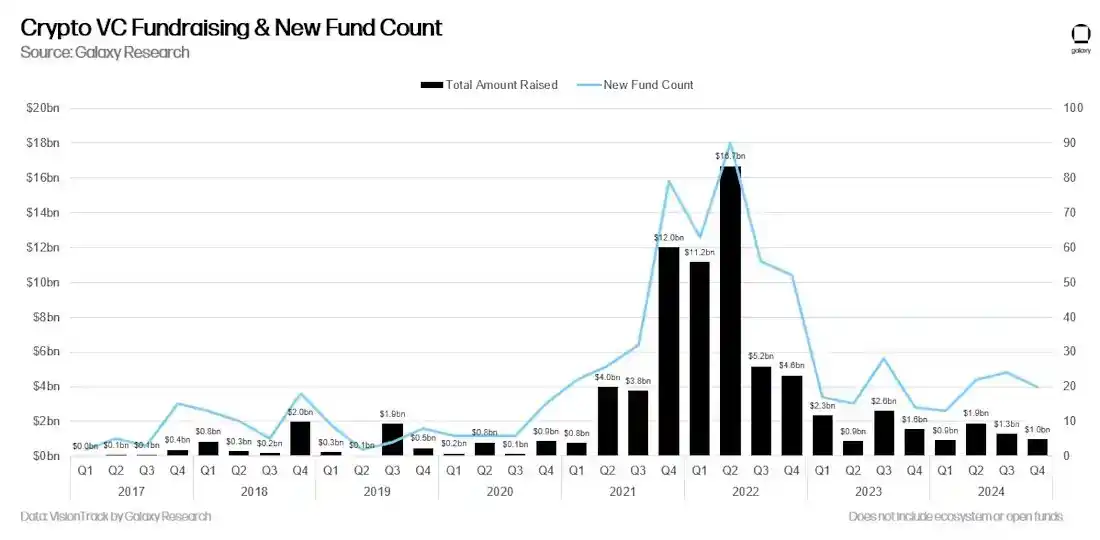

The crypto bull market since 2021 has caused the paper value of major venture capital portfolios to soar, with fund returns reaching 20 times or even 100 times, making crypto venture capital suddenly look like a money printing machine. LPs flocked in, eager to catch the next wave. The scale of new funds raised by venture capital firms is 10 times or even 100 times that of before, firmly believing they can replicate those extraordinary returns.

Farcaster is undoubtedly a product of this liquidity surge. In July 2022, Farcaster announced the completion of a $30 million financing led by a16z. Two years later, Farcaster completed a $150 million financing at a $1 billion valuation, led by Paradigm, with participation from major VCs like a16z crypto, Haun, USV, Variant, and Standard Crypto. With a valuation of $1 billion, it became the largest financing in the history of the Web3 social track. At that time, Fortune magazine commented that this valuation was more a result of internal fund circular gaming than a true reflection of market demand.

Crypto investor Liron Shapira stated, "If venture capital still has LP capital available, they choose to invest $150 million instead of returning it, they can collect an additional $20 to $30 million in management fees." This is not market recognition of Web3 social but a self-consistent closed loop of capital operations. An article in Fortune magazine also quoted an anonymous source who requested anonymity due to business constraints, stating that like most protocols, he expects Farcaster to launch a token, and investors will be eager to capture its fully diluted value.

a16z partners have proposed that "technological waves often appear in the form of combinations," endorsing the intersection of Web3, AI, and hardware. However, they have avoided a fundamental fact: every leap in the mobile internet, whether in smartphones or search engines, is built on real user pain points and technological breakthroughs, not on the structural bubbles under capital narratives.

"The idea that 'technology will eat the world' was once a radical and precise judgment, but its applicable premise is that technology possesses a crushing advantage at the foundational level. The reason AI has exploded is that it challenges individual intelligence—this is a structural ability difference that cannot be resisted; whereas blockchain challenges 'sovereign currency,' a credit system that has remained unchanged for two thousand years. It will not disrupt social structures explosively like the internet or AI; instead, it will slowly evolve over a long period, being absorbed and co-opted by the vested interest system, ultimately being rewritten as part of the original order.

Therefore, the reality is that the crypto systems truly accepted and creating value by users are almost without exception 'mechanism-driven + liquidity-first.' From Uniswap to Lido, from GMX to friend.tech, they rely on the attraction of funds rather than idealism. The VC model of 'investors driving world change' does not apply in this world.

Crypto has never lacked social tools; the so-called protocol ideal is merely an illusion projected by this industry onto the era of internet platforms. It attempts to replace business models with consensus mechanisms, but ultimately just postpones structural issues to the asset realization stage.

The biggest crisis in the current crypto industry is not regulation, nor technology, but strategic confusion and a vacuum of demand. Aside from 'casino logic' and cross-border payments, there is hardly any field that demonstrates the ability to continuously create user value. The failure of VCs is essentially a directional silence under the absence of value: if the industry itself has no real value, then value discovery cannot even be discussed from the very beginning."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。