Recently, the crypto investment bank Galaxy Digital transferred 65,600 Ethereum (ETH) worth approximately $105 million to the world's largest cryptocurrency exchange, Binance, over the past two weeks, while withdrawing 752,240 Solana (SOL) worth about $98.37 million from Binance. This operation has been interpreted by the market as a potential strategy adjustment by Galaxy Digital to exchange ETH for SOL, indicating its optimism about SOL's future potential. Meanwhile, another well-known crypto investment firm, Paradigm, has frequently transferred ETH to the institutional custody platform Anchorage, raising market speculation about its possible preparation to sell ETH.

Galaxy Digital's "Portfolio Adjustment" Concerns

According to monitoring by blockchain data analysis platform Lookonchain, Galaxy Digital began depositing large amounts of ETH into Binance starting April 8, accumulating a total of 65,600 ETH worth about $105 million by April 22. At the same time, starting April 10, Galaxy Digital gradually withdrew 752,240 SOL from Binance, valued at approximately $98.37 million. The market generally believes that this series of transactions indicates that Galaxy Digital may be selling ETH to purchase SOL in order to adjust its investment portfolio.

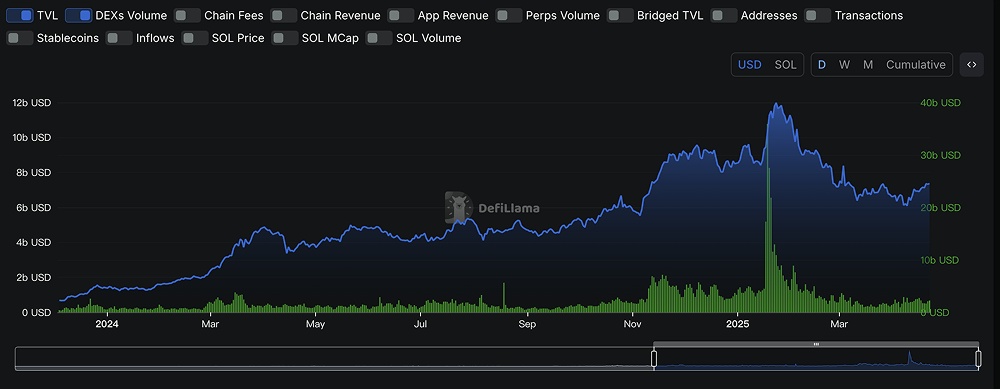

This operation is not an isolated event. As early as April 12 to 17, Galaxy Digital had already transferred 25,000 ETH (about $40 million) to Binance and withdrew SOL worth approximately $77.5 million during the same period. This high-frequency, large-scale capital flow demonstrates Galaxy Digital's strong confidence in SOL. Analysts point out that this move by Galaxy Digital may be related to its positive outlook on the recent strong performance of the Solana ecosystem. The Solana network has seen over $500 billion in trading volume in the past three months, far exceeding Ethereum's $400 billion; the number of active addresses has also reached 220 million, significantly higher than Ethereum and its Layer-2 networks' 80 million.

However, Galaxy Digital's large-scale ETH sell-off has also raised market concerns about Ethereum's price. On April 22, the price of ETH was reported at $1,607, down 1.2% from the previous day, with a cumulative decline of nearly 20% over the past month. Standard Chartered Bank recently released a report indicating that Ethereum is facing "structural decline," with Layer-2 networks (such as Base) causing it to lose market share, and it is expected that ETH's price may come under further pressure by the end of the year. Galaxy Digital's sell-off behavior undoubtedly exacerbates the market's bearish sentiment towards ETH.

Paradigm's ETH Transfers: Signs of a Sale?

In a parallel move to Galaxy Digital, another crypto investment giant, Paradigm, has also been frequently transferring ETH to the institutional custody platform Anchorage. Although the specific scale and purpose of the transfers have not been fully disclosed, the market generally believes that such transfers to custody platforms are typically preparations for subsequent sales or asset reallocation. Anchorage, as a crypto custody platform focused on institutional clients, is trusted by large investors for its security and compliance, making it the preferred choice for institutions like Paradigm to handle large assets.

Paradigm's actions have further intensified the market's pessimistic sentiment towards ETH. Analysts point out that institutional investors often choose to reduce holdings or adjust positions during periods of increased market volatility or when there are doubts about the prospects of a particular asset. Combined with Galaxy Digital's sell-off behavior, the market has begun to speculate whether ETH is facing a collective loss of confidence from institutions.

Why Has Solana Become the New Favorite Among Institutions?

In contrast to ETH's sluggish performance, Solana's ecosystem performance is undoubtedly the core reason why institutions like Galaxy Digital are bullish. Solana is known for its high throughput (theoretically up to 50,000 transactions per second) and low transaction fees (averaging $0.00025 per transaction), attracting a large number of developers and users. Recently, the Solana ecosystem has been continuously expanding in the fields of decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3, with over 400 projects running on-chain, and the total market capitalization of the ecosystem has reached $72 billion, ranking fourth in cryptocurrency.

Galaxy Digital is also actively participating in the governance reform of the Solana ecosystem. On April 18, its research team proposed a voting mechanism called "Multi-Election Weight Aggregation" (MESA) aimed at optimizing Solana's inflation rate adjustment process. This proposal not only demonstrates Galaxy Digital's commitment to the long-term development of Solana but also further consolidates its influence within the Solana ecosystem.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。