Every easy surrender is a desecration of the trend, and every blind stubbornness is a disregard for capital. The emergence of a one-sided market is like a beam of light in a tunnel; it belongs to the persistent. Everyone yearns for the favor of luck, and everyone longs for a doubling of their investments. Sometimes the market is bland and tasteless, and sometimes it is fiercely crazy. Having gotten used to the ups and downs and tasted both joy and sorrow, a single one-sided move is enough to compensate for all the fluctuations.

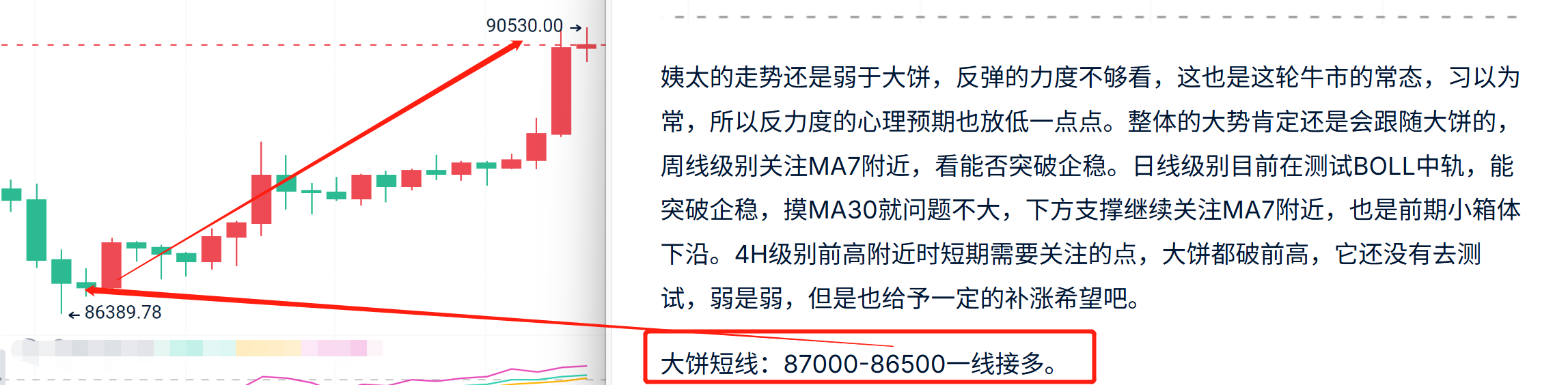

Hello everyone, I am trader Gege. Continuing from the last article, let's first review the strategy discussed. The suggested entry for Bitcoin was at the 87000-86500 line, and the market rebounded around 86390. The outcome of this long position is determined by you, as it is based on the article's strategy. The article also provided insights, emphasizing that as long as it does not break below 86000 on a pullback, one can enter above that level, while indicating a high probability of seeing the 90,000 range, which the market has met as expected. Trading is fundamentally a game of probabilities; we only participate in high-probability events and engage with market movements we can understand, making everything simpler. If you view the market in a complicated way, it will respond to you in kind; if you treat it simply, it will also be simple. Just as when you stare into the abyss, the abyss stares back at you.

In previous articles, Bitcoin sometimes provided short positions, but recent articles have only been bullish, suggesting long positions. Whether it was the previous long entry at 83500 or the recent 87-865 long entry, if you understand the article's reasoning and combine it with strategy and execution, you should achieve a good result. Having finished the small talk, let's return to the market. Bitcoin is currently the eternal favorite (YYDS). Now that it has broken nine, we need to pay attention to the previously mentioned mid-line of the weekly chart, corresponding to the price range of 91000-92000. If it can break through and stabilize, the next hurdle will be the 94000-95000 range. We should not overly focus on where it might go but rather follow the K-line step by step to confirm. There is not much to say about the technical aspect today; the strong upward trend remains robust, and this rise must clear out the shorts before any adjustment occurs. However, as I always say, despite the strength, I personally do not like to chase; I prefer to wait for a pullback to enter. If there is no pullback, I will observe; missing out is better than making a wrong move.

The performance of Bitcoin is still below my expectations; it surprisingly has not broken the previous high. My feelings towards it are mixed; I love it for the good results I achieved in the last bull market, but I hate it for its underwhelming performance in this bull market. Regardless, I still have some expectations for it, and I believe many in the market share this sentiment, which contributes to the performance of this bull market. After all, the principle of going against market consensus does exist. I don't want to say much about the technical aspect today; I am optimistic about it touching above 1700 tonight, so low-position long entries can still be considered. That's all for now; friends holding cash can refer to the short-term suggestions.

Bitcoin short-term: Long at the 90000-89500 line

Ethereum short-term: Long at the 1650-1630 line

PS: Try to use the strategy activation only once.

The suggestions are for reference only; ensure proper risk control when entering the market, and manage your profit and stop-loss space accordingly. Specific strategies should be consulted in real-time.

Alright, friends, we will see you next time. I wish everyone continued success and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today's brief update ends here. For more real-time suggestions on Bitcoin and Ethereum, find Gege.

Written by / I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。