Listed firms linked to the crypto economy rallied sharply on April 22, eclipsing bitcoin’s own advance. Throughout the session, Strategy (formerly Microstrategy) watched its MSTR shares climb 7.95%. The Nasdaq‑traded stock has added 9.87% this week and 16% across the past 30 days. Since Jan. 1, MSTR has also appreciated more than 14% versus the greenback. Strategy’s STRK line, its Series A Perpetual Strike preferred shares, inched 1.54% higher during the same session.

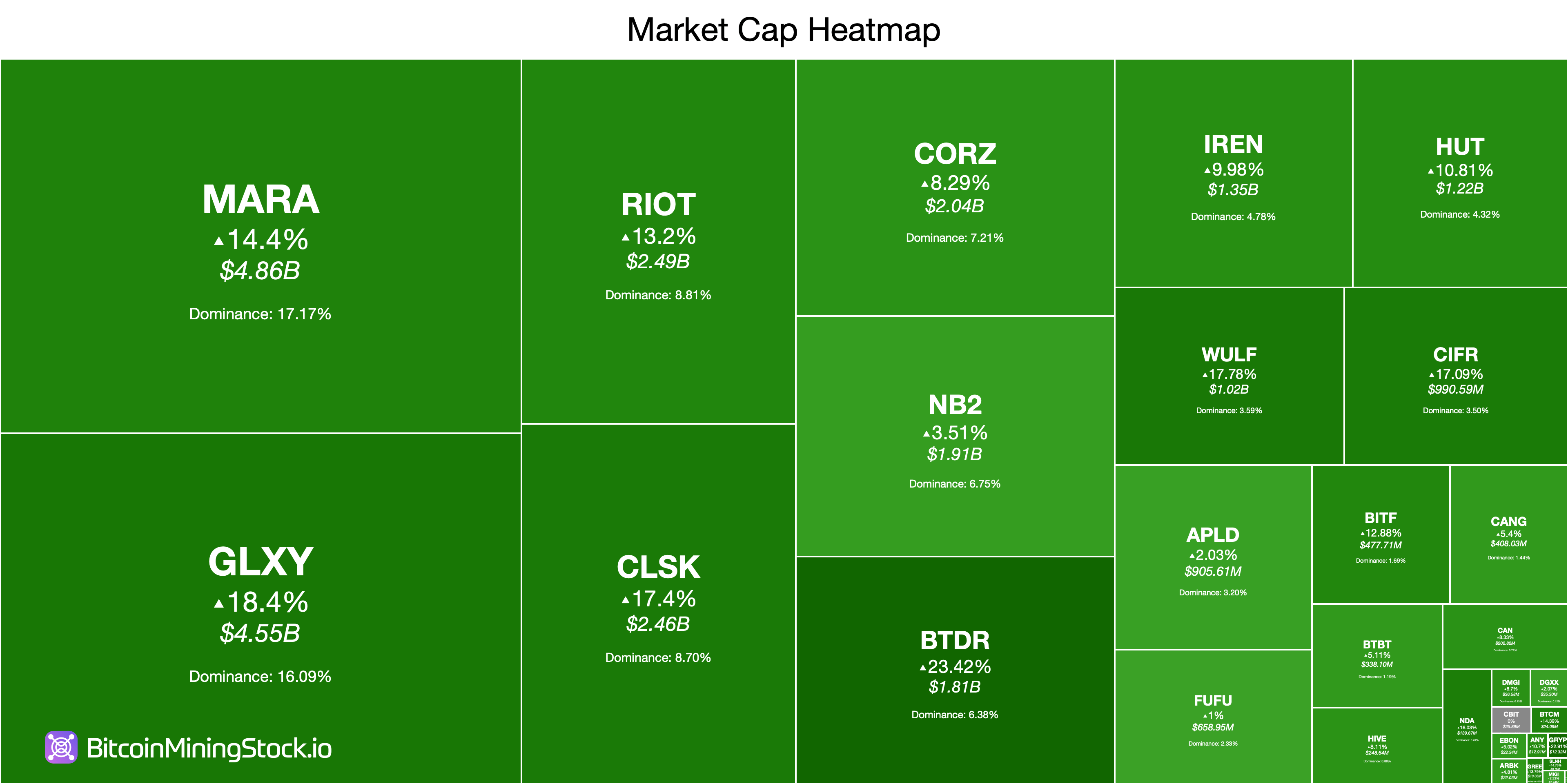

Coinbase’s Nasdaq‑listed COIN jumped 8.57%, and the ticker has advanced 2.39% in the past 30 days. Yet the year‑to‑date ledger reveals a 25.92% slide. Turning to miners, Bitdeer Technologies Group (BTDR) topped the leaderboard with a 23.42% leap, trailed by Galaxy Digital Holdings Ltd. (GLXY) at 18.40%. Cleanspark, Inc. (CLSK) added 17.40%, while Terawulf, Inc. (WULF) notched a 17.78% lift.

Source: bitcoinminingstock.io/heatmap

Marathon Digital Holdings, Inc. (MARA) progressed 14.40%, edging past Riot Platforms, Inc. (RIOT) at 13.20%. Hut 8 Corp. (HUT) chalked up 10.81%, and IREN Limited (IREN) followed with 9.98%. Core Scientific, Inc. (CORZ) tacked on 8.29%, while Northern Data AG (NB2) closed the group with a milder 3.51% lift. Despite Tuesday’s climb, the ten largest mining issues by market cap still reflect steep year‑to‑date (YTD) declines.

BTDR remains underwater, nursing a significant 56.71% YTD reduction. GLXY has surrendered 24.57% YTD, whereas CLSK has weathered the storm, slipping just 4.77%. WULF sits 53.18% lower, and MARA has fallen 16.15% over the same span. RIOT shows a 30.26% retreat, shadowed by HUT’s 42.45% slide since Jan. 1. IREN has declined 38.28%, CORZ has cratered 50.74%, and NB2 has logged a 38.35% pullback.

The pack of publicly listed miners would require several more forceful rallies to erase those YTD wounds, whereas COIN could manage the feat in a single run, and MSTR already stands comfortably above water. The upswing reflects Tuesday’s broad rebound across U.S. benchmarks, which erased Monday’s steep retreat amid optimism over a possible thaw in U.S.–China trade frictions and earnings that surpassed consensus. Consequently, crypto‑linked equities basked in a twin tailwind: Wall Street’s relief rally and the digital‑asset market’s late‑April upswell.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。