Original Title: Ethereum's Path Forward

Original Author: @YashasEdu

Original Translation: zhouzhou, BlockBeats

Editor's Note: Ethereum is facing fierce competition from new public chains like Solana, with prices not reaching new highs and activity declining. The Pectra upgrade and RISC-V proposal aim to enhance scalability, reduce costs, and maintain security and compatibility. Meanwhile, Solana is rapidly rising with high efficiency and low costs, challenging Ethereum's position.

The following is the original content (reorganized for better readability):

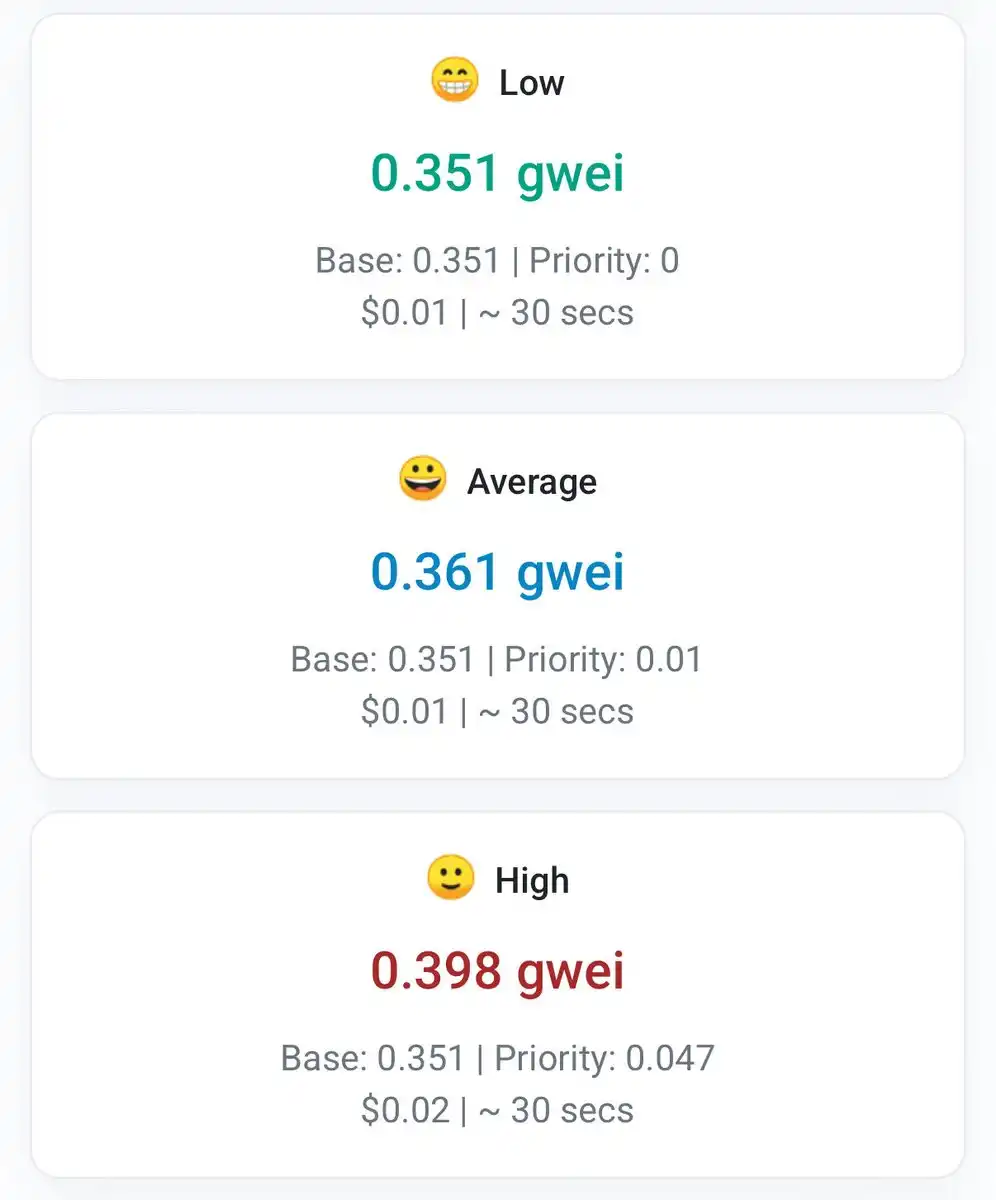

As of 2025, Ethereum's price has not reached new highs, and the ETH/BTC exchange rate has dropped to its lowest point in five years (0.02). Competing narratives like L2 and re-staking have not effectively increased its value. Meanwhile, transaction fees have also fallen to their lowest level since 2020, with an average of only $0.36 per transaction.

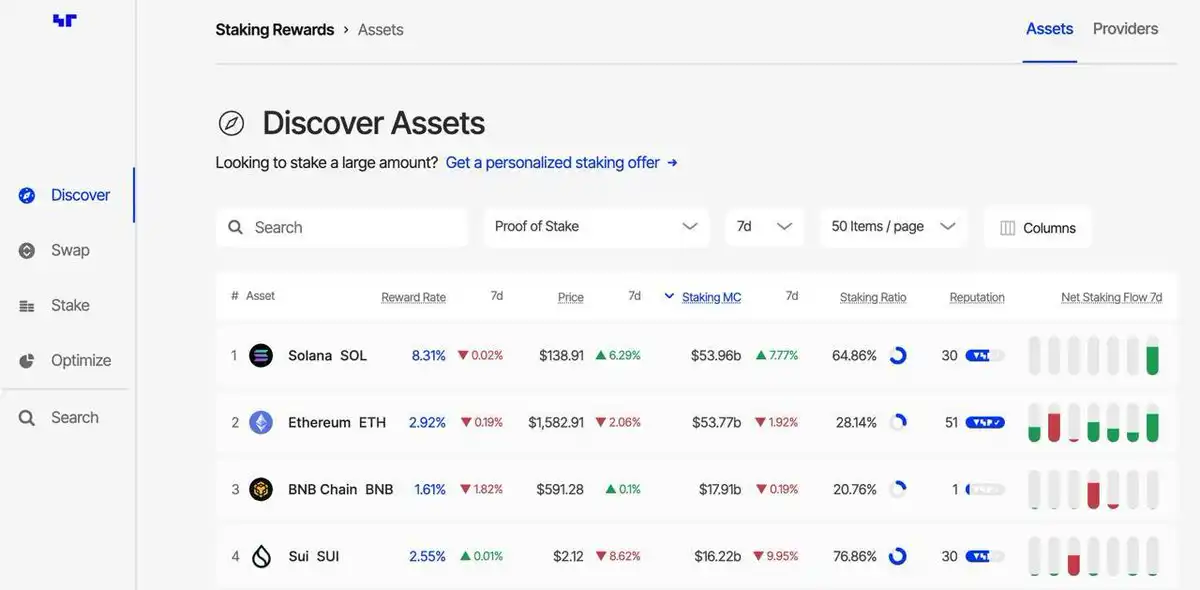

With the surge in @solana users (daily active users reaching 3.25 million, compared to Ethereum's 410,000), daily transaction volume is also far ahead (35.99 million vs. Ethereum's 1.13 million), many are starting to wonder: what will happen to this second-largest global link?

Two major upgrades may reshape Ethereum's future

- Upcoming Pectra upgrade

- Vitalik's proposal to replace the existing EVM with RISC-V technology

Pectra Upgrade (Expected to Launch on May 7, 2025)

The Pectra upgrade integrates two originally separate updates (the execution layer's "Prague" and the consensus layer's "Electra") into a comprehensive upgrade, including 11 EIPs, aimed at enhancing Ethereum's scalability, efficiency, and security.

Three Core Improvements of Pectra

1. Stronger Scalability

- Introduction of PeerDAS and Verkle Trees technology significantly enhances transaction processing capacity.

- Optimizes data storage and reduces node operating costs.

- Hash tree technology accelerates network synchronization speed.

2. Lower Transaction Costs

- Network congestion slows down, and gas fees are expected to drop significantly.

- EIP-7702 implements account abstraction, allowing users to pay gas fees with stablecoins instead of just ETH.

- Batch transactions and customizable security features improve wallet experience.

3. Improved Staking Mechanism

- EIP-7251 increases the maximum staking limit for each validator from 32 ETH to 2048 ETH, facilitating institutional participation and reducing operating costs.

- EIP-6110 moves the staking processing of validators to the execution layer, shortening the activation time for validators by about 48 hours.

RISC-V Proposal (Long-term Transformation?)

Vitalik recently proposed a more radical idea: replacing the Ethereum Virtual Machine (EVM) with RISC-V technology, which would fundamentally change how Ethereum runs smart contracts.

What is RISC-V?

RISC-V is an open-source instruction set architecture (simply put, a language that tells processors how to execute commands).

Unlike the Ethereum-exclusive EVM, RISC-V has advantages such as:

- Completely open-source and free.

- Widely used in mainstream computing hardware.

- More suitable for complex computations.

- More friendly to zero-knowledge proof (zk) technology.

Why Replace EVM?

- Significant Performance Improvement:

- RISC-V is expected to increase execution efficiency by 100 times.

- Transaction fees will drop significantly.

- Private transactions and cross-chain functionality will become more feasible.

- Better Support for ZK Technology:

- Current zkEVM systems must first convert EVM instructions to RISC-V before generating zero-knowledge proofs, which creates a computational burden of 100 to 1000 times.

- Native support for RISC-V will skip this conversion step.

For example, @SuccinctLabs' zkVM (SP1) can directly run smart contracts using RISC-V.

Summary: As the L2 narrative and re-staking enthusiasm have not driven ETH's performance, the Pectra upgrade and RISC-V plan may be key points for Ethereum's new breakthrough. The former is a practical update for short-term efficiency and cost reduction, while the latter represents a long-term revolution in the underlying structure of smart contracts.

- Continuity for Developers:

- Developers can still use Solidity or Vyper to write smart contracts.

- These languages only need to target RISC-V as a new backend.

- User experience will not have significant changes.

- Implementation Timeline:

This is not an immediate change. Vitalik's proposal represents a long-term vision, expected to:

Be implemented gradually over about 2-3 years.

Retain the old system (EVM interpreter) during the transition period.

Ultimately enable Ethereum to compete with efficient chains like Solana and Monad.

What Does This Mean for Ethereum's Future?

Ethereum is facing a survival challenge: maintaining its leading position as the primary smart contract platform while addressing the performance bottlenecks that emerging blockchains have successfully overcome.

The Pectra upgrade addresses urgent issues in staking, transaction costs, and user experience, while the RISC-V proposal focuses on Ethereum's fundamental execution architecture, potentially providing the technical foundation to compete with faster public chains while retaining its security and decentralization advantages.

For Users, These Changes Ultimately Mean

- Faster transaction processing speeds.

- Lower fees.

- More possibilities for new applications (such as on-chain AI, privacy features).

- Achieving better scalability without sacrificing security.

By advancing performance enhancement plans while maintaining compatibility with existing applications, Ethereum is attempting to evolve without abandoning its core principles and ecosystem.

However, whether these changes are sufficient to maintain its market position in the face of faster-growing competitors remains to be seen.

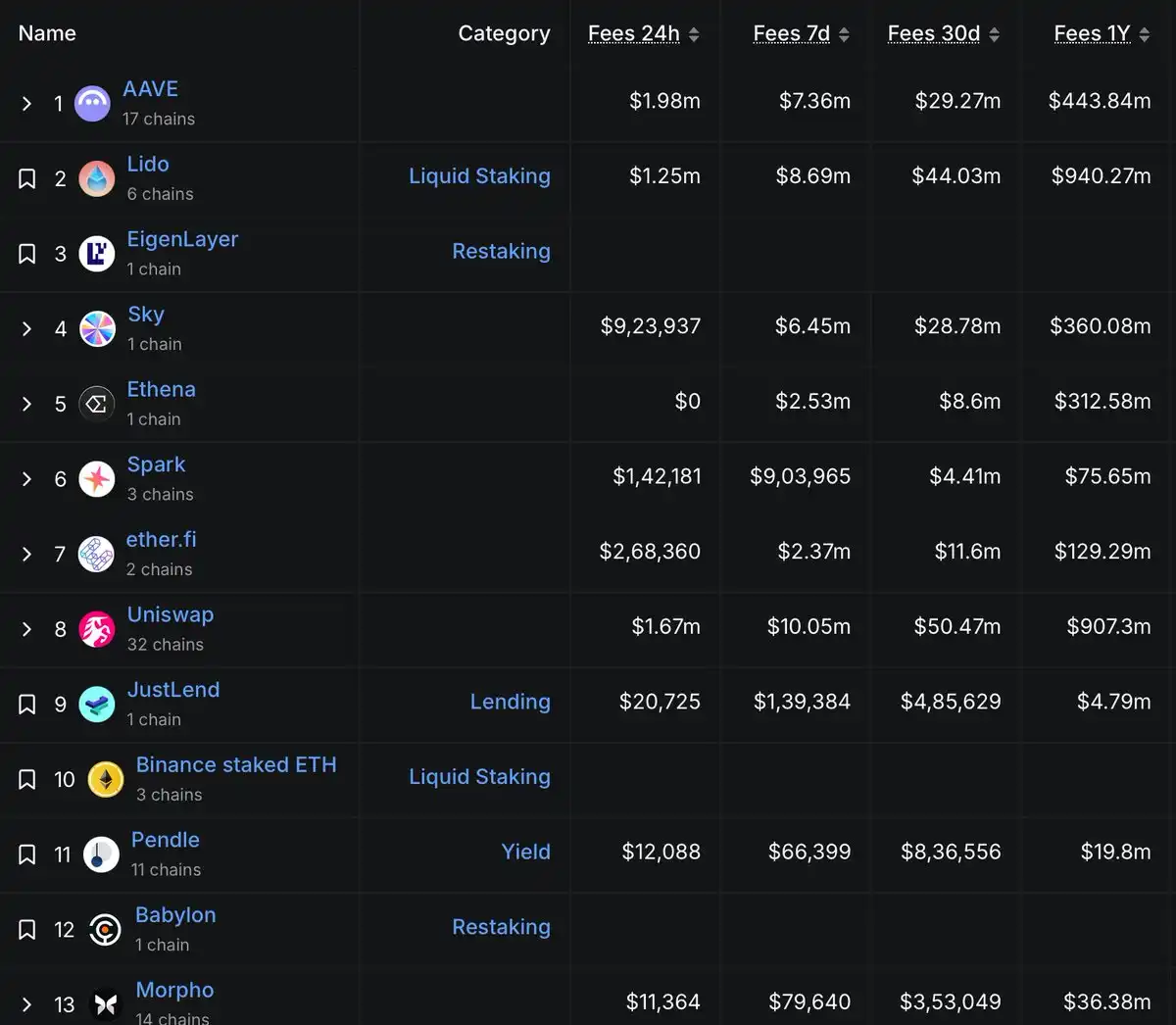

If not Ethereum, then who? Recent data shows that the competitive landscape is changing significantly. While the top ten DeFi protocols still operate on Ethereum, we have also seen warning signs that its leading advantage is weakening.

Projects like @jito_sol and @JupiterExchange are rapidly developing on other chains, while @convergeonchain (Ethena's RWA public chain) has completely left the Ethereum ecosystem. These dynamics indicate that Ethereum's leading position is not guaranteed, raising a critical question.

What technological breakthroughs does Ethereum still need to maintain competitiveness?

According to data from @nansen_ai, Solana recently surpassed Ethereum in total staking market value (an important milestone for the SOL ecosystem), showing that institutional confidence in Solana's staking infrastructure is rapidly increasing.

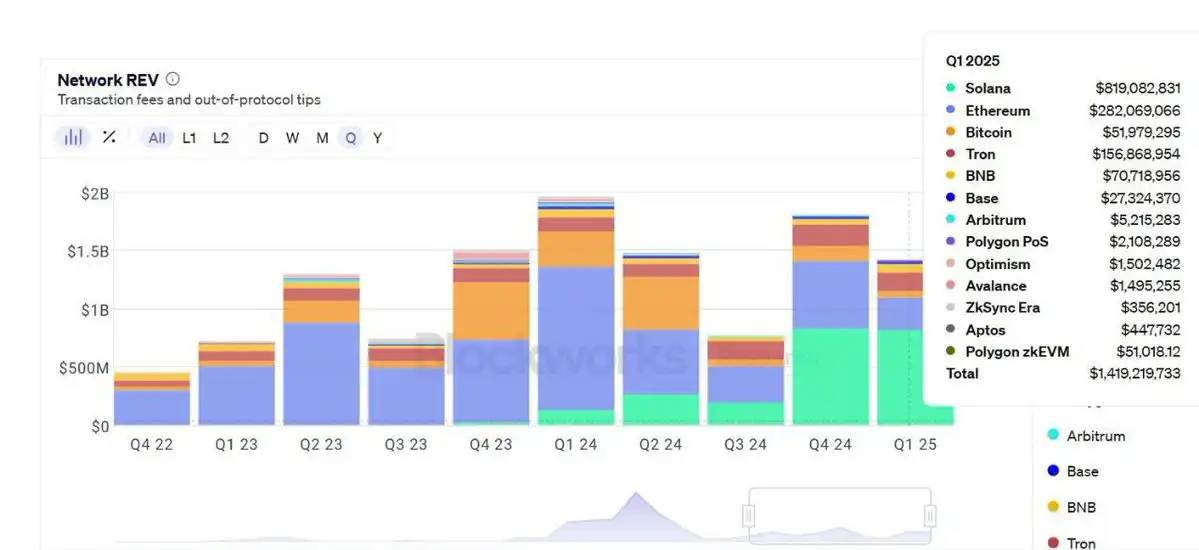

Meanwhile, Solana's revenue performance in the first quarter of 2025 surpassed all other public chains while still maintaining extremely low transaction fees. This combination of "high revenue + low user costs" showcases Solana's efficient economic model.

These developments undoubtedly put greater pressure on Ethereum's technical roadmap. Although the Pectra upgrade and potential RISC-V transformation aim to address Ethereum's scalability and cost issues, Solana continues to gain market attention and share with its existing architecture.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。