Source: Cointelegraph

Original: “Bitcoin Exchange Outflows Resemble 2023 Pattern, Whales Buying Amid Retail Panic Selling”

Key Points:

With the depletion of user inflows this year, Bitcoin (BTC) exchanges are signaling the end of the 2022 crypto bear market.

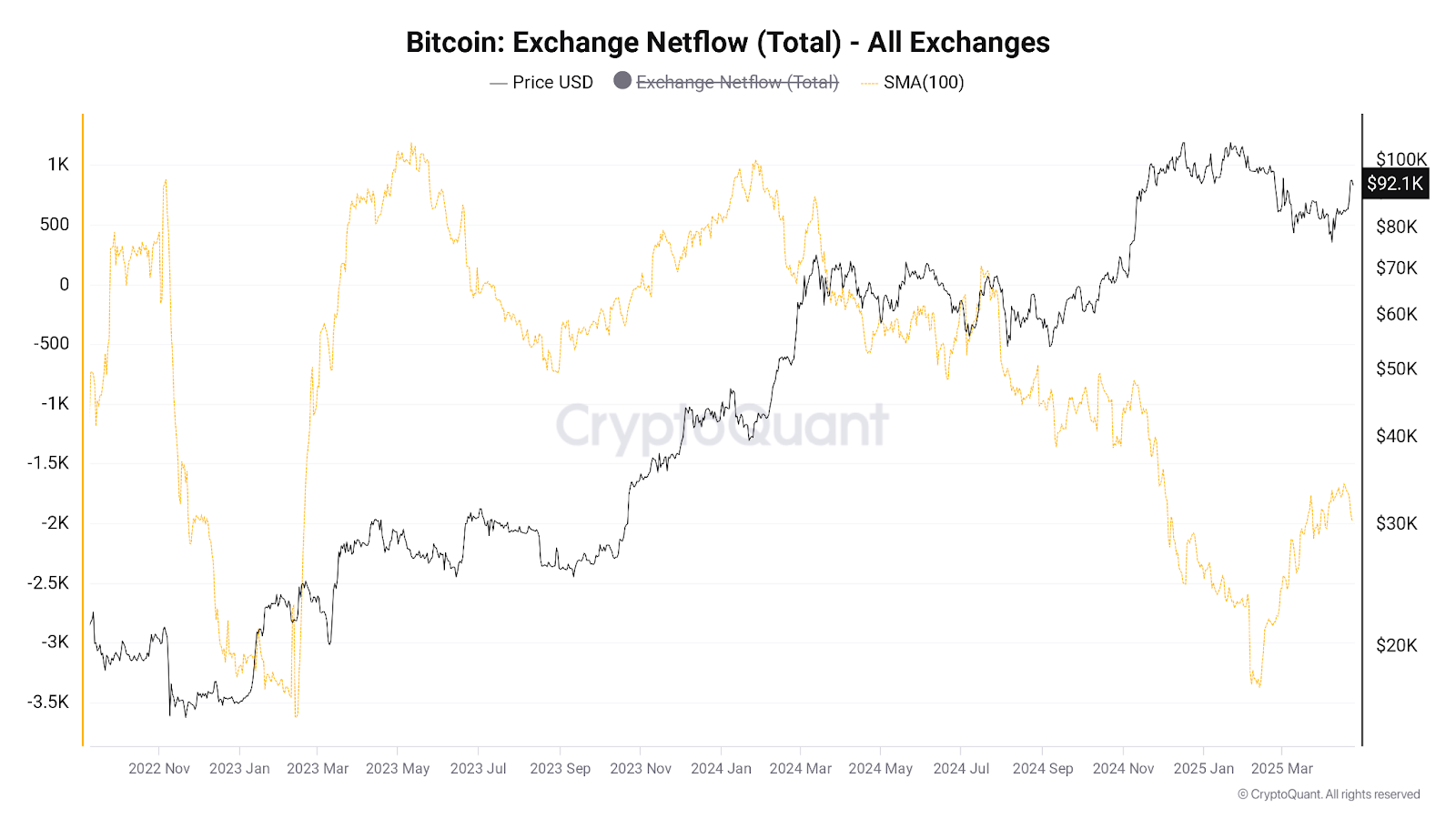

Data from blockchain analytics platform CryptoQuant shows that the average net flow of exchanges has reached a two-year high.

Bitcoin analysis focuses on “asset reaccumulation.”

The trading price of Bitcoin may be much higher than at the beginning of 2023, but the demand from exchange users for Bitcoin recalls the start of a bull market.

CryptoQuant revealed that the 100-day simple moving average (SMA) of net exchange flow recently hit a two-year low.

“This essentially indicates the highest outflow of Bitcoin from exchanges since that date,” contributor CryptoOnChain commented in their “Quicktake” blog post on April 23.

“A review of historical patterns suggests this may mean investors are reaccumulating assets.”

Bitcoin Exchange Network Traffic 100-day SMA Source: CryptoQuant

Negative net flow statistics indicate that outflows from exchanges exceed inflows, reflecting that user demand surpasses the willingness to send BTC to exchange accounts for potential sales.

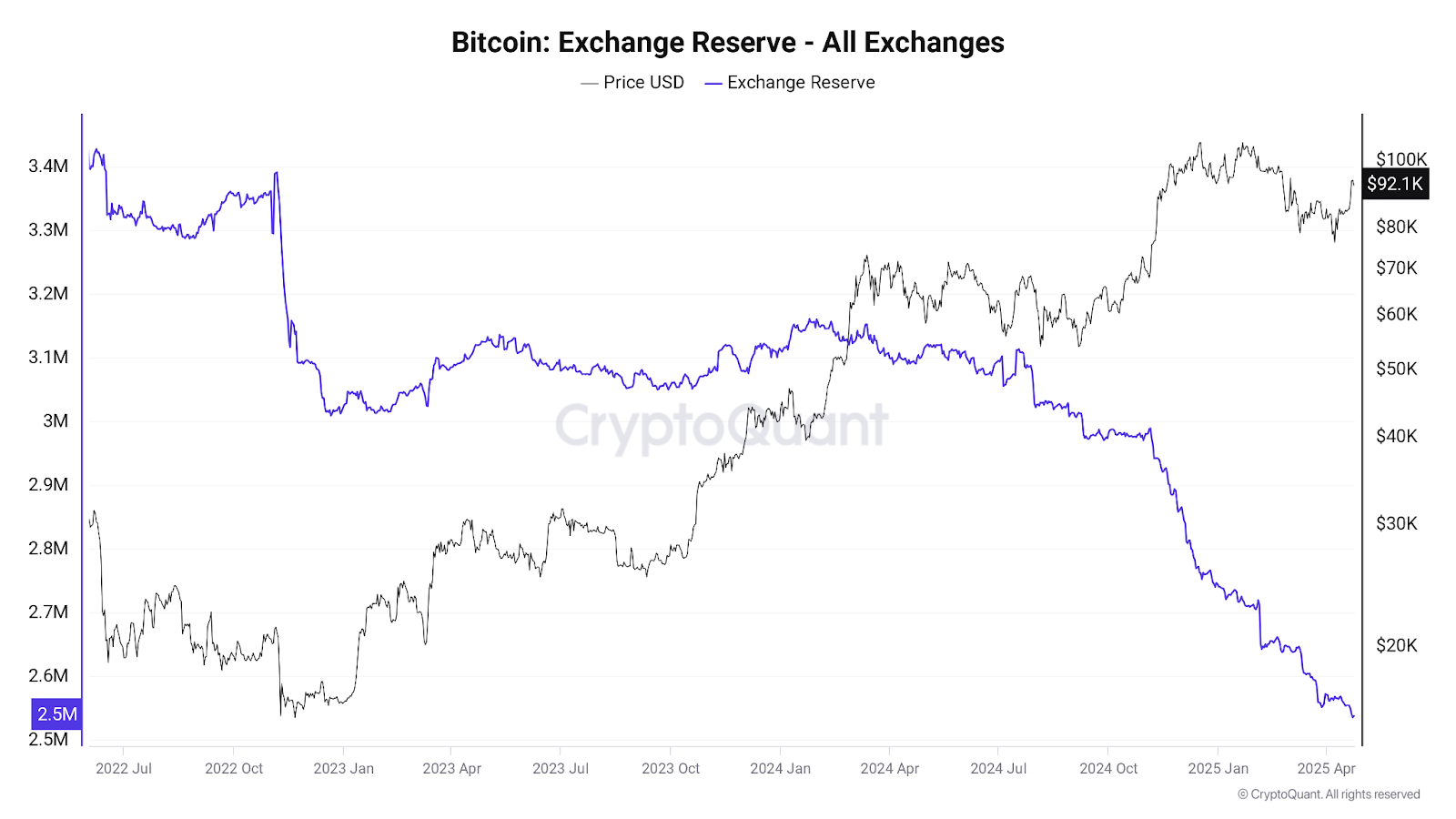

As reported by Cointelegraph, the overall BTC balance on exchanges is at its lowest level in years.

CryptoQuant shows that reserves reached 2.535 million BTC at the beginning of April, down more than 7% from 2.74 million BTC at the start of the year.

Bitcoin Exchange Reserves. Source: CryptoQuant

Whales Buying, Retail Investors Exiting

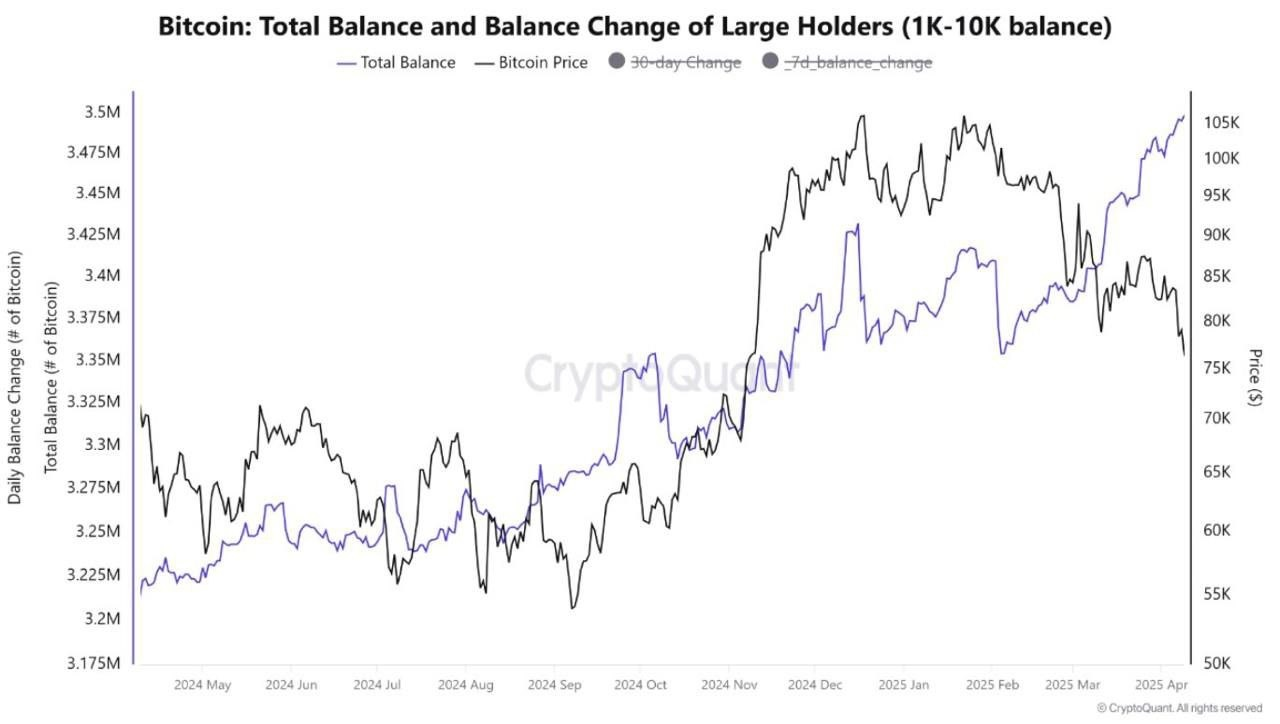

Elsewhere, while smaller retail investors are selling off, larger Bitcoin entities have been increasing their supply throughout April.

“Since March, despite the price drop, whales (1k-10k balance) have been actively accumulating,” cryptocurrency analyst Miles Deutscher pointed out on X this week, sharing data from CryptoQuant.

“Every time the price drops, whales accumulate amid retail panic selling.”

Bitcoin 1K BTC+ Balance Data Source: Miles Seutscher/X

Research firm Santiment reached a similar conclusion regarding entities holding at least 10 BTC, referring to them as “key stakeholders.”

According to X, “The main stakeholders in Bitcoin include wallets holding 10 to 10K BTC, which currently hold 67.77% of the total supply of the highest market cap asset in cryptocurrency.”

“During the volatility in April, these wallets continued to accumulate, having increased by over 53.6K BTC since March 22.”

Bitcoin 10 BTC+ Balance Data Source: Santiment/X

This article does not contain investment advice or recommendations. Every investment and trading involves risks, and readers should conduct their own research before making decisions.

Related Articles: Survey: Cryptocurrency Users Open to AI Managing Portfolios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。