Today, there isn't much content on the information front. Aside from the ongoing tug-of-war between China and the United States, the market has diverged significantly from many partners' expectations. It was previously said that when U.S. stocks fell, $BTC could not only resist the decline but also rise against the trend. However, today U.S. stocks continued to rise by over 2%, while Bitcoin entered a slight fluctuation range and did not continue to rise. I will discuss this issue in detail in tomorrow's weekly report.

The current rise in U.S. stocks is still due to the easing of tariffs and Trump's relief over firing Powell. Especially regarding the tariff issues with China, it has been a rollercoaster. Today, news broke that the U.S. would reduce tariffs on some automotive parts from China, followed by news that China would reduce tariffs on some semiconductors and parts from the U.S. The S&P and Nasdaq have recovered all the declines caused by tariffs since early April.

Tomorrow is the last trading day of the week, and next week we will start the game around GDP. In the latest data, GDPNow has once again lowered the U.S. GDP for the first quarter, and this data will be an important basis for determining the trading difficulty in May.

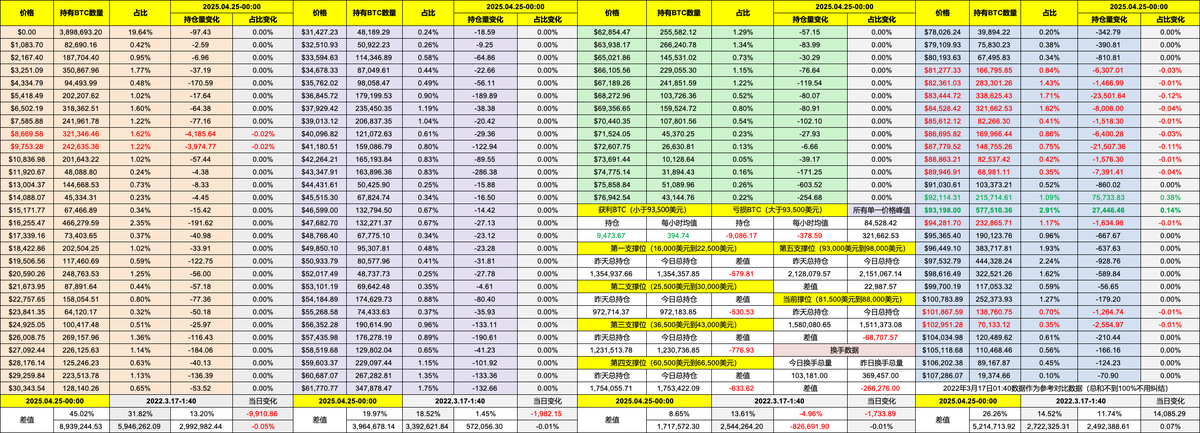

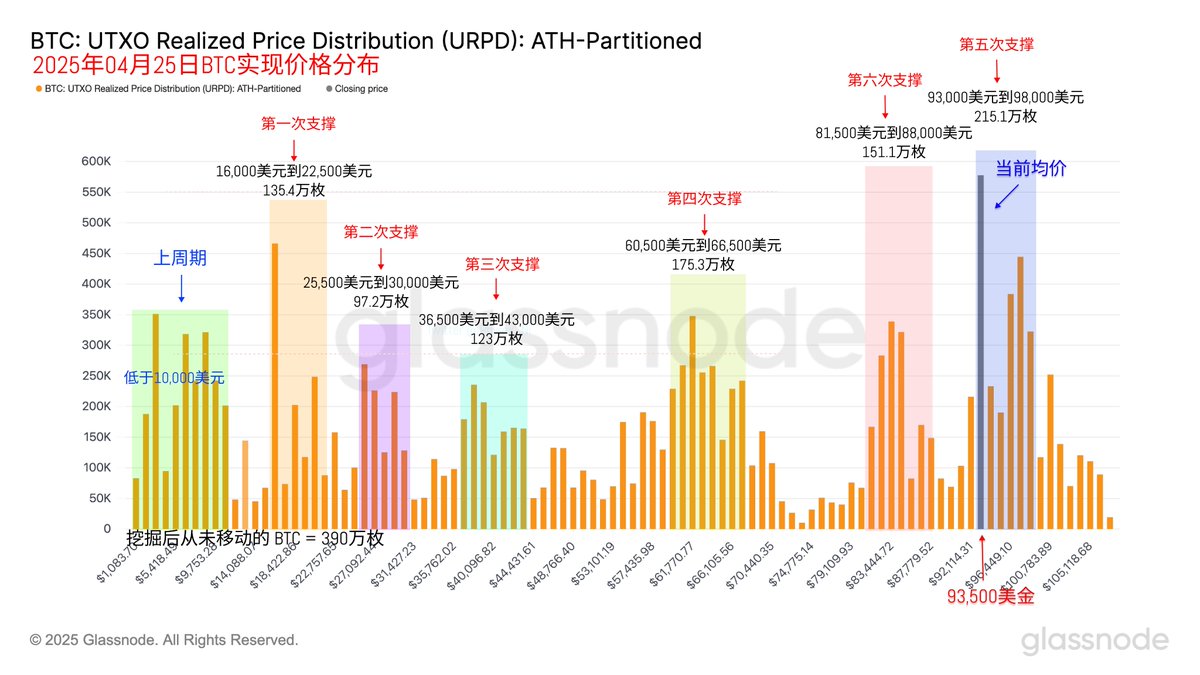

Returning to Bitcoin's data, although BTC's price has seen a slight pullback, investor sentiment remains very stable. The turnover rate has decreased, and investors who bought the dip in the last two days are accelerating their exit, while earlier investors and those at a loss remain calm and observant. The support level around $83,000 is showing signs of gradual collapse, mainly because it hasn't undergone a long period of cleansing.

On the contrary, the positions between $93,000 and $98,000 are gradually increasing. The stability of these investors is likely to be higher, especially those who have not exited even after the price reached around $74,000. Most of these investors should no longer be short-term investors.

We've been discussing this topic for a long time, and after nearly three months, we have returned to a stable fluctuation range. This is the adsorption effect of on-chain data; as long as the concentrated chips at this position do not collapse, returning to this price range is only a matter of time.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。