Bitcoin ETFs Extend Winning Streak as Ether ETFs Rebound With $63 Million Boost

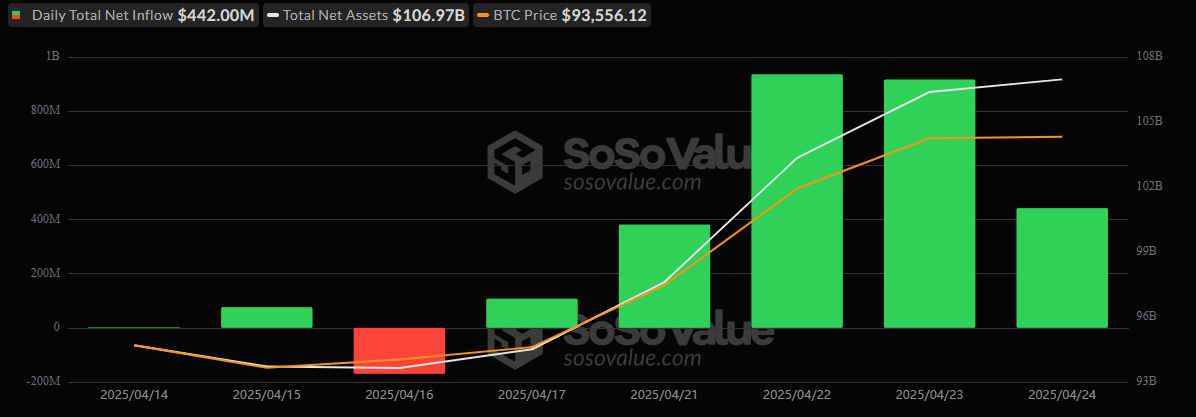

The flow of capital into crypto ETFs isn’t slowing down. Thursday, April 24, brought another wave of investor enthusiasm as U.S. spot bitcoin ETFs locked in $442 million in net inflows, marking the fifth consecutive day of gains.

Once again, Blackrock’s IBIT took the lion’s share with $327.32 million flowing into the fund. Ark 21shares’ ARKB followed with an impressive $97.02 million addition. Bitwise’s BITB and Invesco’s BTCO rounded out the list, drawing in $10.18 million and $7.48 million, respectively. Notably, no bitcoin ETF recorded any outflows.

Total value traded came in at $2.03 billion, and total net assets edged up to $106.97 billion, bringing the $110 billion mark within reach.

Ether ETFs also had a bright day, recording a $63.49 million net inflow after Wednesday’s stumble. Blackrock’s ETHA led the rebound with a $40.03 million inflow. Grayscale’s ETH contributed $18.28 million, while Bitwise’s ETHW, 21shares’ CETH, and Vaneck’s ETHV chipped in $5.06 million, $4.14 million, and $2.58 million, respectively.

The only outflow came from Grayscale’s ETHE, which saw $6.6 million exit. Trading volume for ether ETFs reached $300.99 million, and net assets held steady at $5.92 billion.

With both bitcoin and ether ETFs seeing renewed interest, market sentiment appears to be tilting firmly back toward accumulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。