"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past seven days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

The crypto market remains sluggish; where are the marginal buyers?

In this cycle, the market has reached saturation not only in terms of funding but also in attention. Across every user group, the trend is clear: participation is declining, confidence is weakening, and retail investors are leaving. Nowadays, centralized exchanges cannot stimulate new demand even if prices soar 100 times.

If the next marginal buyers do not come from crypto-native speculators, they may emerge from structural shifts driven by policy, necessity, and real demand, focusing on stablecoins, compliant channels, and RWA.

The true magic of technology is rarely reflected in the initial invention; rather, it lies in the ecosystem that emerges around it. It can be viewed as compound growth. While the pioneers of creating new things grab headlines and attract venture capital, it is often the second wave of builders who can extract the most value—those who discover untapped potential within existing foundations. They attempt to solve immediate problems. In the process, they unlock possibilities far beyond the original vision.

Returning to the crypto space, the author believes that Eigenlayer, Pendle, and Pump.fun+Raydium belong to the category of "second-order explosion" compound innovation products.

Why are crypto VCs generally not making money in this cycle?

The performance of crypto VCs in this cycle has been disappointing. Many projects are overvalued, token prices have collapsed in the secondary market, and VCs have been pushed to the pillory by the community and retail investors, with exit channels blocked.

VCs must return to fundamentals. The future winners will be those projects with real application scenarios, product-market fit, and sustainable revenue models.

Related reading: "Bitcoin bull return? Primary investors have already died from lock-up."

Binance Wallet IDO project survival report

The valuation of TGE does not reflect the "future value of the project," but rather a comprehensive mapping of current market liquidity, expected listings, narrative strength, and market-making systems. The traffic effect of Binance Wallet IDO remains strong, but controlling the pace is key.

The TGE model is undergoing deleveraging, and Wallet IDO projects generally start at low valuations. Binance Wallet IDO does not equate to listing on Binance. What Binance Wallet IDO offers is more like a trial operation ticket to enter the Binance traffic ecosystem; whether it can "turn positive" and enter the spot market still depends on the project's performance data, user feedback, and internal evaluations by the Binance trading team after launch. Project teams should view it as a "rehearsal before the main stage" and prepare adequately for subsequent listings and secondary liquidity support. Although the price fluctuated significantly on the first day, the project's medium to long-term performance relies more on continuous operational capability, market management strategies, and a clear long-term development plan.

Overall, Binance Wallet IDO serves as a "value filter" and a narrative validation.

KOL: How I made $100,000 through prediction market arbitrage

In theory, the sum of all outcome probabilities should be 100%, but in reality, it often reaches 110%. This is because platforms typically charge hidden fees ("excess premiums"), and odds are determined by users, leading to a lot of inefficient pricing.

The core rule for determining whether an arbitrage opportunity exists is: find the same event on different platforms; choose the lowest price for each outcome; if the total price is below $1, arbitrage can be executed; profit can be realized before the outcome is clear.

Note: Prediction market arbitrage is a delayed game; after price discrepancies occur, there is usually only a few minutes' time window, so automate this part, ensure available funds across platforms, and be clear about fees.

Finding potential Alpha: A roundup of 10 early projects without tokens

Burve, Multipli.fi, ambient.xyz, Cline, Optimex, Converge, Hubble Protocol, Monadic DNA, Splenium, Metadrip.

Airdrop Opportunities and Interaction Guides

Survival in the bear market: Ten early projects worth applying for

Interaction tutorial: The idle earning project Orochi, which raised $12 million, the next Grass?

Backpack+AI, even coding novices can script low-risk profits

Meme

Data perspective: After SOL gradually warms up, the trading status of Memecoins

Recently, the survival difficulty in the "trench" has become an open secret, with retained players mostly being "veterans" who have endured the winter challenges of low SOL prices, shrinking trading volumes, and user losses.

The vitality of the Memecoin sector depends on the injection of new liquidity, initially sourced from seasoned crypto investors who were trapped by losses in mainstream altcoins and are now seeking quick profit opportunities. As the sector expands, retail investors are also beginning to venture into this high-risk, high-reward "deep water zone."

Compared to DeFi tokens that require meticulous operation and deep protocol understanding, Memecoins, with their low barriers to entry, high asymmetric returns (i.e., low investment with high return potential), and infinite creative space for tokenization (people/content/events/memes, etc.), remain the preferred vehicle for speculative activities. Solana firmly holds the dealer's seat in the "crypto casino."

The end of on-chain snipers? Understanding the new launch mechanism Genesis of Virtuals Protocol

According to the official description, Genesis Launch is a protocol layer primitive built specifically for the allocation of AI agent tokens, upgrading token launches to a proof system. Its three core features include: a contribution-based access system, on-chain transparent and traceable allocation logic, and an automatic refund mechanism to protect participants' rights.

The Genesis launch mechanism of Virtuals Protocol, with its contribution-oriented allocation model and dynamic adjustment strategy, has built a more transparent and efficient launch platform for AI agent projects and participants within its ecosystem, significantly reducing market manipulation risks and driving the sustainable and healthy development of the Virtuals ecosystem.

Even large holders cannot withstand the crash; 86.9% have cleared their positions; some made a profit of $25 million while others were cut at $33.66 million.

Although Trump's "dinner benefit" temporarily injected rebound momentum into the token, the high concentration of chips and the shadow of suspected manipulation by the project team linger. The current TRUMP token seems to have found a breather after the bad news has been exhausted, but its fate remains tightly bound to the resonance of celebrity effects and market sentiment. For retail investors, this rollercoaster-like market undoubtedly serves as a risk education lesson: in the battlefield of MEME coins lacking fundamental support, even "top-tier traffic" endorsements may just be a glamorous facade for capital harvesting.

Also recommended: "The Pope is gone, does LUCE welcome a new life?."

Bitcoin Ecosystem

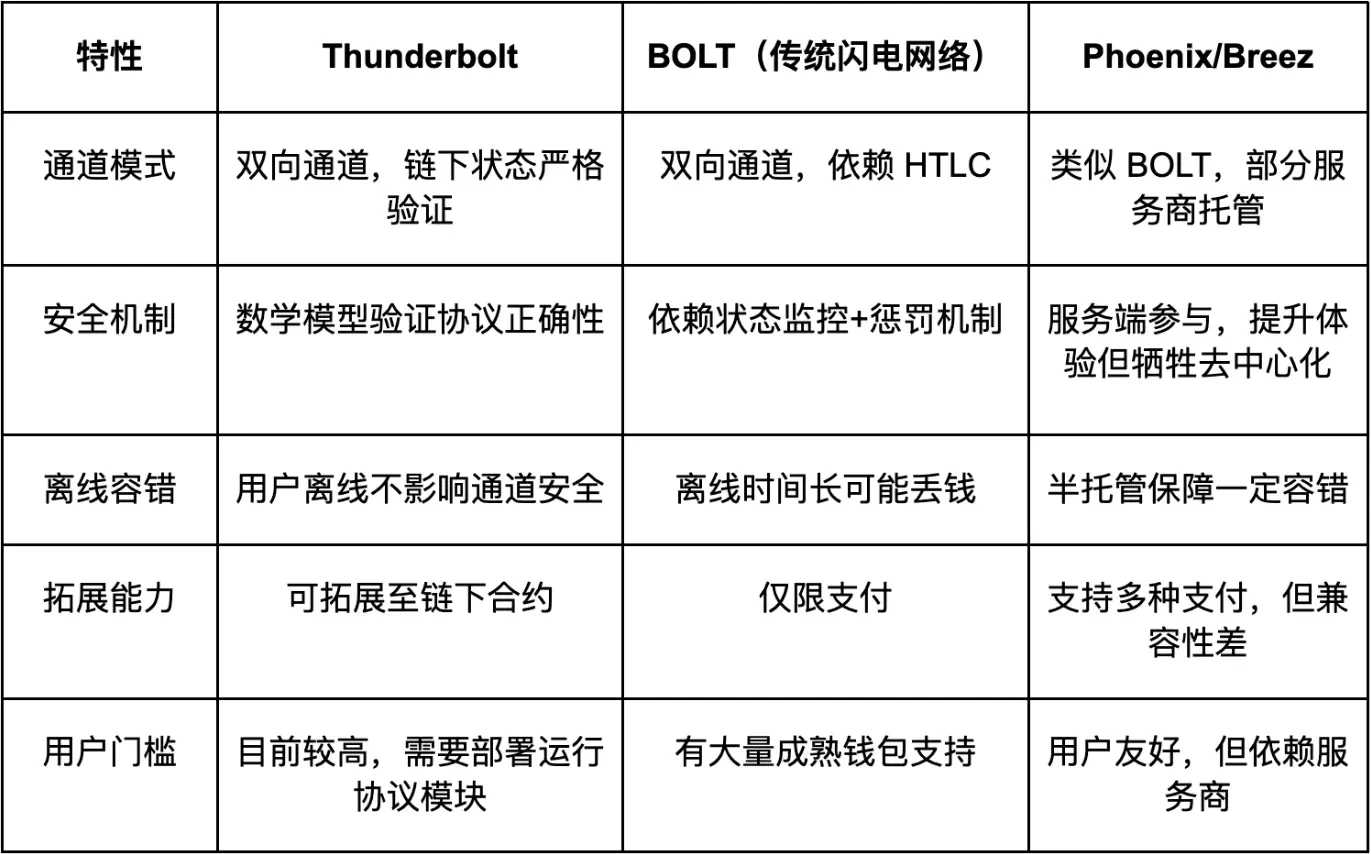

Bitcoin Thunderbolt is a soft fork upgrade method based on the Bitcoin base layer. It does not rely on second-layer networks or cross-chain bridges as a compromise but directly modifies the protocol level of the Bitcoin main chain, fundamentally enhancing Bitcoin's scalability, transaction performance, and programmability.

The main advantages of Thunderbolt lie in "security" and "theoretical completeness." It is one of the few that can prove: the protocol design can be proven to be secure; malicious users cannot profit unilaterally in any state. However, its disadvantages are also evident: deployment complexity, main chain compatibility, and lack of ecological support.

Also recommended: "BRC2.0 debut: What is BRC2.0?."

Ethereum and Scalability

Ethereum is facing severe challenges: not only is there a shift in market perception of Web3.0, but it is also contending with fierce competition from emerging platforms like Solana for the remaining market share. The fragmentation of Layer 2, erosion of value attribution, dilution of ecological control, and lack of leadership further weaken Ethereum's user experience and economic value, shaking its influence as the discourse around second-layer networks grows. These factors ultimately led to one of the most severe price corrections in ETH's history.

Ethereum must immediately address the following core challenges: first, it needs to enforce robust L2 interoperability standards to alleviate fragmentation and retain the seamless composability that the mainnet once defined; second, it must shift from the old model of "aligned with ETH" to an "ETH-led" ecological model, prioritizing L1 scaling and Ethereum-native Rollups to re-establish control and maximize ETH's value capture; finally, leadership should evolve towards a performance-driven decision-making approach, abandoning "trustworthy neutrality" and unifying key infrastructure under the ETH token system.

Is Base "stealing" Ethereum's GDP?

Base has quickly started through the L2 model and is currently achieving ideal returns, but it has also bound itself to an uncontrollable Ethereum scaling route, potentially facing "vendor lock-in" and technical debt risks.

Ethereum seems to be gaining enterprise-level clients by sacrificing L1 fees, creating new demand for ETH and a better user experience. However, the sustainability of this long-term economic relationship is questionable—scenario analysis shows that scaling bottlenecks may persist. If L2 cannot expand rapidly, it may need to increase ETH issuance to maintain validator yields (after EIP 4844, ETH supply has shifted from deflationary to potentially exceeding BTC).

We believe Base is satisfied with the current situation, but if Ethereum's blob expansion falters, it may seek alternatives like Celestia. Ethereum urgently needs to shift its culture from "value alignment" to an enterprise-oriented "security as a service" business model. In the short term, the structural decline of Ethereum's fundamentals will continue. Although traditional finance going on-chain may improve market sentiment, it lacks fundamental improvement catalysts.

Also recommended: "Leaping over the Ethereum Asylum."

Multi-Ecosystem and Cross-Chain

On April 23, the Solana Foundation launched a new policy regarding the Solana Foundation Delegation Program (SFDP). For each new validator added, if certain validators have been eligible for Solana Foundation delegation on the mainnet for at least 18 months and have less than 1,000 SOL staked outside of the Solana Foundation delegation, three of them will be removed. The aim of these policies is to enhance validator independence by reducing their reliance on the foundation. However, the ultimate result may still be the optimization of a large number of small and medium-sized nodes.

CeFi & DeFi

In-Depth Comparison of the Top Ten Crypto Payment Cards: From Application Process to Fees

The author, based on extensive information gathering and user feedback from social platforms, deeply dissects the ten most representative crypto payment cards in the current market, including Bybit, Bitget, SafePal, Morph, Infini, Coinbase, Nexo, MetaMask, 1inch, and RedotPay, systematically organizing and horizontally comparing their application thresholds, supported assets, fee structures, cashback mechanisms, and on-chain interaction capabilities.

A New Standard for Global Currency Flow? A Quick Look at Circle's Cross-Border Payment Network CPN

Circle is expected to launch the stablecoin-driven cross-border payment network Circle Payments Network (CPN) in May. CPN aims to achieve faster and lower-cost international remittances by utilizing stablecoins like USDC and EURC, as well as other regulated digital currencies, for real-time settlement among participants such as banks, payment providers, virtual asset service providers, and digital wallets.

Why Can't Any Web3 Project Escape DEX? A Five-Year Development History Tells You the Answer

Today, as we see DEX capable of supporting project cold starts, liquidity governance, cross-chain routing, launch structures, and even becoming the entry point for users to understand finance, we should instead look back and realize: all of this is not the result of some great design by a project, but rather a product of the self-evolution of the entire on-chain structure.

DEX has not "actively upgraded"; it simply continues to respond to changes in surrounding systems, continuously filling structural gaps. It has neither written a solid plan nor drawn clear boundaries, yet it has gradually transformed itself into a connector and initiator of the ecosystem through AMM, aggregators, ZK identities, and governance bindings. It has never left trading, but it is no longer solely for trading. It has never exited the center, yet it has slowly retreated into the structure. The evolution of DEX has never been a one-time functional leap, but an ongoing protocol reconstruction.

In this process, what it has truly preserved is still that initial essence: not tokens, not gas fees, and not slippage, but—users can freely participate, collaborate, and shape their own financial order on-chain.

Without Interest Rate Perpetuals, Will DeFi Ever Be Complete?

DeFi lacks interest rate perpetual contract tools similar to CME, leading to significant interest rate fluctuations and an inability to hedge risks. Introducing interest rate perps can help both borrowers and lenders lock in rates, achieve arbitrage and risk management, and promote the integration of DeFi with TradFi, enhancing market efficiency and stability.

From Restaking to Stablecoins to Traditional Finance, Pendle is Eating Up the Entire DeFi

The Pendle project itself is well-structured, with transparent data and reasonable token distribution. The team's background and technical capabilities are excellent, with core members remaining stable for a long time, possessing the ability to independently advance complex systems. In terms of token structure, although the tokens of the team and foundation have all been unlocked, the overall selling pace is rationally restrained, demonstrating good long-termism. Pendle excels in "trustworthiness" and "medium to long-term delivery capability," making it a typical "hardcore" DeFi project.

From a market potential perspective, the on-chain interest rate market Pendle occupies is far from fully developed, with potential markets including: stablecoin interest rate spreads, LRT, RWA, and funding rates, potentially reaching hundreds of billions of dollars. Currently, Pendle has dominated the Ethereum ecosystem and is expanding to Solana, TON, Hyperliquid, and others. As a protocol-level platform at the critical point of the on-chain interest rate market explosion, Pendle has extremely high long-term growth potential, but its development still heavily relies on the continuous expansion of the overall scale of interest rate products.

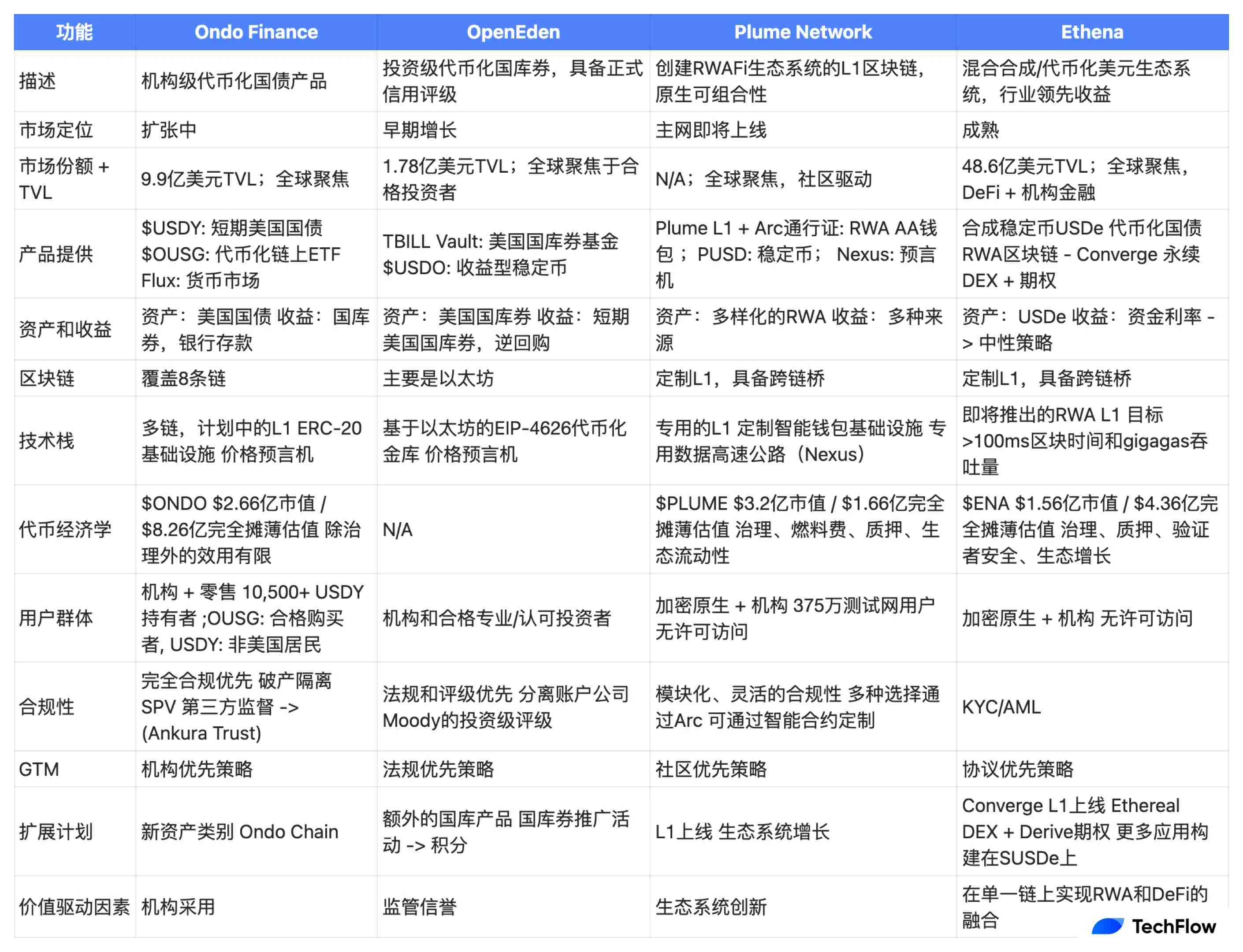

Comprehensive Overview of Four Popular RWA Protocols: Ondo, OpenEden, Plume, and Ethena

Also recommended: "In-Depth Layout Guide: 10 RWA Projects to Watch in 2025" and "Lazy Financial Management Guide: Unichain Incentive Program Launched; Superform Confirms Token Issuance (April 21)."

Web3 & AI

Crypto AI Second Half: Launchpad War, Ecological Empowerment, and MCP Concept

Launchpads are exploding, with Meme Launchpad and AI Launchpad each taking half of the market. The competition for Meme Launchpad is essentially a contest of "ecosystem + creators."

The two most representative projects from the last cycle, Virtuals & ai16z, are also the most diligent and consistently updated project representatives in this round: Virtuals has launched VPN, ACP, Points, and Genesis; ai16z is busy with ElizaOS V2, AUTOFUN, ai16z's new economic model, and Spartan V2.

From Bubble to Rebirth: The Second Half Competition of CryptoAI and Trillion-Level Opportunities

Currently, popular projects in the market can be categorized into several types. The first includes development tools, such as frameworks, AI Coplit programming tools, and MCP infrastructure. The second includes consumer AI applications, such as AI Agents, games, DeFAI "Alpha signals, funds, automated LPs," and GambleFAI. The third includes decentralized AI infrastructure, such as decentralized computing, verification, and storage. The first two types are usually more favored by retail investors, while the third is the preferred choice for VCs or investors, as these projects typically require quite high valuations to sustain.

New Focus in the AI Track? A Review of Eight Major Web3 + MCP Projects

The article introduces DARK, SkyAI, Solix, Open MCP, HighKey, DAMN.FUN, DeMCP, and UnifAI.

Most projects are in early development, and the Web3 + MCP overall remains in the stage of conceptual hype.

Weekly Hot Topics Recap

In the past week, Trump stated that he has no intention of firing Federal Reserve Chairman Powell, leading to a warming market sentiment, with BTC breaking through $90,000; foreign media reported that Trump may significantly reduce tariffs on China; opinions suggest that if Trump wants to lower interest rates, he must fire the entire Federal Reserve Board; the son of the U.S. Secretary of Commerce is leading the launch of a $3 billion cryptocurrency investment plan; Paul Atkins has been appointed as the Chairman of the U.S. SEC, and is expected to implement applications for staking spot Ethereum ETFs and altcoin ETFs; a “TRUMP DINNER” banquet for large holders of TRUMP tokens will be held on May 22; a U.S. senator stated that TRUMP coins may be the most blatant act of corruption by a U.S. president in history;

In addition, regarding policies and the macro market, Musk stated that he will return to Tesla in May, and the time allocated to the DOGE department will be significantly reduced;

In terms of opinions and statements, The Wall Street Journal reported that a script has leaked about Trump conspiring to remove Powell, with potential successors for the Federal Reserve emerging; Powell previously stated that he would not resign voluntarily, and his term as Federal Reserve Chairman will expire in May 2026; Trump stated, “Whoever has gold dominates”; Federal Reserve Kashkari remarked that in developed economies, cryptocurrency is useless; Glassnode reported that Bitcoin high-position builders have "locked in" and shifted to long-term holding, which usually indicates confirmation of a bear market; Vitalik proposed replacing EVM language with RISC-V to improve execution efficiency (full text); CZ stated that if Binance fully discloses the details of the KiloEx support incident, it would teach hackers how to avoid detection; He Yi stated that he does not participate in any project investments, with the only project he is involved in being BNB; ai16z founder stated that the native token of auto.fun is ai16z; Slow Mist's Yu Sin noted that Ethereum Gas is operating at a low level, making it the best time to batch cancel risk authorizations;

Regarding institutions, large companies, and leading projects, Binance Alpha has launched a points system to assess TGE and airdrop participation eligibility; Bitget experienced anomalies with VOXEL contracts; Gate.io displayed anomalies during contract service upgrades; Synthetix founder stated that a sUSD staking mechanism has been implemented to address the sUSD de-pegging issue (interpretation); Movement announced a third-party review of previous market maker anomalies; Zora launched its native token ZORA (interpretation); the lending protocol Dolomite announced airdrop details, with airdrops accounting for 20%; Balance initiated TGE and opened airdrop claims; Hyperlane opened airdrop claims; Initia announced the mainnet launch and opened airdrop claims;

In terms of data, cryptocurrency exchange trading volume has dropped to a six-month low, with spot trading accounting for a new low in the phase; Raydium LaunchLab created 3,760 tokens in its first week, with a graduation rate of 1.12%;

In terms of security, Slow Mist's CISO reported that MCP has vulnerabilities, and conversations between users and AI may be leaked to malicious servers; North Korean hackers Lazarus Group are using U.S. shell companies to recruit to lure cryptocurrency developers; KiloEx announced a security incident user compensation plan, establishing a 10% additional yield activity for staked users… Well, it has been another eventful week.

Attached is the Weekly Editor's Picks series portal.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。