Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

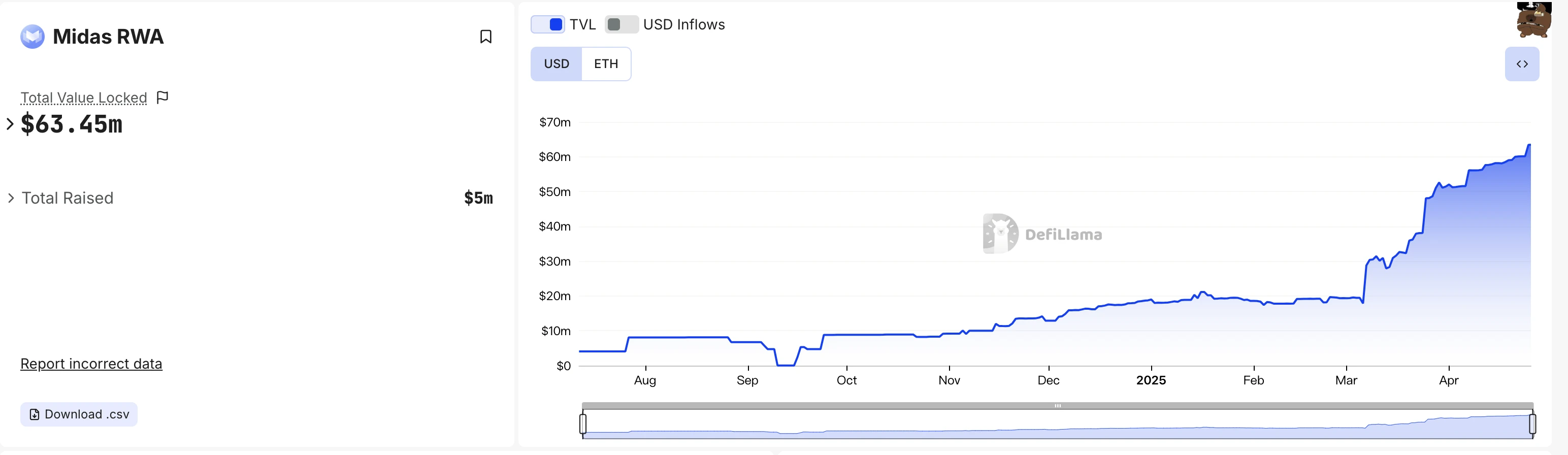

According to the latest data from Defillama, the Midas protocol's Total Value Locked (TVL) has surpassed $60 million, setting a new historical high. As an innovative project combining DeFi and RWA, Midas provides on-chain investment opportunities for institutional-grade assets through blockchain technology. The achievements in data reflect its rapid rise in the asset tokenization field, but unfortunately, this has not garnered widespread attention.

In this article, Odaily Planet Daily will comprehensively analyze the core vision, leadership team, and financing background of the Midas project, while providing ordinary users with a clear participation guide, covering task requirements, reward mechanisms, and operational steps, helping readers gain a deeper understanding of the project and seize interaction opportunities.

Midas: Building a Fast Overpass Between TradFi and DeFi

Vision

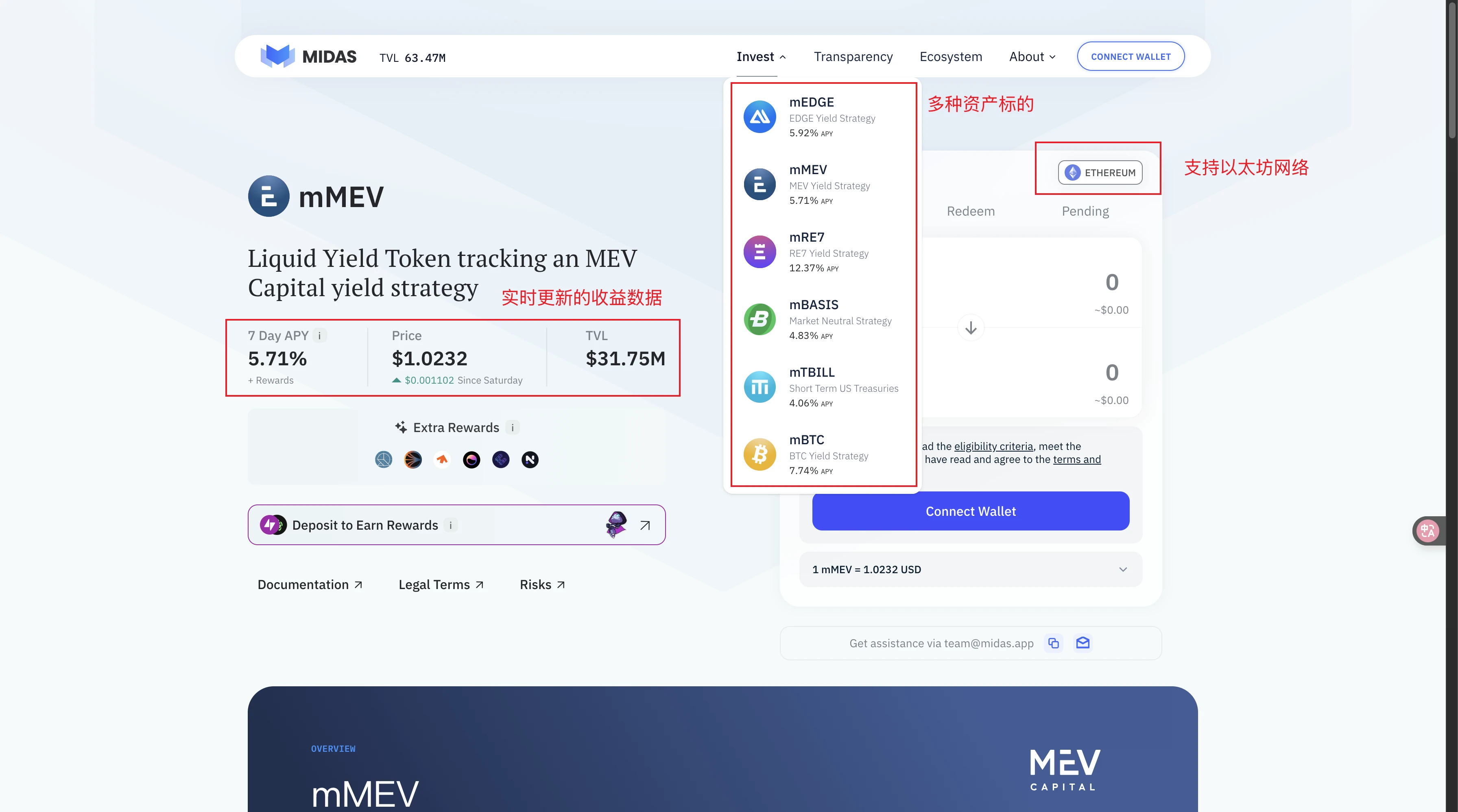

Midas is an asset tokenization protocol dedicated to transforming real-world assets (RWA) into tradable ERC-20 tokens through blockchain technology, thereby breaking down the barriers between TradFi and DeFi. Its core vision is to build the financial infrastructure of the internet era, providing global investors with transparent, secure, and efficient access to institutional-grade financial products. The project features mTBILL (a token tracking short-term U.S. Treasury bonds) as its flagship product, combined with other tokenized assets such as mBASIS, mMEV, and mEDGE, covering various investment strategies.

Launched on December 1, 2023, Midas aims to lower the high entry barriers of traditional finance through the decentralized characteristics of blockchain while maintaining compliance and security. Its product design emphasizes transparency, regulatory compliance, and clarity of investor rights, striving to establish a trustworthy financial service framework within the DeFi ecosystem, particularly targeting non-U.S. and non-U.K. investors.

Team

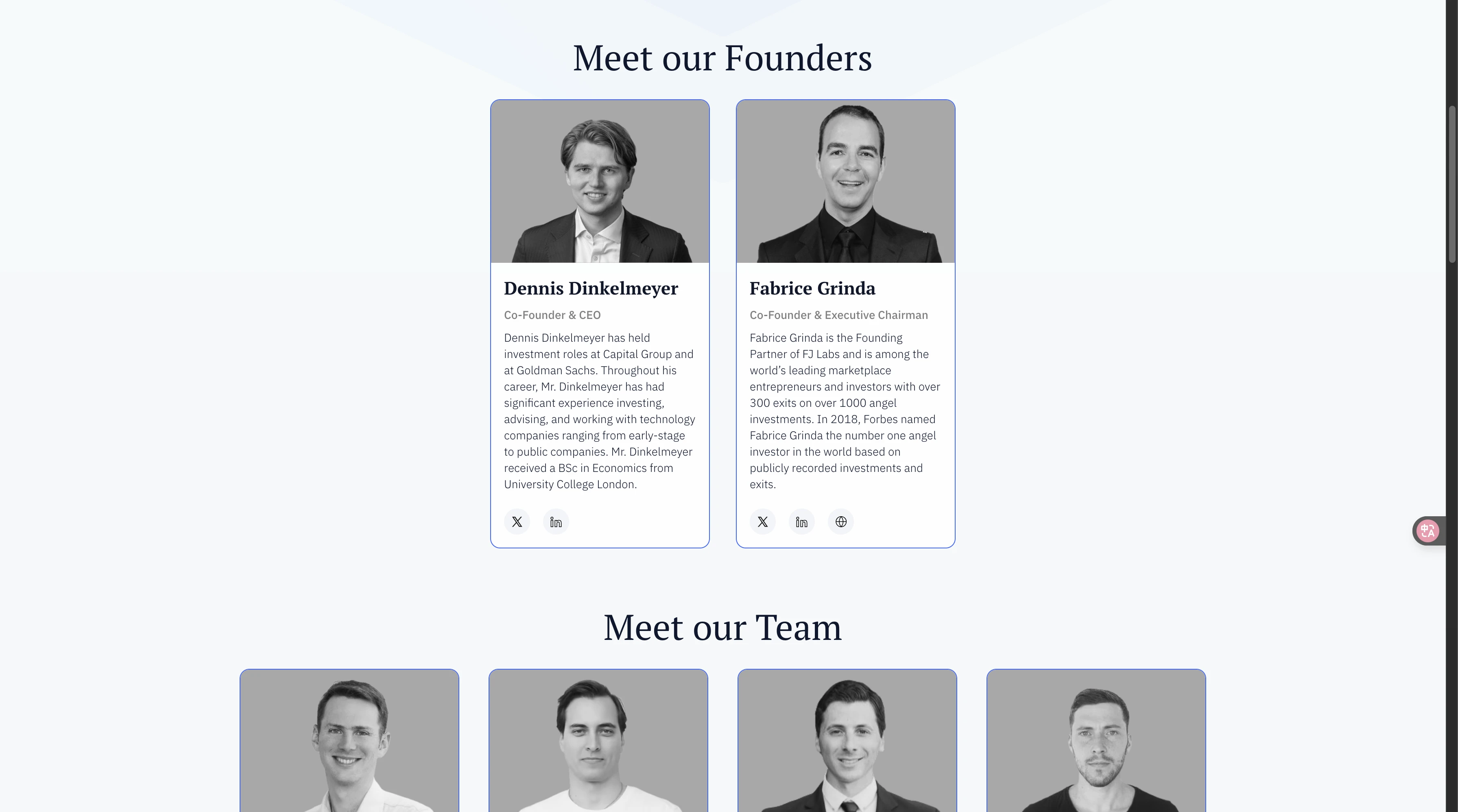

The MidasRWA team consists of experienced professionals:

Dennis Dinkelmeyer, Co-founder and CEO, previously worked at Goldman Sachs and Capital Group, with extensive experience in the financial industry. LinkedIn page: Dennis Dinkelmeyer.

Fabrice Grinda, Co-founder and Executive Chairman, co-founded OLX and supported over 1,000 startups through FJ Labs. LinkedIn page: Fabrice Grinda.

Romain Bourgois, Chief Product Officer, has over ten years of experience in technology product development, having worked at Criteo and Ondo Finance.

Jonas Konstandin, Chief of Staff, established the digital asset department at Solaris Group SE, serving Coinbase and Binance.

Greg Feibus, Head of Sales and Partnerships, previously worked at Anchorage Digital and FIS Global.

Jonathan Chevalier, Head of Engineering, specializes in cloud-native architecture and blockchain, previously serving as CTO of Pegaki.

The diverse backgrounds of the team ensure strong execution in finance, technology, and compliance.

Technology and Security

MidasRWA utilizes the Ethereum and Base blockchains to issue ERC-20 tokens, ensuring compatibility with the DeFi ecosystem. The underlying assets of mTBILL are managed by BlackRock and custodied through Securitize, ensuring asset security and liquidity. Prices are independently verified by Ankura Trust Company, reducing centralized reliance and enhancing investor confidence. All tokens are in a non-custodial form, allowing investors to self-custody through EVM-compatible wallets (such as MetaMask), reducing third-party risks.

$10 Million Financing, Rekindling the RWA Flame

Financing

Midas's performance in the capital markets provides strong endorsement for its technology and vision:

Seed Round Financing: In 2024, Midas completed $8.75 million in financing, led by Framework Ventures and Blocktower Capital, with participation from several institutions focused on blockchain and fintech.

Strategic Investment: In 2025, Midas further secured $13.75 million in financing, with investors including the Plume Ecosystem Fund, with funds allocated for technology development and market expansion.

Midas has attracted the attention of several well-known investment institutions, including: Framework, Ventures, BlockTower, HV Capital, Cathay Ledger, Coinbase Ventures, GSR, 6th Man Ventures, FJ Labs, Lattice Capital, Phaedrus, Theia Blockchain, Pareto, Axelar Foundation, Peer VC, and Anagram. The participation of these investors not only provides financial support but also brings strategic resources and industry networks, enhancing the project's market credibility. Notably, Framework Ventures is known for investing in DeFi projects (such as Chainlink and Aave), while Blocktower Capital focuses on the integration of digital assets and TradFi, highlighting Midas's industry potential. This financing not only provides Midas with ample R&D and operational funds but also lays the foundation for attracting top talent and partners.

Partnerships

Midas's industry recognition is reflected in its collaborations with multiple DeFi protocols and traditional financial institutions:

DeFi Ecosystem Integration: Midas partnered with Pendle Finance to launch mEDGE and mMEV yield pools, supporting leveraged yield and fixed income strategies; collaborated with Turtle Clubhouse's TAC program to provide additional rewards.

TradFi Integration: By collaborating with blockchain infrastructure providers associated with Ledger, Midas ensures that asset custody and compliance meet institutional-grade standards.

Compliance

Additionally, MidasRWA places a high emphasis on regulatory compliance, especially in the European market. mTBILL has received approval for EU retail investors, with no minimum investment threshold, complying with European securities regulations. The project is issued through Midas Software GmbH in Germany as a special purpose vehicle (SPV), with a structured design ensuring compliance with anti-money laundering laws and MiFID II securities classification requirements. Relevant legal documents can be found at Midas Legal Documents.

User Participation: Interaction Tasks and Reward Mechanisms

Midas offers various ways for users to participate, aiming to attract more investors and members of the Web3 community to join its ecosystem. Below are specific participation pathways, task content, and considerations:

1. Participate in Midas Asset Tokenization Products

Task Content:

Deposit Assets: Deposit stablecoins (such as USDC) into mTBILL, mBASIS, mMEV, or mEDGE pools through the Midas official website to earn Annual Percentage Yield (APY) from the asset pool, with specific yields varying by pool type and market conditions (real-time updates on the official website).

Types of Returns: mTBILL offers fixed returns (based on U.S. Treasury bonds), while mMEV and mEDGE provide leveraged DeFi strategy returns, and mBTC tracks Bitcoin price performance.

Additionally, depositing mMEV, mEDGE, or mBTC into Turtle Clubhouse's TAC program can earn extra TAC token rewards.

Operational Steps:

Visit the Midas official website and connect your Ethereum wallet (such as MetaMask).

Select the target asset pool, enter the deposit amount, and confirm the transaction.

Regularly check your earnings and redeem your principal and earnings at any time (there may be a lock-up period depending on the pool type).

Notes:

You need to hold an Ethereum wallet and pay Gas fees.

Some pools (such as mMEV) may have minimum deposit requirements, which are subject to the official website.

Understand market risks before investing; leveraged products (such as mMEV) can be highly volatile.

Ensure wallet security to avoid leaking private keys or seed phrases.

It is recommended to refer to the Midas official documentation for product details.

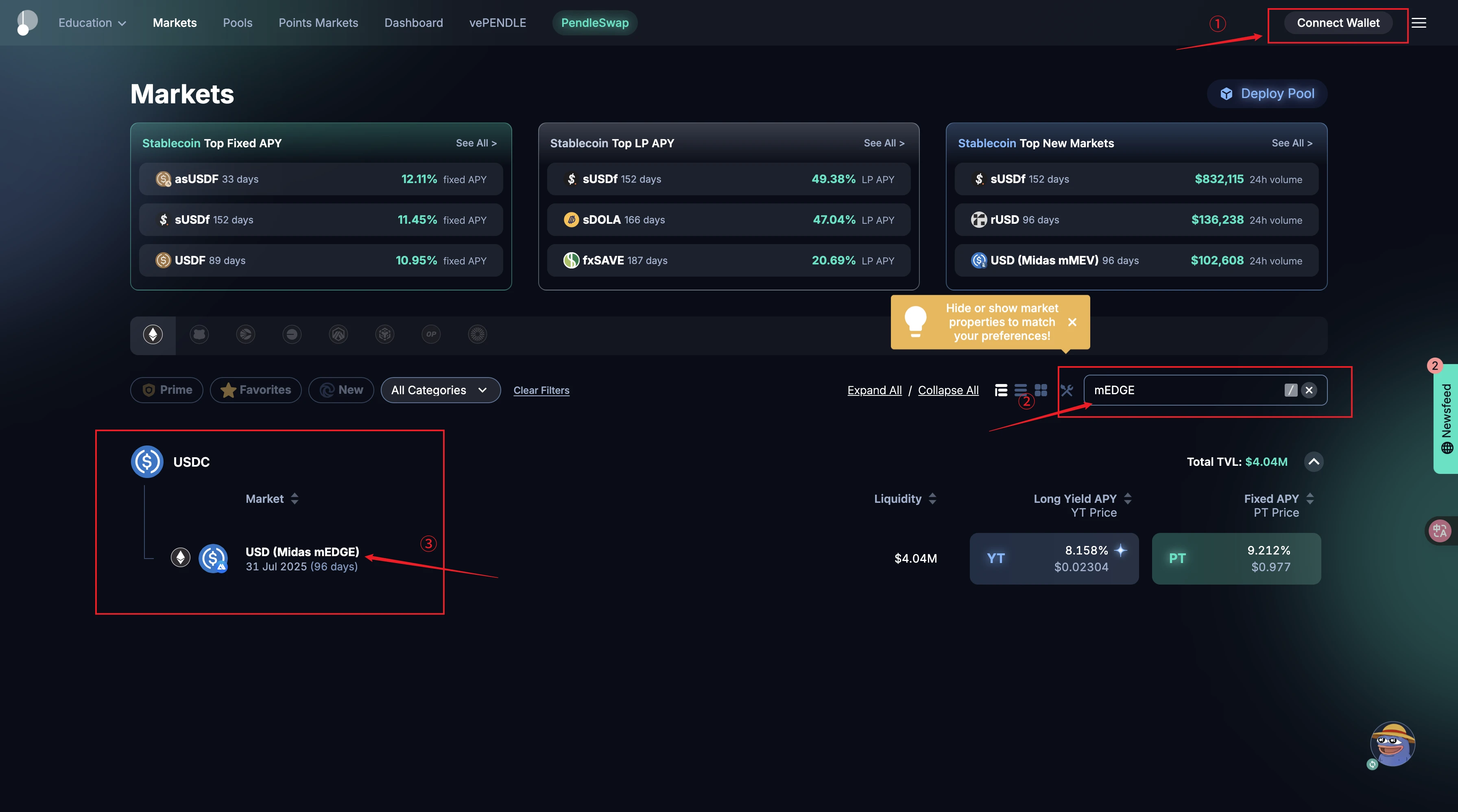

2. Participate in Pendle Finance Yield Pools

Task Content:

- Deposit into Pendle Pools: Users can deposit Midas's tokenized assets (such as mEDGE, mMEV) into Pendle Finance's yield pools to earn fixed returns or LP incentives. Additionally, there are extra rewards, including native tokens of the Pendle protocol or other ecosystem incentives, with specific rewards depending on the deposit size.

Operational Steps:

Visit the Pendle Finance official website.

Connect your wallet and select Midas-related pools (such as mEDGE & mMEV Pools).

Deposit assets and choose the type of return (fixed return or liquidity provision).

Regularly check earnings and reward distribution.

Notes:

You need to hold Midas tokenized assets (such as mEDGE).

The activity ends on July 31, 2025, subject to the Pendle official website.

Users need to pay Ethereum network Gas fees.

Leveraged yield pools carry higher risks; it is recommended to fully understand the strategy mechanisms.

Follow the official announcements from Pendle and Midas for the latest pool status.

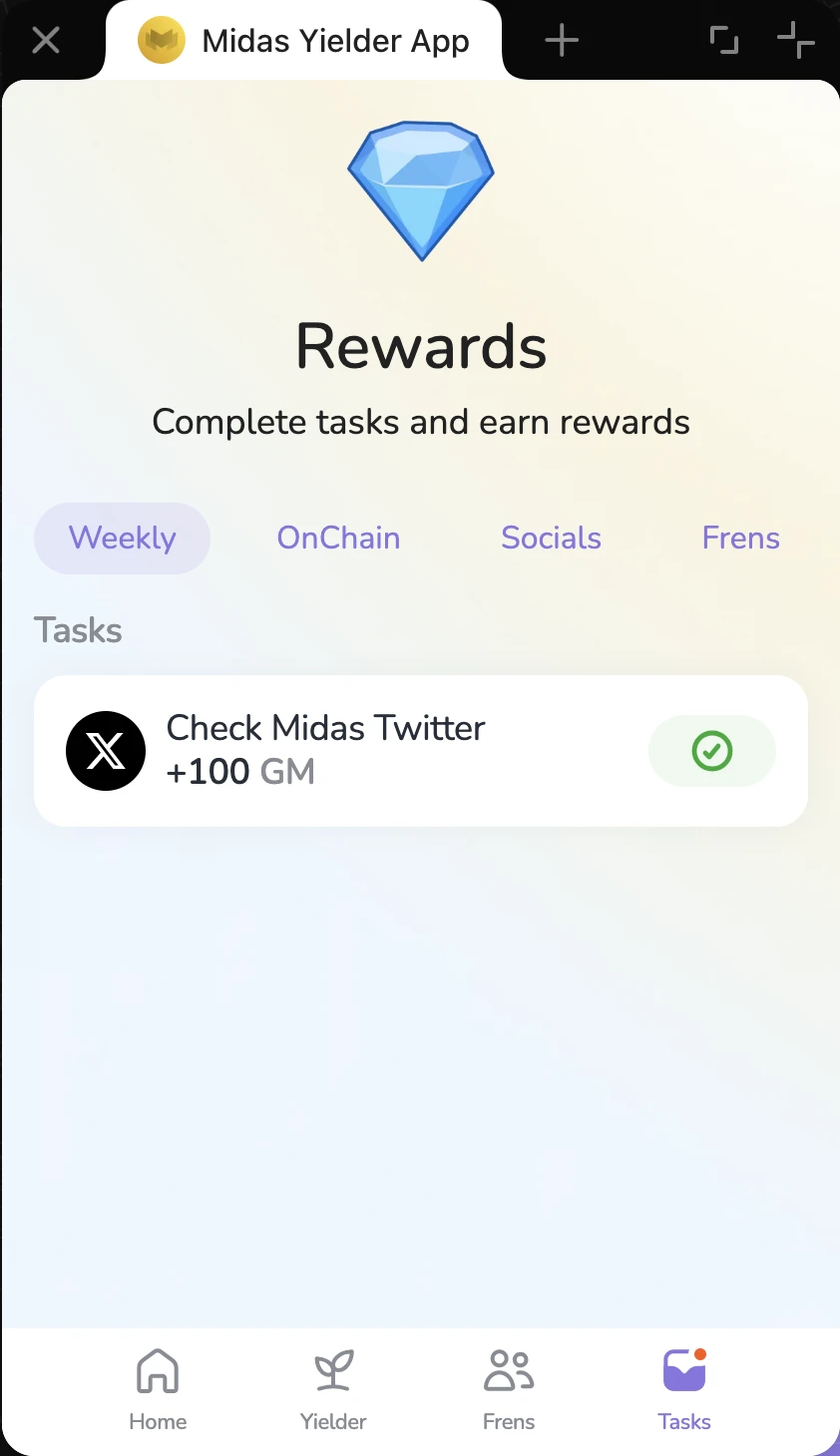

3. Participate in Community Activities and Points Program

Task Content:

- Golden Midas Points: Users can earn Golden Midas points by depositing, inviting friends, or participating in community tasks (such as Twitter retweets, Discord interactions). Points may be redeemable for future project airdrops or other ecosystem rewards. High-point users may receive early roles (such as TacBuild Discord roles) or priority participation rights.

Operational Steps:

Open the Telegram App mini-program Midas Yielder.

Complete the corresponding tasks as prompted to earn corresponding point rewards.

Notes:

You need to register a Telegram account and bind a Ton wallet.

The points activity is a long-term program, but some tasks have time limits, so keep an eye on official announcements.

Some tasks require meeting minimum deposit requirements (such as 100 USDC).

Ensure participation in official channel activities to avoid phishing links.

Points rules may be adjusted with project updates, so it is recommended to check the official website regularly.

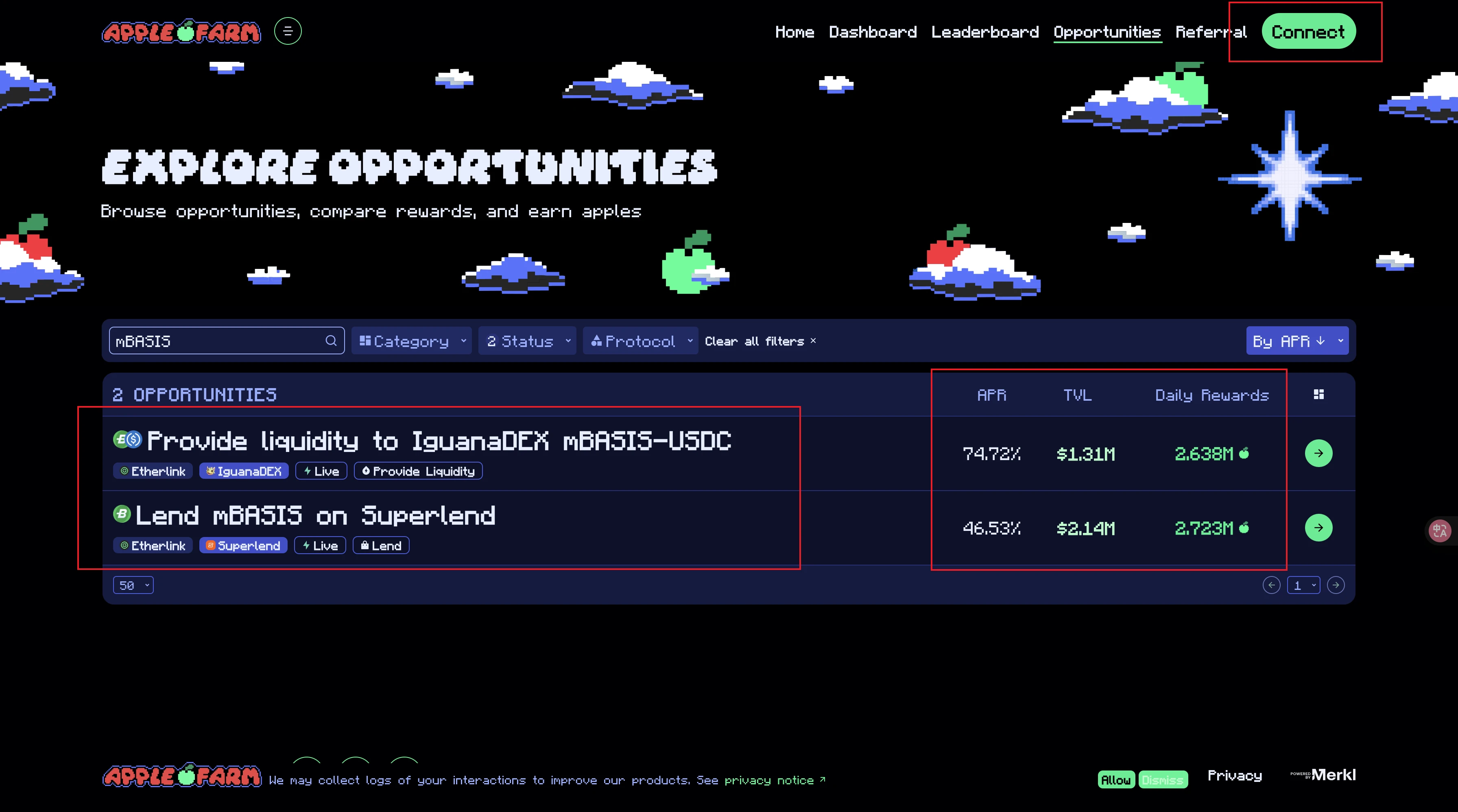

4. Participate in Etherlink Apple Farm Activity

Task Content:

- Deposit mBASIS or mTBILL: Users can deposit mBASIS or mTBILL into Etherlink's Apple Farm activity to participate in the rewards program for stablecoins and yield assets, earning native rewards from the Etherlink ecosystem or stablecoin returns.

Operational Steps:

Visit the Etherlink activity page.

Connect your wallet and deposit mBASIS or mTBILL.

Regularly claim activity rewards.

Notes:

The activity is a limited-time program, with the second round having started in April 2025; specific end dates should refer to official announcements.

You need to hold mBASIS or mTBILL tokens.

The activity rules are complex, so it is recommended to read the joint announcement from Etherlink and Midas carefully.

Ensure a secure network environment to avoid phishing websites.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。