Last week, the Financial Times reported a significant development: the Wall Street veteran financial giant Cantor Fitzgerald is teaming up with SoftBank, Tether, and Bitfinex to form a Bitcoin investment alliance with a scale exceeding $3 billion. Notably, the leader of this financial giant, Howard Lutnick, is the son of U.S. Secretary of Commerce Howard Lutnick. Against the backdrop of the Trump administration's push for cryptocurrency-friendly policies, this investment alliance has sparked considerable speculation about the relationship between politics and business.

The Behind-the-Scenes Player: Tether and Cantor

Cantor Fitzgerald, established in 1945, is a well-known Wall Street financial firm recognized for government securities trading, investment banking services, and bond brokerage. As one of the 24 primary dealers for the U.S. Treasury, Cantor is directly involved in the issuance and trading of government bonds, maintaining close business ties with the Federal Reserve and the Treasury Department. The company operates in over 20 countries worldwide and employs more than 12,500 people.

However, what truly sets Cantor apart is its relationship with Tether. For the mid-sized investment bank located in Midtown Manhattan, Tether has become its most lucrative client, serving as the primary custodian of Tether's dollar reserves and managing 99% of its U.S. Treasury bond reserves, amounting to hundreds of billions of dollars.

The relationship between Cantor and Tether is mutually beneficial. Tether previously struggled to be profitable but now earns billions of dollars annually from the government debt held by Cantor. According to Forbes, Cantor not only provides high-security custody but also leverages its expertise in the bond market to help Tether convert high-risk commercial paper into low-risk U.S. Treasury bonds, significantly reducing systemic risk. An insider revealed that Cantor purchased short-term Treasury bonds with maturities of 3-6 months for Tether, ensuring high liquidity, and adjusted the ratio of Treasury bonds to cash through a dynamic asset management system, generating approximately $2 billion in interest income for Tether in 2023, accounting for nearly one-third of its $5.6 billion profit that year.

One of the key figures facilitating the collaboration between these two companies is Howard Lutnick. The 63-year-old billionaire, former CEO of Cantor, has made his bank the backbone of the Tether system. After federal regulators made it easier for banks to hold digital assets in 2020, he sought ways to enter the cryptocurrency industry and learned about Tether. Cantor manages Tether's U.S. Treasury bond portfolio worth up to $39 billion, making it the custodian of the dollar assets backing Tether's stablecoin USDT. Currently, Tether's token market capitalization exceeds $130 billion, with Cantor holding most of the U.S. Treasury bonds that support these tokens.

Former Cantor CEO Howard Lutnick

The connection between these two companies dates back to 2021. At that time, Tether had already issued over 50 billion tokens, but there were ongoing doubts about whether it truly held an equivalent $50 billion in reserves. In February of that year, the company's owners agreed to pay a $18.5 million fine to the New York Attorney General to settle allegations of false statements regarding its reserves. Due to several U.S. banks refusing to process the company's transactions and concerns from major U.S. regulators about Tether potentially collapsing during a bank run, the company faced a crisis. At a critical moment, Howard stepped in to provide a guarantee for Tether. According to insiders, in return, Tether paid Cantor tens of millions of dollars, and Cantor acquired a minority stake in Tether.

Previously, Tether had kept most of its funds in accounts at Bahamian banks and invested part of its reserves in riskier assets like Chinese commercial paper for returns. This operational model made it highly dependent on Bahamian banks' ability to interface with U.S. banks. However, when Tether paid a $41 million fine to the U.S. Commodity Futures Trading Commission in October 2021 due to false statements about its reserves, this channel was severely threatened.

After obtaining sufficient evidence to confirm that Tether indeed held all its reserves, Howard proposed a solution. As a primary dealer of U.S. Treasury bonds, Cantor could easily access a large amount of secure U.S. Treasury assets. He promised that as long as Tether converted its held assets into U.S. Treasury bills, Cantor would be willing to become its client.

On Tether's side, the contact with Howard was made by Chief Financial Officer and largest shareholder Giancarlo Devasini. According to the Wall Street Journal, their interactions were quite secretive, with Howard "only allowing a select few employees to know about the connection between Cantor and Tether, limited to a few top executives." He often personally handled this relationship with Devasini and met with him on a private jet.

This Italian entrepreneur, who previously dealt in plastic trading, is considered the "shadow captain" of Tether. Devasini has stated that Cantor's custody services allow the company to "more efficiently meet regulatory requirements for liquidity and stability," believing that "Howard will use his political influence to try to eliminate threats to Tether." Howard also places great importance on the collaboration with Tether; in the investment agreement reached last year, he unusually took the lead in negotiations, allowing Cantor to acquire about 5% equity in Tether, valued at $600 million.

As a father figure, Howard is also paving the way for the next generation's network. This Bitcoin investment alliance is being spearheaded by Howard's son, Brandon, who plans to consolidate Tether's $1.5 billion in Bitcoin, SoftBank's $900 million, and Bitfinex's $600 million. This model easily recalls MicroStrategy (now renamed Strategy), a company that achieved a market capitalization surge to $91 billion by hoarding Bitcoin.

Interestingly, Brandon had previously interned at Tether and was instrumental in introducing Tether to the right-wing video platform Rumble Inc. According to Bloomberg, Cantor facilitated Tether's $775 million investment in the right-wing video site Rumble Inc. When this deal was announced, Rumble's stock price surged by 81%, and Cantor's stake in Rumble increased in value by $54 million.

Brandon Lutnick (far left); Howard Lutnick (second from left)

In February of this year, Howard narrowly won his appointment as Secretary of Commerce with a vote of 51 to 45. The former Cantor CEO has publicly supported Tether multiple times: "I hold their Treasury bonds, and they have a lot of Treasury bonds. I am a loyal fan of Tether," emphasizing the contribution of stablecoins to the U.S. economy.

Although when Howard was appointed as a Commerce Department official, he stated that he would resign from his position at the financial company and "intended to sell his shares in these companies to comply with U.S. government ethical standards," opposition voices have persisted. Senator Elizabeth Warren expressed her concerns: "I am deeply worried about Howard Lutnick's past connections with a sanctioned entity (i.e., Tether). The Secretary of Commerce should fight for the interests of the United States—not for his personal interests or those of former clients that undermine our national security."

Looking back now, Howard has indeed fulfilled his promise to resign from his position at Cantor to avoid direct ties with Tether. However, this baton was arranged early on and passed on to Brandon.

From the Commerce Department to the SEC: The Brotherhood Between the Crypto World and the Trump Administration

The combination of Cantor and Tether is not an isolated case. The world's largest asset management company, BlackRock, established the BUIDL fund in 2024, which has become a leader in the RWA sector this year with over $2.5 billion in assets under management. The designated custodian for BUIDL is a company called Securitize. Unlike Cantor's traditional financial background, Securitize is a cryptocurrency company founded in 2017, focusing on blockchain technology and digital asset securitization.

Why did BlackRock suddenly invest in a cryptocurrency company? This may be closely related to the network of Securitize. If you look solely at the management of Securitize, you might not think of it as a cryptocurrency company, but rather as a traditional financial newcomer filled with Wall Street executives. However, don't limit your view to Wall Street; if you look at Washington, you'll find that Securitize hired former SEC Trading and Markets Division Director Brett Redfearn in 2021, who currently serves as a senior strategic advisor and chairman of the advisory board.

The relationship with the SEC goes beyond this; Securitize is also closely connected with newly appointed SEC Chairman Paul Atkins. Paul Atkins joined Securitize back in 2019, serving as a member of the advisory board and board member, holding up to $500,000 in call options, and just stepped down in February of this year. Coincidentally, in the same year, Securitize became a registered broker-dealer with the SEC and an operator of an SEC-regulated Alternative Trading System (ATS).

Related Reading: “New Chairman Takes Office, SEC Becomes 'Crypto Daddy'”

When Trump announced his nomination of Atkins as the next SEC Chairman, Securitize CEO Carlos Domingo specifically congratulated him on LinkedIn: “We are incredibly pleased with this appointment; while we lose an excellent advisor, we also gain an outstanding new SEC Chairman.” At the same time, Securitize's official LinkedIn account created a special congratulatory graphic.

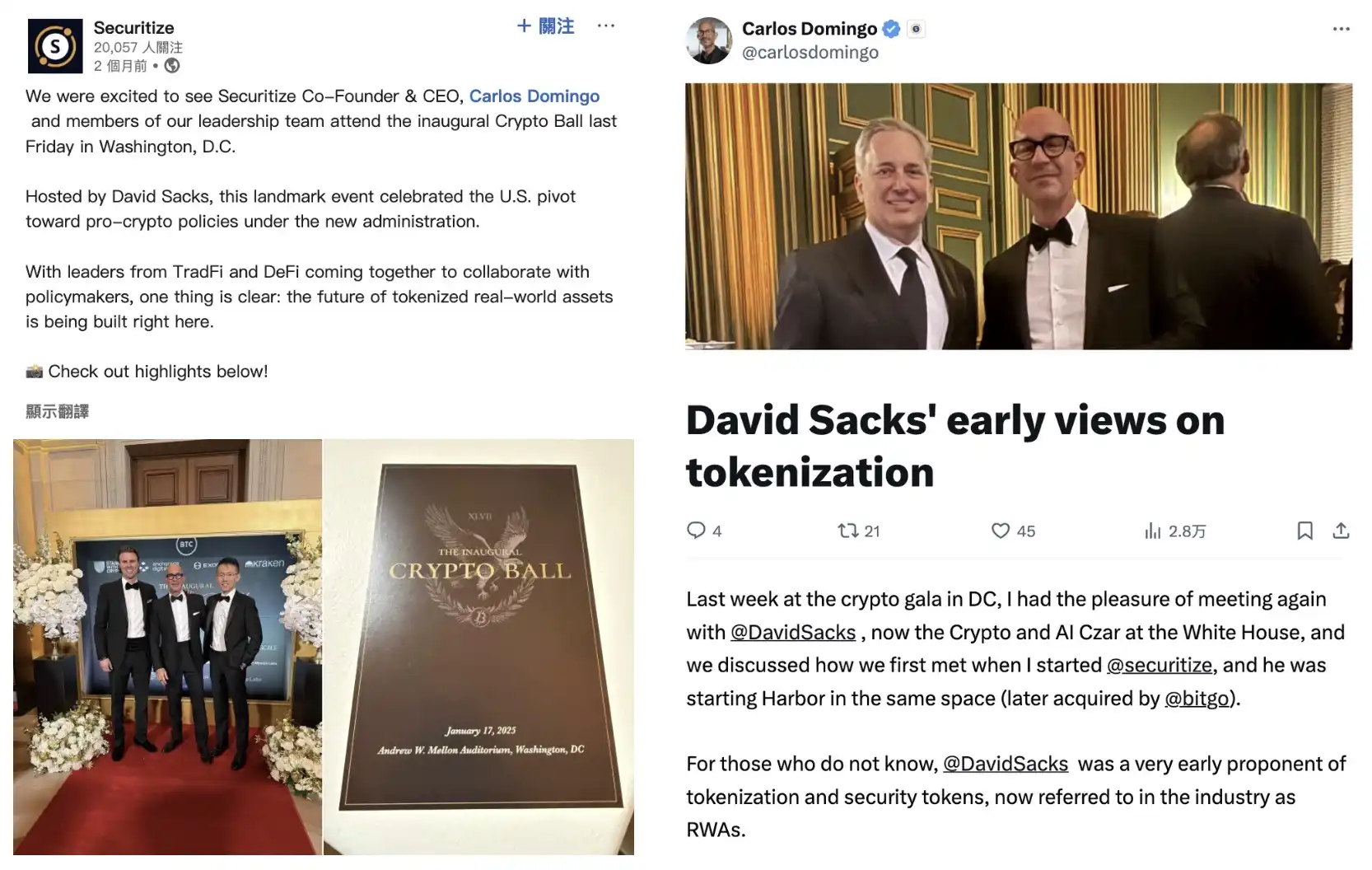

Not only with the SEC, but Carlos Domingo also seems to have a good relationship with the White House's "crypto czar" David Sacks. Although David Sacks does not have direct business dealings with Securitize, Domingo was invited to attend the "Crypto Ball" held in Washington in February this year, where he "met Sacks again," and afterwards wrote a lengthy article reviewing Sacks' early views on tokenization and RWA.

The Best Channel for "Political Monetization"?

When it comes to leveraging political influence to market personal brands in the crypto space, who is the first person that comes to mind? Although in 2021, Trump referred to Bitcoin as a "scam" on Fox Business, three years later, the DeFi project WLFI, supported by the Trump family, made a high-profile appearance with a valuation of $1.5 billion in October 2024. Trump himself serves as the "Chief Crypto Advocate," with his son Barron Trump as the "DeFi Visionary," and Eric Trump and Donald Trump Jr. actively promoting the project. In March 2025, WLFI launched its own stablecoin USD1, operating on the Ethereum and Binance blockchains, competing with Tether's USDT and Circle's USDC.

The funding sources and investment portfolio of WLFI are the focus of public attention. WLFI raised $550 million through two token sales, with Justin Sun investing $30 million, becoming a key supporter. Previously, Justin Sun faced an SEC lawsuit for alleged securities fraud, but in February 2025, the SEC suspended its investigation into him. According to Forbes, Sun's investment brought about $400 million in potential profits to the Trump family, as the family holds 75% of the WLFI token revenue.

The Trump family's footprint in the cryptocurrency space is continuously expanding, with their investment landscape far exceeding the WLFI project. According to Bloomberg's calculations based on public data, the family has diversified investments through NFTs, meme coins, Bitcoin ETFs, and mining, with current paper profits nearing the $1 billion mark.

Trump's first foray into crypto likely occurred in December 2022 when he launched a series of NFT trading cards featuring his personal style. These digital collectibles, presented in the form of superheroes and other images, were proposed by Trump's old friend, Bill Zanker, founder of The Learning Annex, and sparked a buying frenzy in the collectibles market upon release. In hindsight, this successful trial run may have alerted Trump to the business opportunities in crypto.

Entering 2025, the Trump family's crypto activities have noticeably accelerated. In January, the Trump couple launched personal meme coins, with initial price surges bringing in $11.4 million in profits. Through their entities CIC Digital and Fight Fight Fight LLC, the Trump family controls 80% of the token supply and has set up a three-year gradual unlocking mechanism. Just last week, Trump announced that the top 220 holders of $TRUMP would have the opportunity to dine with him.

In February of this year, Trump Media & Technology Group partnered with Crypto.com to apply for registration of the "Truth.Fi Bitcoin Plus ETF," coincidentally as the SEC concluded its investigation into Crypto.com. By the end of March, the Trump family took a further step, announcing a partnership with the well-known North American mining company Hut 8 to enter the Bitcoin mining sector, even launching a dollar-pegged stablecoin USD1 to compete with Tether and Circle for market share.

From the President to the Secretary of Commerce, then to the SEC Chairman and "crypto czar," these key figures' intersections with the crypto industry seem to form a tightly knit circle of interests. As the cryptocurrency-friendly policies promoted by the Trump administration gradually take shape, Cantor, Securitize, and WLFI may just be a microcosm of the entire industry; perhaps this "cycle" is just beginning. As for the binding of interests and the crypto layout of government officials, whether it will trigger stricter public scrutiny and regulatory review, or has already become an accepted fact or even a new "unwritten rule," remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。