Source: Cointelegraph

Original: “Bitcoin (BTC) Needs to Break Key Resistance to Restart Bull Market - $2.4 Billion Bitcoin Withdrawn from Exchanges in One Day”

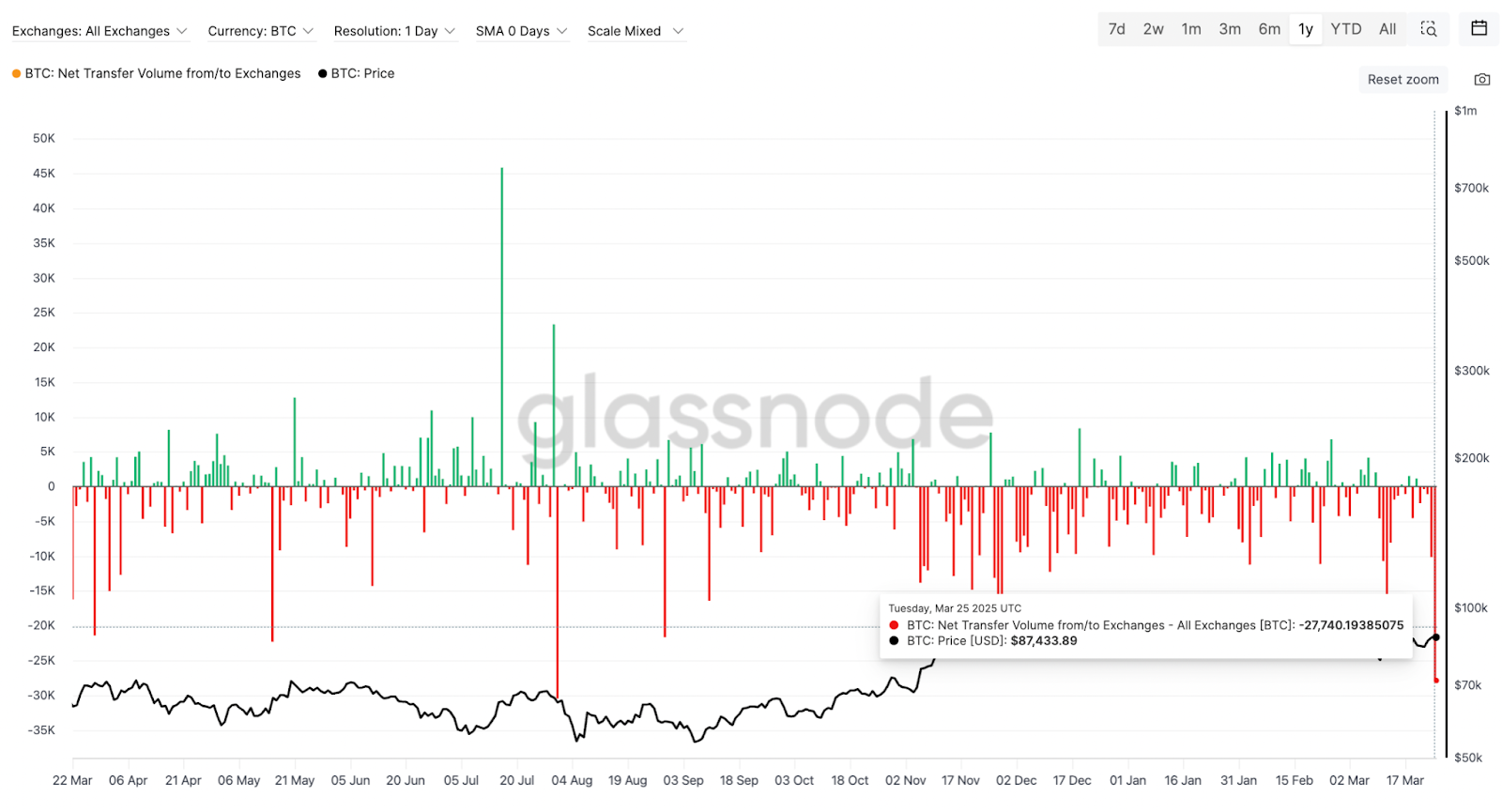

More than 27,740 Bitcoins (BTC) (worth $2.4 billion) were withdrawn from exchanges on March 25, marking the largest single-day outflow since July 31, 2024. Meanwhile, U.S. spot Bitcoin ETFs continue to see net inflows, indicating a resurgence in institutional demand.

Is a Bitcoin bull market about to restart?

Bitcoin exchange outflows have reached a seven-month high. As exchange supply continues to decrease, Bitcoin is attempting to break through the technical barrier of $90,000.

Bitcoin: Net Flow to Exchanges Source: Glassnode

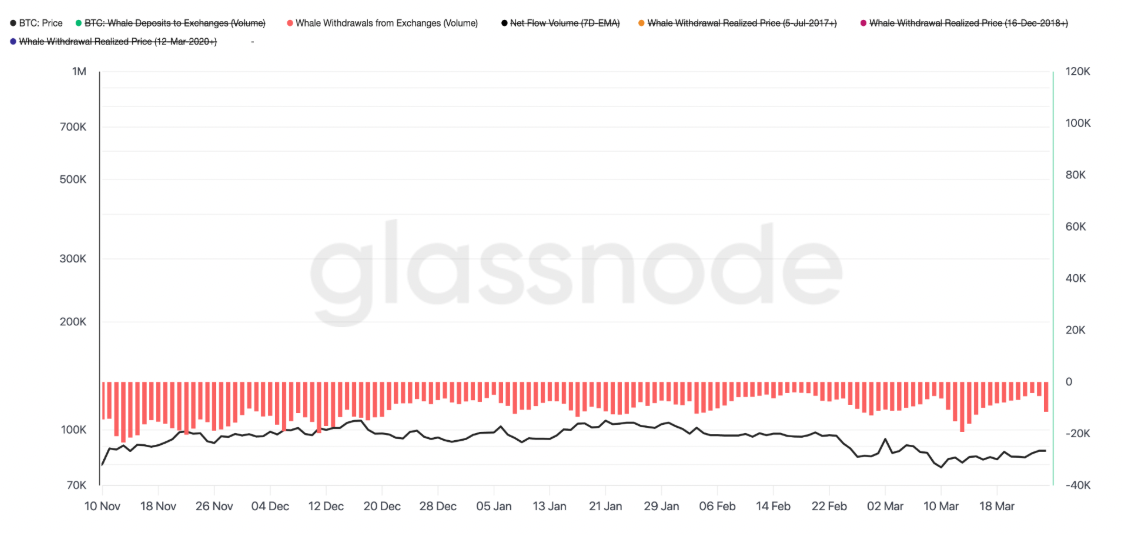

In-depth analysis shows that a significant portion of these withdrawn funds came from whales (entities holding at least 1,000 Bitcoins), who withdrew over 11,574 Bitcoins worth approximately $1 billion from exchanges on March 25.

Bitcoin whales are withdrawing funds from exchanges Source: Glassnode

The large outflow of Bitcoin from exchanges, particularly the withdrawals by whales, alleviates selling pressure, typically indicating accumulation and bullish sentiment, which could drive prices higher.

Additionally, blockchain analytics firm Arkham Intelligence noted that a "billionaire Bitcoin whale" increased their holdings by 2,400 Bitcoins, worth over $200 million, on March 24. Despite some selling in February, this whale currently holds over 15,000 Bitcoins.

This whale began purchasing Bitcoin five days ago, having previously sold when Bitcoin prices ranged between $100,000 and $86,000 in February. This may suggest that these large investors view recent lows as buying opportunities, anticipating future price increases.

Spot Bitcoin ETF Fund Flows Show "Positive Shift"

Another sign that major investors are re-entering Bitcoin is the continuous inflow into spot Bitcoin ETFs since March 14. Spot Bitcoin ETFs have recorded net inflows for eight consecutive days, totaling $896.6 million.

Market data provider Santiment stated: "Since March 14, there has been a positive shift in ETF flows, as well as for Bitcoin and altcoins."

"This is the first time in 2025 that such a long consecutive inflow period has occurred."

As Cointelegraph reported, digital asset investment products also recorded weekly net inflows for the first time in five weeks.

Bitcoin Price Focuses on Key Trend Line to Restart Bull Market

Data from Cointelegraph Markets Pro and TradingView shows that BTC/USD is trading at $88,265, up 1.2% in 24 hours. Bitcoin's price faces resistance above the 20-week exponential moving average (EMA), which currently stands at $88,682.

Bitcoin's price must convert this level into support to continue its bullish trend. The chart below shows that breaking above the 20-week moving average often signals a significant price increase for Bitcoin.

Bitcoin/USD Weekly Chart Source: Cointelegraph / TradingView

Notably, when Bitcoin's price broke above this moving average in October 2023, it surged approximately 170% from $27,000 on October 16, 2023, reaching a new high of over $73,000 on March 14, 2024.

A similar price movement occurred when the price broke above the 20-week moving average in September 2024, subsequently rising 77% from $60,000 to $108,000 in December 2024.

Analyst Decode emphasized the importance of this trend line, stating that this moving average is "the most important level for Bitcoin at the moment."

Meanwhile, Keith Alan, co-founder of trading resource platform Material Indicators, stated that Bitcoin needs to reclaim the opening price of approximately $93,300 from 2025 to confirm a path to historical highs.

This article does not contain investment advice or recommendations. Every investment and trading involves risks, and readers should conduct their own research when making decisions.

Related Articles: This Week's Top 5 Bitcoin (BTC) Market Focus: "Local Top" and $88,000 Retracement?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。