Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

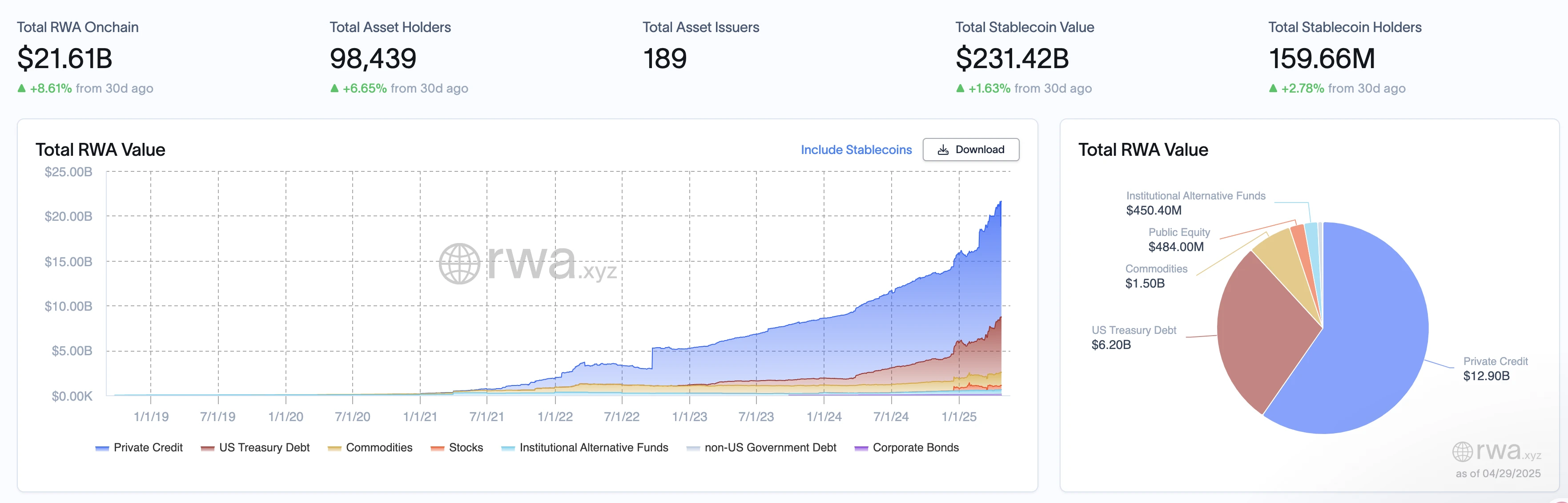

RWA Sector Market Performance

According to RWA.xyz data, as of April 29, 2025, the total on-chain value of RWA reached $21.61 billion, an increase of 8.61% compared to 30 days ago. The total number of on-chain asset holders is 98,439, an increase of 6.65% from 30 days ago, with a total of 189 asset issuances. The total value of stablecoins is $231.42 billion, up 2.78% from 30 days ago, while the number of stablecoin holders is 159.66 million, also up 2.78% from 30 days ago.

Historically, the total on-chain value of RWA has shown significant growth since 2019, especially accelerating after 2023, peaking in early 2025, indicating the rapid adoption of tokenized assets. In terms of asset class distribution, private credit dominates with a value of $12.9 billion, accounting for 59.69% of the total value; U.S. Treasury Debt is valued at $6.2 billion, accounting for 28.69%, an increase from last week's 27%; commodities are valued at $1.5 billion, accounting for 6.94%; and international alternative funds are valued at $450.4 million, accounting for 2.08%. Stocks, non-U.S. government debt, and corporate bonds have relatively small proportions.

From a comparison with last week's data, U.S. Treasury and private credit remain the core engines, contributing a total of $660 million to the week-on-week increase of $620 million (94% share). The RWA sector continues to maintain structural growth, dominated by compliant assets (Treasuries, credit), while institutional alternative funds, commodities, and equities are still in the early stages. At the same time, the siphoning effect of stablecoins cannot be ignored, with the on-chain stablecoin scale increasing by $4.33 billion week-on-week, far exceeding the RWA non-stablecoin asset increment ($620 million), reflecting a market preference for low-risk liquidity tools in the short term.

Review of Key Events Last Week

Circle to Launch Cross-Border Payment Network, Aiming to Challenge Visa and Mastercard

Stablecoin giant Circle will unveil a new payment and cross-border remittance product at its headquarters in New York's World Trade Center on Tuesday. This product is referred to as Circle's "next move," targeting users including banks, payment institutions, fintech companies, and USDC partners.

Circle is the issuer of USDC, which currently has a market cap of approximately $60 billion. The new network will initially focus on cross-border remittances and may challenge traditional giants Visa and Mastercard in the future. According to insiders, Circle is working to return to its payment roots to expand the use of stablecoins in the global payment space.

In the context of clearer stablecoin regulations, Circle also plans to go public in the U.S., but has delayed its IPO due to market volatility. Industry insiders believe that as USDC, USDT, and other stablecoins are widely used for cross-border transfers, Circle's move may accelerate the replacement of traditional payment systems by stablecoins.

Lynq Real-Time Yield Settlement Network to Launch in Q2 2025

According to an official announcement, Arca Labs, Tassat Group, and tZERO Group are jointly launching Lynq, a real-time yield settlement network, which is planned to go live in Q2 2025. Lynq is supported by the tokenized Arca Institutional U.S. Treasury Fund (TFND) and issues shares using the Avalanche blockchain, with U.S. Bank providing custody services. Partners such as B2C2, Galaxy Digital, and Wintermute will assist with initial liquidity and user onboarding, aiming to address market fragmentation and risk issues in digital asset settlement.

Wall Street Giant DTCC Launches Collateral AppChain to Promote Real-Time Tokenized Asset Settlement

DTCC has announced the launch of the Collateral AppChain platform, aimed at achieving real-time collateral management for tokenized assets, revolutionizing the traditional T+X settlement process. The platform is based on Hyperledger Besu and supports global real-time trading of stocks, Treasury bonds, and crypto assets, eliminating liquidity constraints. DTCC clears $9 to $11 trillion daily, and this move demonstrates its embrace of blockchain technology to tackle market challenges, with plans to create an efficient, low-cost settlement system.

The Federal Reserve has announced the withdrawal of regulatory guidance for banks regarding crypto assets and dollar token businesses, while simultaneously updating related business expectation standards. Analysts believe that this move marks a broader legitimization of Bitcoin in the eyes of regulators, surpassing mere banking policy, and helps the Federal Reserve accelerate its vision of making Bitcoin as easily accessible and secure as traditional fiat currency, which may mean that Bitcoin checking accounts, crypto-backed loans, and the conversion of crypto to fiat will be incorporated into traditional banking services faster than expected.

U.S. Payment Giant Stripe Developing Stablecoin-Centric Financial Products, Ready for Testing

U.S. payment giant Stripe's product head Jeff Weinstein posted on X platform that Stripe is building its first stablecoin-centric financial product, which is ready for testing.

Previously, Stripe completed an $1.1 billion Bridge acquisition deal and is preparing to promote stablecoins vigorously.

The U.S. Securities and Exchange Commission released a memo indicating that representatives from Ondo Finance and Davis Polk & Wardwell LLP met with the SEC's crypto working group to discuss compliance pathways for issuing and selling tokenized U.S. securities. The meeting topics included structural models for tokenized securities, registration and broker requirements, market structure regulations, financial crime compliance, and state corporate law. Ondo Finance proposed seeking a regulatory sandbox or other forms of regulatory exemption to advance the issuance of its tokenized asset products. This meeting aims to provide a clear regulatory framework for tokenized securities in the U.S. market.

BlackRock and Five Other Entities Hold 88% of Tokenized Treasury Issuance

RWA.xyz data shows that six entities hold 88% of tokenized U.S. Treasury bonds. The largest tokenized wealth issuer remains BlackRock. The company's tokenized U.S. Treasury fund BUIDL has a market cap of $2.5 billion, 360% higher than its closest competitor. The top six funds also include Franklin Templeton's BENJI, with a market cap of $707 million; Superstate's USTB, with a market cap of $661 million; Ondo's USDY, with a market cap of $586 million; Circle's USYC, with a market cap of $487 million; and Ondo's OUSG fund, with a market cap of $424 million. These six funds collectively account for 88% of all tokenized Treasury issuance.

Latest Updates on Hot Projects

R2 Yield (R2)

Official Website: https://www.r2.money/

Introduction: R2 Yield is a stablecoin yield protocol that integrates real-world assets (RWA), traditional finance (TradFi), and decentralized finance (DeFi), aiming to provide users with stable yield opportunities through blockchain technology. Its core product, R2USD, is a stablecoin backed by real-world assets, including on-chain tokenized U.S. Treasury bonds, money market strategies, and real estate rental income. This design allows R2USD to combine stability with yield generation, breaking the limitation of traditional stablecoins (such as USDT and USDC) that do not directly generate yield for users.

Latest Updates: On April 25, it was announced that a partnership with Arbitrum has been established, completing the deployment on the Ethereum Layer 2 network Arbitrum testnet. Currently, users can claim test tokens through the official Discord, experience the minting, staking, and liquidity operations of R2USD on the Arbitrum Sepolia testnet, and earn points by participating in task activities.

Since the launch of the testnet on April 25, R2 has completed deployments on multiple test networks including Plume, ETH Sepolia, and Arbitrum Sepolia, attracting over 90,000 users in just one week.

Usual (USUAL)

Official Website: https://usual.money/

Introduction: Usual is a decentralized stablecoin protocol aimed at creating a fair, community-driven financial ecosystem through the tokenization of real-world assets (RWA). Its core goal is to transform the centralized profit model of traditional stablecoins (like USDT) into a user-owned and governed model, redistributing value and control to the community through its stablecoin products USD0 and USD0++, as well as the governance token USUAL. The project combines the stability of physical assets with the composability of DeFi, striving to provide users with secure, transparent, and high-yield financial tools.

Recent Updates: On April 25, Usual completed the redistribution of the second wave of early redemption fees, distributing 8.4 million USUALx tokens to eligible USUAL holders. More distribution plans will be announced to incentivize users to participate in staking for long-term gains. Previously, the Usual community approved the UIP-7 proposal, which sanctioned the redistribution method for the early redemption fees collected earlier.

Plume Network

Official Website: https://plumenetwork.xyz/

Introduction: Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, art, equity, etc.) into digital assets through blockchain technology, lowering investment barriers and enhancing asset liquidity. Plume provides a customizable framework that supports developers in building decentralized applications (dApps) related to RWA, integrating DeFi and traditional finance through its ecosystem. Plume Network emphasizes compliance and security, dedicated to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Latest Updates: On April 25, Plume released a Q1 Summary Report, detailing its progress in the first quarter of 2025; on April 28, Plume Network held the first RWA Ecosystem Day in Dubai.

Recommended Related Articles

《TVL Surpasses $60 Million, Analyzing the Hidden Wealth Opportunities Behind Midas》

The author provides a detailed breakdown of the innovative project Midas, which combines DeFi and RWA, and offers a participation guide for users.

《In-Depth Layout Guide: 10 RWA Projects to Watch in 2025》

The article summarizes 10 real-world asset (RWA) projects worth watching this year and delves into several core issues in the RWA sector.

《Comprehensive Overview of 4 Popular RWA Protocols: Ondo, OpenEden, Plume, and Ethena》

Written by Ash and compiled by TechFlow, this article introduces four popular protocols in the RWA (tokenization of physical assets) field, emphasizing their potential in introducing traditional financial assets and comparing the characteristics, challenges, and market strategies of each protocol.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。