Selected News

U.S. Department of Justice Seeks 20-Year Prison Sentence for Celsius Founder Alex Mashinsky

Hyperliquid Announces New Fee Structure and Staking Levels to Launch on May 5

U.S. Democratic Congressman Shri Thanedar Proposes Impeachment Articles Against Trump

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

XMR: Due to a significant price increase of about 50%, XMR has become the cryptocurrency with the largest gain in discussions. The price surge was triggered by a major theft of up to 3,520 bitcoins (approximately $330.7 million). The stolen bitcoins were quickly laundered and exchanged for Monero (XMR) through multiple exchanges, leading to strong demand and price increases for XMR. This incident has sparked widespread discussions about the use of privacy coins (like Monero) in illegal activities, their impact on market liquidity, and regulatory concerns.

POLYMARKET: Polymarket has received a lot of attention today for its role in predicting the Canadian election results. Users are actively discussing the platform's accuracy and reliability in political event predictions. Polymarket's prediction markets are highly regarded for their high accuracy, with discussions focusing on the probabilities of various political outcomes, including the Canadian election and potential policy changes in the U.S. and other countries. The heated discussions around Polymarket stem from its ability to provide real-time analysis and predictions, which are considered more reliable than traditional media.

OKB: Today's discussions about OKB mainly focus on the launch of OKX Pay, a new crypto payment system that integrates self-custody wallets, zero-fee transactions, and automatic reward mechanisms. This product aims to simplify the crypto payment process and enhance user experience, making transfers as easy as sending messages. Additionally, the OKX card, issued in partnership with Mastercard, which connects crypto transactions with everyday spending, has also garnered widespread attention. These initiatives are seen as key steps in promoting the adoption of crypto payments and establishing OKX's leading position in the Web3 payment space.

COINBASE: Coinbase has gained significant attention today for announcing the launch of the Bitcoin Yield Fund, which offers institutional investors an annual return of 4-8%. This news has spread widely and received positive feedback. Furthermore, the integration with TradingView has provided users with more powerful trading features; the appointment of Joe Salama as Chief Compliance Officer and ongoing regulatory reform efforts have also increased its visibility. A series of strategic initiatives and partnerships (such as collaborations with Animoca Brands and Founders Factory to accelerate the development of the blockchain and AI ecosystem in the UK) further highlight Coinbase's proactive positioning in the crypto space.

CAKE: The main discussion point for CAKE today is the launch of PancakeSwap Infinity (formerly PancakeSwap v4), which introduces various pool types, customizable fees, and significant gas fee savings. This upgrade is seen as a major evolution in the DeFi space, providing traders and liquidity providers with more powerful tools. The release has sparked a lot of discussion and excitement on Twitter, making CAKE one of the most talked-about cryptocurrencies today.

Featured Articles

In this cycle, the top-tier investment institution that is "doing the best" in the crypto field is undoubtedly AllianceDAO, at least in the eyes of retail investors, it is still the "dark horse VC that incubated billion-dollar revenue applications." Currently, the primary market in crypto is bleak, and fund managers are competing on social media over IRR and DPI, lamenting their situations. Facing the future, some funds have "silenced their guns" and turned to the secondary market, while others have ceased operations and stopped fundraising. At this moment, Qiao Wang, the founding partner of AllianceDAO, stated: We need to increase investments and become more aggressive.

In October 2024, since the launch of AI Meme—GOAT, which introduced the AI Agent concept, Crypto has begun to accelerate its integration with AI. Concepts like Game+AI, DeFAI, and AIAgent Hive have emerged, with new conceptual projects appearing almost weekly, until January 18 of this year when Trump announced the issuance of MemeCoin, which directly drained market liquidity, prematurely bursting the CryptoAI bubble. Two days later, DeepSeek announced the open-source R1 model, and after a few weeks of fermentation, the AI concept stocks in the U.S. stock market also saw their bubbles burst.

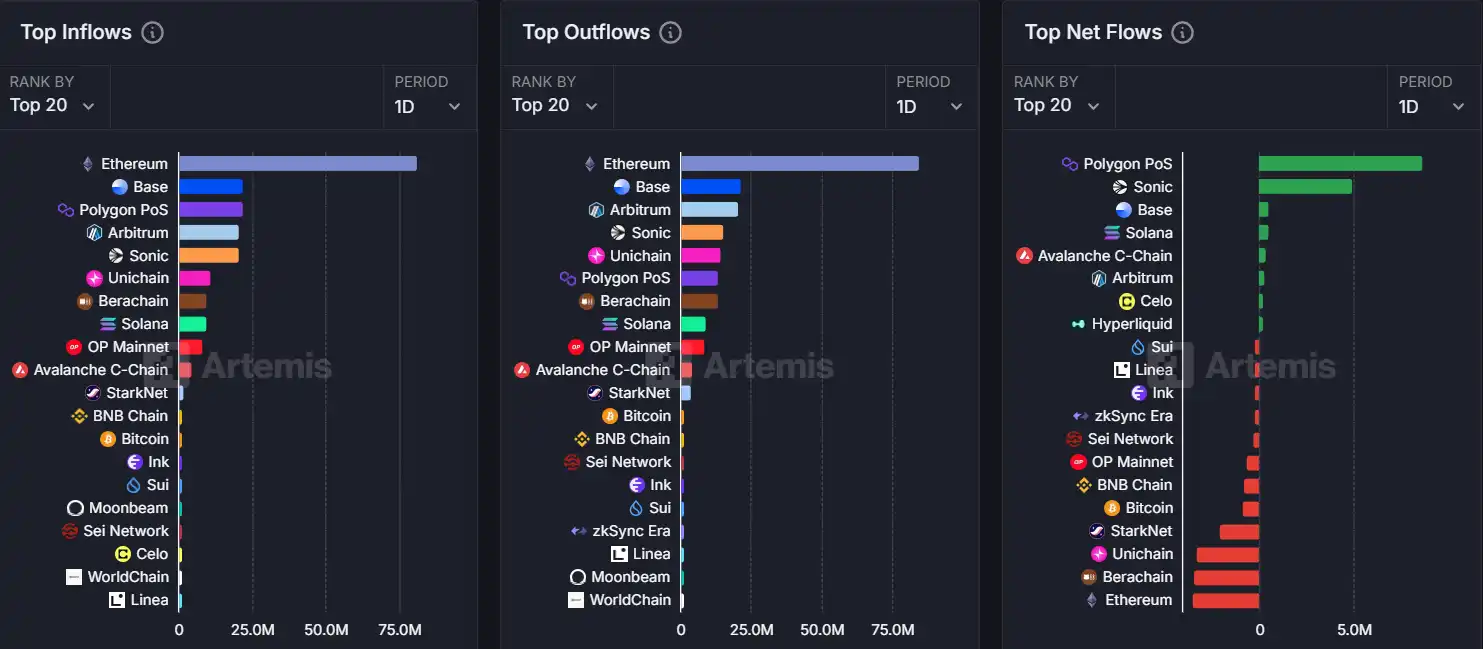

On-chain Data

On-chain capital flow situation as of April 29

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。