Latest Data: Governments Worldwide Currently Hold 463,000 BTC, Exchange Balances Hit a Near Seven-Year Low!

Macroeconomic Interpretation: Today, I came across a set of data indicating that since Trump's second term, the total market value of cryptocurrencies has evaporated by $537 billion. During this period, the market has undergone unprecedented structural changes—institutional capital, sovereign funds, and geopolitical policies are reshaping the value logic of Bitcoin. This transformation is not only about price volatility but also points to a strategic reconfiguration of crypto assets within sovereign economic systems.

From a macroeconomic perspective, the delayed expectations of Federal Reserve interest rate cuts have set the stage for the crypto market. Economists note that despite rising recession risks, the Fed is more likely to cut rates twice in the second half of 2025. This policy lag resonates with the current Sino-U.S. trade frictions: the Chinese Ministry of Commerce's cautious attitude towards Boeing deliveries and the Ministry of Foreign Affairs' repeated calls for "equal dialogue" reflect the profound impact of tariff policies on global capital flows. The phenomenon of "tariff-induced Bitcoin whale accumulation" revealed by Standard Chartered Bank is a microcosm of this macro uncertainty—when traditional assets face policy risks, Bitcoin's censorship-resistant characteristics become a new choice for institutional hedging.

The market's supply and demand structure is undergoing a fundamental reversal. Data shows that approximately 80 listed companies hold 700,000 BTC, accounting for 3.4% of the circulating supply. If we include the holdings of U.S. spot ETFs (5.5%), institutional capital has already controlled 9% of Bitcoin supply. Notably, Twenty One Capital recently announced the accumulation of 42,000 BTC, echoing MicroStrategy founder Michael Saylor's assertion: "The only asset the U.S. government cannot confiscate and liquidate is Bitcoin." This awareness is triggering a chain reaction: Coinank data shows that the exchange's BTC balance ratio has dropped from 16% last year to 13%, while ETF custodians' holdings continue to rise, indicating that a liquidity siphoning effect has already formed.

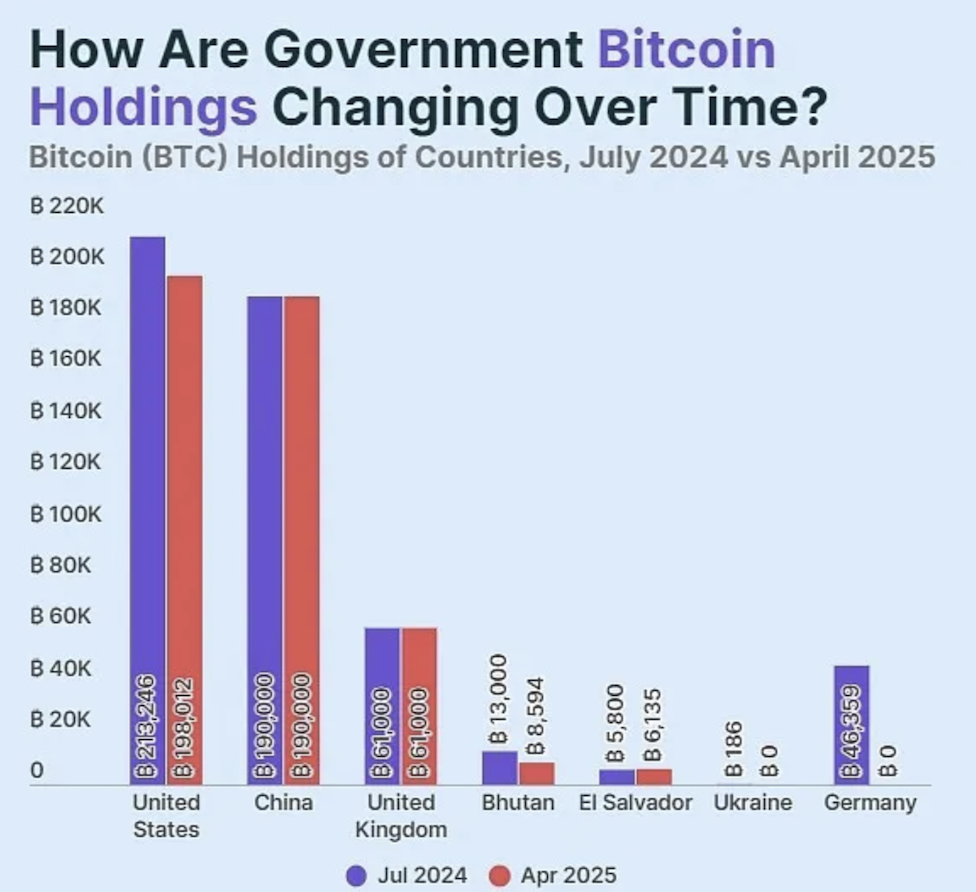

The intervention of sovereign nations injects new variables into the market. Currently, global governments hold 463,000 BTC, with the U.S. holding 198,000 BTC as strategic reserves, China holding 194,000 BTC through judicial recovery, and the UK's asset forfeiture mechanism accumulating 61,000 BTC. This national-level competition for holdings contrasts with El Salvador's monetary policy of "daily investing in 1 BTC" and Bhutan's energy conversion strategy through hydropower mining. The ruling party in South Korea has introduced even more groundbreaking policies: opening Bitcoin spot ETFs within the year, abolishing the "1 exchange - 1 bank" restriction, and promoting STO legislation. These measures may reshape the East Asian crypto market landscape.

The resonance between technical aspects and capital flows warrants caution. Material Indicators analyze the battle for the key level of $93,500, which is essentially a pendulum test of market sentiment. Currently, Bitcoin's 21-week SMA defense coincides with exchange reserves dropping to a new low of 2.49 million since 2018. This "exchange blood loss" diverges from the $3 billion net inflow into ETFs in a single week, revealing a structural shift in capital flows—when institutional reports show that 48% of holdings come from investment advisors, it indicates that Bitcoin is completing its transformation from a speculative tool to a core asset.

For the future market, several catalysts may ignite a new round of trends: first, the regulatory arbitrage potentially triggered by stablecoin legislation promoted by the Trump administration; second, the potential demand for diversification of foreign exchange reserves by central banks worldwide. Bernstein's forecast of a $200,000 target by 2025 seems aggressive but implicitly contains a supply tightening logic—if the current pace of institutional accumulation continues, institutional control could exceed 15% by 2025, combined with strategic reserves that various governments may implement, a liquidity crisis in the market could drive prices to rise non-linearly.

However, risks always lurk nearby. The German government's sale of 46,000 BTC last year, which triggered a 15.7% drop, serves as a warning: the entry and exit of sovereign capital may exacerbate market volatility. The more profound impact lies in the fact that when 9% of Bitcoin is controlled by institutional capital, its price discovery mechanism may deviate from the decentralized intent designed by Satoshi Nakamoto. The endgame of this capital feast may not simply be a new price high but rather a global financial system's re-evaluation of the value of digital gold—in an era of fiat currency credit fluctuations and frequent geopolitical conflicts, Bitcoin is evolving into a new type of strategic reserve asset for sovereign economies.

BTC Data Analysis:

Coinank data shows that Bitcoin exchange balances have hit a near seven-year low, briefly rebounding to 2.492 million before maintaining a tightening trend, down 12% from the 2018 cycle bottom. In contrast, institutional funds continue to flow in—Bitcoin funds attracted $3.2 billion in a single week, marking the largest weekly net inflow since Q1 2024, creating a unique market structure of "supply tightening - incremental inflow." On-chain anomaly indicators show that the exchange whale ratio (the proportion of large transfers) has plummeted from 0.51 to 0.36 within ten days, exposing that retail trading volume has surpassed 64%, marking the first occurrence of a "retail-driven" price breakout since the 2021 bull market.

This round of liquidity movement reveals three turning points: first, the median holding period for long-term holders (LTH) has surpassed 155 days, forming an "on-chain lock-up effect" for value storage; second, compliant platforms like Coinbase continue to show positive spot premiums, indicating that institutions are hedging against exchange liquidity risks through over-the-counter channels; finally, the ratio of open interest in futures to spot trading volume has risen to a historical extreme of 3.7, with leveraged funds dominating short-term pricing power. For the crypto ecosystem, while the shrinking exchange balances reduce the risk of concentrated selling pressure, they may exacerbate liquidity crises under extreme market conditions. If combined with high leverage in the derivatives market, daily fluctuations of over 5% may become the norm. Notably, the resonance effect between the influx of retail investors and institutional allocation demand may push Bitcoin's market cap ratio to break through the 70% threshold, further squeezing the survival space of small and mid-cap tokens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。